ValueTrades is an FX and CFD broker that is located in the United Kingdom and regulated by the Financial Conduct Authority (FCA). The company describes its mission as leveling the playing field, in order to give all clients complete access to the real financial markets. We certainly see the broker providing one advantage for the underdog, by allowing clients to open an account with no required deposit amount. If you’re located in London, it’s even possible to arrange an in-person meeting, something that many of the broker’s competitors would never consider offering. Stay with us to find out more.

Account Types

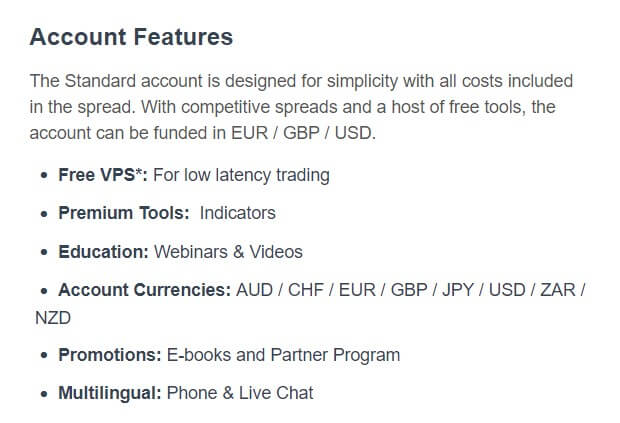

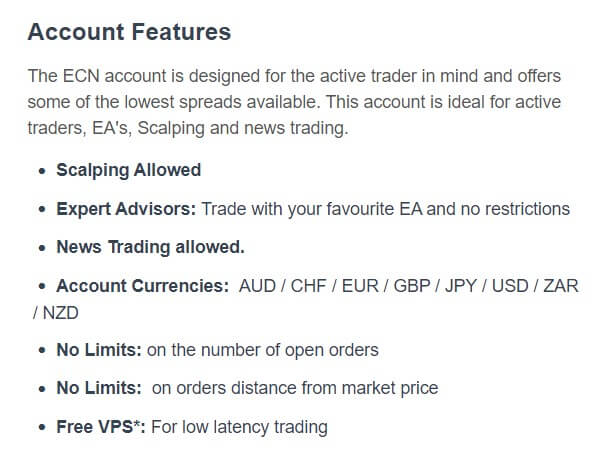

This broker offers two account types; Standard and ECN. Both accounts are extremely affordable, with no minimum deposit requirements. On Standard accounts, commissions are applied in the spread, meaning there are no separate commission entries. This setup type is ideal for beginners and long-term position takers. The ECN account offers the lowest spreads and is designed for active traders, EA’s, scalping, and news trading. Leverage options are based on the exact instrument that is being traded, in addition to the equity in the account. Platforms, trade sizes, and tradable instruments are also shared by both account types. We’ve provided a quick overview below.

Standard Account

Minimum Deposit: None

Leverage: Up to 1:500 on FX

Spread: From 1 pip

Commissions: None

ECN Account

Minimum Deposit: None

Leverage: Up to 1:500 on FX

Spread: From 0 pips

Commissions: $3 (Forex & CFD) (per Side)

Platform

This broker offers three separate trading platforms; MetaTrader 4, MetaTrader 5, and Fix API. Chances are, many traders have already heard of the award-winning MT4 and MT5 trading platforms. Due to its wide range of trading resources, MT4 is preferred by all types of traders, including novices and investors. MT5 intends to build upon the success of MT4 and offers more pending order types and tools while providing a more powerful experience.

Both platforms can be downloaded on PC (Windows operating system 7 or better), Mac, or Mobile devices. The browser-based version, WebTrader, is also available for those that do not wish to download the program. Fix API is also offered as an alternative to the more traditional platforms and claims to focus on providing total control to traders. This platform provides direct market access and is applicable on all tradable instruments. The broker does not specify about device compatibility.

Leverage

Leverage options seem to be based on the equity within the account. All FX options offer a maximum leverage of either 1:125 or 1:500 on accounts that are funded with less than $20,000. The options are divided about half and half, so you’ll want to check the “Products” page to see which leverage is applicable on certain currency pairs.

For accounts that have equity between $20k – $100k, the broker also offers a mixture of leverages of either 1:50 or 1:200. Accounts with balances over $100,000 offer leverage up to 1:25 or 1:100 on FX options. On CFDs, the broker offers a leverage cap of 1:100 for all options.

Looking at Commodities, we see maximum leverage of 1:100 on US and UK Oil options, regardless of the account balance. The four remaining options offer a leverage cap of 1:500 for equities less than $20,000, a cap of 1:200 is offered for balances between $20k – $100k, and a cap of 1:100 is available for accounts holding more than $100k.

Trade Sizes

The minimum trade size is one micro lot across both account types. Maximum trade sizes differ based on the asset that is being traded. The maximum trade size on Forex options ranges from 10 to 50 lots, aside from on EURCZK, which has a higher maximum of 100 lots. The maximum trade size is 10 lots on all CFDs, with one exception, being a limit of 100 lots on AUS200. The maximum trade size is 30 lots on most Commodities, with a limit of 10 lots on Oil.

Trading Costs

Traders will pay charges through commissions, swaps, and spreads. If you’re a Standard account holder, you’ll be able to avoid commission charges altogether, since this account type applies commissions to the spread. For ECN account holders, both commissions and spreads will apply, although spreads start from 0 pips. Commissions charged on this account type are $3 per Standard Lot per side, or $6 round turn. Any positions that are left open overnight will be subject to swaps and an interest rate that is credit or debit will be applied to swaps.

On FX, the value of the credit or debit is based on the difference between the interest rates of both currency pairs. Three times the swap is applied on Friday nights for CFDs. Oil behaves like a futures contract, where the settlement is a fixed date each month. You can find further information about swaps on the FAQ page and swap rates for any given day are published on the website daily; however, these rates can only be accessed by logging in through the client portal.

Assets

This broker advertises 100+ instruments, including FX, Precious Metals, Oils, and Indices. If you’re looking for Cryptocurrencies, you won’t find those options available with this broker. FX options are made up of 80 total products, including majors, minors, and exotics. In total, 11 CFDs and 7 Commodities are available. Taking everything into account, we can say that this broker is offering an excellent selection of currency pairs; however, the broker also seems to be focused on providing the most basic products. Some may feel satisfied with these options, while others may be looking for a larger variety.

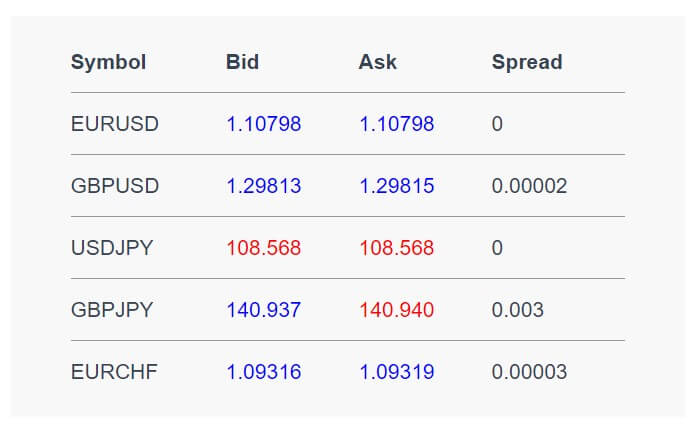

Spreads

Spreads with this broker are floating and start from 0 pips on ECN account types. On Standard accounts, the spreads start from 1 pip, which is significantly lower than the industry’s average 1.5 pips, especially considering this is not a more expensive account type. On the “Products” page, the broker offers complete transparency and lists live spreads for each instrument, so there is no need to worry whether spreads will appear much higher than advertised. Some brokers require deposits in the thousands of dollars to access these types of spreads, so we’re overly happy with the numbers here.

Minimum Deposit

One of the advantages of signing up for an account with this broker would seem to be the lack of minimum deposit requirements. Many other brokers tend to ask for deposits in the hundreds for Standard accounts, or in the thousands on other account types, which can often limit the account types one could realistically open. Fortunately, affordability will not be an issue with this broker and traders will be able to open either account of their choosing.

We do recommend making a deposit that is large enough to handle some trading activity, otherwise, you may find yourself making frequent deposits. However, we do want to point out one discrepancy. On the homepage, the broker mentions a $50 deposit requirement, although support assured us that there are no minimum deposit requirements set in place. We typically tend to listen to support, but we’d like to point this out, just in case this comes up when making a deposit.

Deposit Methods & Costs

This broker accepts the following payment methods: Bank Wire Transfer, Visa, MasterCard, Neteller, Skrill, China UnionPay, Advanced Corretora, Boleto, and Remessa. This broker does not charge any fees on incoming deposits and credits the exact funded amount to the client’s trading account. The broker fails to mention how long it can take to see funds posted once sent.

Withdrawal Methods & Costs

The broker doesn’t offer much information when it comes to withdrawals. We can hopefully assume that all available deposit methods can be used for withdrawals, although we can’t say for sure. Many brokers often have some type of policy in place that forces withdrawals to be treated as refunds and returned back to the payment source, so it is likely that there will be requirements with ValueTrades as well. We tried to reach out to support for more clarity on this policy; however, we did not receive a response.

We do know that withdrawals are marketed as being fee-free. A condition of the fee-free withdrawal policy would be that the broker doesn’t charge fees on the first three withdrawals each month; therefore, it would be in your interest to try to limit the number of outgoing withdrawals. The lack of clarity on information related to this section made us feel disappointed in this broker’s transparency, for the first time so far.

Withdrawal Processing & Wait Time

As we mentioned earlier, this broker is very vague about withdrawals, including the amount of time it can take to process them. This is very important for many traders to know since it would be crucial to know the timeframes in case a problem causes a delayed withdrawal. Sadly, the broker just doesn’t give us anything to go on here. From experience, we can definitely say that Bank Wire Transfer would likely take the longest to be received.

Bonuses & Promotions

Currently, the broker is not offering any special promotions or bonuses. Traders should never choose a broker based on special opportunities alone, although it’s always nice to have an opportunity to earn extra money. It’s possible that the broker could add some type of promotion in the future, so be sure to check from time to time if you sign-up.

Educational & Trading Tools

Most of the broker’s educational resources are located under the “Blog” > “Resources” section of the website. This section includes webinars related to operating MT4 and MT5, trading harmonic patterns, reading economic calendars, etc. Ebooks are also available and cover topics like effective forex trading strategies, risk management, and more. You’ll also find trading news, live quotes, an economic calendar, forex glossary, trading indicators, sentiment, and a FAQ.

Demo Account

This broker labels their practice accounts as “Simulation Accounts”, although the concept is exactly the same as a demo account. Traders are able to sign-up for one of these accounts free of charge. In order to open a simulation account, you’ll need to fill in your name, country, phone number, email, and choose an account currency. The broker also offers the ability to choose between the two account types and MT4/MT5 trading platforms.

Another advantage would be the fact that the broker allows traders to type in any amount for their initial deposit, where many others choose a predetermined amount that may be unrealistic. Also, note that the US is missing from the country list, although there would be no reason one couldn’t select a different country for a training account. In addition, the broker offers simulation accounts, which are basically demo accounts.

Customer Service

Support can be contacted via LiveChat, phone, email, or by filling out an online contact form. The broker is not clear about their working hours, although we did hear from support at a late hour. As usual, we made it a priority to test out the website’s LiveChat feature. Upon connecting in the chat, the broker displays a message stating that support typically replies within a few minutes. Not long after we joined the chat, the broker automatically asked for our email address and stated support would be in touch as soon as possible.

Hours later, support responded on the chat with an apology and an answer to our question. We were happy to receive a response, although we do feel that a support agent should have been online at the time we initially sent our message. On further attempts, support did not manage to respond at all. The contact form can be filled out on the website and all other listed contact information is included below.

Hours later, support responded on the chat with an apology and an answer to our question. We were happy to receive a response, although we do feel that a support agent should have been online at the time we initially sent our message. On further attempts, support did not manage to respond at all. The contact form can be filled out on the website and all other listed contact information is included below.

Phone: +44 (0) 20 3141 0888

Email: [email protected]

Address: 51 Eastcheap, London EC3M, 1JP, United Kingdom

Countries Accepted

The broker claims that the website is not intended for residents of the United States or any country where distribution would be contrary to local law or regulation. We still decided to attempt opening an account from our US-based offices, to see whether this restriction is upheld. Sadly, the US and all similar options are missing from the sign-up list, so there will be no way around this restriction. On the bright side, we did see that many other options that are often restricted are available.

Conclusion

ValueTrades is a regulated FX and CFD broker that offers several advantages, alongside a few disadvantages. There are no minimum deposit requirements for either of the available account types, spreads start from 0.0 or 1 pip, three trading platforms are offered, and leverage options go up to 1:500 for accounts that have equity of less than $20,000. Commission charges are only applicable on ECN accounts, so traders can choose between the lowest spreads with some commission charges, or having the commissions built-into the spread.

Some of the drawbacks would be lack of bonus opportunities, the fact that US residents cannot open accounts, and a limited variety of trading instruments, aside from currency pairs. Accounts can be funded through a variety of methods and there are no fees on deposits. The website is extremely vague when it comes to withdrawals, although we do know that the first three withdrawals each month are free.

We did find support to be available through a variety of methods, although it took a few hours for support to respond on LiveChat on our first attempt, and we received no response on further attempts. The website also provides a few educational resources in the form of eBooks and webinars. The conditions this broker offers can be advantageous; however, one must decide whether they can get past the vague information about withdrawals and other drawbacks before opening an account.