Introduction

USDTWD is the abbreviation for the US dollar against the New Taiwan Dollar. Due to the involvement of Taiwan in this pair, this pair is classified as an Asian emerging currency pair. Here, the US Dollar is the base currency, and the New Taiwan Dollar is the quote currency.

Understanding USD/TWD

The TWD required to purchase one USD is determined by the price on the exchange rate. It is simply quoted as 1 USD per X TWD. For example, if the price of this pair was 25.856, a rounded figure of 26 TW Dollars are needed to buy one US Dollar.

Spread

The spread is a type of fee that is paid to the broker on each trade. The amount to be paid depends on the lot size traded and also the volatility of the market. It is simply the difference between the bid price and the ask price on the exchange board. The bid and ask price is typically different from different brokers. It also varies based on the execution model implemented by the broker.

ECN: 27 pips | STP: 30 pips

Fees

The commission that a broker charges on each of your trade is the fee. This, too, depends on the type of execution model. Note that there is no fee on STP accounts. However, this is covered by higher spreads.

Slippage

In market orders, one does not get the exact price at which they triggered their buy/sell button. It varies due to the market volatility and the broker’s execution speed. This could be in favor of or against the client.

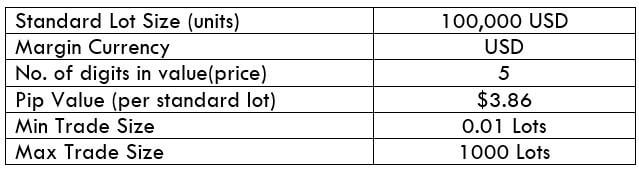

Trading Range in USD/TWD

The trading range is a range of pip movement values in different timeframes. In simple terms, it tells the number of pips the currency pair has moved in a given timeframe. For example, if the minimum volatility value on the 1H timeframe is five pips, then it means that this pair moves at least five pips in about an hour or so. These values can be helpful in figuring the approximate P/L on a trade, even before placing the trade.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

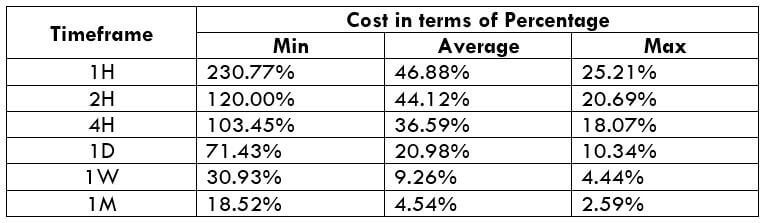

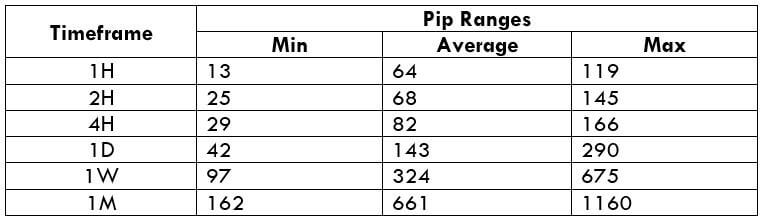

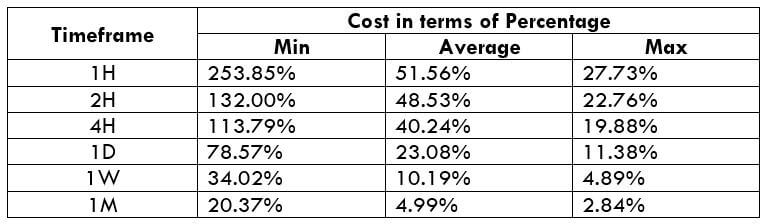

USD/TWD Cost as a Percent of the Trading Range

From the above table, one may even determine the total cost variation in trade in different timeframes for different volatilities. With these values, we can, in turn, determine the ideal way to trade this currency pair.

ECN Model Account

Spread = 27 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 27 + 3 = 33

STP Model Account

Spread = 30 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 30 + 0 = 33

The Ideal way to trade the USD/TWD

The magnitude of the percentages in the table represents how high or low is the cost of the trade. It is proportional to the cost of the trade. In the below table, we can clearly see that the costs are high in the min column, depicting high costs for lower volatilities. Similarly, low costs for high volatilities.

Also, the costs are pretty high on lower timeframes compared to the higher timeframes. So, this definitely is not the best pair to trade for scalpers. With an investment point of view, it could prove to be the best pair irrespective of the timeframe you’re trading. Talking about a positional trader, it is ideal to trade during those times when the volatility of the market is around the average values.

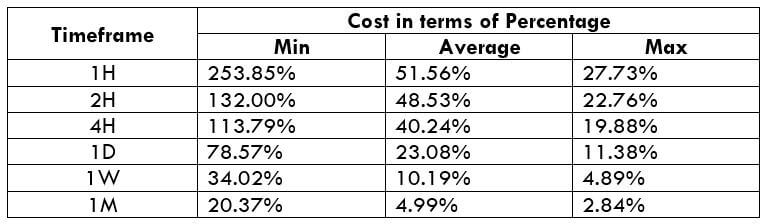

Another simple way to bring your costs down is by placing limit or stop orders instead of market orders. This considerably brings down the cost of the trade as the slippage in such orders is nil.

Below is an example of the cost percentages when the slippage is made zero.

Spread = 30 | Slippage = 0 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 0 + 30 + 0 = 30