Introduction

Private Sector has a significant and crucial role to play in the economic growth of capitalist economies. The development of private sectors can single-handedly drive the GDP and development of the country forward. Credits and loan availability to the private sector can significantly impact the pace of expansion of the country. Hence, an analysis of the loans disbursed to the private sector can offer us much insight into the country’s growth.

What are Loans to Private Sector?

Loan

It is a credit incurred by an individual or entity. The creditor is generally a financial institution or the Government. The lenders give borrowers money on certain conditions that can include terms relating to the repayment date, interest charges, or other transactional fees. A loan can be secured or unsecured. In secured loans, the loan is given out against collateral like property, mortgages, or securities.

Private Sector

It refers to the part of the economy, which is not under state or central government’s control. The private sector industries are mostly privately owned and for-profit businesses. Private sectors can produce productive jobs, higher income, productivity growth. When private sectors are complemented with the Government sector’s support, the growth rate is multiplied many folds.

Loans to Private Sector

It refers to credits provided to the private sector by financial corporations. Credit can be as loans, nonequity securities purchases, and trade credits, etc. Financial corporations here can be monetary authorities (ex: Central Banks), finance and leasing companies, lenders, pension funds, insurance companies, and foreign exchange companies.

How can Loans to Private Sector numbers be used for analysis?

Most modern economies are capitalist economies, i.e., most of the GDP is derived from the private sector that operates on profitability. Economic indicators like employment, wage growth, the standard of living, GDP, etc. are all heavily dependent on the private sector. In the United States, the private sector contributes more than 85% of the total GDP. Hence, private sector growth is almost equivalent to the country’s growth.

In capitalist economies, the private sectors are competitive, provide high employment, better income, and lie at the forefront of technological innovation in general. Due to competition amongst fellow business organizations, the benefits of working in the private sector far exceed that of the public sector.

Credit plays a vital role in the economic growth of capitalist economies. Credit serves as a crucial channel for money transmission from central authorities to the private sector. Loans can fund production, consumption, and capital formation for businesses that, in turn, generate revenue for the country.

Loans can help private businesses to expand beyond just the cash in hand and speed up their growth rate. The ease with which credit facilities are made available to the private sector will largely control the pace of economic growth. The Government and the Central Bank authorities’ support in providing credit to private industries have historically proven to be very beneficial for the state and country’s urbanization and rapid growth.

On the flip side, a decrease or lack of credit availability can significantly impact small and medium businesses, resulting in halting expansion plans, laying off employees, or in the worst close filing bankruptcy.

The public sectors can only take care of the essential services and set rules and regulations in different areas. The required development has to come from the private sector. But it is the private sector that can boost economic growth through investment, employment, competition, innovation, and better wages.

In the underdeveloped economies, the Government’s support in credit and business support to the private sector has mostly helped uplift people from poverty. In the developing economies, private sector investments have dramatically improved the standard of living for many countries like China, Japan, and India. Private sectors of developed countries already enjoy the support from the public and banking sector, which explains their high GDP and consistent growth rate.

Impact on Currency

An increase in loans to the private sector is a positive sign for the economy. It indicates more businesses are now creditworthy and are working on expansionary plans. A healthy increase in the number of loans to the private sector is good for the future economy. An increase in loans to the private sector also indicates the market is more liquid, and the currency will lose value for the same set of goods and services. Conversely, a decrease in loans to the private sector means the market is less liquid, and money is costly. Currency appreciates, but economic growth is difficult to achieve.

Loans to private sector statistics are useful for the Governments and international investors and companies to check the health of the private sectors in a particular economy. International companies open businesses where ease of doing business is high. For them, it is a useful indicator. Private Sector Loan is not a significant economic indicator for the FOREX markets. Hence it is a low impact indicator.

Economic Reports

The World Bank collects domestic credit data to the Private Sector as a GDP percentage on their official website. The dataset is annual and covers most countries. The datasets are updated once they receive the latest data from the respective countries.

Sources of Loans to Private Sector

The World Bank’s Domestic Credit to private sector reports is available here.

We can also find a consolidated list of Loans to the private sector on the Trading Economics website.

How Loans to Private SectorAffects The Price Charts?

Loans to the private sector is not a statistic most forex traders keep an eye when making their trades. The lack of interest is because it is considered a their-tier leading indicator. It is, however, essential to know how the release of this fundamental economic indicator affects the forex price charts.

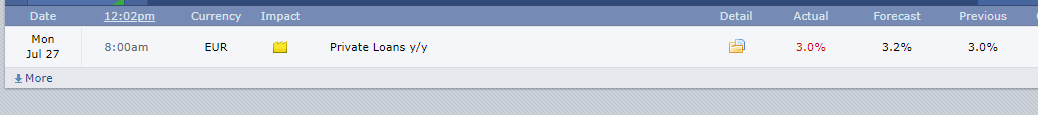

The Eurozone private sector loans data is released monthly by the European Central Bank about 28 days after the month ends. It measures the change in the total value of new loans issued to consumers and businesses in the private sector. The most recent release was on July 27, 2020, 8.00 AM GMT can be accessed here. A more in-depth review of the economic news release can be accessed at the ECB website.

Below is a screenshot of the Forex Factory official website. On the right side, we can see a legend that indicates the level of impact the Fundamental Indicator has on the EUR.

As can be seen, low impact is expected on the EUR.

The screengrab below is of the most recent change in private loans in the EU. In June 2020, private loans grew by 3% as compared to the same period in 2019. This change represented a flat growth from the previous release. Based on our fundamental analysis, this should be positive for the EUR.

Now, let’s see how this positive news release made an impact on the Forex price charts.

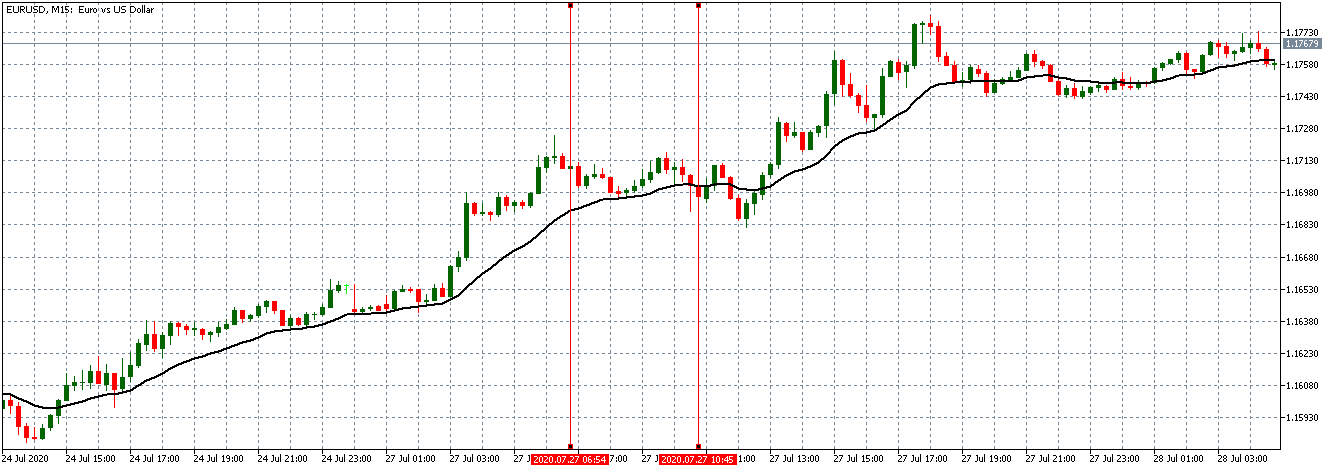

EUR/USD: Before Eurozone Private Sector Loans release on July 27, 2020, Just Before 8.00 AM GMT

From the above chart, the EUR/USD pair is trading on a neutral trend before the data release. The candles are forming around the flattening 20-period Moving Average. This trend is an indication of relative market inactivity.

EUR/USD: After Eurozone Private Sector Loans release on July 27, 2020, 8.00 AM GMT

After the news release, the pair forms a 15-minute bullish candle as EUR becomes stronger as expected. However, the news release was not strong enough to cause a shift in the pair’s trend since the pair continued to trade in the previously observed neutral trend.

Now let’s see how this news release impacted other major currency pairs.

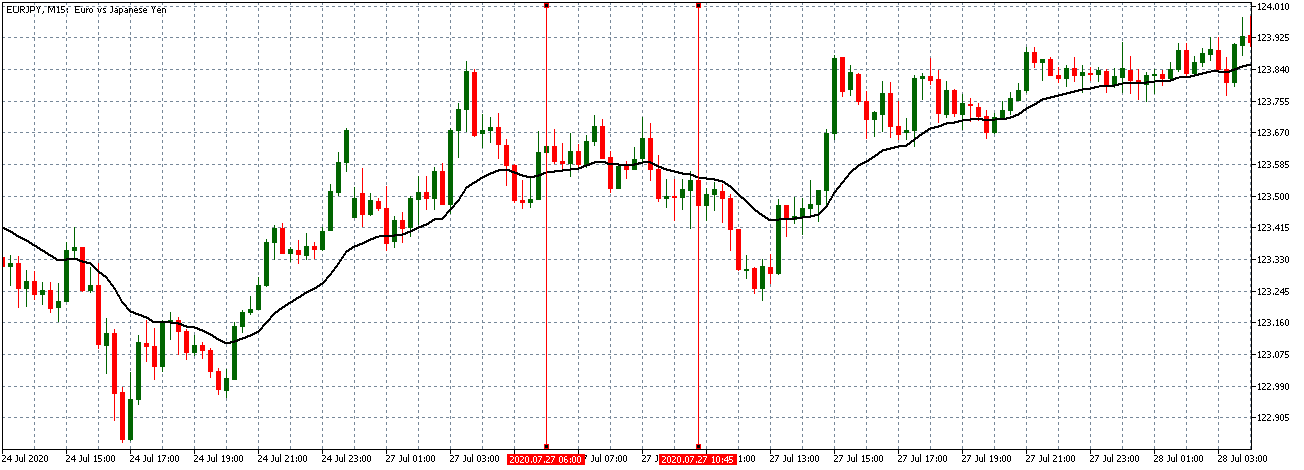

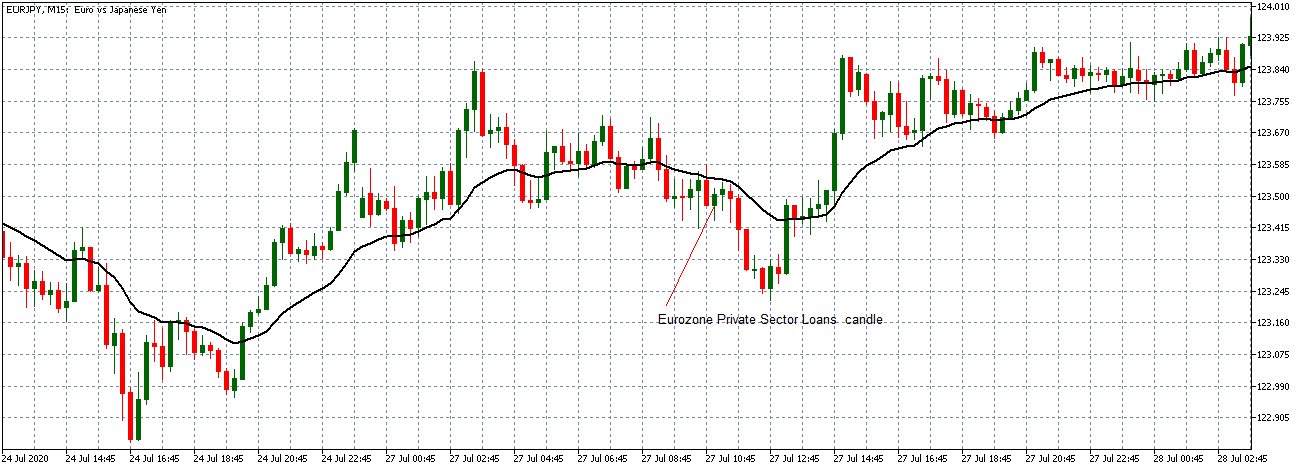

EUR/JPY: Before Eurozone Private Sector Loans release on July 27, 2020, Just Before 8.00 AM GMT

Before the news release, EUR/JPY traded in a similar neutral trend as observed with the EUR/USD with the candles forming around a flattening 20-period Moving Average.

EUR/JPY: After Eurozone Private Sector Loans release on July 27, 2020, 8.00 AM GMT

As observed with the EUR/USD pair, EUR/JPY formed a 15-minute bullish candle after the news release as expected. The subsequent trend does now significantly shift.

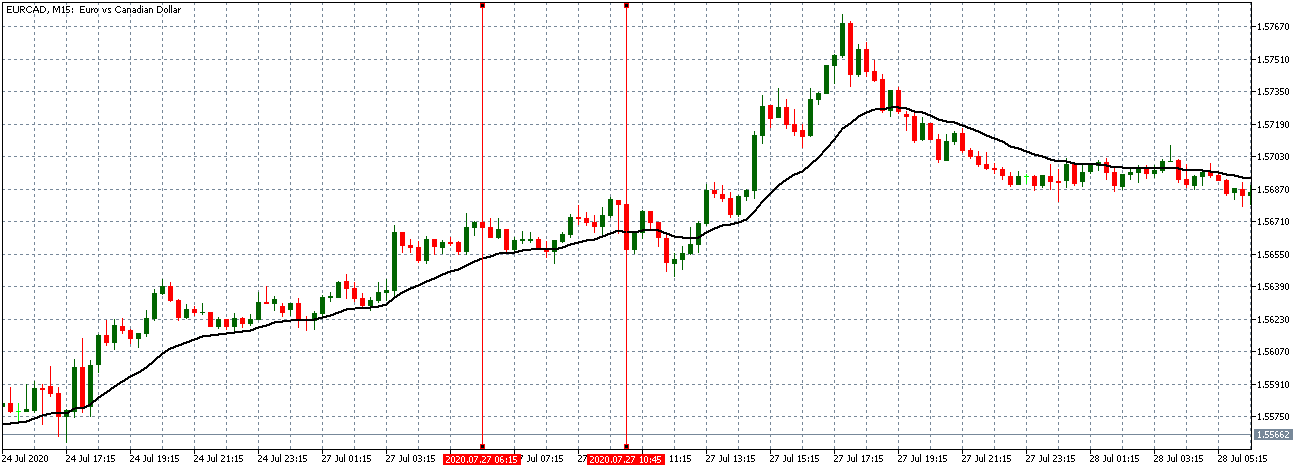

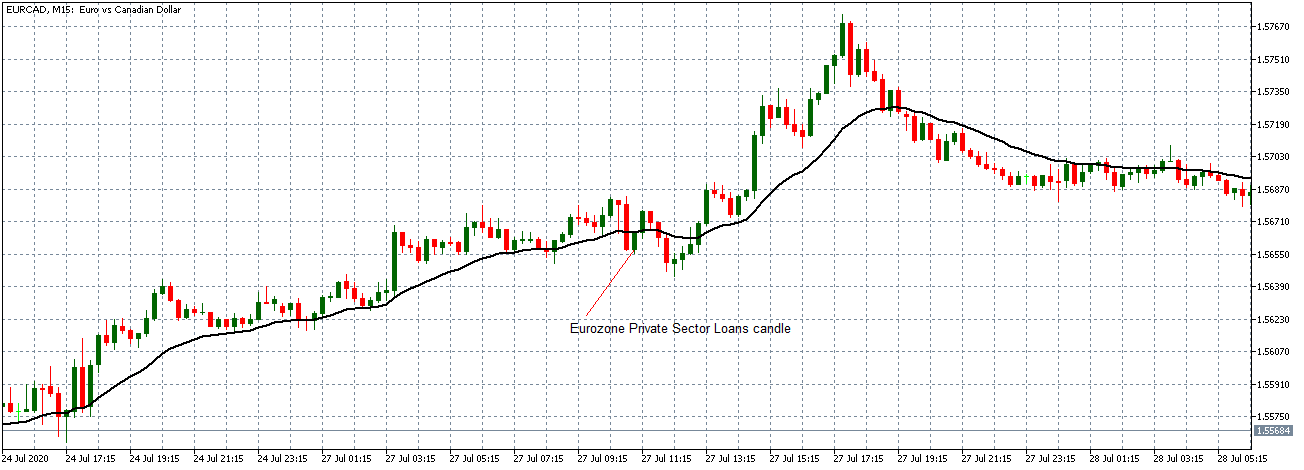

EUR/CAD: Before Eurozone Private Sector Loans release on July 27, 2020, Just Before 8.00 AM GMT

EUR/CAD: After Eurozone Private Sector Loans release on July 27, 2020, 8.00 AM GMT

The EUR/CAD pair shows a similar neutral trading pattern as the EUR/USD and EUR/JPY pair before the news release. After the news release, the pair forms a 15-minute bullish candle but later continued trading in the earlier observed neutral trend as the 20-period Moving Average flattens.

Bottom Line

Loans to the private sector play a vital role in stimulating a country’s economic growth. From the above analyses, the release of the loan growth data has an instant short-term effect on the EUR. The data is, however, not significant enough to cause any relevant shift in the prevailing market trend.