Position Size IV – Equity Calculation Models

In our previous video, we learned the basics of calculating mini-lot sizes for a single position. But how to proceed if we have concurrently open positions? This video is aimed at providing different solutions to the theme.

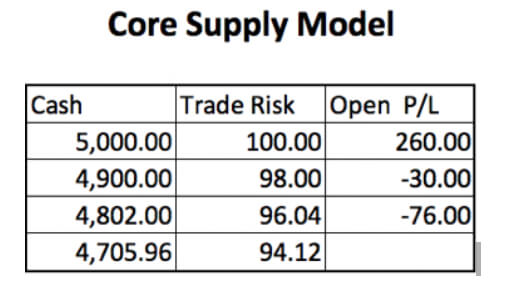

Core Supply Model

Using this guideline, you determine the dollar risk for the next trade by taking the remaining cash left on your account. For example, your initial account cash balance is $5,000, and you have risked 2% (or $100) in your first trade. To compute the next position size, you should consider the $4,900 remaining cash; thus, if your position sizing method told you to use a 2% risk, the size of your next trade should be $4900 *2% or $98.

Using the Core Supply Model, open profits are not considered until the trade or trades are closed. The formula subtracts all the initial risk of the previous trades until the trades are closed. New positions are always computed using the cash calculated with the formula:

Cash = Total equity – Open-trade risks

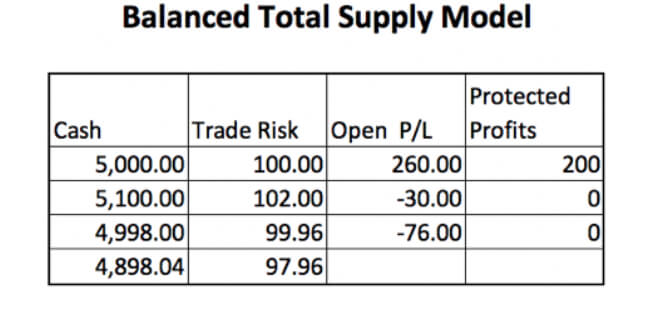

Balanced Total Supply Model

This method is similar to the Core Supply Model, but it adds the profits of the positions in your favor, but only if a stop-loss level protects them. For example, let’s assume you currently have a paper gain of $260 in your first trade, as in the following figure, and you’ve placed a trailing stop that is now protecting $200 of it. In this case, the available cash for the second trade will be $4,900+$200 = $5,100.

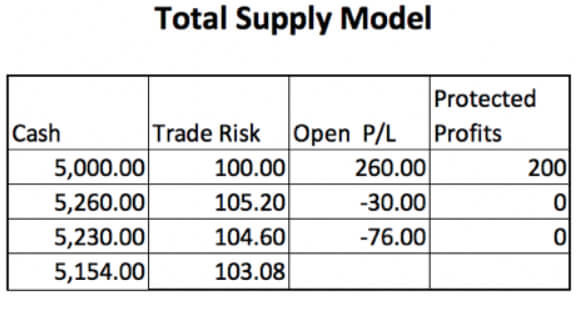

Total Supply Model

The total available cash is calculated by adding and subtracting all the open positions’ gains and losses. This model is a bit riskier than the previous model, as all the profits are added without the requirement of protecting them with a stop-loss. This makes it very simple, although it delivers slightly larger sizes. If we use the previous table, the $250 current profit on the first trade will be entirely added to the $4,900 base supply for a total supply of $5,150 available for the next trade.

This risk model is very much used by account managers, as it helps them keep their position size (their risk) constant, because the next trade size it will always be a percentage of the total available equity.

Boosted Supply Model

This model is made of two “pockets”: The Conservative Money Pocket and the Boosted Money Pocket. This central approach uses a low-risk sizing model on the Conservative Money Pocket and an expanded risk sizing model on the Boosted Money Pocket. The Boosted Money Pocket can be filled using two methods. The first one is to allocate a percentage of the equity ( from 5% to 20%) to the Boosted Money Pocket. The second method is to wait for “market money.” Market money is money resulting from your net gains.

The Boosted Supply Model’s main idea is to be conservative with most of your trading funds and be speculative with the market’s money or a small part of your equity.

Also, the key to this methodology is that the Boosted Money Pocket be rebalanced. We can set a rule to rebalance every week, 15 days or one month, or set a profit target for this pocket that, when reached, will trigger a rebalance action to set it to a pre-defined 5%-20% level.

Using this boosted model, a trader is willing to set a max drawdown much higher to profit from the accelerated equity growth. It is well known that equity growth grows in a geometric progression while drawdowns move in an arithmetic progression. That means that we could obtain over 10X equity growth with just a 2X drawdown increase. We will develop more on this with specific models in future videos. But, as an example, if a trading system delivers a 10% drawdown using 1% position sizing, a boosted pocket could be set to 6X this risk (6%) for a 60% projected drawdown on this 10% portion of the funds of the market’s money. That would triple the profitability of the system but remaining conservative on the core funds of the trader.