Introduction

CHF/CNY is the abbreviation for the Swiss Franc against the Chinese Yuan. It is categorized as an exotic-cross currency pair with moderate volatility and low trading volume. Here, the Swiss Franc (on the left) is the base currency, and the Chinese Yuan (on the right) is the quote currency. The Chinese Yuan(CNY) is also known as the Renminbi, which is also the official currency of China.

Understanding CHF/CNY

The market price of CHF represents the value of CNY that is compelled to purchase one CHF. It is quoted as 1 CHF per X CNY. If at all the market price of this pair is 7.5423, then this amount of CNY is required to buy one unit of CHF.

Spread

The distinction between the asking price and the offering price is termed as the spread. ECN and STP account models will have different spread values. The estimated spread values of CHF/CNY pair in both the accounts are mentioned below:

ECN: 19 pips | STP: 24 pips

Fees

The fee is the commission that one pays for the trade. There is no commission charged on STP accounts, but a few additional pips are charged on ECN accounts.

Slippage

The variation between the trader’s expected price and the executed price offered by the broker is referred to as slippage. Its cost varies on the volatility of the market and the broker’s implementation speed.

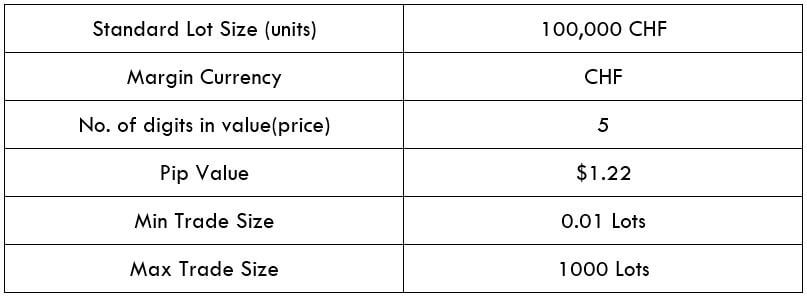

Trading Range in CHF/CNY

The trading range is represented in a tabular form to understand the pip movement of a currency pair in different timeframes. These values help us determine the profit, which will be generated from trade. To obtain the worth, you will need to multiply the below pip value with the volatility value.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

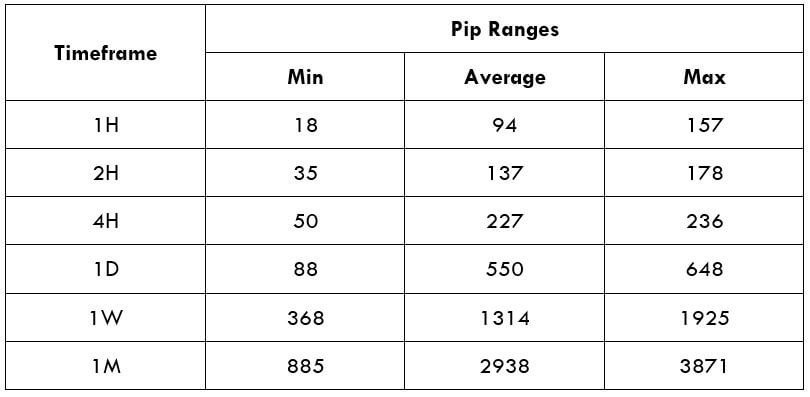

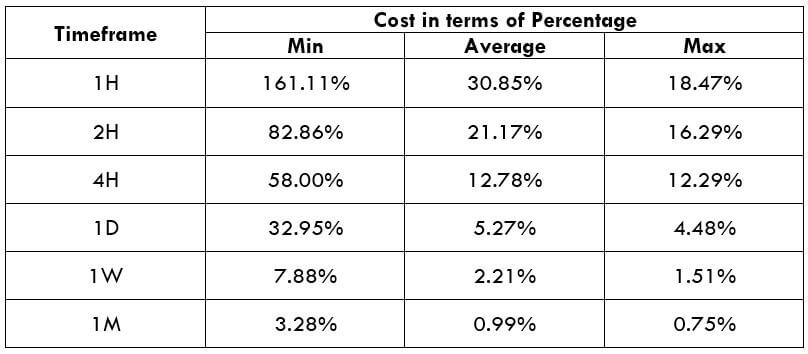

CHF/CNY Cost as a Percent of the Trading Range

We can ascertain the cost variations in trade by implementing the total cost to the below-mentioned table. The values are achieved by identifying the proportion between total cost and volatility value, and they are represented in the form of a percentage.

ECN Model Account

Spread = 19 | Slippage = 5 |Trading fee = 8

Total cost = Slippage + Spread + Trading Fee = 5 + 19 + 8 = 32

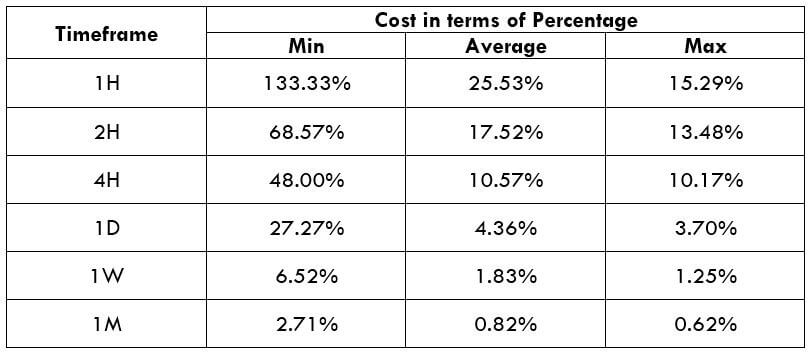

STP Model Account

Spread = 24 | Slippage = 5 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 5 + 24 + 0 = 29

The Ideal way to trade the CHF/CNY

Understanding the above table is very simple. The proportion of the total cost of trade is directly relative to the value. It is seen that the rates are approximately high on the minimum section and the other way around. The perfect time to enter the market might be where CHF/CNY’s volatility is between the average pip movement.

To lower your risk, it is recommended to trade when the volatility is near the minimum levels. In this case, the volatility is low, and the costs are marginally high compared to the average and the max values. But, if your primary worry is on lowering costs, you may trade when the market volatility is close to the maximum values.

Trading in such timeframes will assure low expenses just as smaller liquidity. It will also include fewer costs by placing orders using limit/pending orders instead of market orders. This will substantially reduce the total cost with slippage being zero.

STP Model Account (Using Limit Orders)

Spread = 24 | Slippage = 0 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 0 + 24 + 0 = 24

I hope this article will aid you to trade this pair in a much efficient way. Cheers!