GTCM is a forex broker that is situated in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC). Their aim is to provide the best service they can, however, do not give away a lot of information about themselves. In this review, we will be looking into the services provided to see if they are worth using as your broker.

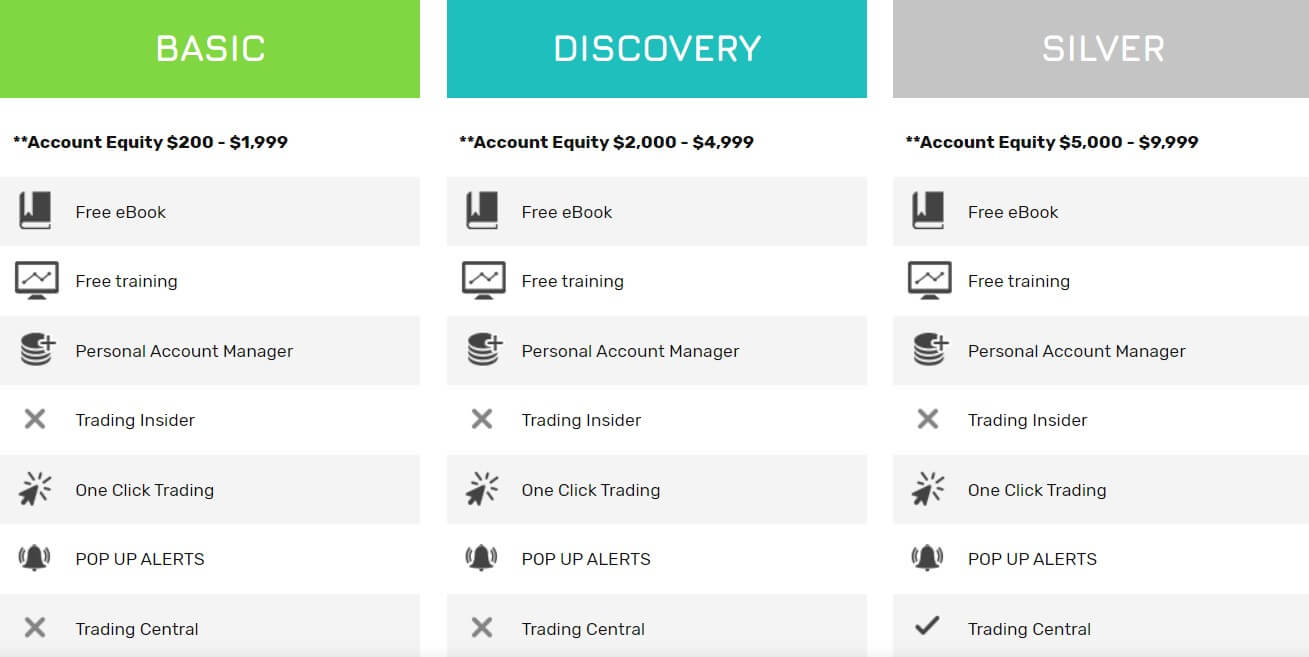

Account Types

When it comes to accounts, there is a huge selection from GTCM, in fact, there are 7 accounts on offer, 8 if you include the professional account (we won’t be looking at this). Certain aspects such as spreads are not listed on the accounts page so we will be looking into those later in this review, the accounts page simply states features rather than trading conditions.

Basic Account: The basic account requires equity between $200 and $1,999. It comes with free ebooks, free training, a personal account manager, one-click trading and pop up alerts.

Discovery Account: The discovery account requires account equity of $2,000 to $4,999. It comes with a free ebook, free training, a personal account manager, one-click trading and a price discount of 10%.

Silver Account: Required equity increases further for the silver account, you are now required between $5,000 and $9,999. This account gets you a free ebook, free training, a personal account manager, one-click trading, pop up alerts, access to trading central and a 20% price discount.

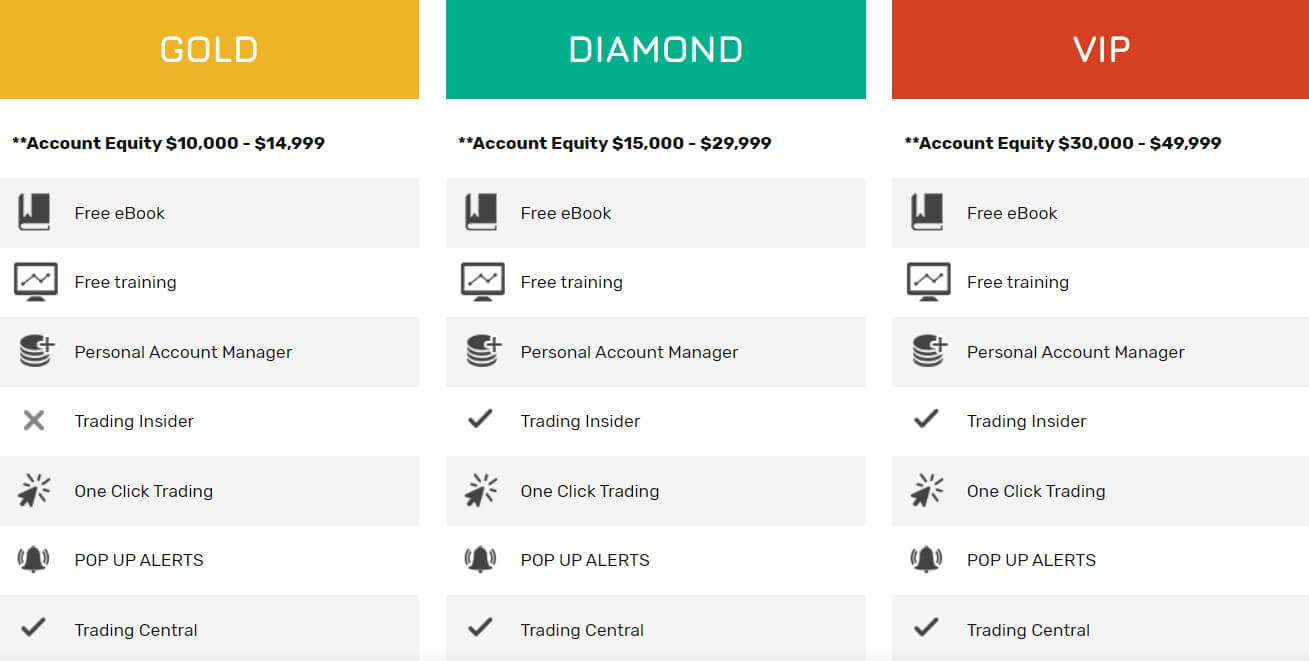

Gold Account: The gold account requires equity between $10,000 and $14,999. This account comes with a free ebook, free training, a personal account manager, one-click trading, pop up alerts, access to trading central, a 30% price discount and a rollover discount of 17%.

Diamond Account: The diamond account further increases the required equity up to between $15,000 and $29,999. This account comes with a free ebook, free training, a personal account manager, one-click trading, pop up alerts, access to trading central, a 40% price discount and a rollover discount of 20%.

VIP Account: The VIP account required equity now sits at $30,000 and $49,999. This account comes with a free ebook, free training, a personal account manager, one-click trading, pop up alerts, access to trading central, a 50% price discount and a rollover discount of 33%.

VIP+ Account: The VIP+ account is the top-level account, this account requires account equity above $50,000. The account features a free ebook, free training, a personal account manager, one-click trading, pop up alerts, access to trading central, a 60% price discount and a rollover discount of 50%.

Platforms

GTCM use their own mobile and web trading platform instead of an already established platform, let’s take a little look at it:

WebPROfit: GTCM’s WebPROfit platform provides an extensive and user-friendly interface and easily customizable trading environment, as well as tools for enhanced functionality of graphics and sophisticated order management to help traders manage their positions easily and efficiently through their internet browser. With the web version of the PROfit platform, you can trade from anywhere where there is access to the internet without having to download additional plugins.

Some of the main features include instantaneous access from any computer with internet, same account details for all PROfit versions. (Web and Mobile), multilingual environment and, no download required

Leverage

The following list will give you the information regarding leverage, each asset type has different maximum leverages.

- Major Currency Pair: 1:30

- Non-Major Currency Pair: 1:20

- Gold: 1:20

- Other Commodities: 1:10

- ASX 200, CAC40, DAX, Dow Jones, FTSE, Nasdaq, Nikkei, S&P 500: 1:20

- Other Indices: 1:10

- Single Stock CFDs: 1:5

- ETF CFDs: 1:5

- Cryptocurrency CFDs: 1:2

- Protected Positions: 1:20

Major currency pairs refer to EURUSD, USDJPY, GBPUSD, USDCAD, USDCHF, EURGBP, EURCHF, EURCAD, EURJPY, GBPJPY, CHFJPY, CADJPY, GBPCHF, GBPCAD, CADCHF.

Trade Sizes

Trading sizes for all accounts start at 0.01 lots which are also known as micro-lots. Trades then go up in increments of 0.01 lots so the next trade would be 0.02 lots and then 0.03 lots. We could not locate information on the maximum trade size, however, no matter what it is we would not suggest trading over 50 lots in a single trade as it becomes increasingly harder for the markets and liquidity providers to execute trades quickly and without any slippage the bigger they get.

Trading Costs

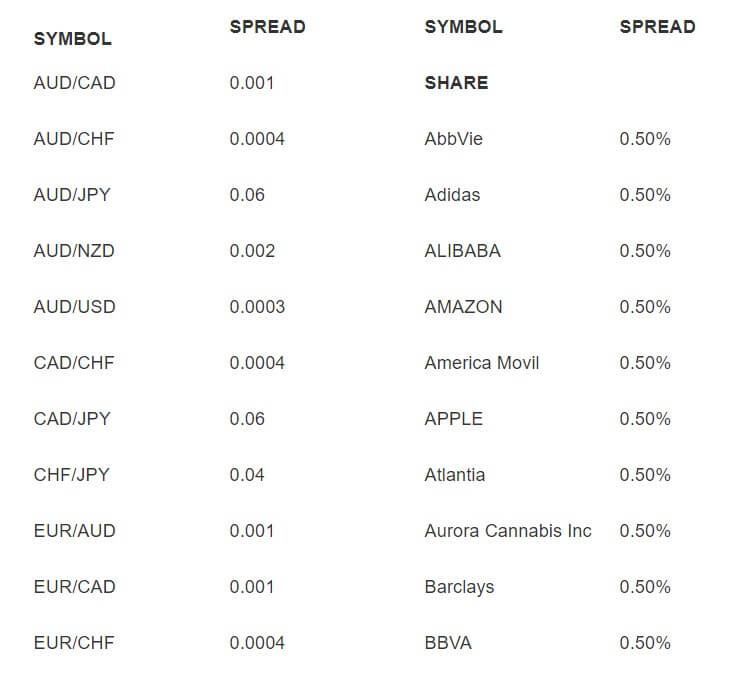

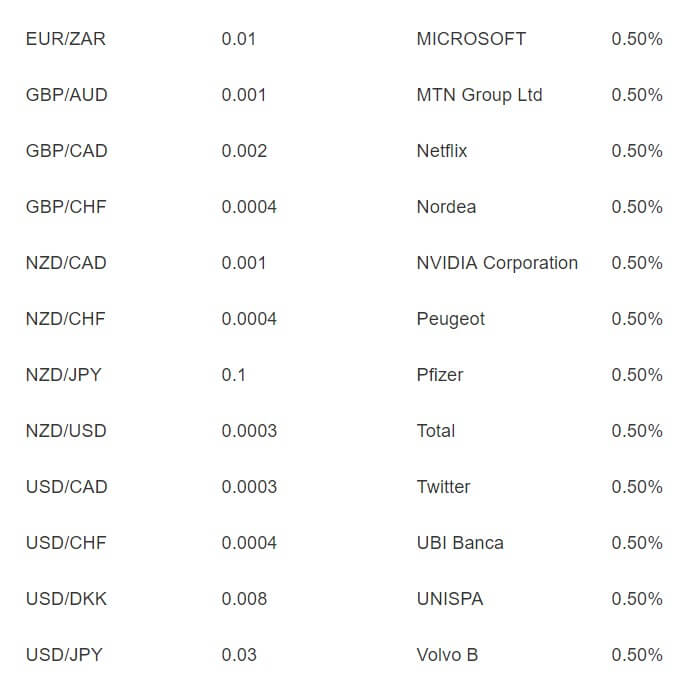

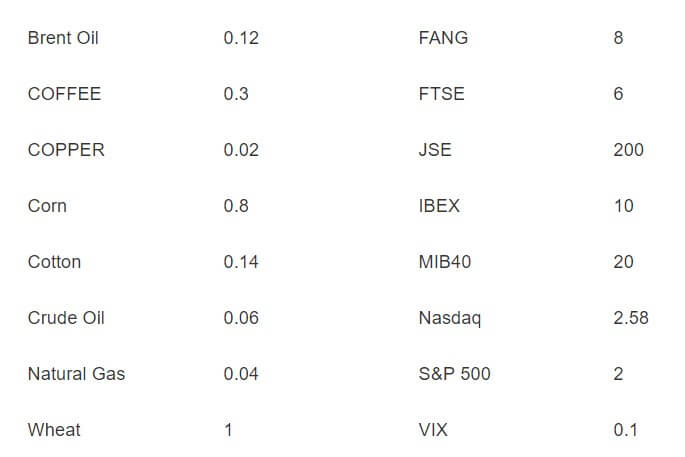

We have set out the following table to show the current spreads and commissions for each asset:

The above was taken directly from the GTCM website and was accurate at the time of writing this review.

The following table is relevant to the charges you will receive for holding trades overnight.:

- Currencies: 0.015% of the overnight exposure

- Commodities: 0.015% of the overnight exposure

- Indices: 0.015% of the overnight exposure

- Shares: 0.015% of the overnight exposure

- EFTs: 0.015% of the overnight exposure

- Cryptocurrencies: 2%

- Options: No charge

Assets

Assets

The assets at GTCM are broken down into various categories, they are Forex, Shares, Commodities, Indices, Options, Cryptocurrencies and EFTs. The full list of assets, as well as their costs, can be viewed above in the trading costs section of this review.

Spreads

The spreads have been detailed above in the trading costs section of this review.

Minimum Deposit

The minimum amount required to open an account is set at $200 which gets you the basic account, the more you deposit the higher grade account you will be able to use.

Deposit Methods & Costs

The following methods of deposit are available from GTCM:

Visa / MasterCard, Bank Wire Transfer, PayPal, Maestro, Skrill, Neteller, Klarna, SafeCharge, and Trustly. There is no indication about any fees but there is also no mention of there being no fees so we can not comment on the costs of depositing at this time.

Withdrawal Methods & Costs

The same methods are available to withdraw from GTCM, however, it seems like GTCM has made the withdrawal process as complicated as possible requiring the faxing to withdrawal requests and other documents, this could put off a lot of potential clients who are looking for a streamlined and simple process.

Once again there is no mention of fees and it is important to note that you must withdraw back the amount deposited with a method before using a new one.

Withdrawal Processing & Wait Time

The website states that the back office department will initiate the processing of a request within one business day as long as all the appropriate paperwork and requirements are met. The time it takes after this will depend on the method used, e-wallets generally take up to 15 minutes to receive the funds while bank transfers and card withdrawals can take between 1 to 5 working days for the funds to be available in your account.

Bonuses & Promotions

There is only one promotion active, this is that your first 10 trades are protected, meaning if they lose you get your money back, there are of course restrictions as you can not just bet your entire balance and get a refund if it loses.

Educational & Trading Tools

The educational stuff provided by GTCM is pretty basic to say the least, there is an ebook we mentioned in the accounts section, however, we have no access to it so can not comment on its usefulness. There is also some market analysis but we waited a bit for the page to load, it never did. There is the standard economic calendar to tell you when any news events are coming up and which markets they may effect along with some very basic analysis which you can find all over the internet anyway.

Customer Service

The customer services team is accessible in a number of different ways. You can use the online submission form to fill out your query, you should then get a reply via email. Should you wish to email directly there are email addresses for the customer service and technical support departments.

You can also contact GTCM via telephone, plenty of numbers available for the office, customer support, and brokerage department. The phone lines are open between 07:00 and 21:00 GMT. Finally, there is a WhatsApp number available and this support is open from 08:30 to 19:00 GMT.

Demo Account

There is no demo account available with GTCM, which is a shame as a demo account gives new clients the chance to test out the trading environment and servers, it also allows current clients to test out new strategies without risking their own capital, GTCM should work on making demo accounts available.

Countries Accepted

There isn’t any specific information regarding which countries can use the service, however as GTCM is regulated by CySEC the usual countries will be excluded from them. If you are not sure whether you are eligible for an account or not, get in contact with the customer service team to find out.

Conclusion

GTCM has plenty to offer when it comes to accounts, however, there isn’t a real different between them, plenty of assets including the growth in popularity cryptocurrencies is a good sign. Things get a little shaky when it comes to the information provided for deposits and withdrawals, as this is a company that will be holding on to our money, we would want more solid information, not to mention how difficult it seems they are making withdrawals, not many people have a fax machine anymore.

We hope you like this GTCM review. If you did, please be sure to check out some of the other reviews here atForex Academy to help find the broker that is right for you.