Introduction

Fundamental analysis and technical analysis are an essential part of Forex trading. A Forex trader cannot be a profitable trader unless he knows this analysis. Fundamental analysis provides a logical reason for the upcoming movement of a currency pair based on economic releases. Traders evaluate these releases to determine the exact movement of a currency pair.

What is Fundamental Analysis?

According to finance and accounting, Fundamental analysis is the process of analyzing the business’s financial statement, including the competitor and market analysis. Moreover, it considers the core feature of a country’s macroeconomic factor, including the interest rate, inflation, GDP, manufacturing index, export, import, etc.

However, in forex trading, the fundamental analysis focuses on macro-economic factors mostly. The currency pair in a forex market represents the economy of two separate countries. In fundamental analysis, traders usually focus on major economic events and releases and their impact on a currency pair. Moreover, most professional traders consider both technical and fundamental analysis to get the best output from the market.

Elements of Fundamental Analysis

The fundamental analysis has two major elements- the fundamental releases and the fundamental events.

The Fundamental Releases

Fundamental releases are economic news of releases of a country that is published at regular intervals. Among the fundamental releases, the primary 4 economic releases are most important as it creates an immediate impact on a currency pair. Let’s have a look at four major economic releases:

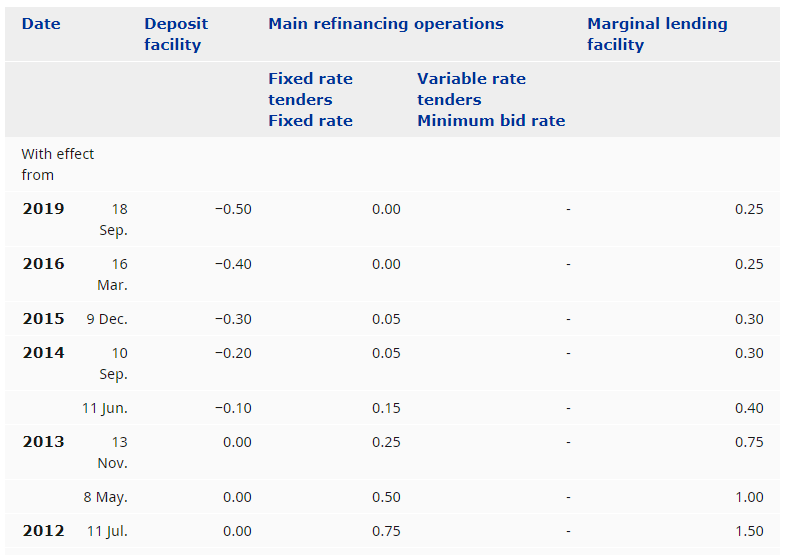

- Interest rate: The interest rate is how much we have to pay to the central bank if we take any loan. Central banks raise the interest rate if the economic condition is excellent. On the other hand, the central bank reduces interest rates if the economic condition is terrible.

Image Source: https://www.ecb.europa.eu/

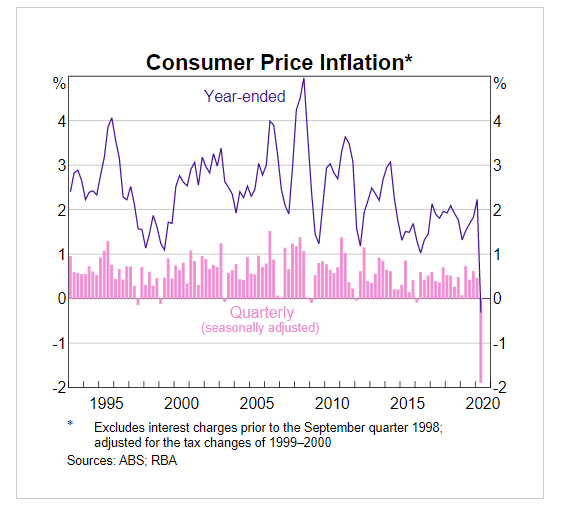

- Inflation Rate: Inflation is the buying power of the money. The increase in inflation indicates a rise in the consumer product’s price that reduces the buying power of money. Any increase in the inflation rate is terrible for the economy.

Image Source: RBA

- Gross Domestic Product: Gross Domestic Product or GDP refers to the country’s products and services’ total value. Any increase in GDP is positive for a particular currency.

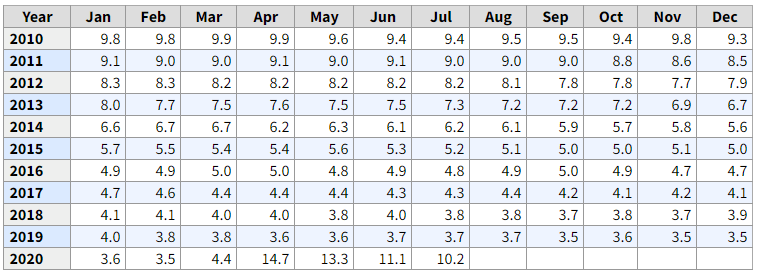

- Employment: The number of employed and unemployed persons for a country works as a crucial fundamental indicator. Any decrease in employment is bad for the economy, and any increase in employment is reasonable.

Image source: https://www.bankofcanada.ca/

Fundamental Events

Besides fundamental releases, some essential fundamental events put a significant impact on a currency pair as mentioned below:

- Central Bank Meeting: Central of a country meets once a quarter and discusses its economic condition. Any dovish tone negatively impacts the currency, while a hawkish tone creates a positive impact.

- Geopolitical Events: There is some condition when one country meets another country to discuss the trade deal or conflict. Any positive news from a country’s geopolitical event may create a bullish momentum of the country’s currency.

In fundamental analysis, traders usually evaluate these releases and events to measure the strength and weaknesses of a currency pair.

Conclusion

Traders usually gather recent economic releases and compare the result with the previous result. Any better than expected result indicates a buying opportunity on a particular currency. On the other hand, traders often evaluate fundamental releases to measure the volatility of a currency pair. [wp_quiz id=”86400″]