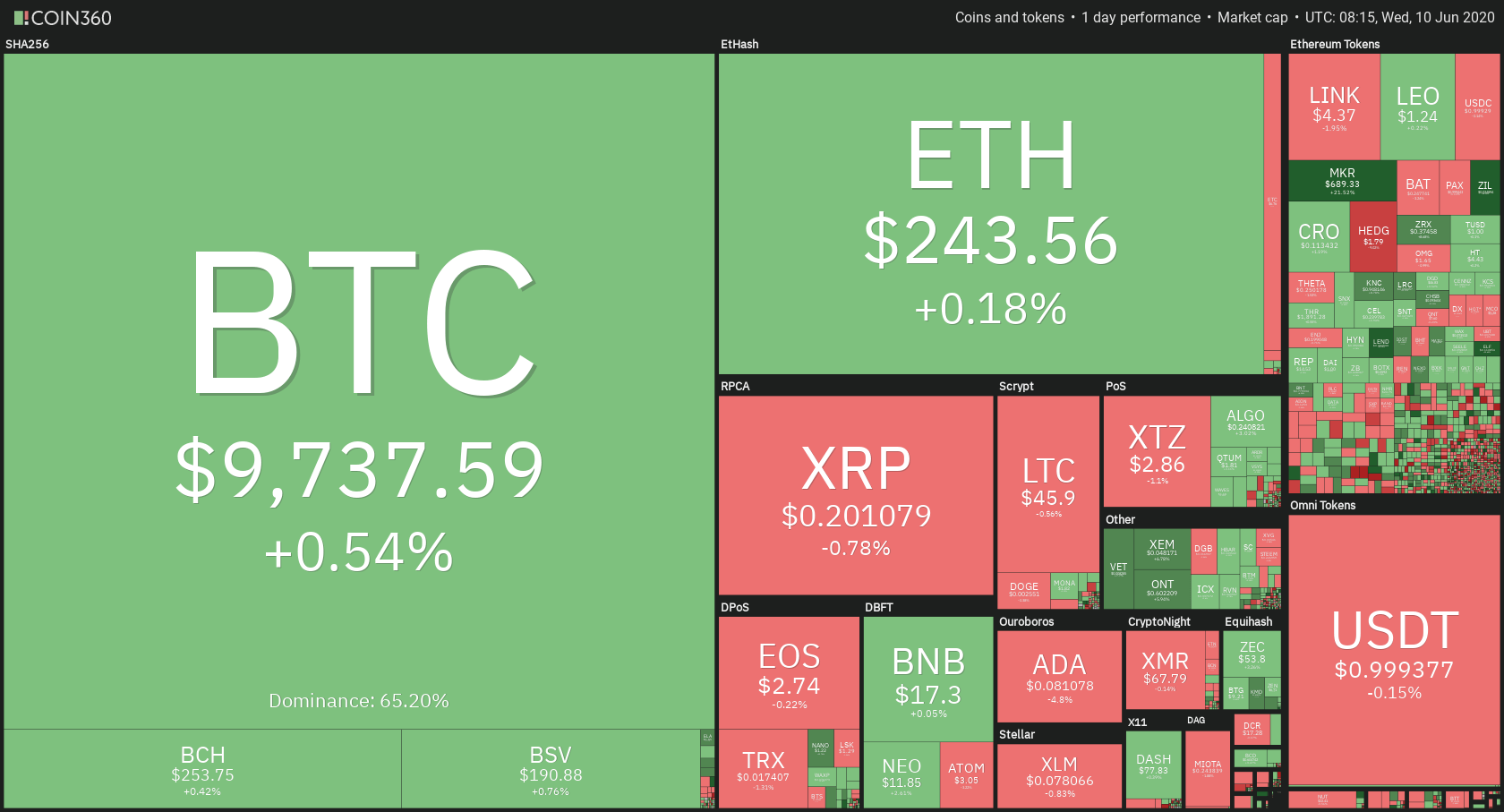

The crypto market has spent the day without much movement and with low volatility. Bitcoin is currently trading for $9,737, which represents an increase of 0.54% on the day. Meanwhile, Ethereum gained 0.18% on the day, while XRP lost 0.78%.

Swiss Borg took the position of today’s biggest daily gainer, with gains of 18.23%. HedgeTrade lost 7.87% of its daily value, making it the most prominent daily loser.

Bitcoin’s dominance decreased since we last reported, with its value currently at 65.20%. This value represents a 0.92% difference to the downside when compared to yesterday’s value.

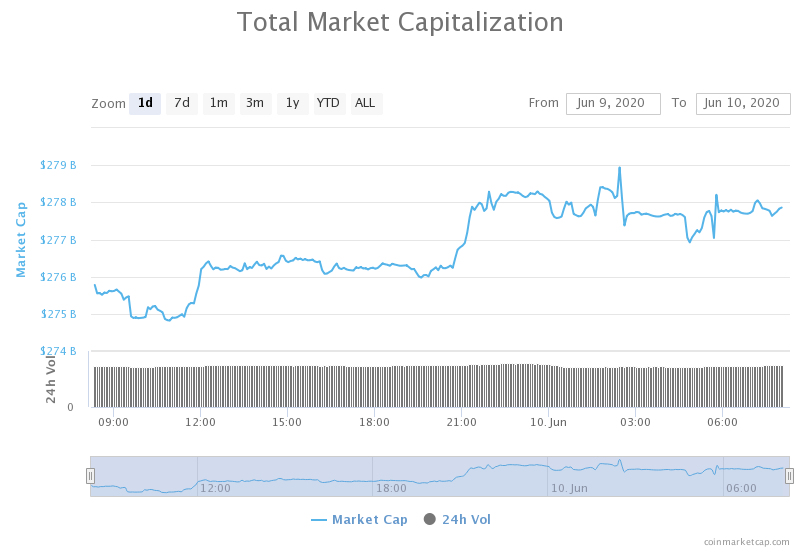

The cryptocurrency market capitalization increased slightly over the course of the day, with the market’s current value being $277.69 billion. This value represents an increase of $1.61 billion when compared to the value it had yesterday.

What happened in the past 24 hours

Crypto Ransomware Cartel?

Ransomware attacks started happening all over the world recently. They were performed by well-known cybercriminal groups, which are reportedly teaming up and creating cartel-style alliances, all with the idea to pressure their respective victims into paying the ransom requests.

The central feature to show that this is happening is that the gang notes that Ragnar Locker, which is a ransomware group, provided this info, as the title of the blog post they have posted says: “MAZE CARTEL Provided by Ragnar.”

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

The largest cryptocurrency by market capitalization has spent the day without much movement. As we noted yesterday, the $9,735 level was breached to the downside but was not confirmed (the lack of confirmation made us think that the move might be corrected soon). Bitcoin regained its price as well as the $9,375 level. There aren’t many opportunities for traders at the moment, but scalp traders might use the fact that Bitcoin is fluctuating around $9,735 and testing support and resistance levels above and below it.

Key levels to the upside Key levels to the downside

1: $9,870 1: $9,735

2: $10,010 2: $9,580

3: $9,250

Ethereum

Ethereum had no movement throughout the day, as it stayed within a one-dollar range. The second-largest cryptocurrency by market capitalization is secured by the 21-period moving average on its downside, while it has absolutely no volume to even try to test the upper levels.

Ethereum’s volume is extremely low while its RSI level is flat for a couple of days, sitting at 53.

Key levels to the upside Key levels to the downside

1: $251.4 1: $240

2: $260 2: $225.4

3: $217.6

Ripple

XRP slowly moved towards the $0.2 downside and tested the level after failing to break $0.205 due to the lack of volume. The third-largest cryptocurrency by market cap is in an inverse spot to Ethereum, as both the 21-period and 50-period moving averages are guarding the upside rather than the downside. XRP will require a substantial increase in volume in order to break this range. On top of that, unless it gets “pulled” up by Bitcoin or fundamentals, XRP is most likely to go under $0.2.

Key levels to the upside Key levels to the downside

1: $0.205 1: $0.2

2: $0.214 2: $0.19

3: $0.227