Introduction

Before you develop your trading strategy around the news releases, you first need to decide which news you will use for trading. As we mentioned in our previous course, different economic releases have a varying impact on the forex market. Since the aim of any trade is to gain as many pips as possible, it is only natural that you trade news releases that create high impact – those which can significantly move the forex market in the short-term; or even the longer-term.

The primary way to identify high-impact news releases is by establishing which economic indicator gives a relevant, most current, and comprehensive overview of the economy. The high-impact news releases usually cover these aspects;

Central banks’ monetary policies: These policies can impact future economic growth – both in the short and long term.

Labour market reports: Such reports tend to be of the changes in the previous month. They are a leading indicator of changes in household demand, which is a major contributor to economic growth.

Manufacturing and industrial activities: These sectors are usually among the largest employers in the labor market. Monitoring their growth can be a leading indicator of GDP growth and changes in the unemployment levels.

The services industry: This industry is the first to be impacted by changes in consumer demand.

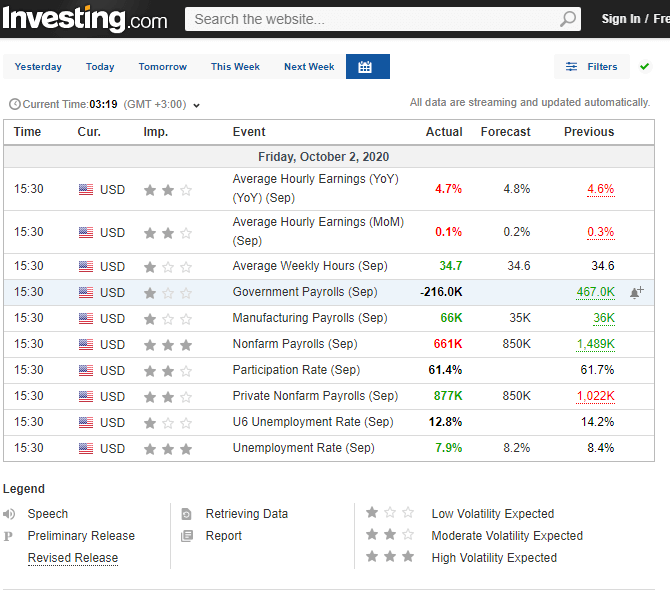

You don’t have to stress about determining which specific economic indicators are high-impact. The economic calendars take care of this for you. Furthermore, there are several economic calendars out there, so you can compare multiple calendars and check put the consensus about the impact magnitude of the various news releases.

Note that these calendars have a legend to indicate the magnitude of the news release. They show whether the news will have high, medium, or low volatility.

Here’s our recommended list of high-impact economic indicators.

- GDP releases

- Inflation indicators like CPI, PPI, and PCE

- Interest rate decision

- Unemployment rate and wages data

- Industrial production, factory orders, or manufacturing production

- Retail sales

- Surveys on the manufacturing sector and services industry

- Sentiment surveys on consumers and businesses

It is important to note that geopolitical developments can be happenstance. These events could include upcoming elections in major economies, natural disasters like tsunamis, pandemics, and geopolitical conflicts. When these events happen, the impact of the release of the economic indicators may change.

For example, towards the end of Q2 in 2020, the impact of these economic indicators was heightened. The reason is that they signaled the rate of economic recoveries after the coronavirus-induced recessions. Furthermore, they showed whether or not the expansionary policies adopted impacted the economy as expected. [wp_quiz id=”94066″]