Royal Capital Pro is a foreign exchange broker situated in Tallin, Estonia. They claim to be perfect for traders from all backgrounds, offering superb trading materials and training, a wide array of bonuses and perks, step by step analysis, latest risk management tools and top quality customer service team. That is what the expectations are, so in this review, we will be looking at what is on offer to see if they live up to these expectations.

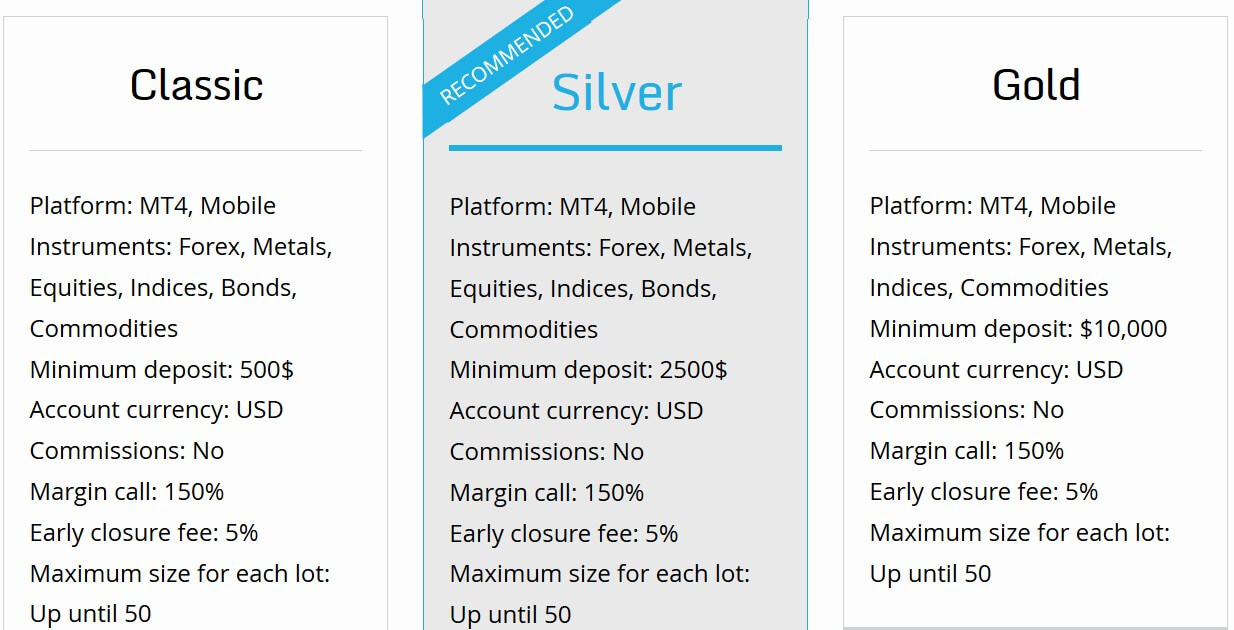

Account Types

There are three main accounts on offer and then an additional Islamic account, here is what their requirements and features are.

Classic Account: This is the entry-level account from Royal Capital Pro, it has a minimum deposit amount of $500, this account uses the MetaTrader 4 trading platform, has access to Forex pairs, metals, equities, indices, bonds and commodities, the account currency must be in USD and there are no added commissions. The margin call is set at 1505 and the maximum trade size is 50 lots. The account also comes with an account manager with a professional degree in Economics, a plethora of materials that help you understand trading, free tutorial trading sessions consisting of 3 lessons, a trading platform is compatible with mobile phone and daily recommendations from your account manager

Silver Account: The silver account increases the required deposit to $2,500, this account also uses MetaTrader 4 and has access to forex, metals, equities, indices, bonds, and commodities. The currency must be in USD and there is no added commission, the margin call is set at 150% and the maximum trade size is 50 lots. The account also comes with an account manager with a professional degree in Economics, a plethora of materials that help you understand trading, free tutorial trading sessions consisting of 5 lessons, daily recommendations from your account manager, a trading platform is compatible with a mobile phone.

Gold Account: The Gold account has a required deposit level of $10,000, this account is also un USD and has access to forex pairs, metals, indices and commodities. It uses the MetaTrader 4 platform and has no added commissions. The margin call level remains at 150% and the maximum trade size remains at 50 lots. The following features are also part of the account: An account manager with a professional degree in Economics, more advanced materials that are designed for you to learn the most advanced strategies. Free tutorial trading sessions consisting of 7 lessons, free access to all sorts of video tutorials, daily review by your market analyst, daily recommendations from your account manager, a trading platform is compatible with mobile phones.

Islamic Account: An Islamic account is for those that are not able to receive interest (swap fees) due to their beliefs, the website states the following features for this account: Buying and selling occur immediately and there is no postponement clause. All currencies are properly documented between the buyer and the seller. The deal must be paid for in full without any delay. If there are any usurious rates the contract is invalid.

Platforms

The trading platform offered by Royal Capital Pro is MetaTrader 4, so let’s see what this platform offers.

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. Millions of people use MT4 for its interactive charts, multiple timeframes, one-click trading, trade copying and more. In terms of accessibility, MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Leverage

The amount of leverage offered is the same for all accounts, however, different asset types have different maximum leverage amounts. You can select your maximum leverage when opening up an account and should you wish to change it you can get in contact with the customer service team to give them your request.

- Forex Majors: 1:200

- Forex Crosses: 1:200

- Indices: 1:50

- Metals: 1:200

- USA Shares:1:20

- Commodities: 1:50

- Energy Futures: 1:100

- Europe Shares: 1:20

Trade Sizes

Trade sizes for all accounts start at 0.10 lots (known as a mini lot), usually, broker start trades at 0.01 lots which make them more accessible and easier to apply risk management. Increments of the trades are unknown as to whether it is 0.01 lots or 0.1 lots. The maximum trade size is 50 lots which are fine as we always recommend to stay under 50 lots, the bigger the trade size, the harder it is for liquidity providers and the markets to execute the trades quickly and without any slippage.

Trading Costs

All the accounts use a spread based system that we will look into later in this review, there is no commission on any of the accounts. The other cost that is valid for all accounts except for then Islamic accounts is swap charges, this is an interest that is either paid or received for holding trades overnight, the amount of this interest can be viewed within the MetaTrader 4 trading platform.

Assets

Assets at Royal Capital Pro have been broken down into a number of different categories. We will outline some of the instruments in each group below.

Forex Majors: EURUSD, USDJPY, AUDUSD, USDCAD, NZDUSD, USDCHF, GBPUSD.

Forex Crosses: CADJPY, AUDJPY, EURGBP, EURAUD, EURJPY, EURCHF, CHFJPY, NZDJPY, HBPCHF, GBPJPY, EURCAD, GBPCAD, AUDCAD, AUDCHF, GBPAUD, CADCHF, NZDCHF, AUDNZD, NZDCAD, GBPNZD, USDHKD, USDPLN, EURNZD, USDSGD, USDTRY, EURTRY, EURPLN, EURDKK, USDDKK, EURNOK, USDNOK, EURSEK, USDSEK, USDZAR, USDMXN.

Indices: NASDAQ, DOW JONES, S&P 500, CAC 40, IBEX 35, NIKKEI, SMI, Dax 30, FTSE 100.

Metals: XAGUSD (Gold), XAUUSD (Silver).

USA Shares: (a lot so only a few mentioned) Cisco, Alcoa, Apple, Google, CitiGroup, Coca Cola, Exxon Mobile, Pepsi.

Commodities: Cocoa, Corn, Soy Bean, Wheat, Coffee, Sugar.

Energy Futures: Crude Oil, Natural Gas, Brent Crude Oil.

Europe Shares: Eni, Fiat, Banco Santander, BMW, BBVA, Inditex, Telefonica, Deutsch Bank, Siemens, Volks Wagon, Enel, Unicredito Spa, Barclays, BP, HSBC, British Airways, Roll Royce, Tesco, Vodafone.

Spreads

There is only one set of spreads mentioned on the site so we believe that all accounts use the same spreads. EURUSd is shown as having a spread of 3.2 pips, this is the starting level, the spreads are variable (also known as floating) which means they move with the markets when there is a lot of volatility they move a lot more and can be larger. Different instruments also have different starting spreads, so while EURUSD shows as 3.2 pips, other pairs like NZDUSD are shown as 4.2 pips.

Minimum Deposit

The minimum amount needed to open up an account is $500 which gets you the Classic account, if you want a different account you will need to deposit at least $2,500. Usually, once an account has been opened small er amounts can be deposited to top up the account but there is no mention of such a thing on the Royal Capital Rpo website.

Deposit Methods & Costs

There are a few different ways to deposit into Royal Capital Pro, these are Credit / Debit Card, both Visa or MasterCard, Bank Wire Transfer and a number of different e-wallets including, WebMoney, CashU, Neteller and Skrill.

Currently, there is a high fee of $25 (or currency equivalent) per deposit which is very high for depositing, there is also a note saying that Royal Capital Pro could change this at any time. We would also suggest checking with your processor or bank to see if they add any fees of their own.

Withdrawal Methods & Costs

The same methods are available to withdraw, for clarification these are Credit / Debit Card, both Visa or MasterCard, Bank Wire Transfer and a number of different e-wallets including, WebMoney, CashU, Neteller and Skrill. The minimum withdrawal is 50 units unless you have less than this and it is your last withdrawal.

There is no mention of a fee, however considering there is a fee for depositing we are confident that there will be one for withdrawing too, in any case, we would recommend checking with your processor or bank to see if they add any fees of their own.

Withdrawal Processing & Wait Time

Withdrawal requests will take up to 24 hours to be processed once it has been processed it may take up to 7 days for funds to reach your bank account.

Bonuses & Promotions

The only promotion that seems to be running is a cashback program where you can earn up to $10 per lot traded as cashback. The following details are correct at the time of writing:

Deposit $5,000 – $10,000 – $1 cashback per lot traded

Deposit $10,000 – $50,000 – $5 cashback per lot traded

Deposit $50,000+ – $10 cashback per lot traded.

The cashback is deposited as real funds and the client can do as they see fit including withdrawing.

Educational & Trading Tools

There is a page on trading strategies but it is very simple not a whole lot of information and provides a very brief overview of different trading strategies. There are also trading signals on offer but we can not see them so we can not tell how accurate or profitable they have been in the past. There is then a glossary of different terms should you come across a word or phrase that you do not understand. There is a training section, however, registration is currently closed so you can not currently sign up for this.

Customer Service

The contact us page on the website offers you a few different ways to get in touch. You can use the online submission to send your query which you should then get a reply via email. There is also a physical address available along with an email address to the support team and a phone number, there is also a separate email for the support team, and complaints team.

No message about what times the support team is open but we will be assuming that they will be closed over the weekends, the same times as the markets are.

Demo Account

There is no option to select a demo account so it does not appear that there are any. This is a shame as new clients like to use them to test out trading conditions and current clients like to use them to test out new strategies without risking any of their own capital. This is an area that Royal Capital Pro should look into improving.

Countries Accepted

There is no statement on the website about which countries are eligible for an account and which are not, so if you are interested in joining we would recommend getting in touch with the customer service team first to make sure you are eligible for an account.

Conclusion

The trading conditions offered by Royal Capital Pro are a little on the steep side, while there is no commission, the spreads are starting at over 3 pips which is quite expensive, a lot of the competition start at around 1.5 pips for non-commission based accounts. Deposit and withdrawal methods are good however there is a fee for depositing and we expect there to be one for withdrawing too which is always a shame to see. No demo account makes it hard to really gauge the trading conditions that are being offered.