Direktbroker-FX.de is a brand operated by the Cyprus-based investment firm Leverate Financial Services Ltd. Under the leadership of veteran Forex brokers, the company describes themselves as an independent brokerage that aims to provide service to traders of all skill levels, while offering a wide variety of tradable instruments on very competitive terms. The broker’s parent company is regulated by the Cyprus securities and exchange commission (CySEC) with license number 160/11 and the Federal Financial Supervisory Authority (BaFin) for providing services to Germany. If you’re interested in opening an account, you’ll want to keep reading to find out more about the broker’s four main account types, competitive spreads, and other important facts.

Account Types

Direktbroker offers four main account types: Silver, Gold, Platinum, and Professional. In order to get started, traders will need to deposit at least 500 Euros for a Silver account, $5,000 for a Gold account, or up to $25,000 in order to open the more expensive Platinum and Profession accounts. The broker follows ESMA standards regarding leverage and sets the maximum cap at 1:30 for retail clients and 1:400 for Professional clients. Spreads are shared when trading currencies and start as low as 0 pips on all account types, but options do differ when trading indexes.

Commission fees can be broken down into charges on forex pairs and share CFDs. Commissions are one of the most important things to consider, as this is where most of the cost of trading will come from with this broker. Accounts offer access to the same tradable instruments and trade sizes, but traders should note that EAs are only allowed on Silver accounts. We’ve provided an overview of each account below.

Silver Account

Minimum Deposit: 500 Euro

Leverage: Up to 1:30

Spread: From 0 pips

Commission: 2.5 points on FX and 5.95 Euros for single stock CFDs

Gold Account

Minimum Deposit: 5,000 Euro

Leverage: Up to 1:30

Spread: From 0 pips

Commission: 1.2 points on FX and 2.95 Euros for single stock CFDs

Platinum Account

Minimum Deposit: 25,000 Euro

Leverage: Up to 1:30

Spread: From 0 pips

Commission: 1.2 points on FX and 2.95 Euros for single stock CFDs (after the first 12 months)

Professional Account

Minimum Deposit: 25,000 Euro

Leverage: Up to 1:400

Spread: From 0 pips

Commission: 1 point on FX and 2.95 Euros for single stock CFDs (after the first 12 months)

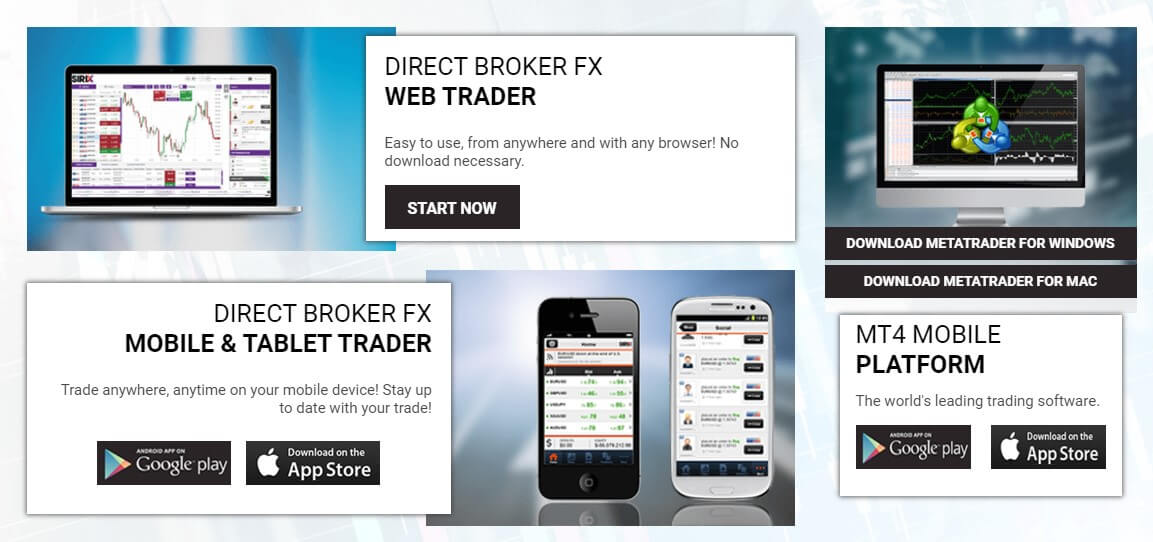

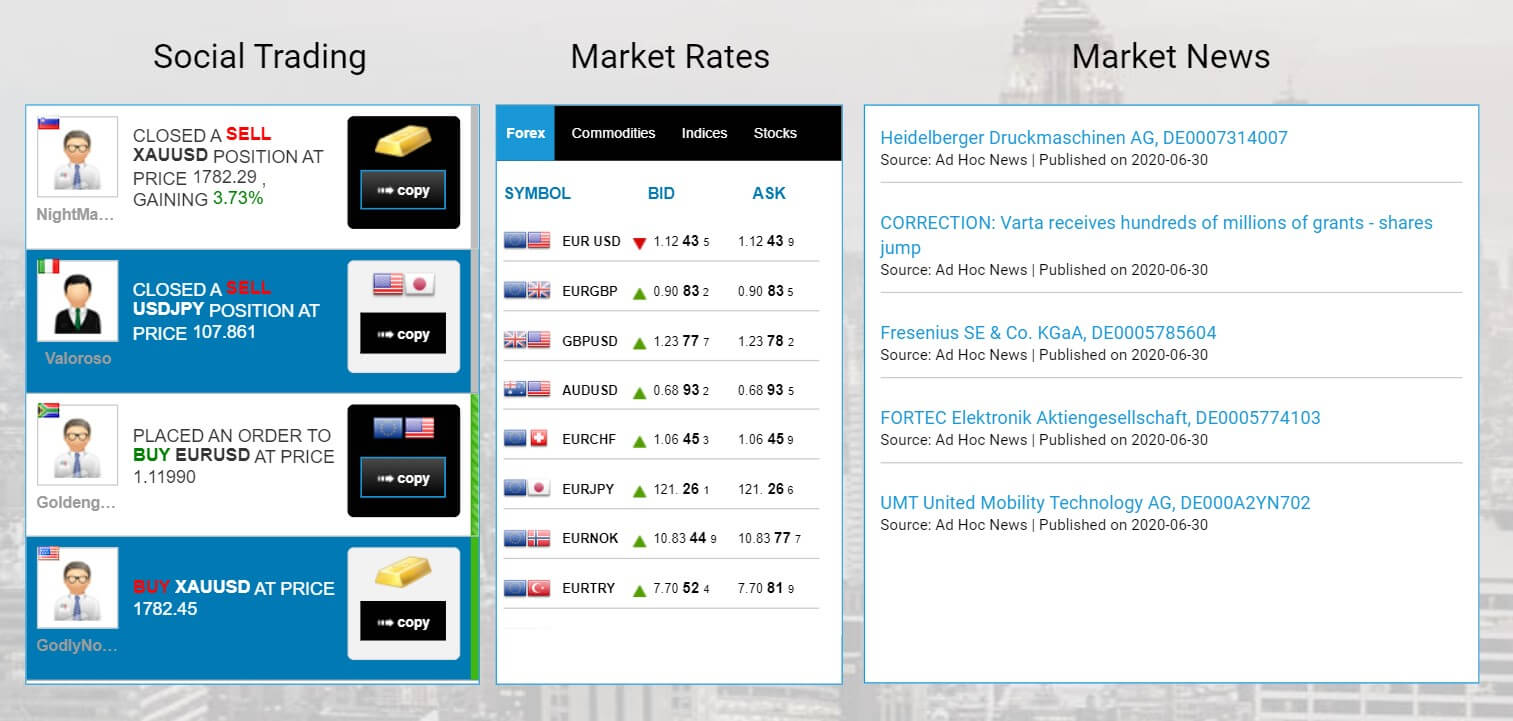

Platform

The broker offers its own web-based, mobile/tablet compatible platform alongside what is likely the world’s most popular trading platform, MetaTrader 4. MT4 can also be downloaded on mobile & tablet devices, accessed through the web, or downloaded directly on PC. Direktbroker doesn’t put any effort into describing their own platform, which is surprising. We typically see brokers going to great lengths to list features included on their secondary platforms in an attempt to compete with the more well-known MT4.

Fortunately, traders can simply opt for MT4, which we already know comes with multiple features, built-in indicators, and tools, languages, charting tools, analytical objects, and other features. The platform supports EAs (although this is only available on the Silver account) and allows traders to customize their experience on a navigable interface. With the lack of information about the Direktbroker platform, we would highly recommend choosing the timeless MT4 option, although one could certainly test the broker’s platform to see which option is more preferable from a personal standpoint.

Leverage

The company follows ESMA’s product intervention guidelines regarding leverage, which sets a 1:30 cap on FX majors, 1:20 on all other currencies, gold, and major indices, 1:10 on all other indices and commodities, and 1:5 on equities for retail clients. Under the same guidelines, professional-status clients would be able to use a more significant leverage ratio as high as 1:400. I[‘]f one considers themselves to be within the professional category, then it is possible to apply for those higher options. Note that the aforementioned limits are related to the opening of positions and that higher leverage can be used once the position has been opened. For retail clients, the maximum maintenance leverage is 1:60 and the option is double the original offer at up to 1:800 for professional status investors.

Trade Sizes

The smallest allowed trade size is one micro lot (0.01). Exact margin call and stop out levels are determined based on statistical data. The stop out level is at least 50%, while the margin call level is set at a level of at least 150%. The broker has also set a restriction on EAs by only allowing the option on Silver accounts.

Trading Costs

Costs can be broken down into commission fees, spreads, overnight interest charges, and inactivity fees. Since spreads are tight, the main cost of trading comes from applicable commission fees, which differ based on account type and the type of instrument that is being traded. We’ve provided a more detailed overview of the FX costs below for comparison.

- Silver Account: 2.5 points per lot (half-turn)

- Gold Account: 1.2 points per lot (half-turn)

- Platinum Account: 1.2 points per lot (half-turn)

- Professional Account: 1 point per lot (half-turn)

When trading share CFDs, the broker also charges a flat-rate commission fee, all of which have been provided below. Note that Platinum and Professional account holders can trade these instruments for free for the first 12 months before the listed charges apply.

- Silver Account: 5.95 Euro

- Gold Account: 2.95 Euro

- Platinum Account: 2.95 Euro

- Professional Account: 2.95 Euro

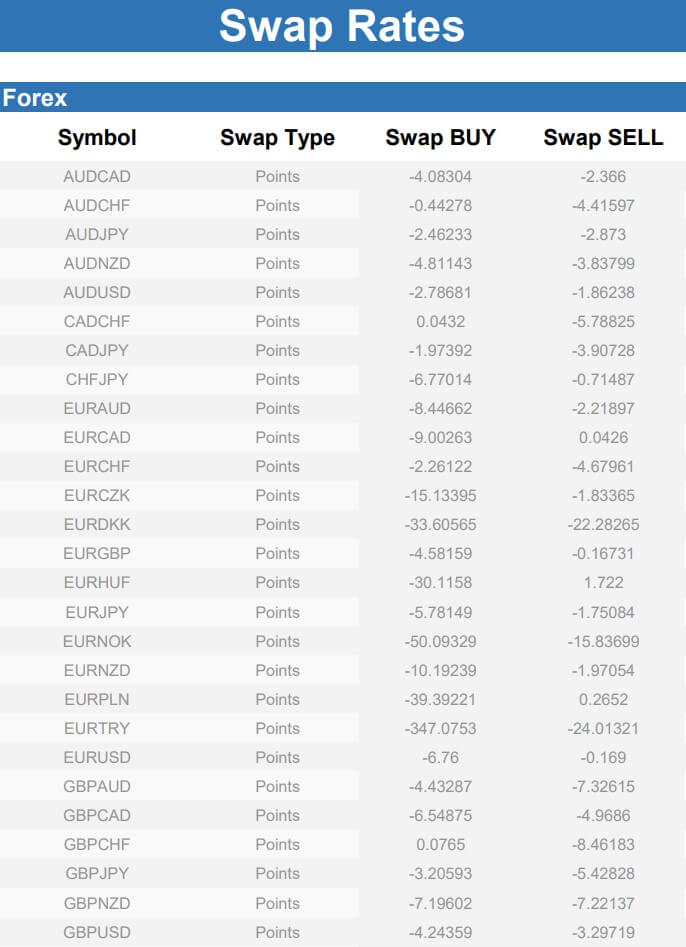

Traders will be credited or debited swaps based on the long and short swap rates of positions that are held past the daily market closing time. Swap rates are not listed on the website and the broker advises clients to view those charges from within the trading platform while remembering that triple charges occur on Wednesdays. Any account that remains inactive for 3 months will begin to be charged a monthly 15 Euro fee until trading resumes or the account’s balance is completely depleted.

Assets

Direktbroker offers a nice variety of currency pairs, including 49 total options that consist of majors, minors, and exotics, including the Mexican Peso, Turkish Lira, Danish Krone, South African Rand, and Swedish Krone. The broker also offers the spot metals Gold & Silver, in addition to Sugar, Coffee, Crude Oil, and Brent Oil. Eleven indices, 5 indexes, and 250+ share CFDs bring the total number of tradable instruments to more than 300 options. Traders would have access to a wide variety of options through this broker, however, some may be disappointed that cryptocurrencies are not available.

Spreads

While the website doesn’t provide us with a live feed, we did find a helpful chart that lists minimum and typical spreads. According to the chart, traders should expect to see the same spreads on currency pairs, regardless of the chosen account type. Below, we’ve provided a few examples of minimum and typical spreads, respectively.

- EURUSD: 0/0.1

- AUDUSD: 0.6/0.7

- EURGBP: 0.5/0.7

- EURJPY: 0.5/0.7

- GBPUSD: 0.6/0.8

- USD/CAD: 0.4/0.6

- USDJPY: 0.4/0.6

Traders should notice that typical spreads are very close to the minimal option and that spreads are very tight, especially compared to the industry’s average 1.5 pips. Of course, commission charges do apply and those charges help to offset the lowered spreads. When trading indexes, spreads tend to be cut in half for Gold and Platinum account holders. For example, DAX is 1 pip on the Silver account and 0.5 pips on the Gold/Platinum accounts. Further details can be viewed under “Trading Conditions” on the website.

Minimum Deposit

The broker’s accounts are on the expensive side, starting from 500 Euros on the Silver account and 5,000 Euros on the Gold account, which equates to about $40 extra when depositing in USD on the Silver account and a $5,423 deposit requirement for the Gold account in USD (based on current conversion rates). The Platinum and Professional accounts are meant for more experienced traders and ask for a 25,000 Euro deposit as such.

Deposit Methods & Costs

Deposits can be made via bank wire transfer, Swift, E-wallet, debit/credit card, Neteller, or any other method of electronic money transfer, according to the website. The company credits incoming deposits within one business day of the time that the funds are received. There is a 1.5% fee charged on credit/debit card deposits and bank wire funds will likely incur fees on the bank’s behalf. Conversion fees would apply if depositing using any currency other than EUR, GBP, USD, and CHF.

Withdrawal Methods & Costs

Direktbroker has a policy that states withdrawals must be made through the same method that was used to deposit funds into the account. The minimum withdrawal amount is $5 USD/EUR/GBP, depending on the account’s currency. A fee of 1.5% is charged on credit/debit withdrawals and the broker charges a 15 EUR fee on bank wire withdrawals from their side, which is charged in addition to any banking fees. The remaining methods are fee-free.

Withdrawal Processing & Wait Time

The website doesn’t cover exact processing times for withdrawals. Based on contact information, we know that the finance team’s working hours are from 09:00 – 17:00 GMT+2 on weekdays, meaning that any requests made after those hours wouldn’t be processed until the following business day. E-wallets or electronic payments are typically sent and received much more quickly than more traditional methods like bank wire or even card deposits, so this would be something to keep in mind if you’re looking for funds to be credited more quickly.

Bonuses & Promotions

While the broker does offer some extra perks like free training, participation in training seminars, etc., none of the offers come in the form of bonuses, contests, or rebates. It’s always disappointing to see a lack of options in this category, although one shouldn’t always expect to see some type of promotion being offered. Keep in mind that there are usually conditions that make it difficult to withdraw funds that are earned instead of deposited, so always be sure to read the terms & conditions on any other website, especially if you’re considering a broker based on an attractive deposit bonus or other promotional offers.

Educational & Trading Tools

Direktbroker seems to understand the importance of educating clients, based on the fact that the broker offers multiple resources, including an Academy that provides a free one-day trading seminar to each client. A Trader-Camp is also available for free for Gold account holders. Traders will find an investment guide, introduction, risk-management, and top 6 mistakes to avoid sections on the website, all of which can be accessed without opening an account. Some resources are based on account status, for example, Gold account holders get 3 months’ worth of mentorship and strategy-consulting, while Platinum/Professional clients can use the service for 6 months. Trading tools are more limited, but the website does offer an expiry calculator and dividend calculator, along with various tools built-into the trading platform MetaTrader 4.

Demo Account

Traders can open a free demo account through Direktbroker by clicking on “Open Account” and then choosing “Try Free Demo”. Demo accounts come pre-loaded with 1,000,000 worth of virtual funds, which can be used to trade in an environment that simulates trading from a live account. Demo accounts are excellent educational tools that can be used for multiple purposes, like testing trading conditions, becoming more familiar with a trading platform, testing spreads, etc. These accounts are typically offered by forex brokers as an educational advantage.

Customer Service

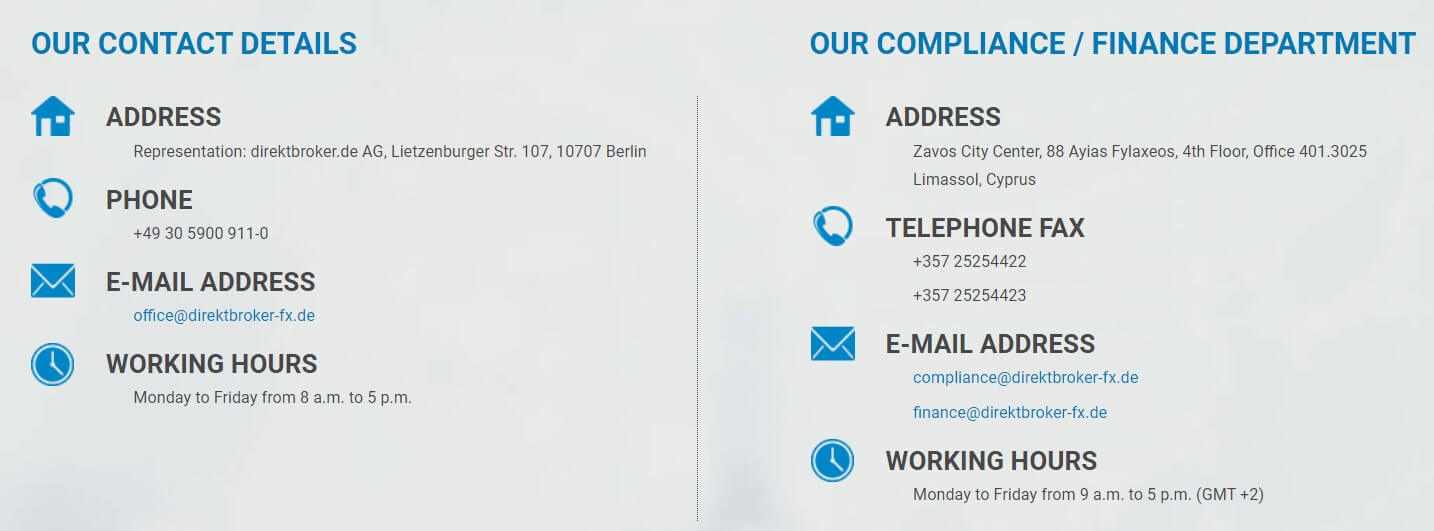

The broker’s normal business hours occur on weekdays from 8 am to 5 pm for regular support and from 09:00 – 17:00 GMT+2 for the finance and compliance departments. During that timeframe, support is on standby to answer LiveChat, email, phone, and fax inquiries. Support seems to be extremely active on LiveChat, and we even had a real agent reach out to us with helpful information once she saw that we were on the website. Call trading is available during normal business hours via the trading desk number that has been listed below. Before calling, traders should have their account ID and password ready in order to verify their identity. Contact details have been listed below.

Email:

Support: [email protected]

Compliance: [email protected]

Finance: [email protected]

Phone:

Support: +49 30 5900 911-0

Fax: +357 25 254423

Trading Desk: +357 25 254422 (extension 512, 514, 505)

Countries Accepted

According to a statement on their website, the broker only accepts clients from a very limited number of locations – which includes Germany, Austria, Lichtenstein, Luxembourg, the Netherlands, and Switzerland. Customer support even greeted us over LiveChat once we entered the website to inform us that clients from our current location (USD) are not allowed to open accounts due to current regulation. The registration list backs up this claim by only listing the aforementioned countries. The sign-up list does have “other” as an option, but the website quickly gave us a message that clients in our jurisdiction were not allowed when we selected the option. Unfortunately, the broker’s registration policy seems to be very strict and there is no way around it.

Conclusion

Direktbroker-FX.de is a fully regulated investment firm that offers currency pairs, metals, commodities, energies, indexes, indices, and 250+ share CFDs to a rather restrictive list of countries like Germany, Switzerland, etc. The broker follows ESMA guidelines regarding leverage and sets initial caps at 1:30 for retail clients and 1:400 for professionals. Direktbroker offers tight spreads from 0 pips to all account holders, while charging commissions at varying rates. Funding an account is fairly straightforward, the broker offers a nice selection of payment options and charges low fees or none at all.

Customer support is also readily available on LiveChat, or via phone and other methods. While promotional offers aren’t available, there is a large emphasis on education and traders would be able to access seminars and benefit from mentors for 3-6 months on accounts that are of a Gold status or higher. If you’re located in one of the accepted countries, then this broker could certainly be of consideration.