Position Sizing

Position sizing is the technical size of a trade, or the monetary risk, that a trader is going to take in any given trade. Investors use position sizing to help determine how many units of a particular currency they can purchase, or sell, which helps to control risk and help maximize returns.

Let’s face it, some people might be prepared to go into a casino and put all of their available funds on black, or red, or odds or evens, or a select a number on the roulette wheel, or snake eyes on a throw of the dice, and then hope for the best! A few lucky punters might win occasionally. However, the house always wins in the end!

In Forex trading, we are unlike a casino, insofar as we use fundamental and technical analysis skills in order to try and stack the odds in our favor. We then utilize position sizing in order to maximize our winning potential and also to help to mitigate against the risk of losing trades. In other words, if we do suffer a few losses, we live to fight another day, unlike gamblers who put all their money on one roll of the dice.

Therefore, traders must put up an appropriate amount per trade, given their level of experience, the level of volatility in the market, and proportional to their account balance size. This is where most inexperienced traders go wrong; they simply use too much of their capital per trade, and as a result, when they have a couple of losing trades, they blow their accounts. Statistically speaking, over 70% of new retail forex traders will blow their accounts within the first six months. This, coupled with a lack of understanding of how the forex market works and a lack of understanding regarding leverage and margin requirements, is the account killer for new traders.

In order to be a successful Forex trader, they must learn how to apply the correct use of capital exposure per trade or position sizing. The three most important issues are 1: how much capital they wish to assign to each trade, 2: what is the trade risk associated with each trade, and 3: are they calculating position size accurately.

All of these issues come under effective risk management and are just as important as any other area in Forex trading, such as technical and fundamental analysis. If traders do not understand this, then everything else they know about the market is a waste of time! In Forex trading, every aspect must work together in unison, in order for a trader to consistently win trades. When it comes to trading, capital preservation is paramount to survival.

Example A

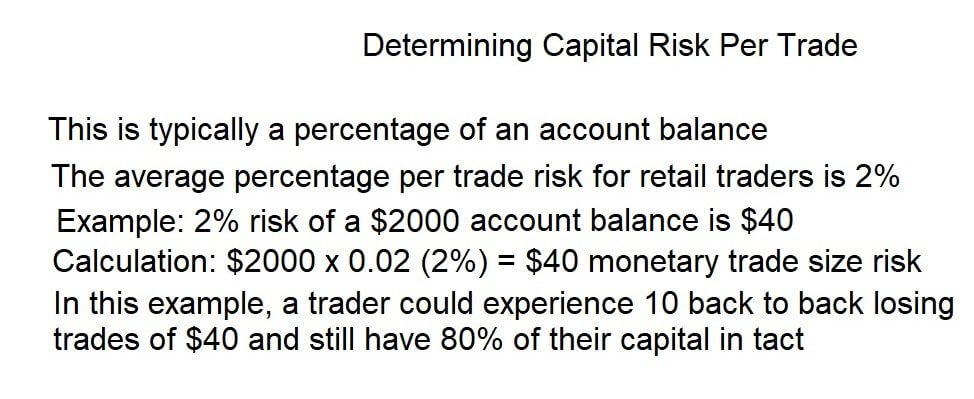

Let’s look at example A: Determining capital risk per trade This is typically a percentage of an account balance

The average percentage per trade risk for retail traders is 2%

Example: 2% risk of a $2,000 account balance is $40

Calculation: $2000 x 0.02 or 2% = monetary trade size risk

In this example, a trader could experience ten back-to-back losing trades or $40 and still have

80% of the capital intact.

It is extremely advisable that new traders adopt this very important position sizing risk strategy, in order to achieve longevity in their trading careers, especially in the early stages. Once a trader has a consistent winning methodology in place percentage risk per trade can be gradually increased above 2%. Traders are also advised to try and achieve a minimum of 2 to 1 win to loss ratio. This would mean that a trader should be looking to make a minimum of $80 per trade win while risking a $40 loss.

Example B

Let’s look at example B: Determining trade risk per trade

Is there an accurate assessment of the probability of a positive outcome?

Are there enough reasons in place to enter this trade?

Decisions must be made to determine precisely where to place a stop loss

Does the chart confirm a realistic possibility of your trade hitting a minimum profit based on the 2 to 1 win to loss ratio?

One area where new traders fall down is their failure to understand that when they trade in the Forex market, they trade on a per pip basis within exchange rate fluctuations. That is to say, that traders’ winnings and losses are calculated on the movements of pips. In Forex, trading pips are calculated from four places to the right of the decimal point.

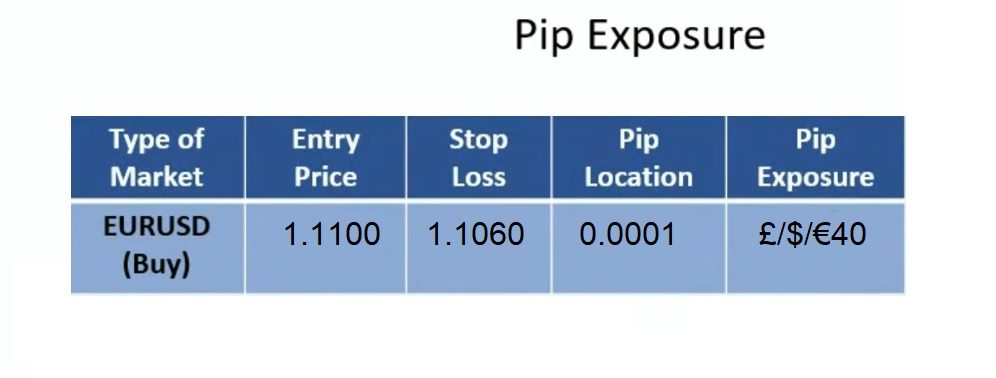

Example C

Therefore in example C, if we bought 1 mini lot of the EURUSD pair at 1:1100, we would need to place our stop loss at 1.1060, which would give us an exposure of $40.

Therefore in example C, if we bought 1 mini lot of the EURUSD pair at 1:1100, we would need to place our stop loss at 1.1060, which would give us an exposure of $40.

In keeping with our 2 to 1 win-loss ratio, we would put our take profit at 1.1180.

Example D

Let’s look at example D: Notional trade size.

Let’s look at example D: Notional trade size.

In order to understand position sizing, traders also need to understand the notional size of a trade. In keeping with our earlier EURUSD trade example, when setting our trade size on our platform, we need to understand about lot sizes. Therefore when trading currencies, because we are trading on leverage, essentially when we trade one mini lot, we are effectively trading 10,000 units of the base currency of the particular pair.

And so in our example, we would be buying 10,000 units of Euros, as the base currency is always quoted first, and the counter currency is always quoted second.