Introduction

Natural gas is a soft commodity that is extensively traded in the market, like Crude Oil. The price changes every moment, as it is publicly traded on an exchange. The price of natural gas is determined by supply and demand in the physical market, as well as the demand and supply from the traders in the online market.

Understanding Natural Gas

Trading natural gas in the online market is speculating the short-term price fluctuations. Buying natural gas is only an electronic transaction and does not mean the physical purchase of the commodity.

There are several ways to trade natural gas in the online market. One of the heavily traded ways is through futures contracts. A futures contract is a contract (agreement) to buy or sell an asset at a future price.

Chicago Mercantile Exchange (CME Group) is the route through which nature gas futures is traded. There are many types of natural gas and its contracts that can be traded. However, the most traded contract is the Henry Hub Natural Gas Futures (NG).

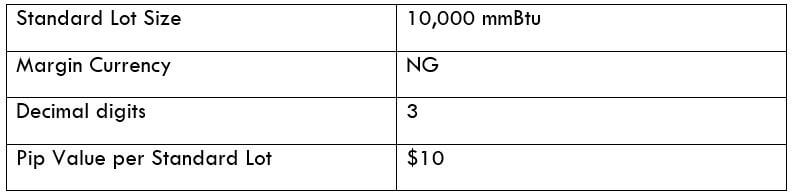

Each contract of NG represents 10,000 million British thermal units (mmBtu). In the futures exchange market, NG fluctuates with a minimum of $0.001. In other words, a $0.001 price movement in NG represents one pip (tick). Like pip value in forex, the tick value of NG is $10. For every tick in price, a trader will see a $10 change in P/L.

Natural Gas Specification

Fees Associated with Natural Gas Futures Trading

There are different types of fees involved while trading natural gas futures. Typically, there are four basic fees that a brokerage charges for every futures contract traded:

- Exchange/Clearing fees

- National Futures Association (NFA) fee

- Data fees

- Brokerage commissions

The types of the fee listed above are either charged “per side” or “round turn” basis. Also, it varies from broker to broker.

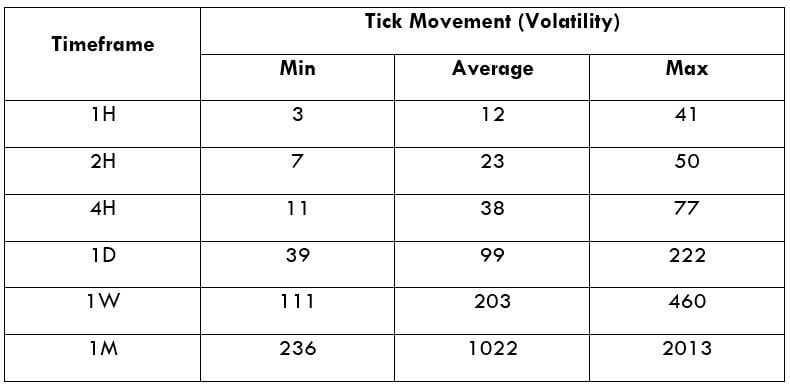

Trading Range in Natural Gas

A trading range represents the price fluctuations in natural gas in different time frames. Similar to pips in currency pairs, the price movement in natural gas is represented in ticks, where each tick is an increment of $0.001.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a significant period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

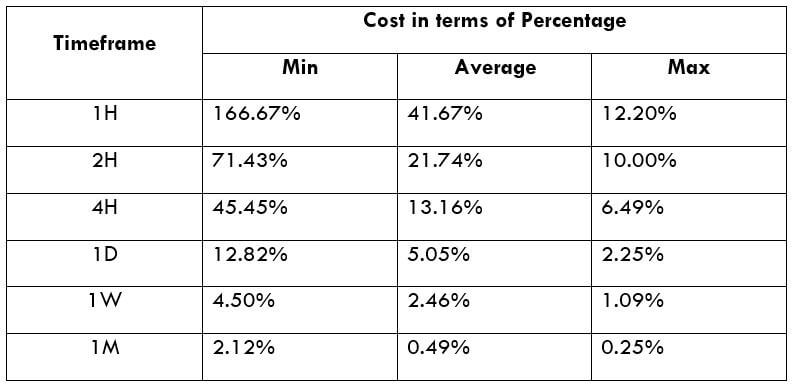

Cost as a Percent of the Trading Range

Cost a percent of the trading range is the depicts the variation in fees on the trade-in different time frames for varying volatility. It is simply the ratio of the total fee and the tick values.

Total fee (per contract) = $50 (5 ticks) [approx. fee]

Trading the Natural Gas

Natural gas is heavily traded in the futures market. It is a soft commodity like Crude Oil and is quite popular in the commodity space. Traders speculate on natural gas using both fundamental and technical analysis. The fundamentals of NG vary from that of other commodities, while the technical analysis works perfectly the same as any other asset. The fee structure, too, is pretty different from that of currency pairs, as it is mostly traded in the futures market. However, the total fee is more or less the same.

Understanding the fee variation

The fee is something that varies relatively with the change in time frame and volatility traded. In essence, a trader trading the 1H time frame will have to pay relatively more fee than a trader speculating on the 4H. Due to this, the percentage values are higher on the 1H time frame than the 4H time frame.

Likewise, the relative fee is higher when the market volatility is at the minimum values, even though the time frame remains the same. So, to efficiently manage the fee, one must trade during the times when the market volatility is at or above the average values.