BP Prime, which stands for Black Pearl Securities Limited, has been around since 2013 and it is authorized and regulated by the reputable Financial Conduct Authority (company number: 08823678). When a company is regulated by the FCA, this means reliability, funds are held securely and compliance with strict requirements. They are headquartered in London, with operational offices in Italy and China. This company has both retail and institutional clients from across South America, Asia, and Europe.

This UK forex broker was named Broker of the Year by Le Fonti Awards in 2018. BP Prime offers its clients a choice of three accounts with attractive trading conditions whilst using the most popular platform available, MT4. BP Prime claims to offer dedicated 24/6 customer support, non-dealing desk, fast execution, and low latency. On their website, clients can learn more about the background and experience of their IT Director, CEO & Founder as well as the compliance manager. This can help clients feel more at ease when trading money through this broker.

Account Types

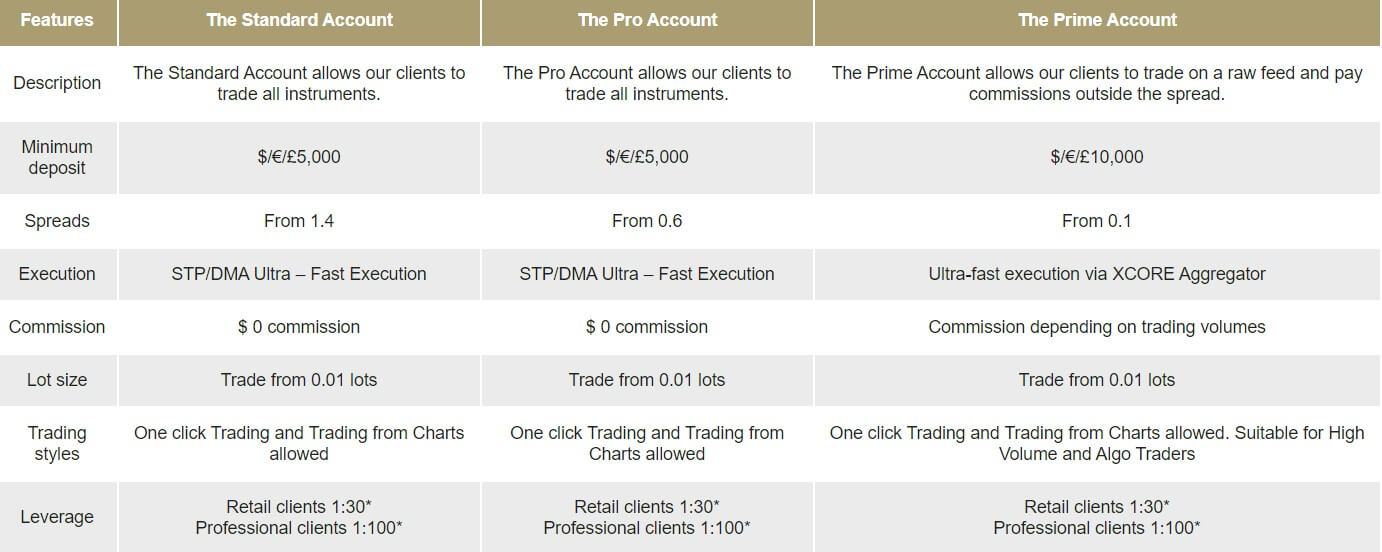

If you are interested in creating an account with BP Prime you have three available options, namely; The Standard Account, The Pro Account and the Prime account.

The Standard and the Pro accounts have quite a lot of similarities including the minimum deposit requirement of $5,000 (or equivalent in Euro). This is quite high when compared to other brokers. We did find some contradicting information regarding this in another section of their website, but we will go into more detail about this in the Minimum Deposit segment of the review.

These two accounts are also fee-free and the minimum lot size available for trading is 0.01 lots. Spreads for the Standard account start from 1.4 Pips whilst the Pro Account spreads start from 0.6. The leverage for both these accounts changes according to the clients. For retail clients, leverage is set at 1:30 whilst for professional clients, this increases to 1:100. Both the Standard and the Pro accounts allow their clients to trade using all available instruments, we will go into detail about this in the Assets segment of this review.

The Prime account has a minimum deposit requirement of $10,000 or equivalent and spreads are competitive as they start from 0.1 pips. The minimum trade requirement is 0.01 lots and this particular account is suitable for high volume as well as Algo traders. Clients opting for this account should take into consideration that the commission is dependent on trading volumes. Leverage for retail clients is set at 1:30 whilst for professional clients, it is increased to 1:100.

Clients must meet a number of stipulated criteria in order to qualify as a professional trader. These criteria are; A financial instrument portfolio that exceeds €500,000, a minimum of 1-year experience in trading in the financial sector and the placing of 10 relevant trades of a significant size per quarter for the previous year.

On the FAQ page on their website, we also found information stating that this broker allows hedging. You can find more details about this on their website. Accounts that are left with 0 balance are archived after a ninety-day period but there are no dormant fees.

We have outlined the main characteristics of all accounts offered by BP Prime below:

The Standard Account

Minimum Deposit: $5,000 (or equivalent)

Leverage: Retail Clients – 1:30

Professional Clients – 1:100

Spreads: 1.4 Pips

Commissions: None

The Pro Account

Minimum Deposit: $5,000 (or equivalent)

Leverage: Retail Clients – 1:30

Professional Clients – 1:100

Spreads: 0.6 Pips

Commissions: None

The Prime Account

Minimum Deposit: $10,000 (or equivalent)

Leverage: Retail Clients – 1:30

Professional Clients – 1:100

Spreads: 0.1 Pips

Commissions: Dependent on trading volume

Platforms

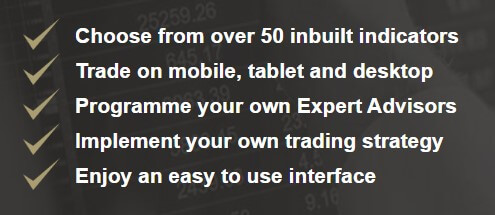

BP Prime uses the most popular platform available, which is the MetaTrader4 (MT4). The MT4 gives traders easy access to Commodities, Cryptos, Forex, and CFDs. This platform comes equipped with over 50 in-built indicators that simplify and highlight key trends that helps clients to determine the best entry and exit points. Another cool feature of this platform is the ability to automate trades by using Expert Advisors as well as the facility of building your own trading strategy, including instant executions, stop orders and trailing stop functionalities. You can use this platform on any device from desktop to mobile devices which makes it easy to trade on the go, wherever you are.

Leverage

When comparing BP Prime’s leverages to other brokers, they seem to be quite low as the maximum leverage offered is that of 1:100. The leverages are reasonable and they comply with regulations applicable to CFD trading. Apart from this, the ESMA (European Securities and Markets Authority) introduced a leverage cap of 1:30 for retail clients in 2018 and this broker must comply with these regulations.

Trade Sizes

The minimum lot size for all accounts is 0.01 Lots. We did not find information regarding the maximum lot sizes available for trade with this broker on their accounts page.

Trading Costs

The Standard and Pro account are fee-free which means no commissions are applicable when trading through these accounts. The Prime account, on the other hand, does have commissions that are dependent on the trading volumes, but we could not find any more details about this commission. You can reach out to the broker if you want more details regarding any fees you will encounter when trading with the Prime account.

Assets

When trading with BP Prime you will have quite a variety of assets to trade with, namely; Forex, Indices, Commodities as well as Cryptocurrencies. We saw 28 currency pairs available for trading on their FOREX page. The currencies are split into three categories; Majors, Minors and Emerging/Exotics. The trading hours for these assets are from Sun 21:00 to Friday 21:00. We also noticed that spreads for Major pairs were quite low as most fell under 0.7 Pips.

Clients can also trade more than 10 index CFDs, including; DAX, S&P, DOW JONES and FTSE amongst others, with real-time pricing either through GUI or via FIX API. BP Prime claims to offer extremely tight spreads offering the chance to profit big from small price movements. Clients can also be more in control of their risks since this broker offers flexible leverage when dealing with these assets.

BP Prime has four commodities available for trading including; UK Oil, US Oil, Gold, and Silver. Spreads are quite low here as well as they range from 0.04 to 0.027. US Oil, Gold and Silver can be traded from Sunday 22:00 till Friday 20:45 while UK Oil can be traded from midnight on Monday till Friday 20:45.

On their Cryptocurrencies page, potential clients can have a look at a table comparing this broker with other popular brokers who trade Cryptocurrencies. This data is based on the analysis of the published Crypto spreads published on BP Prime’s UK competitor sites. Leverage on this type of asset is up to 1:10 and no commissions or fees apply. You can trade Bitcoin, Ethereum, Litecoin, and Ripple.

On their Cryptocurrencies page, potential clients can have a look at a table comparing this broker with other popular brokers who trade Cryptocurrencies. This data is based on the analysis of the published Crypto spreads published on BP Prime’s UK competitor sites. Leverage on this type of asset is up to 1:10 and no commissions or fees apply. You can trade Bitcoin, Ethereum, Litecoin, and Ripple.

Spreads

Spreads with BP Prime are quite low overall, although they seem to be a bit high on the Standard account. One must also remember that although the spreads on the Prime account are very low, there will be a commission to add to that, so keep that in mind.

Minimum Deposit

On BP Prime’s ACCOUNTS page, one can see the minimum deposit required for each account; Standard & Pro Account £5,000 and £10,000 for the Prime account. We thought these requirements were quite high, especially for the Standard account, where clients can find other brokers offering similar conditions for much less.

Whilst we were going through the FAQ page, we did find a piece of contradicting information regarding minimum deposits. On this page, the broker states that the Standard account has a minimum deposit of £100, the Pro £1,000 and the Prime £10,000. Although these figures make more sense, we are unsure which figures are the correct ones. We reached out to BP Prime through live chat to find out, but as of yet, we have not received an answer.

Deposit Methods & Costs

If you’ve opened up an account with BP Prime you can choose one of the following methods to deposit money into your account; Credit/Debit card, Neteller, Skrill, WebMoney, and Bank Wire Transfer. There are no fees charged to clients from the broker’s side, but they do inform clients that their credit card provider may charge transaction fees or international processing fees.

Withdrawal Methods & Costs

Currently, BP Prime has a number of options available for clients wanting to withdraw their funds, such as multiple credit cards, multiple electronic payment methods, bank wire transfer, and local bank transfers. Money can be deposited in any currency the client wishes. This will be automatically converted to the base currency of the client’s account.

In order to withdraw funds, clients must have a validated account. Once confirmation has been received from the Validation Department that the account has been validated, clients can request funds withdrawal by logging into the Members Safe Area, selecting the withdrawal tab and sending a withdrawal request.

Withdrawals are sent back only to the original source of deposit. Clients can also withdraw their money whilst having an open position. This is possible if, at the moment of payment, the free margin of the client exceeds the amount specified in the withdrawal request.

Withdrawal Processing & Wait Time

All withdrawal requests are processed by the broker’s back office within 24hours on business days. Bank wire or credit/debit card usually takes 2-5 business days, whereas standard bank wire in the EU countries takes 3 working days and in some other non-EU countries this may take up to 5 working days.

Bonuses & Promotions

At the moment, it seems as though no bonuses or promotions are available when trading with this broker.

Educational & Trading Tools

Clients of BP Prime can register to watch free Webinars organized by the broker which covers a variety of topics related to trading. Apart from these, clients, as well as potential clients, can access a number of interesting articles related to trading, with an emphasis on Cryptocurrencies, which can help assist beginners as well as professional traders in their trading endeavors.

Although we didn’t find any specific information regarding trading tools on their website, we did find mention of this on their Brochure that you can access on their Legal Documents page. Here BP Prime state that they offer a suite of multi-platform, multi-lingual, market informed apps which help their traders to optimize their trading strategies. They claim that these apps give traders institutional-quality tools over and above those offered by MT4. This includes decision assistance, messaging broadcasting facilities, news & market data and trade execution, and management.

Customer Service

Clients wanting to get in touch can do so either by live chat, request forms or a free call back. This broker offers these services 24/6. We did try to contact BP Prime through live chat but we weren’t given any feedback regarding our queries. You can find BP Prime’s contact details below:

Address: BP Prime

Lower floor, 62 Great Eastern St

London EC2A 3QR, United Kingdom

Phone: +44 (0)20 3745 7101

Email: [email protected]

Demo Account

On BP Prime’s website, you can find a Try a Free Demo Button. This button takes you to a simple form that you must fill out. Apart from the usual personal details, you will also get to choose which account you want to test, Standard, Pro or Prime. All three options are offered in USD.

Countries Accepted

In their FAQ page, one can find information that BP Prime does not accept US clients because of regulations. In the footer of their website this broker claims that the content of this site is not directed at clients of the US, Canada, France or Belgium. If you are from any of these countries, you might encounter some issues when trying to open up an account with BP Prime. You can contact the broker directly for more information regarding restricted countries.

Conclusion

This UK based broker is licensed by the FCA, which for some, is a major plus. Apart from this it uses the industry’s leading platform MT4 and claims to offer even better proprietary apps available for clients. It offers its clients a choice of three accounts, two of which being fee-free. Leverages are reasonable whilst spreads are low especially in the Prime account. The website does offer some up to date and useful educational content in the form of webinars and articles. Although BP Prime claims to offer 25/6 customer support, we weren’t given any feedback via live chat.

If you think you’d feel safe trading through BP Prime, get a closer look at their conditions by visiting their website.