In August 2011, the Turkish Capital Markets Board (CMB) announced a new set of regulations, according to which foreign exchange brokers can no longer offer commercial services in Turkey without a local license. Only 7 brokers were allowed to continue operations with a temporary permit. Fortunately, Ncminvest is one of them.

This broker has a wide selection of commercial instruments, we have been able to find, 45 currency pairs, many of which are exotic or minor. And also, we see many CFDs in precious metals like silver, gold, platinum, and palladium, as well as oil, natural gas, 9 indices, several shares, and even several cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple.

Ncminvest is a financial company based in Abu Dhabi, United Arab Emirates, offering a wide range of services, asset management, financial advice, and fund management, as well as forex trading and online CFDs.

Obviously, we want to focus on your trading business. The broker offers numerous currency pairs and CFDs on precious metals, raw materials, energy, and indices. Ncminvest has four different account types, leverage up to 1:100, and offers its customers the popular Metatrader4 platform.

Ncminvest is licensed in the UAE (United Arab Emirates). Ncminvest is the trademark that is operated and is owned by Noor Capital PSC, a private limited company incorporated under UAE law with a registered office in Abu Dhabi. The company is registered with the Abu Dhabi Department of Economic Development and is authorized and regulated by the Central Bank of the United Arab Emirates to distribute banking, financial investments, and consulting, as well as trade-in financial and monetary intermediation.

Basically, this is a reputable company, and your money will be safe with them.

The financial authorities of the United Arab Emirates have quite strict regulatory requirements. For example, all forex brokers and CFDs in the country must have at least one million dirhams (approximately 250,000 EUR), of which at least 60% have to be in local funds.

By comparison, regulated brokers in Europe, must maintain an operating capital of no less than EUR 730,000, and also submit regular reports, have external audits, keep the funds of all clients in segregated accounts, and participate in customer clearing systems, in cases where the broker becomes financially insolvent.

Another distinction is that all brokers in Europe are restricted to offer leverages above 1:30 to retail customers, while UAE brokers do not provide for such a restriction.

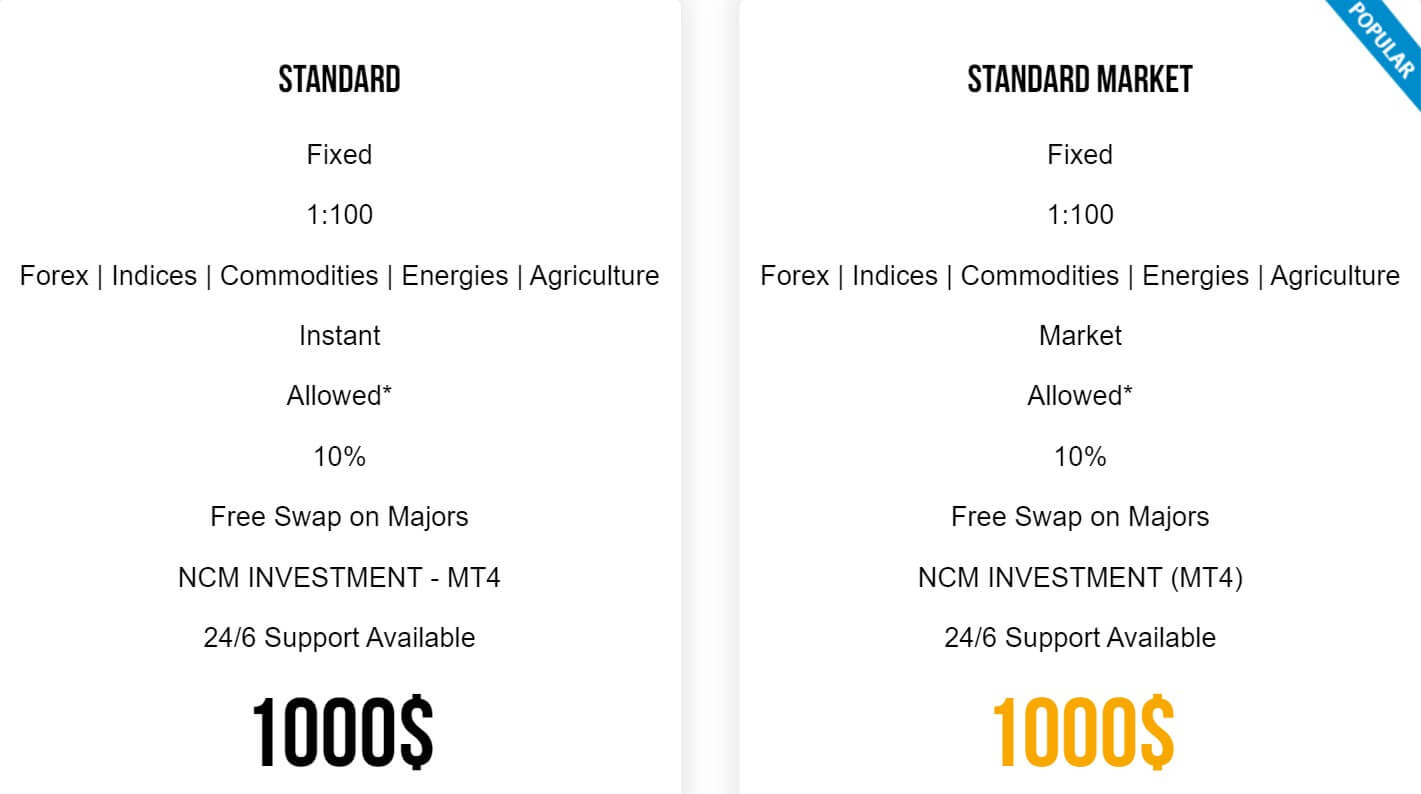

Account Types

NCMinvest offers its clients 4 different types of accounts. We summarize in the following table the characteristics of each of them:

Standard Account

- Spread Fixed

- Leverage 1: 100

- Products Forex | Indices | Commodities | Energies | Agriculture

- Execution Type Instant

- Hedging Allowed

- Stop Out 10 %

- Swap Charges Free Swap on Majors

- Platform NCM INVESTMENT – MT4

- Helpdesk Support 24/6 Support Available

- Minimum deposit 1.000 EUR

Standard Market Account

- Spread Fixed

- Leverage 1: 100

- Products Forex | Indices | Commodities | Energies | Agriculture

- Execution Type Market

- Hedging Allowed

- Stop Out 10 %

- Swap Charges Free Swap on Majors

- Platform NCM INVESTMENT – MT4

- Helpdesk Support 24/6 Support Available

- Minimum deposit 1.000 EUR

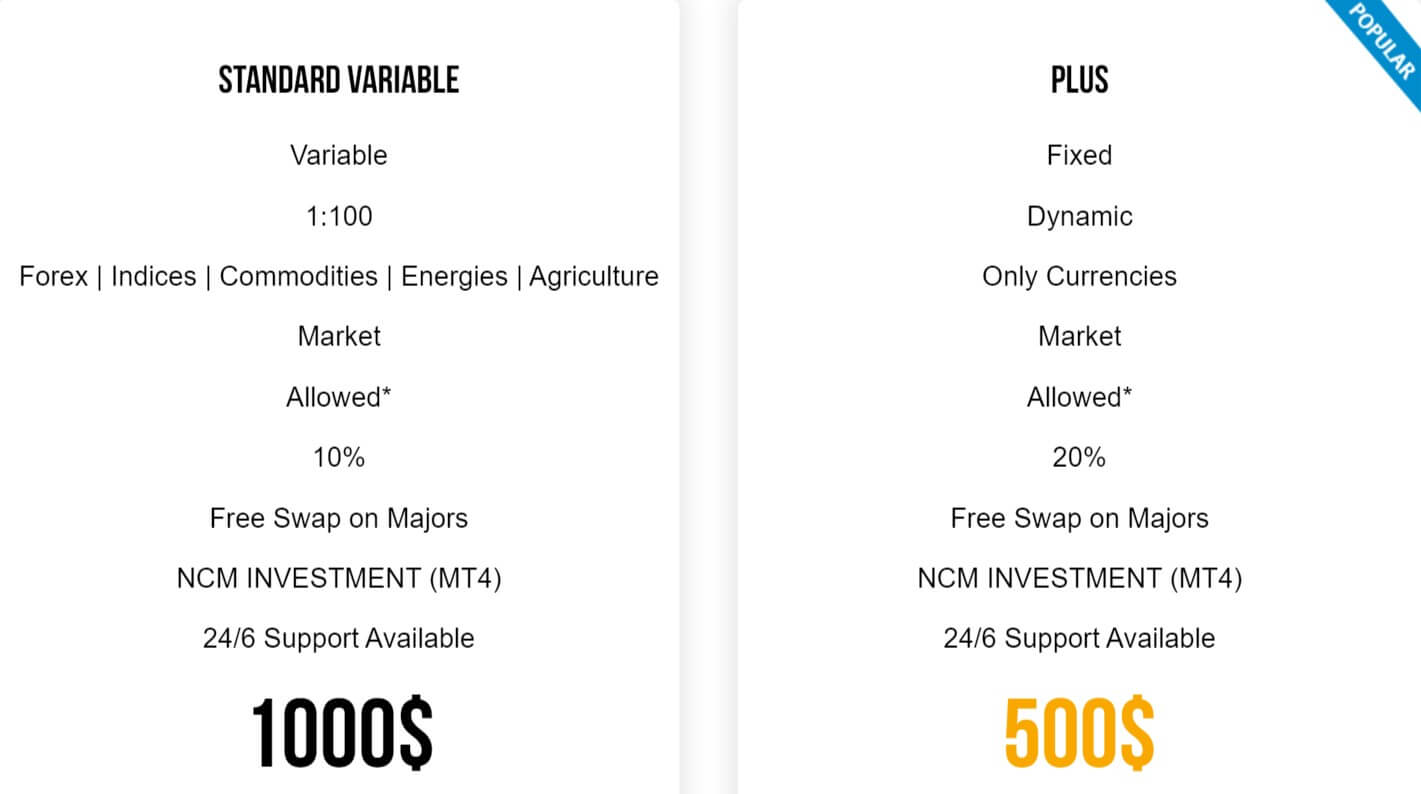

Standard Variable Account

- Spread Variable

- Leverage 1: 100

- Products Forex | Indices | Commodities | Energies | Agriculture

- Execution Type Market

- Hedging Allowed

- Stop Out 10 %

- Swap Charges Free Swap on Majors

- Platform NCM INVESTMENT – MT4

- Helpdesk Support 24/6 Support Available

- Minimum deposit 1.000 EUR

Plus Account

- Spread Fixed

- Leverage Dynamic

- Products Only Currencies

- Execution Type Market

- Hedging Allowed

- Stop Out 20 %

- Swap Charges Free Swap on Majors

- Platform NCM INVESTMENT – MT4

- Helpdesk Support 24/6 Support Available

- Minimum deposit 500 EUR

The four accounts are very similar, and the differences we can find are the required minimum deposit, the spread rate used, the leverage, the available financial assets, and the stop out. These differences will be further detailed in the following paragraphs.

Platforms

Good news, the Metatrader4 platform is available. This platform is by far, one of the best and most comprehensive commercial platforms available on the market. MT4 is a highly reliable and multifunctional commercial resource, offering us numerous technical market indicators and even commercial robots with which we can efficiently execute automated business strategies. Furthermore, MT4 also has an excellent set of advanced graphics tools in different timeframes and with historical data.

Leverage

NCMinvest offers leverage of 1:400. Currently, leverage levels that are this high are only available in regulated offshore brokers in countries such as the United Arab Emirates, South Africa, and New Zealand. In most major markets, including the European Union, the United States, Canada, Japan, and even Australia, financial regulators have placed strict leverage restrictions, this is a targeted effort to reduce retail clients’ investment risks.

Trade Sizes

In the demo account that we have used, we have been able to verify that you can trade with micro-lots (0.01 lots), which is favorable for new traders who want to take small positions in the market to limit their monetary risks.

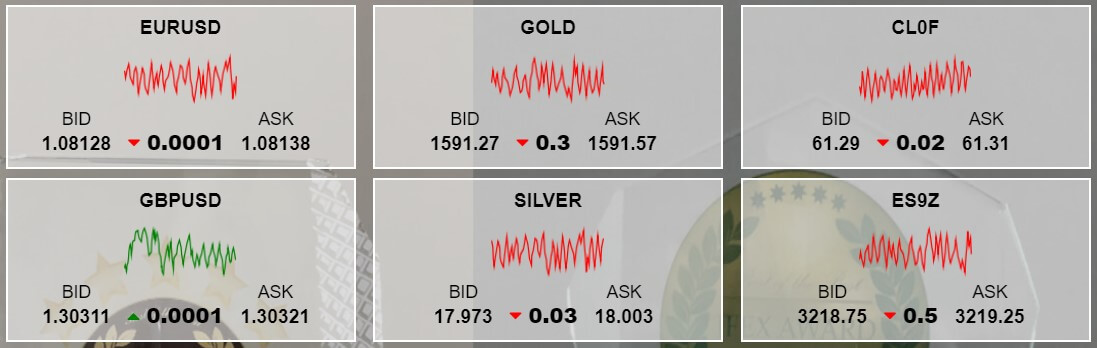

Trading Costs

The spread seems to be quite hight. For example, in the pair EUR/USD, we have detected a fluctuation between 2 pips and 2.1 pips. In the Demo account, there are no commissions for trading lots, and we understand that in the real account, there will not be any. Concerning Overnight Financing (Swap), Noorcm reports that they do not charge Swaps on open positions in the Majors, which are the most valuable currency pairs.

As for the remaining assets, you will have to pay this swap cost, which is any position held overnight, which will incur a maintenance cost (interest). This amount can be negative or positive depending on the instrument and the direction of the position, and its amount is fixed by the central banks of the base currency of the open position.

Assets

We found a wide selection of financial assets to trade with. When we tested Ncminvest’s Demo trading platform, we found 45 currency pairs, many of which are exotic or minor as, USDMXN, USDNOK, USDZAR, USDTRY, USDSGD, USDSEK, USDPLN, USDHUF, USDDKK y USDCZK.

Also, there we find many CFDs in precious metals, such as silver, gold, platinum, and palladium, as well as oil, natural gas, 9 indices, a wide variety of stocks, and even several cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple.

Spreads

We found some rather high spreads. According to what we have tested in the demo account, the reference spread in EUR/USD fluctuated around 2 pips – 2.1 pips, and that spread is a bit high for how the industry average is. Note that spreads are usually considered attractive only when they start below 1.5 pips in a standard account and without trading fees.

Minimum Deposit

The minimum deposit required by this broker is a little high compared to the industry average. Depending on the type of account the customer chooses, the minimum deposit required to open a trading account can be USD 1,000, or USD 500 in the PLUS account.

Deposit Methods & Costs

NCM Invest informs you of the availability of the following payment methods, credit or debit bank card, Visa or Mastercard, and local means of payment, K = net, Naps, and Benefit. The broker reports that the maximum deposit that can be made with card is 20,000 USD per day. And that the base currency in their accounts is KD (Kuwaiti Dinar) for payment. If payment is made with a card that has a different base currency, additional conversion rates may apply. Unfortunately, the broker does not report the costs associated with the different deposit methods offered.

Withdrawal Methods & Costs

The broker does not report about the withdrawal policy. Either way, we understand that the customer may request withdrawals in any of the methods he used to make the deposits. Again, we have no information about withdrawal fees, if any.

Withdrawal Processing & Wait Time

We have no information about the withdrawal process or waiting times.

Although usually, in the case of cards and e-wallets, the waiting time should not exceed 24 hours since the broker processes the withdrawal.

Bonuses & Promotions

NCM Invest does not currently have any bonuses or promotions available. The broker offers an Introducing Broker program. An Introducing Broker is an agent that introduces customers to a broker. The IB’s receive compensation in the form of a commission for the clients they add, collecting these funds directly from the broker.

Education & Trading Tools

Noorcm has a high-quality educational section. It offers online and face-to-face education in its various Forex courses. On the website, they have a section of recorded webinars, and ready for viewing, among the topics they deal with are:

- The best and easiest way to trade currencies

- Fibonacci retracements

- Trends and Patterns

- Developed Harmonic patterns (Gartley wave)

- Wyckoff Theory

- Pivot points

- Magical Bollinger

- Broken trend strategy

- Three best currency to trade

- Regression channel strategy

- Gann methods

- Divergence

- Technical indicators

- Market overview

- Introduction to Forex

- Money management

- Classic patterns

- Price behavior

- Advantages of trading in the Forex market

- Trader psychological (greed and fear)

- Performance of U.S. Indices

- Introduction to fundamental analysis

- How to build your trading strategy

- Oil market in the current political climate

- Gold trade on demand

- Forex overview

- Bollinger bands and momentum indicators

- Japanese candlesticks

- And more

They also have a good section of economic news that is updated on a regular basis, and an economic calendar, a tool that we always consider useful for the trader, because in it you can observe all the events of interest of the day, and that may affect the different assets you may be trading.

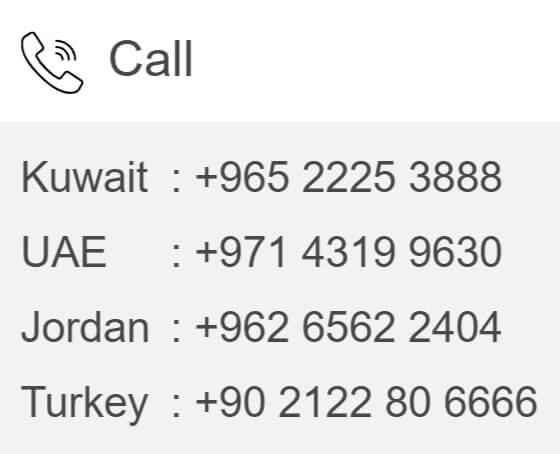

Customer Service

To contact NCMinvest customer service, there are 3 main ways of contact. These include telephone, contact form that you will find on the website, and an online chat. They also have 4 offices where it is possible to visit them, in Kuwait, UAE, Turkey, and Jordan. The data related to these is as follows:

Kuwait Headquarters:

Kuwait Headquarters:

Dar Al Awadi Tower, 27 th Floor / Mezzanine Floor, Ahmad Al Jaber Street, Sharq, P.O.Box 26489, Safat 13125, Kuwait. Phone: +965 2225 3888. Fax: +965 2246 5992 / 91

UAE Office:

The H Hotel Dubai, Offices Tower, Level 15, Office No. 1502, Sheikh Zayed Road, P.O. Box 31045 Dubai, United Arab Emirates. Phone: +971 4 319 9630. Fax: +971 4 330 3550

Turkey Office:

Noor Capital Market Menkul Değerler A.Ş. A.Ş. GENEL MÜDÜRLÜK Merkez Mah. İstiklal Sok. Key Plaza 11 / 7 Şişli İSTANBUL. Phone: +90-212 280 6666. Fax: +90 212 280 6692

Jordan Office:

Mecca Street, Kent Complex, Building 145, Second Floor, Office 203 – 204, Amman, Jordan. Phone: +962 6 5622 404. Fax: +962 6 5511 404.

Demo Account

A Demo account can benefit the trader in 2 ways:

– Practicing commercial techniques

– Learning the different tools of the platform

It is very common for traders to open a Demo account before depositing money into a real account. It is also important to know that the Demo account retains the same live prices and market conditions, simulating the exposure in a real account. Fortunately, NCM Invest has a demo account for its clients on the MT4 platform. All you have to do is register, provide your personal data, and they send you an email with instructions for installation and use.

Countries Accepted

We have not found restrictions on countries where their citizens cannot trade. On the registration page, we have observed the list of available countries and we do not detect that any country is missing from it, so we assume that anyone can open a trading account with this broker.

Conclusion

NCMinvest is a well-regulated broker. Below we detail the list of the 4 regulations that it has in different jurisdictions:

NCM Investment (HQ) is regulated by Capital Markets Authority, Kuwait under license No: AP / 2019 / 0003 & AP / 2017 / 0009 | LEI No. 2 1 3 8 0 0 1 6 3 E L E M N K Q Z I 7 7

NCM Investment (HQ) is regulated by Capital Markets Authority, Kuwait under license No: AP / 2019 / 0003 & AP / 2017 / 0009 | LEI No. 2 1 3 8 0 0 1 6 3 E L E M N K Q Z I 7 7

Noor Capital Markets Menkul Değerler is regulated by Capital Markets Board of Turkey under license No. 022 | Member of Borsa Istanbul under Member Code: NOR | Turkey Trade Registry No. 784981 – 0| LEI No. 789 0005OA66 NLKG8HS26

Noor Al-Mal for Local and Foreign Financial Brokerage is regulated by Jordan Securities Commission under license no. 18 / 01533 / 1 / 3.

SHUAA Capital PSC is regulated under the UAE Securities and Commodities Authority with license no. 200219.

With his UAE license, Noorcm appears to be a reliable broker. It offers a good selection of financial assets for trading, with a multifunctional trading platform such as MT4, and leverage of up to 1:400. The minimum deposit requirement has seemed to us very high, 500 USD or 1,000 USD, depending on the account. We do not have information about the possible costs of deposits or withdrawals, or the estimated time to complete them. The spreads have seemed a little high to us, as we can find them tighter in many other well-regulated brokers. We have been pleasantly surprised by the educational area, very complete, and the tools available to the trader, especially the existence of an economic calendar.

Advantages:

- MT4 platform is available

- Leverage up to 1: 400

- A lot of asset variety

- Excellent educational and resource area for the trader

- Demo account available in MT4

- Regulated broker in the countries in which it is established

Disadvantages:

- Higher than average spreads

- High minimum tank capacity

- We do not know the possible costs of deposits and withdrawals