Price action traders are to take entry and exit by determining support and resistance on the naked chart. Significant highs and lows are considered to draw support and resistance, which help traders find out stop loss, take profit as well as risk-reward. In today’s article, we are going to demonstrate an example of a level holding the price as support, where the price had a rejection earlier. Let us find out how we are to deal with such levels.

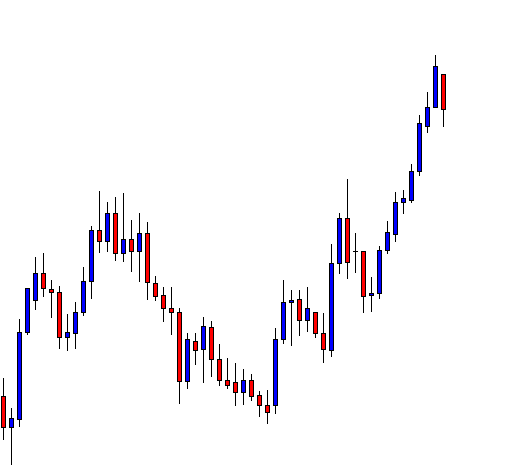

This is the daily chart. The price heads towards the North with good bullish momentum. Look at the last candle. It is a strong bearish candle with a long solid bearish body. The daily-H4 chart combination traders may want to flip over to the H4 chart to find short entries.

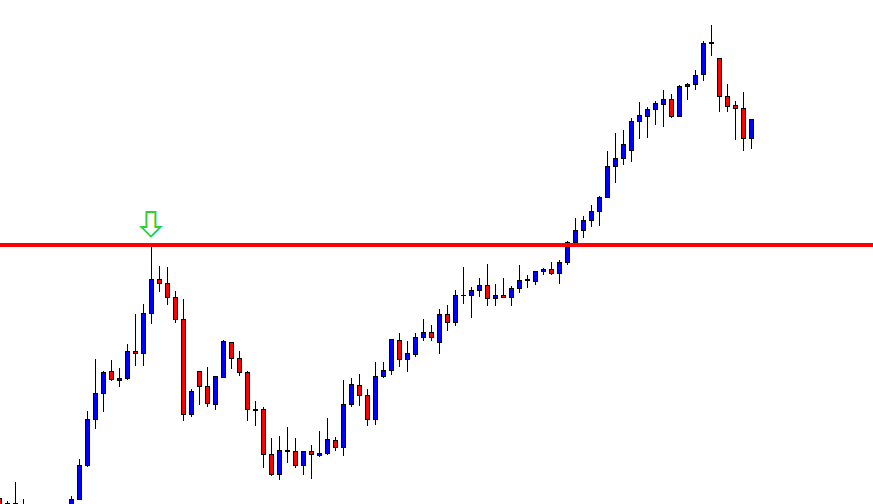

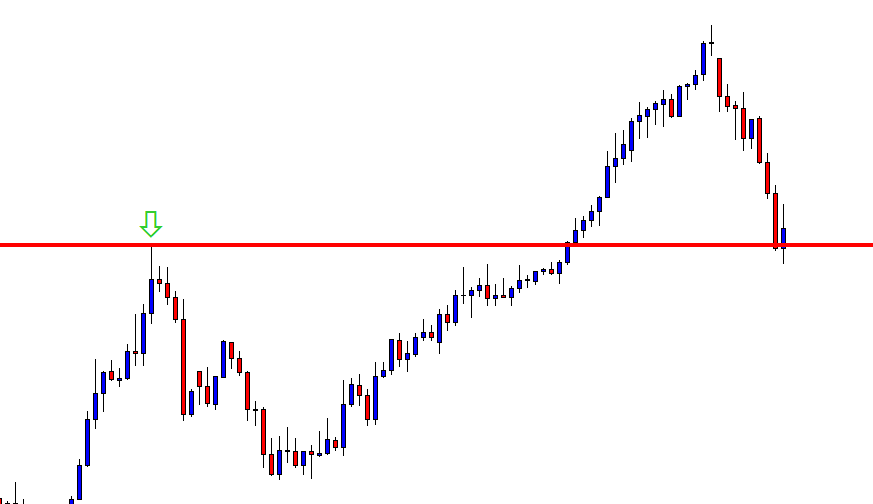

This is how the H4 chart looks. The price has been bearish. The last candle comes out as an inside bar. If the price consolidates and produces a bearish candle breaching the lowest low, the sellers may go short on the pair. The question is, where do they set their take profit level? Look at the red line, which is drawn right at the point where the price had a rejection earlier. The level of support is further down, but the red-lined level is a significant level, which the sellers must consider before making any selling decision on this chart.

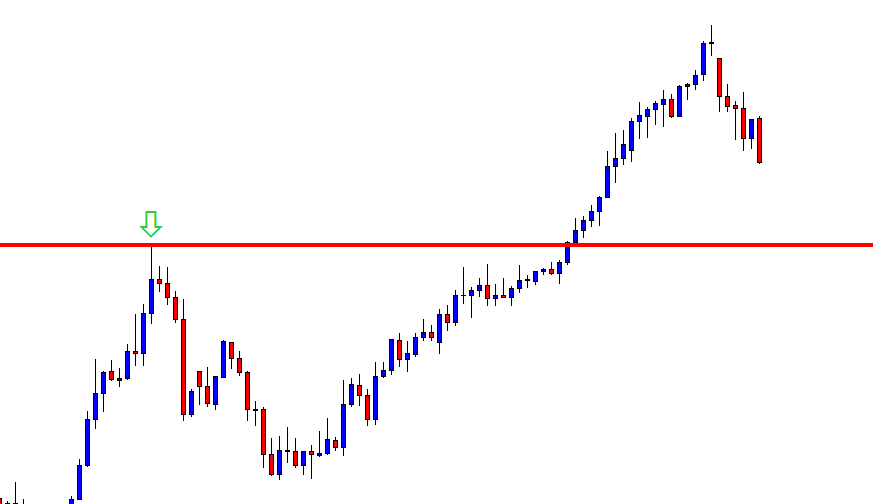

The price produces a bearish engulfing candle breaching the lowest low. It means that the price has found its resistance. The sellers may draw two lines here to identify their stop loss and entry point.

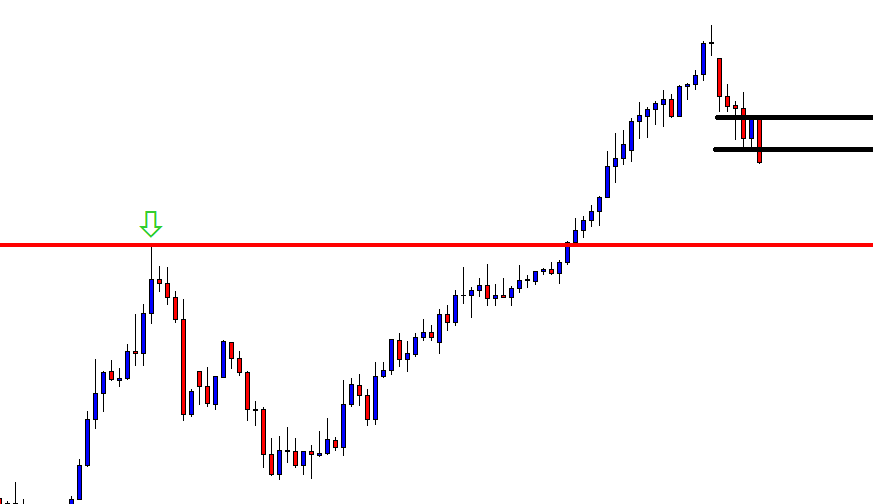

This is how it looks with two drawn lines. The live above is the stop loss level. The price breaches the line and closes below it. Thus, the sellers may trigger a short entry right after the candle closes. Let us proceed to the next chart to find out how the trade goes.

The price heads towards the South with good bearish momentum. Look at the last candle, which comes out as an inside bar. It produces right at the flipped support. This is where the price had a strong rejection earlier. The sellers shall set the take profit right here. Some traders may take out partial profit and use trailing stop loss by making sure that they do not lose even a single penny. Both have pros and cons. However, the matter of fact is they must count such level before making any trading decision. It helps them determine the take profit level, risk-reward, and trade with more winning chances.