How to apply Forex Academy trade signals to your own trading account?

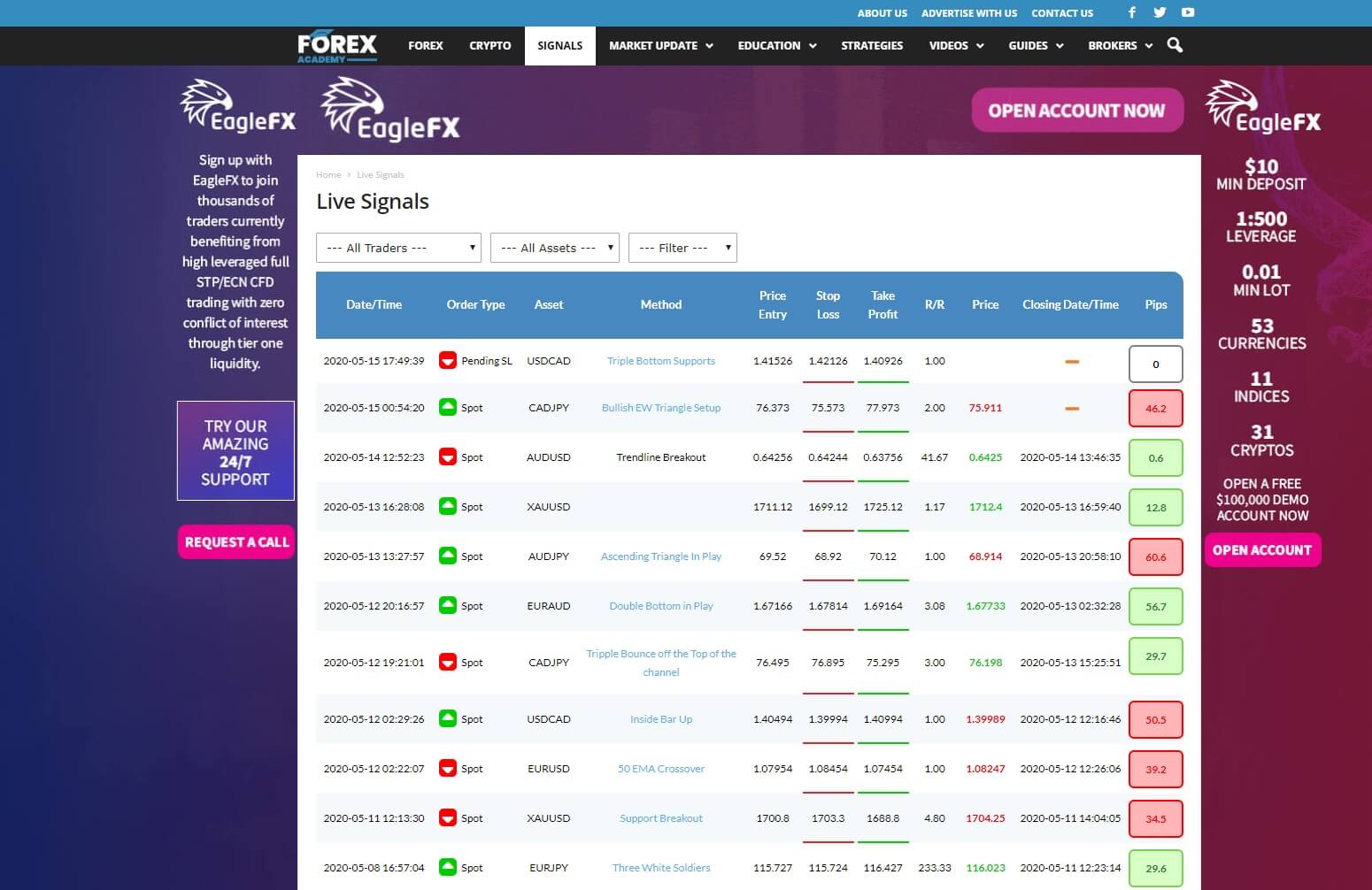

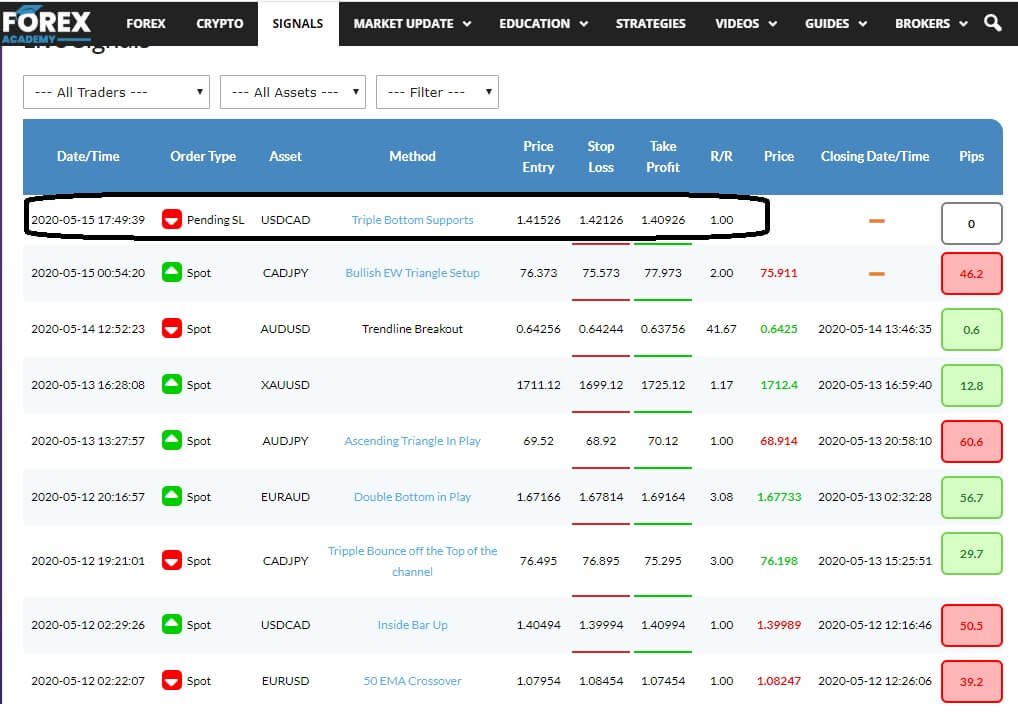

Ok, you have seen the Forex Academy signals table and the incredible success our professional Traders are enjoying, and you want to start copying some of the trades onto your own account, but you are a novice trader and a little bit unsure what to do next.

This presentation is designed to assist you with such tasks. Let’s take a look at a couple of examples of how you can go about applying the trades from the signals table on to your own trading account.

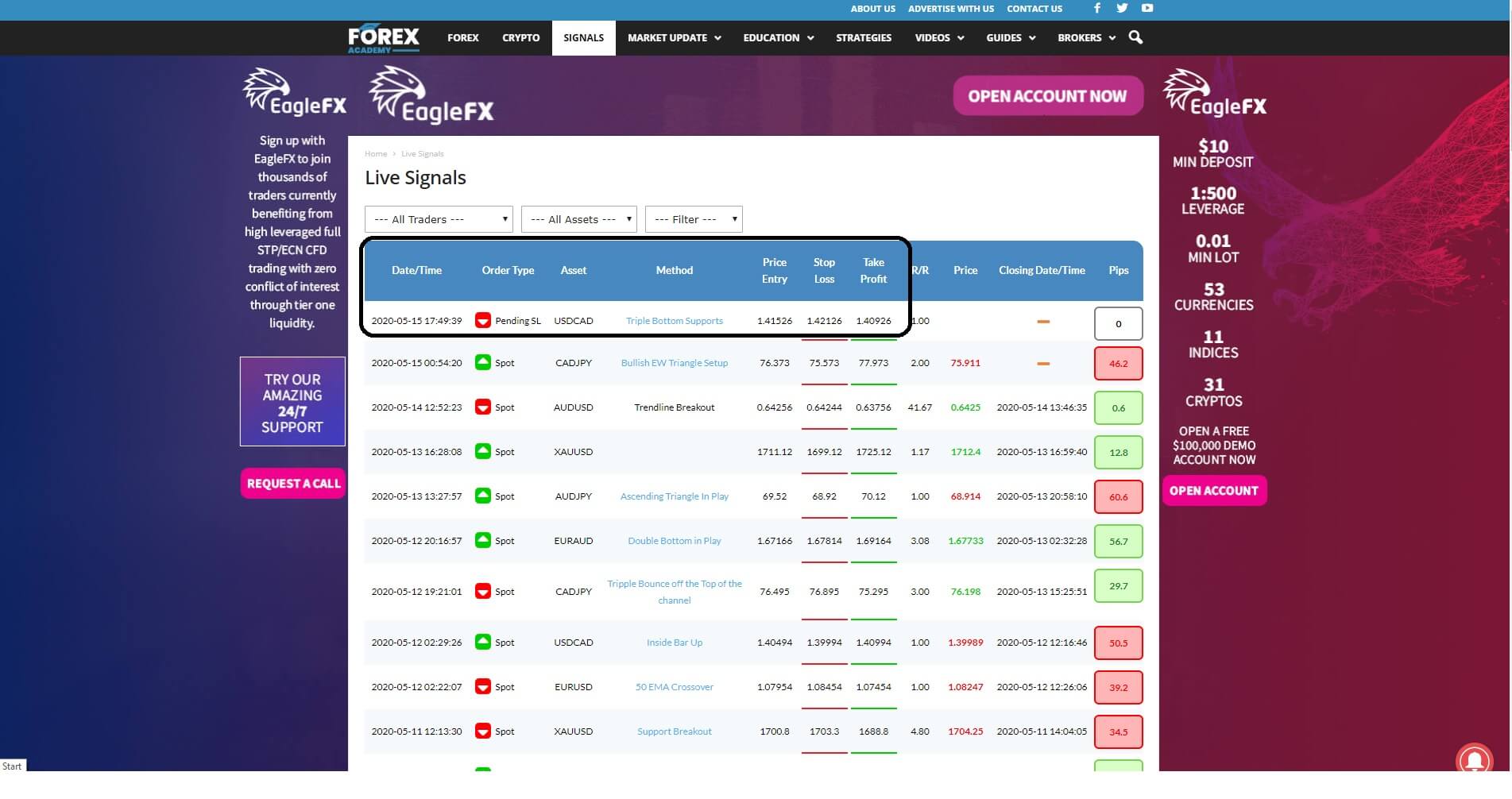

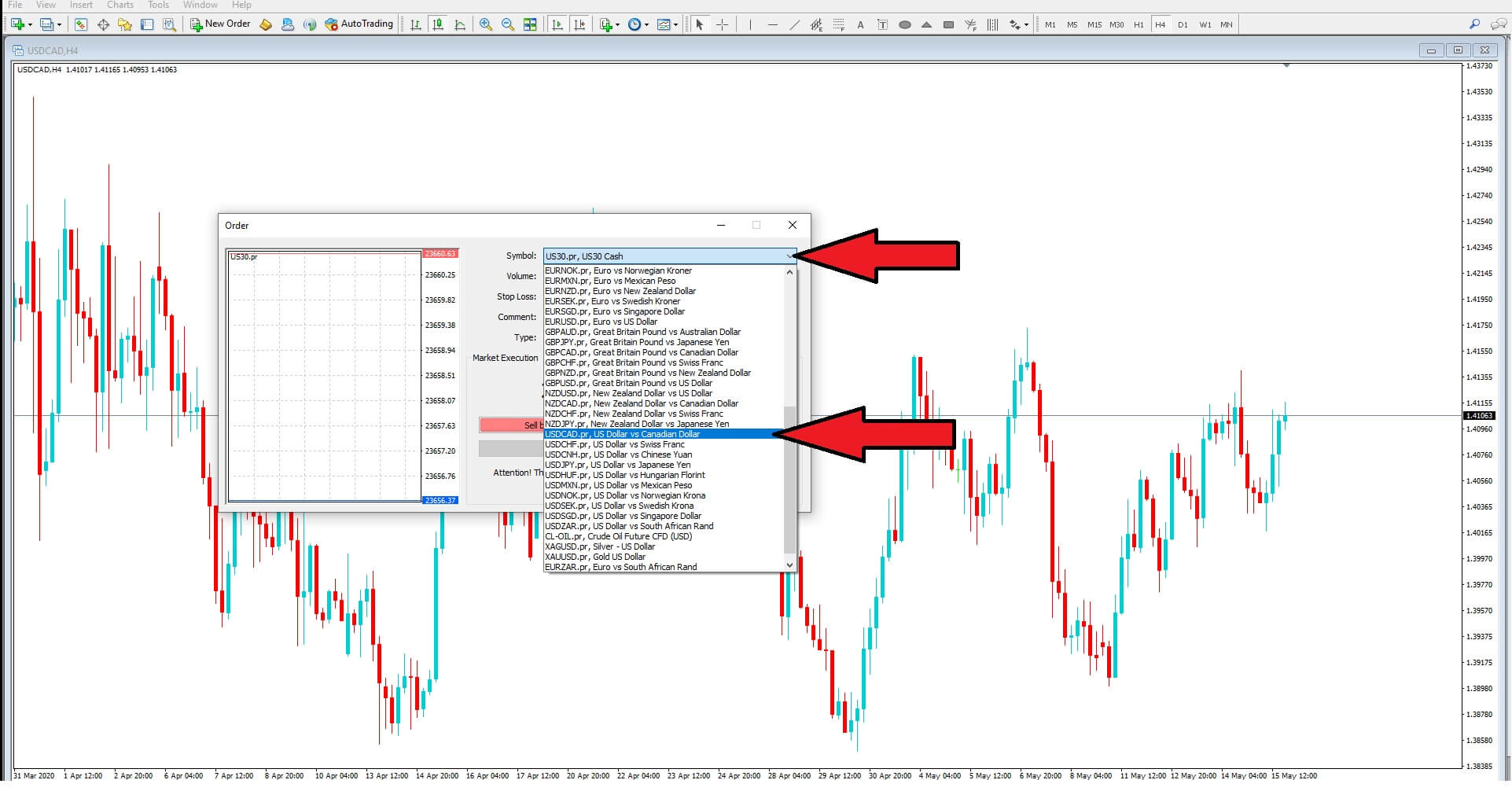

Let’s drill down into this pending order for the US dollar CAD trade at the top of the table.

We can presume that you have clicked onto the Method tab to have a look at the traders’ technical analysis and overview; you agreed with the sentiments and decide that you want to take this trade on by applying the price entry, take profit, and stop-loss on to your own trading platform.

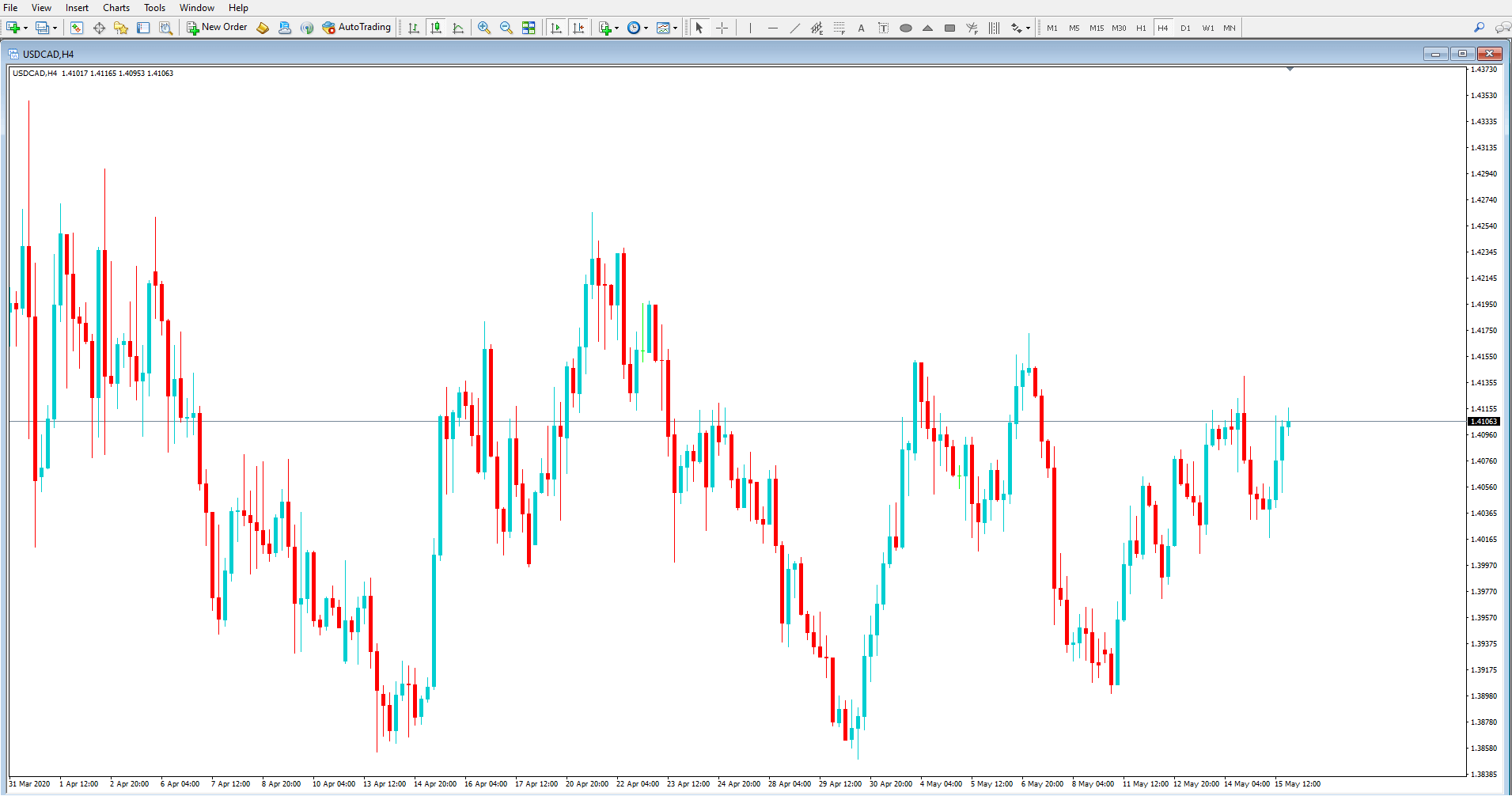

The most common trading platform which is offered by the majority of brokers is the Metatrader mt4 platform, and so we assume that you are using this platform, in which case you should open it up and select the US dollar CAD chart. You don’t have to add technical analysis.

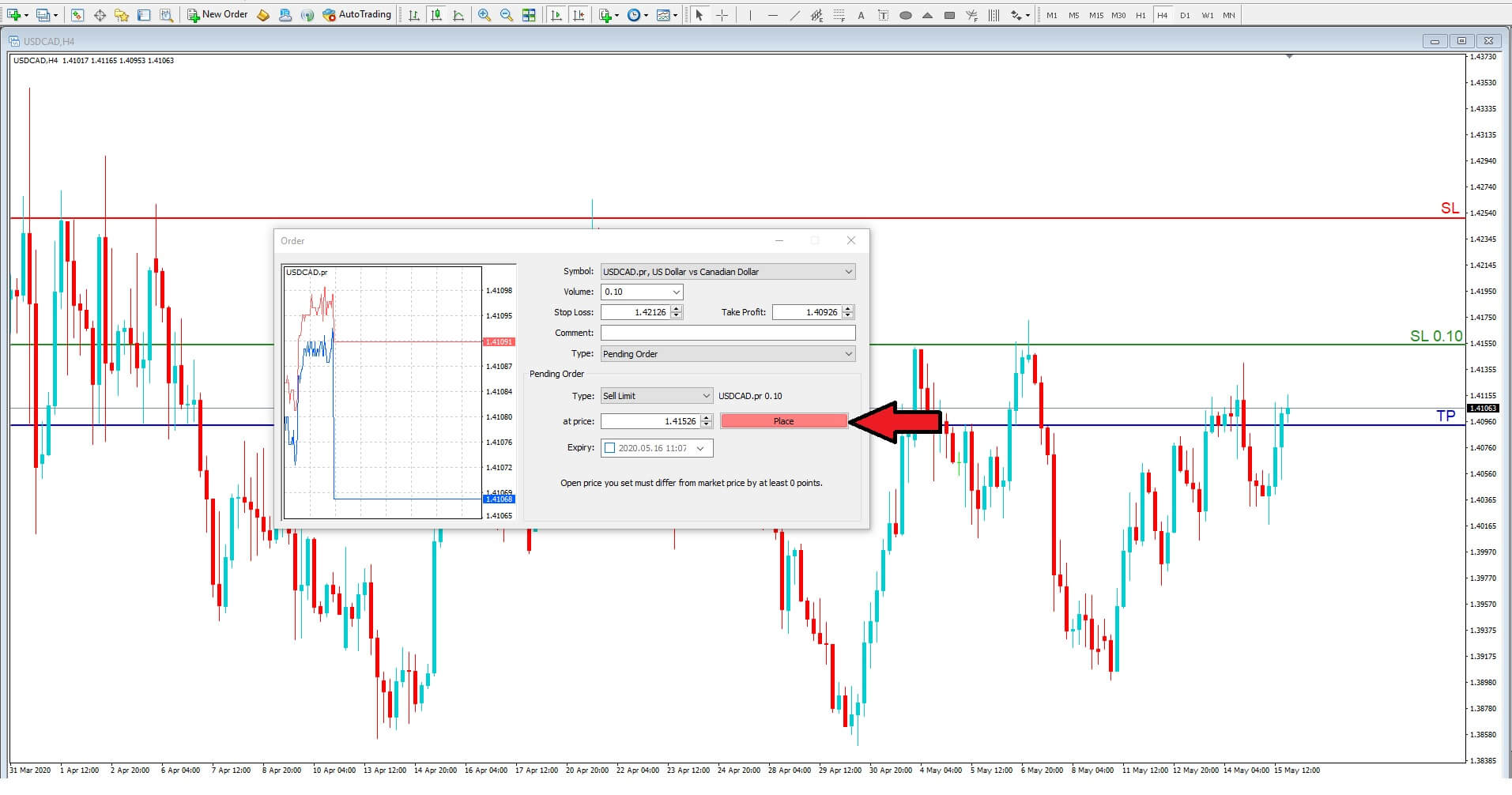

Click on the New Order tab, and an order box will pop up onto your screen.

Click onto the symbol drawdown panel to select the US dollar CAD asset.

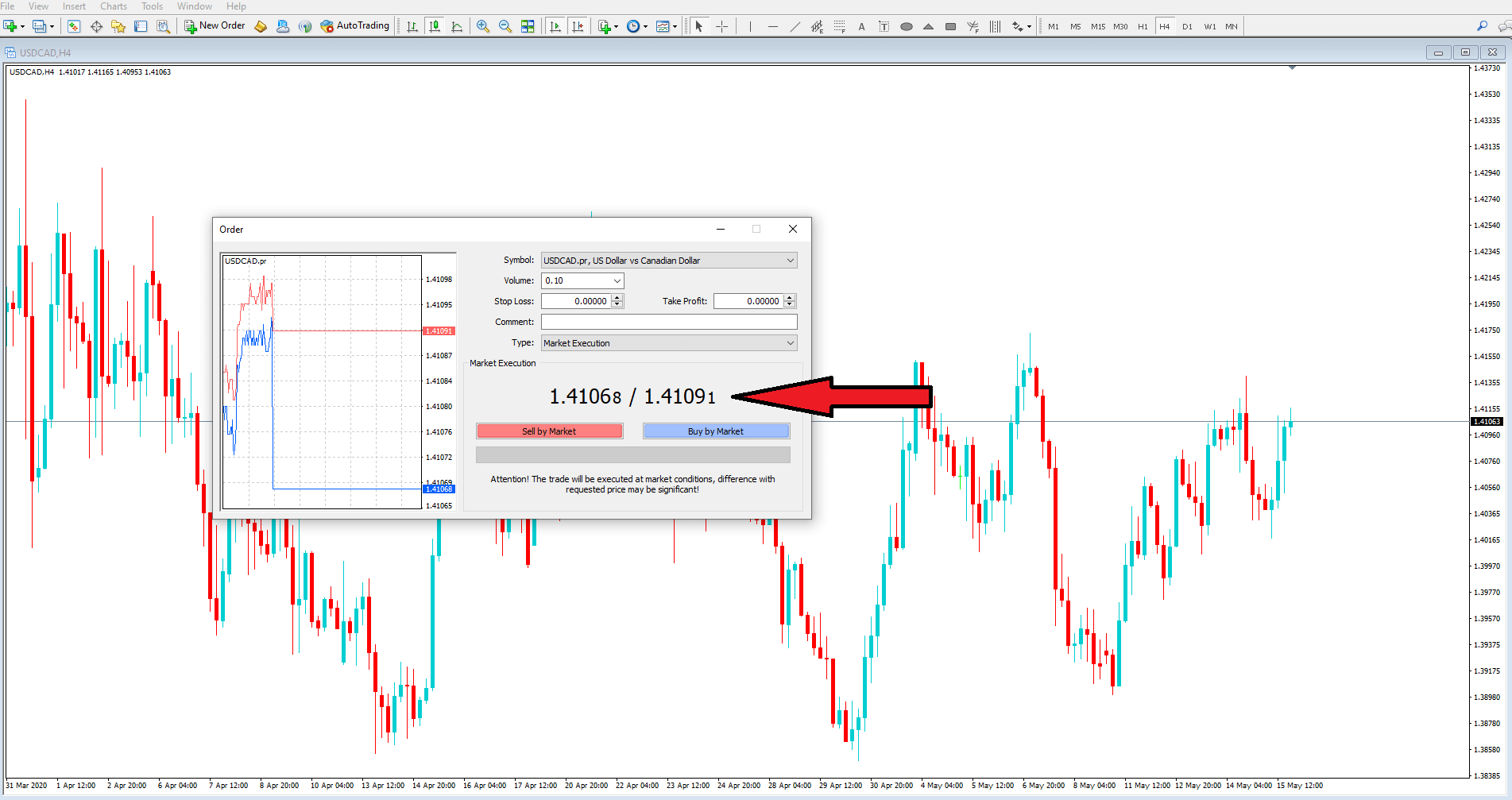

The price will then change to the current exchange rate for this pair.

If this was an instant execution, you would simply sell-by market or buy the market by clicking on the relevant price paddles, which are colored red and blue.

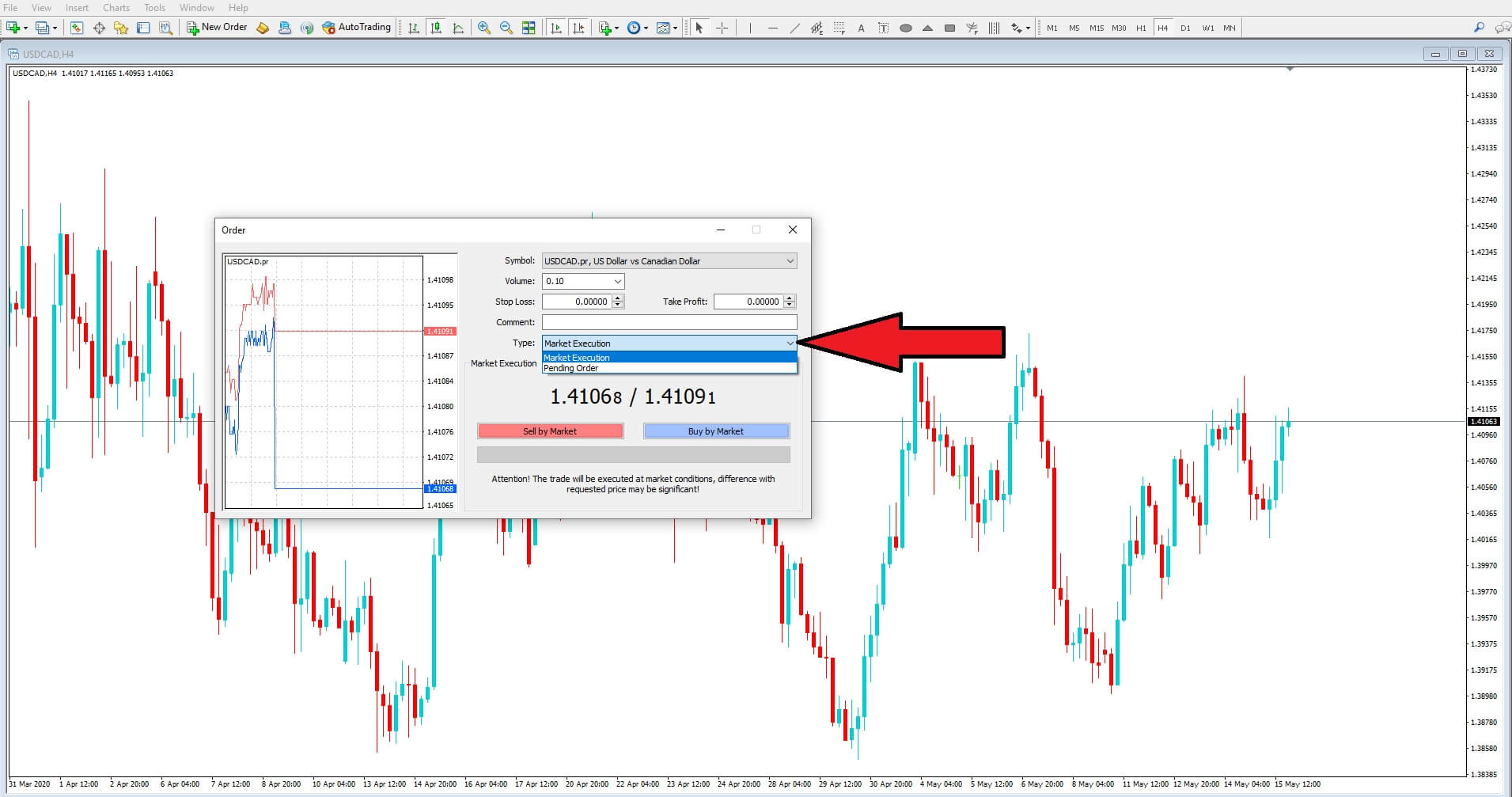

However, this is a pending order which we need to select from the type of trade drop-down menu.

Let’s quickly remind ourselves of the trade we are copying. this is a Sell-limit pending order of the US dollar Cad pair, with an order to sell the pair at some point in the future with no specified cancellation date at an exchange rate of 1.41526 with a stop loss of 1.42126 and a take profit of

Let’s quickly remind ourselves of the trade we are copying. this is a Sell-limit pending order of the US dollar Cad pair, with an order to sell the pair at some point in the future with no specified cancellation date at an exchange rate of 1.41526 with a stop loss of 1.42126 and a take profit of

1.40926. This represents Minus 60 pips or plus 60 pips, where the risk to reward has a ratio of 1:1. So for every unit traded in a standard lot of 1.0, which equals 10 units of the base currency traded, you would win or lose $600. Or if traded with a mini lot equal to 0.1 unit of volume you would win or lose $60 and if you were trading in micro-lots of 0.01 units of volume you would win or lose $6

We now take this information and add it to our order box. Firstly you will need to put in the volume of currency you want to trade. Here we have added a volume of 0.10 units, which equates to around about $1 for every pip in movement.

We then complete the stop loss box by entering in the exchange rate 1.42126, the take profit at

1.40926, and then in the pending order section itself, click on the sell limit for the type of pending order. Enter an exchange rate of 1.41526.

Then simply click on the place tab, and if the server accepts your trade, it will be confirmed by three lines popping up on to your chart. One is the sell limit order with the volume you have chosen at the exchange rate at which the trade will be executed if the price reaches it at some certain point. The second will be the level at which the trade will be stopped out should it move against you, and the setup fail. And the third line is the take profit where the trade will close out if price action moves to this exchange rate level should the trade have been opened having gone to plan.

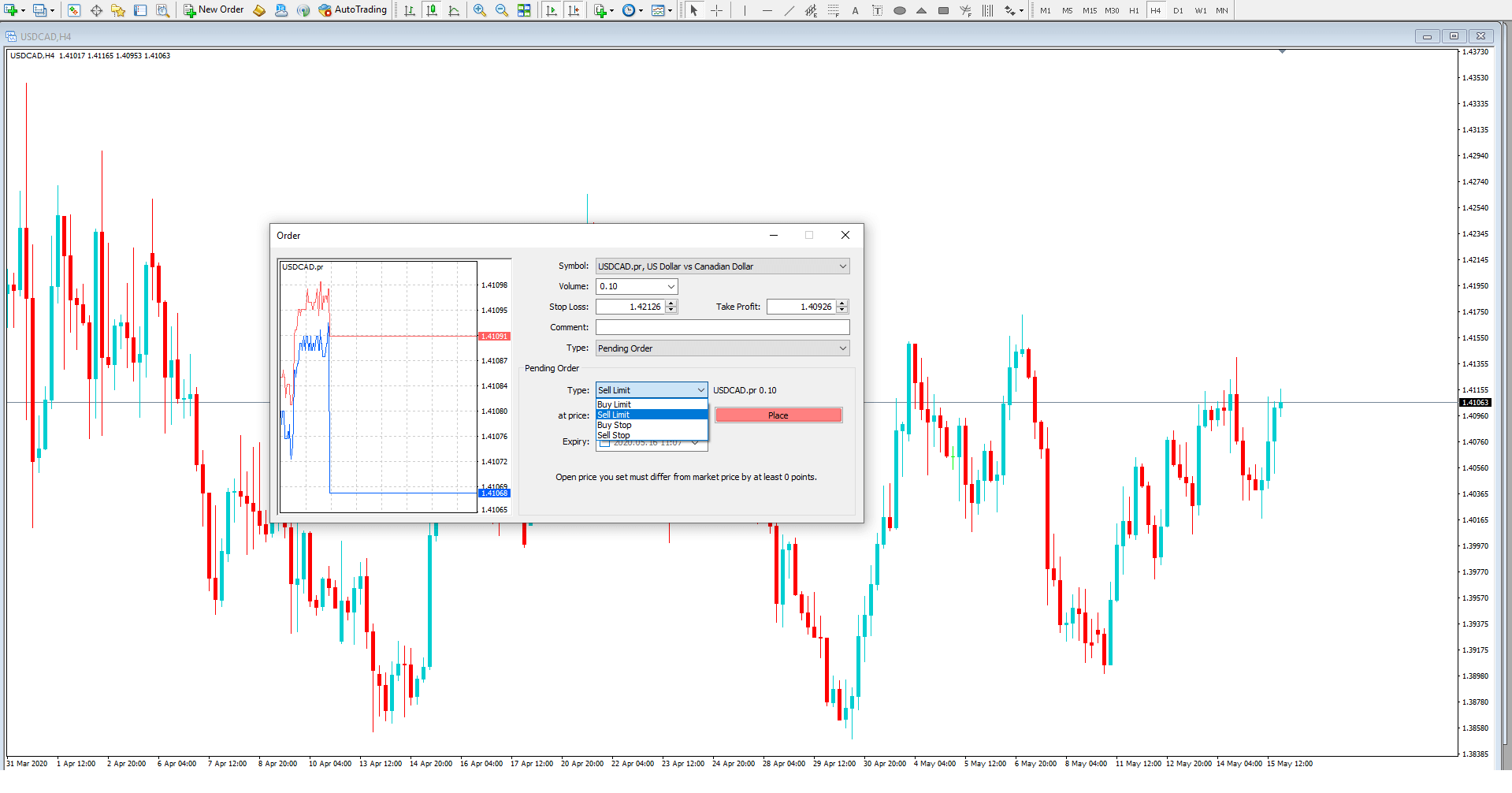

Should the trade you are looking at copying require a different type of pending order this can be found in the order type drop-down box and will include buy limit, sell limit, buy stop and sell stop orders.

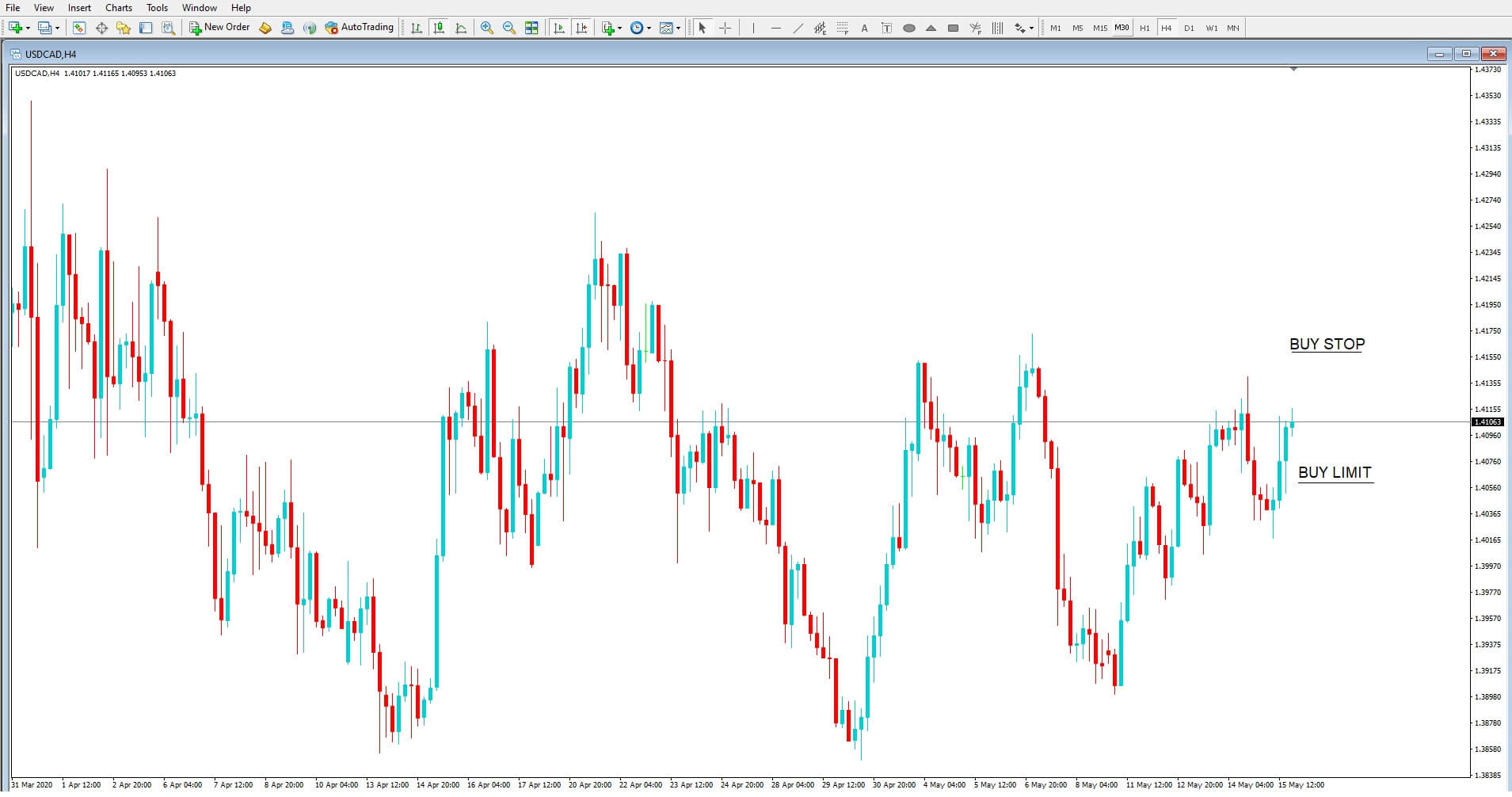

Different types of pending orders are buy-limit, where a trader expects that the current exchange rate will fall lower before continuing in an upward trend, In which case he would use a buy limit order to enter a trade at a lower point than the current exchange rate.

Or the trader would use a buy stop order to enter a trade which is above the current exchange rate, and where he or she might use such an order anticipating that an upward trend would continue.

Conversely, a trader would use a sell limit pending order if they thought that the exchange rate was going to move slightly higher before reversing into a downward trend. This provides them with the possibility of gaining some extra pips. Or they use a sell stop order where they presume the exchange rate will move lower than where it is currently.

Other trading platforms have similar trade order systems, and so if you are not using the MT4, you will just need to research a little to find the trade execution setups.

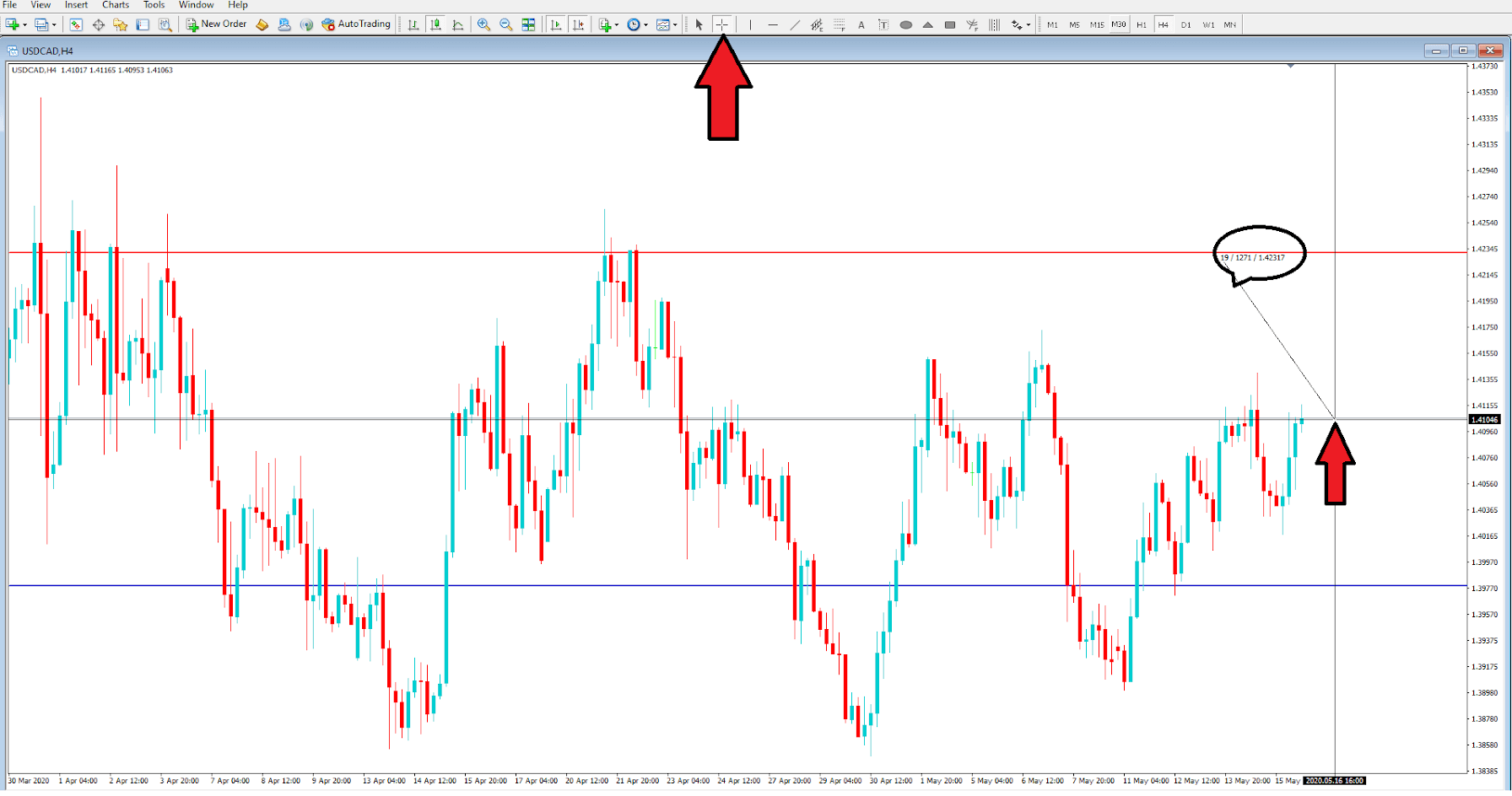

To calculate your risk, most platforms, including the MT4 offer a cross-hair feature which you can drag onto your chart and by clicking on the current price exchange rate, or anywhere else, you can drag the cross-hair to any level on your chart, and it will show you the number of pips that you might lose or gain. In this example we can see that should a trade be executed at the current exchange rate the level to the stop loss we have chosen by the introduction of the red line is 127 pips away, and where one pip typically will equate to one US dollar with a volume of 0.10 units traded.

On that basis, if we were to go short on this pair at the current exchange rate with the current stop loss in place, we would have lost $127 should the pair have moved up to our stop loss. We can also simply drag the cross-hair lower to calculate possible winnings in pip amount values too.