EUR/JPY Exogenous Analysis

- The EU and Japan Current Account to GDP differential

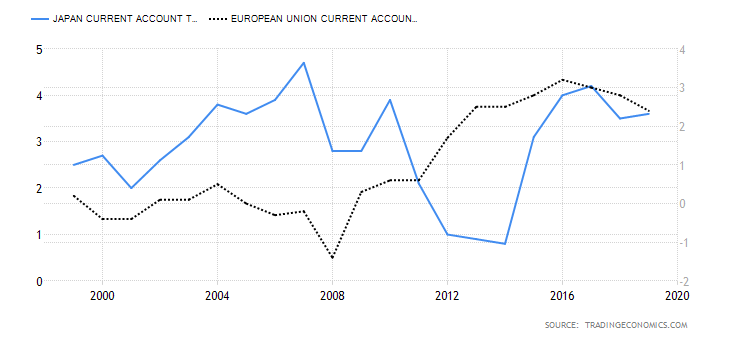

The current accounts have three basic components: net exports, the difference in incomes that countries pay each other, and transfer payments that countries make to each other. A country that has a surplus in international trade has a higher current account to GDP ratio. Since its domestic currency is in higher demand, it tends to appreciate. Conversely, a country with current account deficits will need to buy more foreign currencies to finance its imports – which weakens the domestic currency in the forex market.

In 2020, the Japanese currency account to GDP ratio was expected to drop to 3.5% while that of the EU 3.4%. This means that the 2020 current account to GDP differential between the EU and Japan is -0.1%. In this case, we expect a bullish JPY; hence, we assign a score of -2.

- The interest rate differential between the EU and Japan

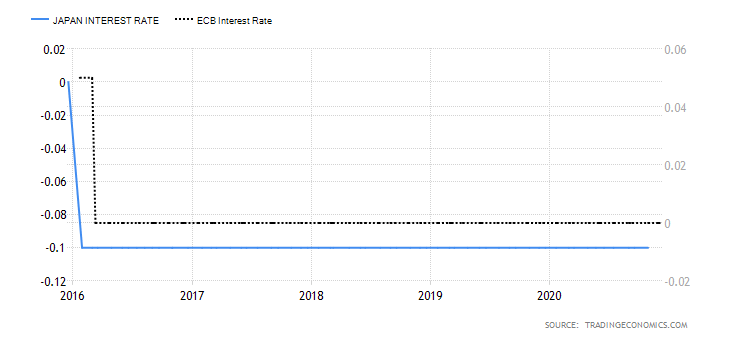

The interest rate differential between the EUR/JPY pair is used to determine whether traders are bullish or bearish. If the interest rate differential is positive, it means that traders can receive higher returns by selling the JPY and buying the EUR since the EUR offers higher returns. Thus, they are bullish on the pair. Conversely, if the interest rate differential is negative, it means that traders can receive higher returns by selling the EUR and buying the JPY, which means they will be bearish on the EUR/JPY pair.

In 2020, the Bank of Japan maintained the interest rates at -0.1% while the ECB maintained at 0%. Therefore, the interest rate differential for the EUR/JPY pair is 0.1%. We assign a score of 2.

- The EU and Japan GDP Growth Rate differential

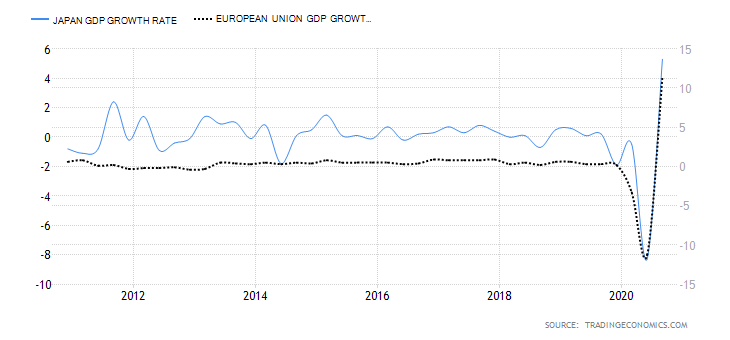

The rate at which an economy is growing impacts the strength of the domestic currency in the forex market. Since it is impractical to compare countries’ economic performance using absolute GDP numbers, we will use their growth rate. In this case, if the GDP growth rate differential is positive, it means that the EU economy has been growing at a faster pace than that of Japan hence a bullish outlook for the EUR/JPY pair. Conversely, when negative, it implies a bearish outlook for the pair.

The Japanese economy contracted by 3.5% in the first three quarters of 2020, while the EU economy contracted by 2.9. Thus, the GDP growth rate differential is 0.6%. Thus, we assign a score of 2.

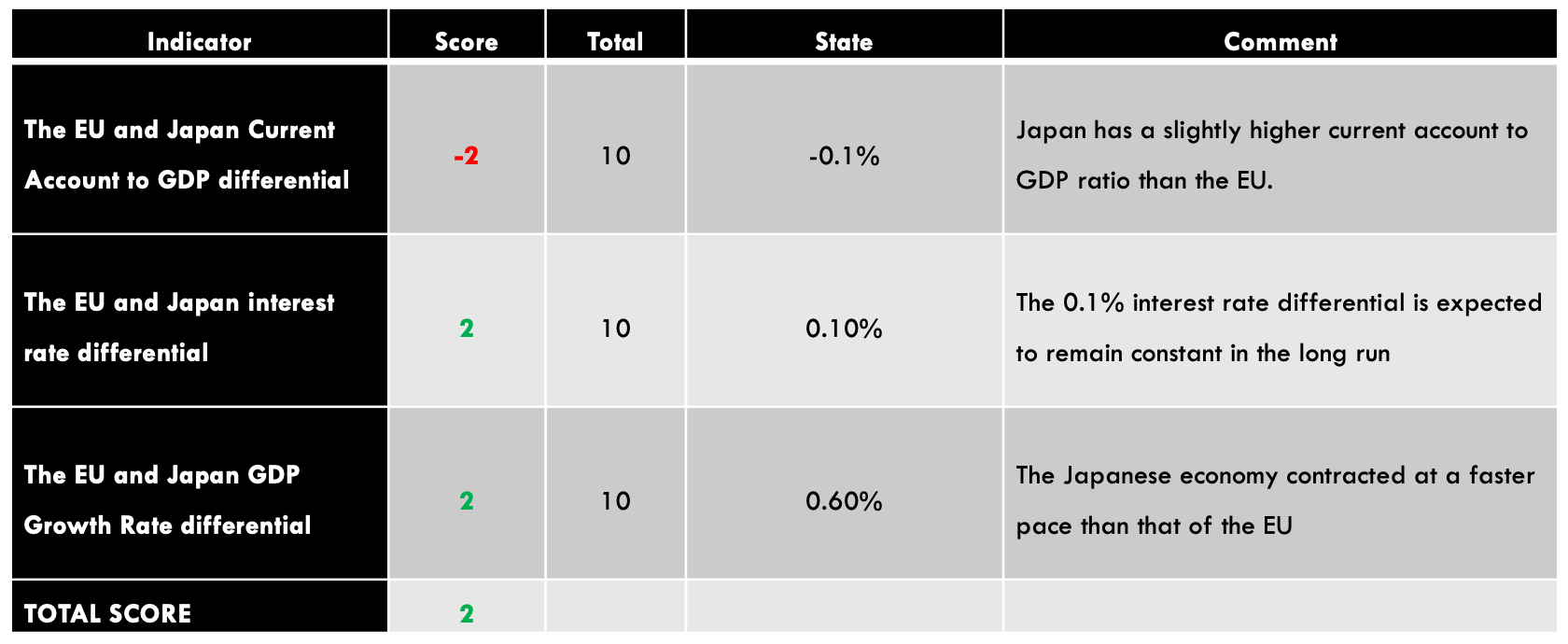

Conclusion

The exogenous factors have a cumulative score of 2. That means we can expect a short-lived bullish trend for the EUR/JPY pair. The weekly EUR/JPY chart shows that the pair has crossed the 200-period MA for the first time since August and attempting a breach of the upper Bollinger band.

We hope you find this article informative. In case of any questions, please let us know in the comments below. Cheers.