What are Factory Orders?

Factory orders are the dollar value of all orders received by factories. The U.S. Department of Commerce reports the number of new orders every month. Factory orders are divided into four parts: new orders, unfilled orders, shipments, and inventories. It includes information about durable goods and non-durable goods. Factory orders data is often not very surprising because the report of durable goods orders comes out one or two weeks earlier.

Dividing Factory Orders

The factory orders data is divided into four sections:

- New orders, which indicate whether orders are increasing or decreasing

- Unfilled orders, indicating a backlog in production

- Shipments, which indicate produced and sold goods

- Inventories, which indicate the strength of future production

The figures are mentioned in billions of dollars and also as a percent from the previous month and previous year. Factory orders data is often dull, mostly because the durable goods orders come out a couple of weeks earlier, and people have an idea of factory orders for the current month. However, the official factory orders data gives more detailed information on orders estimate and fulfillment.

The factory orders report includes information about both durable and non-durable goods. Durable goods have a life span of at least three years and often refer to items not purchased frequently, such as machines, garden equipment, motor vehicles, and electronics. In contrast, non-durable goods include fast-moving consumer goods such as food, clothes, footwear, medication, and cleaning items.

Investors get an insight into the growing trend of the economy with the help of factory orders report, which largely influences their investment decisions. Factory orders give an early indication of the growth in the economy, and its impact is felt on the equity market.

Analyzing the data

When it comes to the fundamental analysis of a currency pair, it is important to understand how factory orders are analyzed to make proper investment decisions. Factory orders are analyzed by comparing the previous and current readings, where, if we notice a consistent drop in the ‘orders,’ it could signal a slump in the overall demand.

These factory orders are not just used for analyzing one country but also for comparing the economic growth of any two countries. Investors shift their funds to countries where there is a growth in the factory orders, and demand is high. One needs to remember to compare countries with the same economic status. For example, factory orders of a developed country should not be compared with that of a developing nation.

The economic reports

Factory orders are released monthly by the Censuses Bureau of the U.S. Department of Commerce. The full name is “Full report on Manufacturers’ Shipments, Inventories and Orders” but is commonly referred to as Factory Orders. This report usually follows the Durable Goods Reports, which provides data on new orders received from more than 4,000 manufacturers of durable goods.

The factory orders report is more comprehensive than the durable goods report, where it examines the trend within industries. For example, the durable goods report may account for a broad category, such as industrial equipment. In contrast, the factory orders report will provide details about the hardware, software, semiconductors, and raw materials. This lack of information in a durable goods report is attributed to its release speed.

Impact on currency

Factory orders are an important economic indicator. When factory orders increase, the economy usually expands as consumers demand more goods and services. High demand, in turn, requires retailers and suppliers to order more things from factories. This is interpreted as positive for the economy by foreign investors who then invest in the country through the stock market or currency.

An increase in factory orders could also mean that inflation is just around the corner. When factory orders decrease, the economy is usually contracted, which means there is less demand for goods and services, so retailers will not place a lot of orders. When this is reflected in reports, investors tend to have a negative on the economy and think twice before investing in such economies.

Sources of information on Factory Orders

The factory Orders data is closely watched by investors around the world, which is why the report is immediately available on most of the open-source economic websites and some of the broker’s websites. The official source of information is the U.S. Census Bureau, where it provides statistical information of all the information related to factory orders.

Links to ‘Factory Orders’ information sources

GBP (Sterling) – https://tradingeconomics.com/united-kingdom/factory-orders

USD – https://tradingeconomics.com/united-states/factory-orders

EUR – https://tradingeconomics.com/germany/factory-orders

Factory orders are a key economic indicator for investors and others monitoring the health of economies. It provides information on how busy factories may be in the future. Orders placed in the current month may provide work in factories for many months to come as they will have to work to fill the orders. Businesses and consumers generally place orders when they are confident about the economy.

An increase in factory orders signifies that the economy is trending upwards. It tells investors what to expect from the manufacturing sector, a major component of the economy. The factory orders data often tend to be volatile with revision in the methodology now and then. Hence, investors typically use several months of averages instead of relying too heavily on a single month’s data.

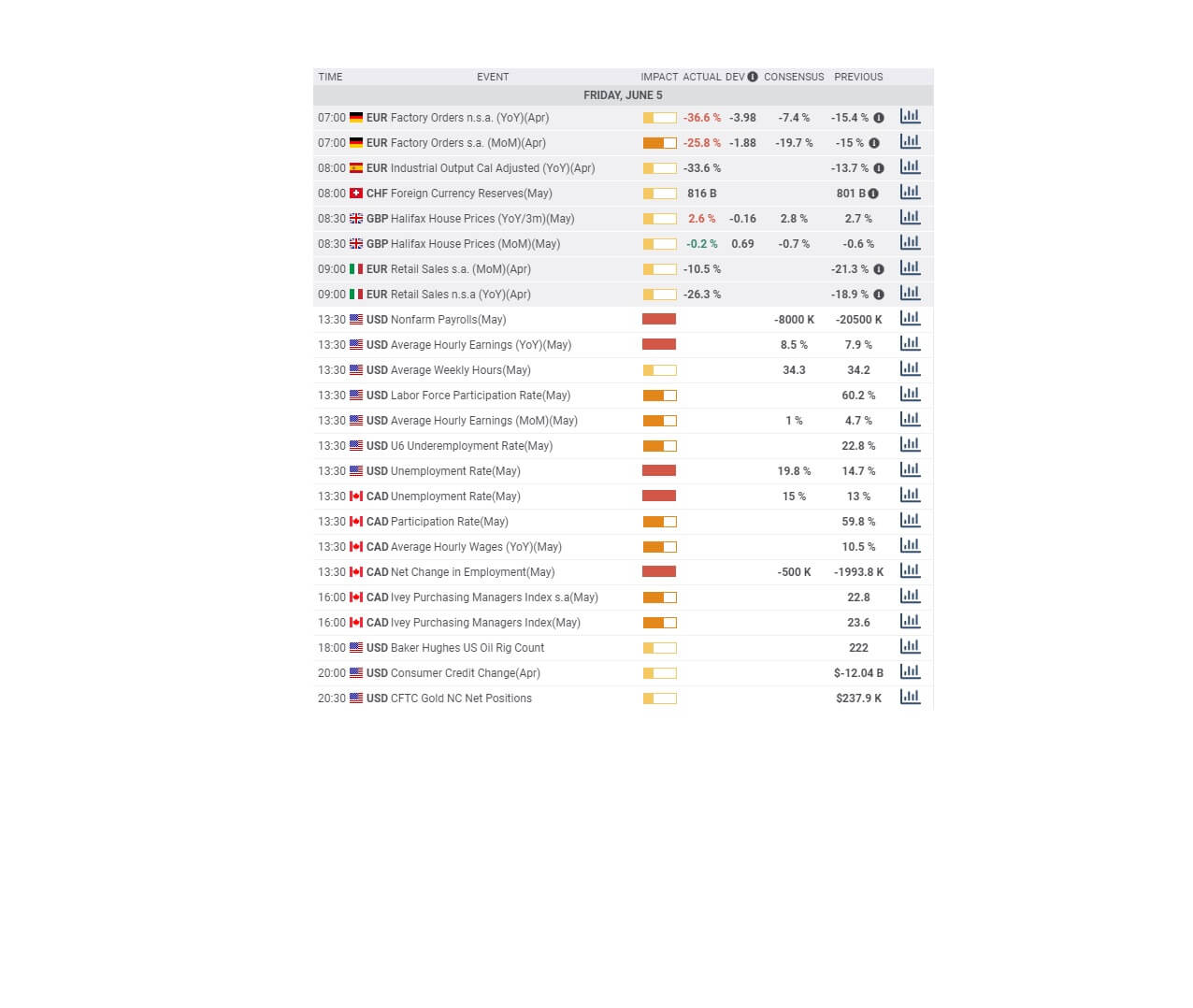

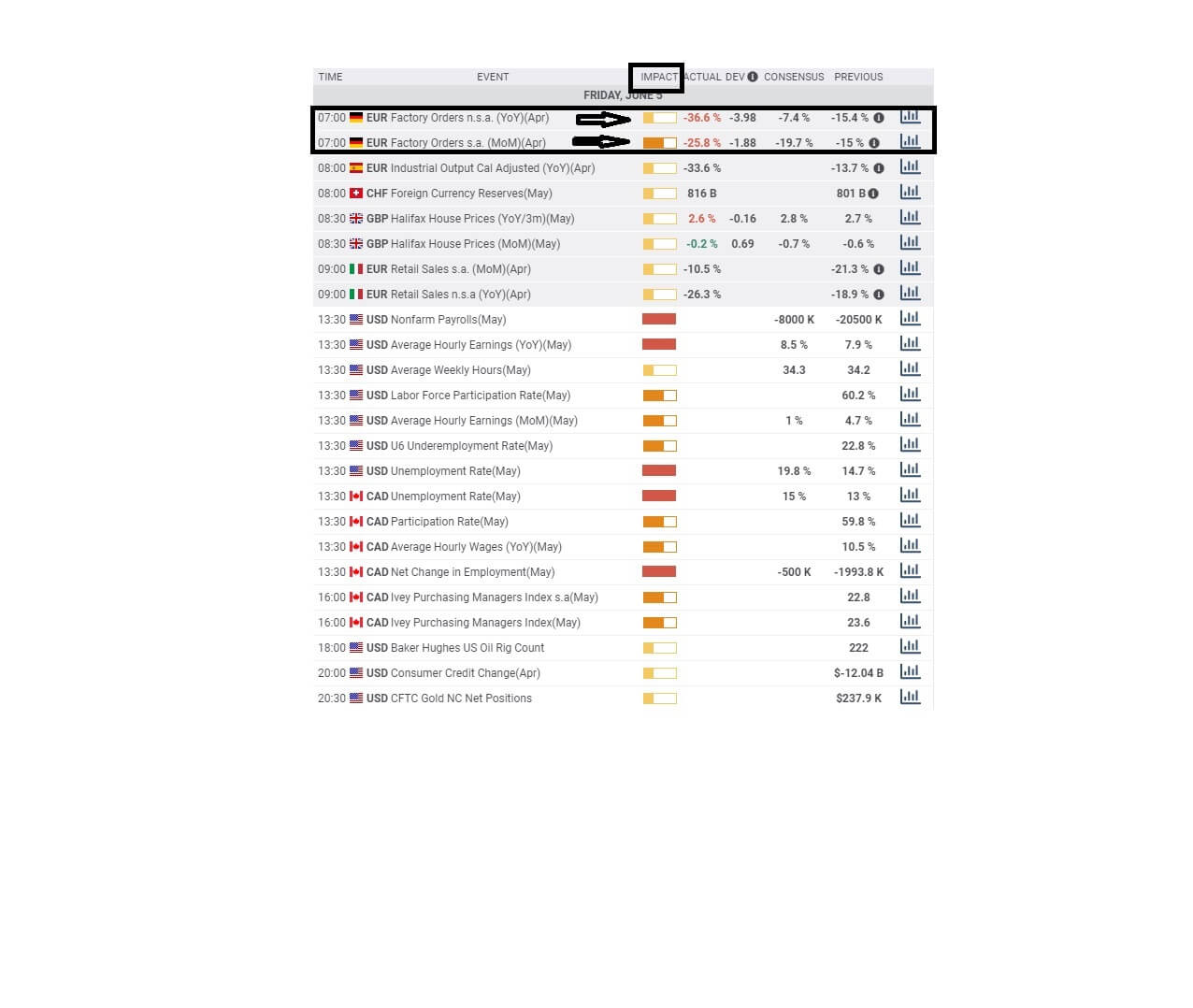

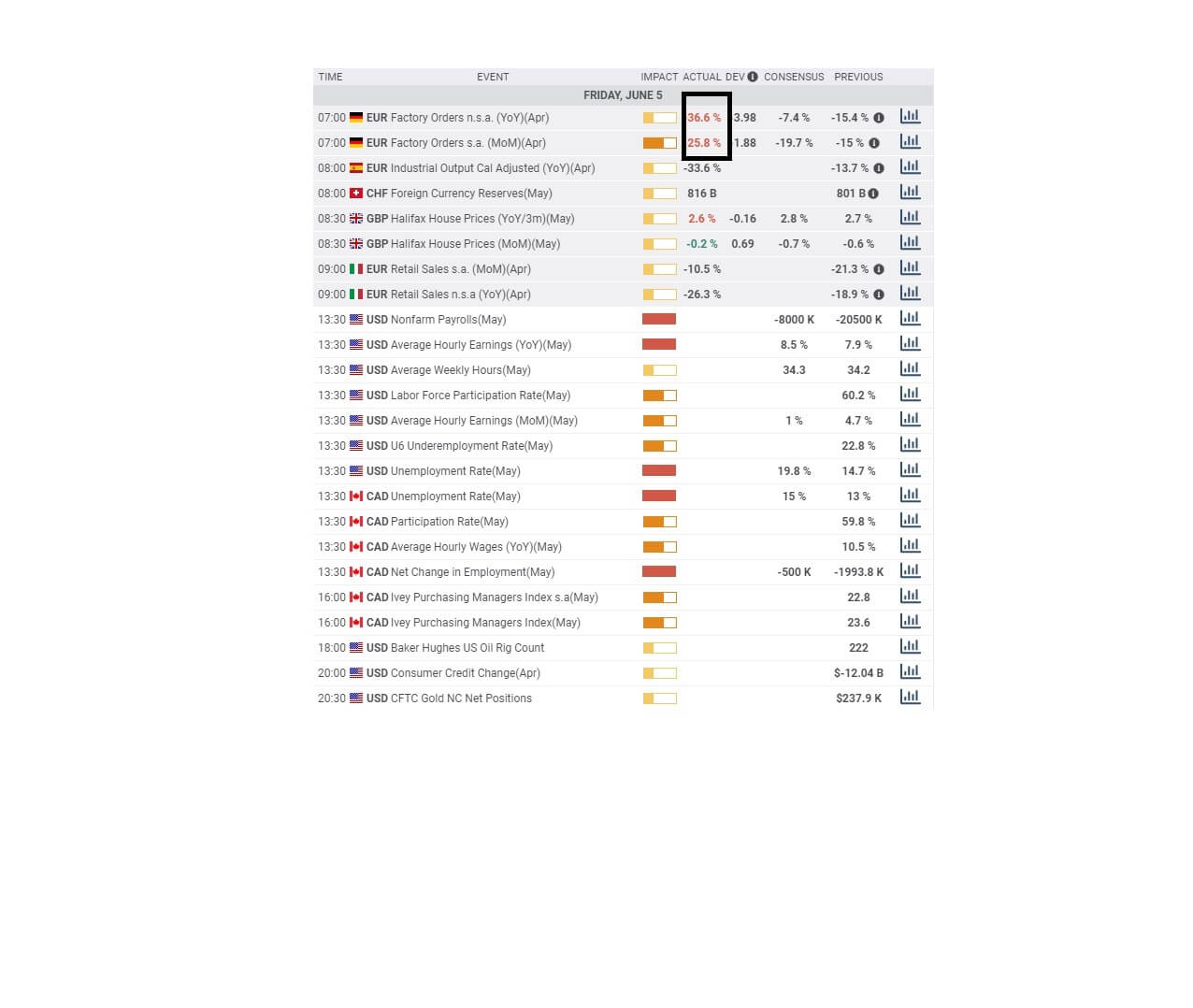

Impact of the ‘Factory Orders’ news release on the Forex market

In the previous section of the article, we understood the factory orders economic indicator and saw how important it is for foreign investors. As defined earlier, it is a report which shows the value of new factory orders for both durable goods and non-durable goods. The survey is usually released a week after durable goods orders report. The report tends to be predictable, with only non-durable goods appearing as the new component compared to the previous report. Thus, investors would have priced in most of the information even before the official release. Still, it causes some volatility in the currency pair during the news announcement.

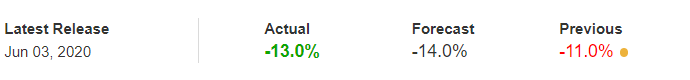

In today’s lesson, we will analyze the impact of the factory orders news announcement on various currency pairs and witness the change in volatility due to the news release. The below image shows the latest factory orders data of the United States, where it can be seen that the orders were better than expectations but were lower than last time. A higher than expected reading is considered to be bullish for the currency, while a lower than expected reading is considered negative. But, let us find out how the market reacts to this data.

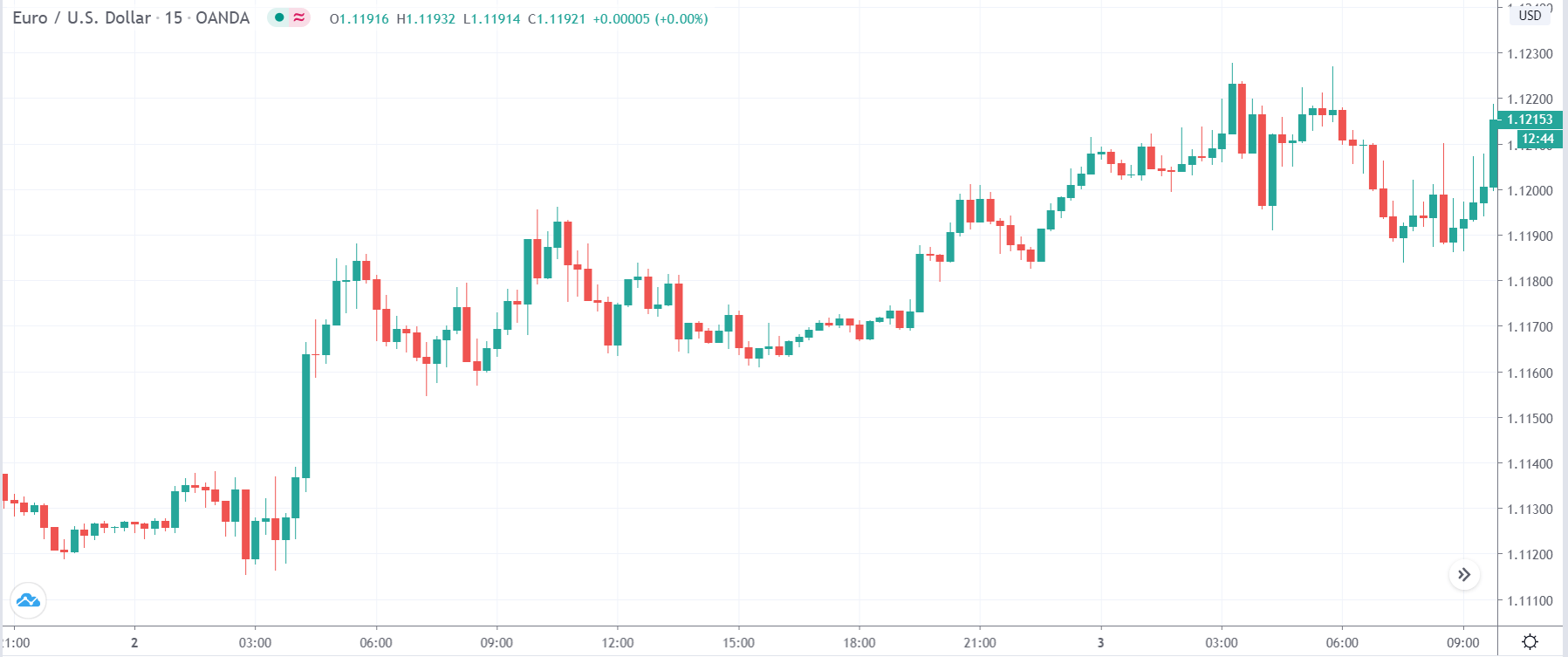

EUR/USD | Before the announcement

Let us start with the EUR/USD currency pair to observe the impact of factory orders on the U.S. dollar. The above image shows the 15 minutes time-frame chart of the currency pair where the market is in a strong uptrend before the news announcement. Recently the price has formed a ‘range,’ and the price is at the top of the ‘range’ at this moment. Technically, this is an ideal place for going ‘short’ in the market, but since a news announcement is due, it is advised not to take any portion before the announcement.

EUR/USD | After the announcement

After the news announcement, the price initially moves higher, but this is immediately sold, and the market erases all the gains. The ‘news candle’ finally closes at the price where it had opened. Therefore, the factory orders data brought about a great amount of volatility in the currency pair, which is evident from the wick on top of the ‘news candle.’ One should wait for the volatility to settle down before taking a position in the market.

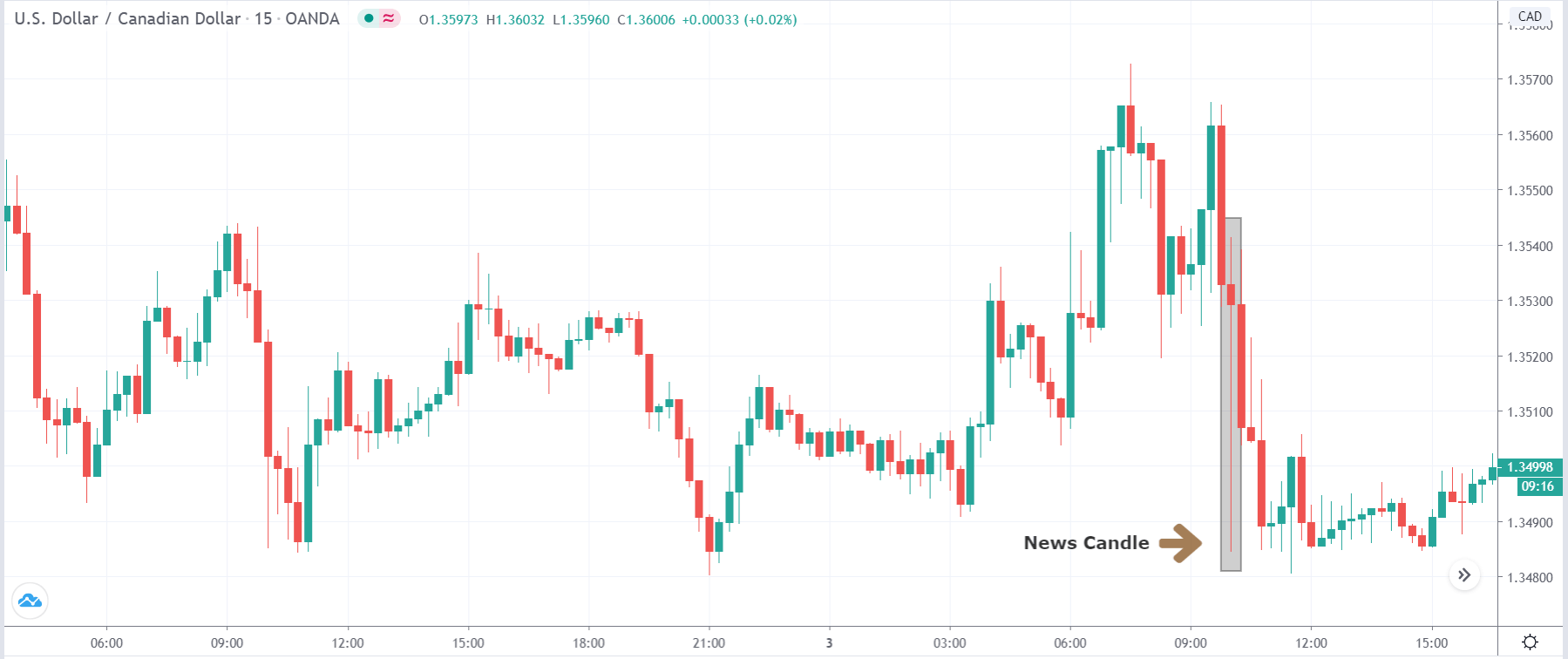

USD/CAD | Before the announcement

USD/CAD | After the announcement

The above images represent the USD/CAD currency pair, where we see that the market is extremely volatile before the news announcement, and there is no clear direction of the market. As a point of a tip, it is not advisable to trade in currency pairs where the volatility is more than normal as there are a lot of risks associated with trading in trading such pairs.

After the news announcement, the currency pair gets exceedingly volatile where essentially the price drops greatly, but buyers pressure from the bottom takes the price back to its opening level. Therefore, the factory orders data had a major impact on the pair where the price continued to move lower a few minutes after the news release.

AUD/USD | Before the announcement

AUD/USD | After the announcement

The above images are that of the AUD/USD currency pair, where the price is retracing the overall uptrend of the market. In such market situations, we should be looking for trend continuation candlestick patterns to confirm that the market will continue moving up.

After the news announcement, the price sharply moves higher and leaves a wick on top of the ‘news candle.’ Since volatility is high on both sides of the market during the announcement, we cannot ascertain if the factory orders data was positive or negative for the currency. As the market continues to move higher after the close of the ‘news candle,’ one should look for going ‘long’ in the market a few hours after the news announcement.

This ends our discussion on the ‘Factory Orders’ Fundamental driver. It is crucial to know its impact on the Forex price charts before trading this market. Cheers!