Introduction

CHF/BGN is the abbreviation for the Swiss Franc and the Bulgarian Lev exotic pair. Here, CHF is the base currency, while BGN is the quote currency. The pair as a whole explains the number of units of the quote currency (BGN) that is required to buy a single unit of the base currency (CHF). BGN stands for The Bulgarian Lev, and it is the official currency of Bulgaria.

Understanding CHF/BGN

In the Forex market, we always purchase the base currency while selling the quote currency and vice versa. Here, the market value of CHF/BGN helps us to comprehend the potential of BGN against the CHF. So if the exchange rate of the pair CHF/BGN is 1.8384, it means to buy1 CHF we need 1.8391 BGN.

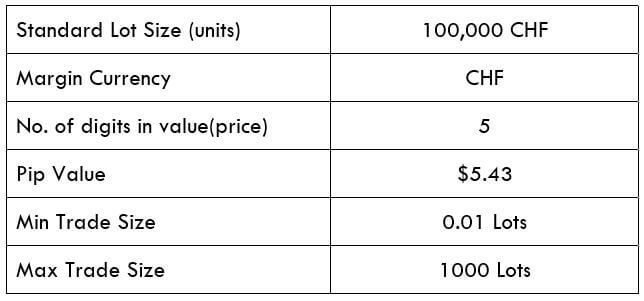

CHF/BGN Specification

Spread

Spread in exchange is the distinction between the bid-ask price proposed by the broker. It is quantified in terms of pips and fluctuates on the type of account and kind of broker. Below is the spread for the CHF/BGN pair in both ECN & STP accounts.

Spread on ECN: 7 | STP: 12

Fees

Fees are the commission charged by the broker for each trade a trader takes. The fee varies on both types of accounts and brokers. For our analysis, we have maintained the fee flat at five pips.

Slippage

A trader will not get the price that he demands, due to the volatility in the market. The original price varies from the asked price. The difference is termed as slippage. For instance, if a trader performs a trade at 1.8384, the actual price received would be 1.8391. The difference between the two pips is called slippage.

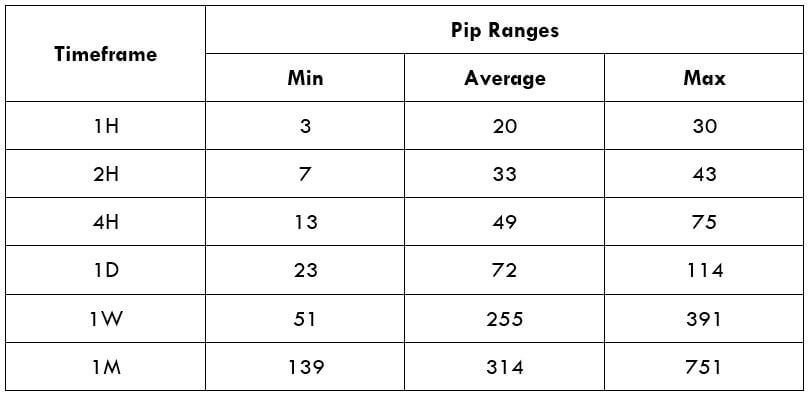

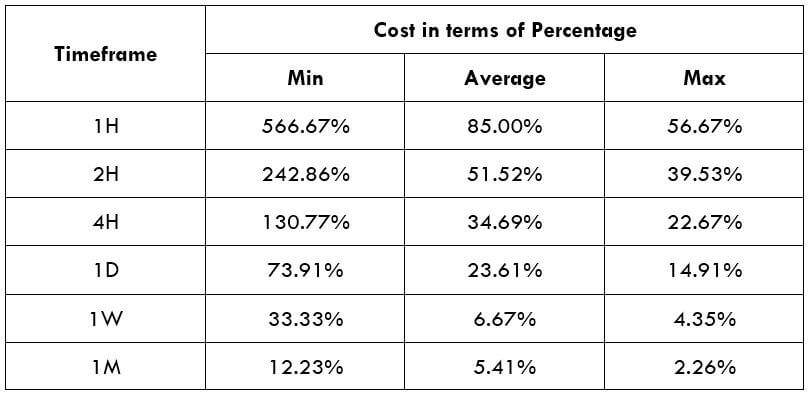

Trading Range in CHF/BGN

The trading range is a tabular interpretation of the min, average, and maximum pip movement in a specific timeframe. Obtaining understanding about this is essential because it helps manage risk and determine the appropriate times of the day to enter-exit a trade with minor costs.

Below is a table representing the minimum, average, and maximum pip movement (volatility) in various timeframes.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

CHFBGN Cost as a Percent of the Trading Range

The above table illustrates the number of pips the currency pair move in the various timeframe. We will apply these values to identify the cost ratio when the volatility is minimum, average, and maximum. The cost percentage will then help us sort the ideal time of the day to enter the trades.

The understanding of the cost percentage is straightforward. If the percentage is elevated, then the cost is high in that specific timeframe and range. If the percentage is low, then the cost is comparatively low for that timeframe and range. The total cost on every trade is calculated by adding up the spread, slippage, and trading fee.

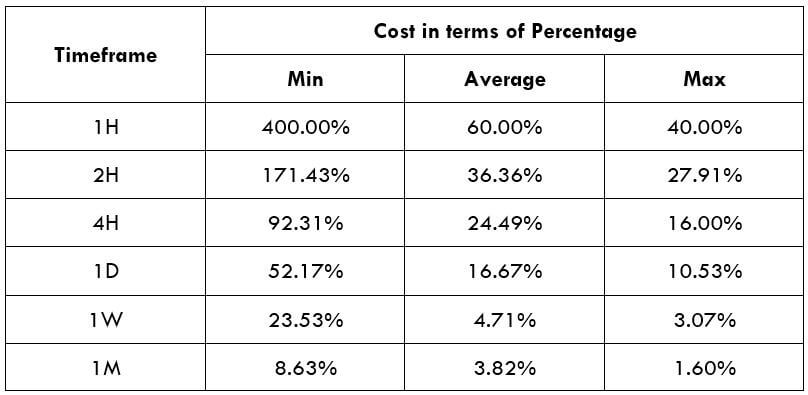

ECN Model Account

Spread = 7 | Slippage = 5 | Trading fee = 8

Total cost = Slippage + Spread + Trading Fee = 5 + 7 + 8 = 20

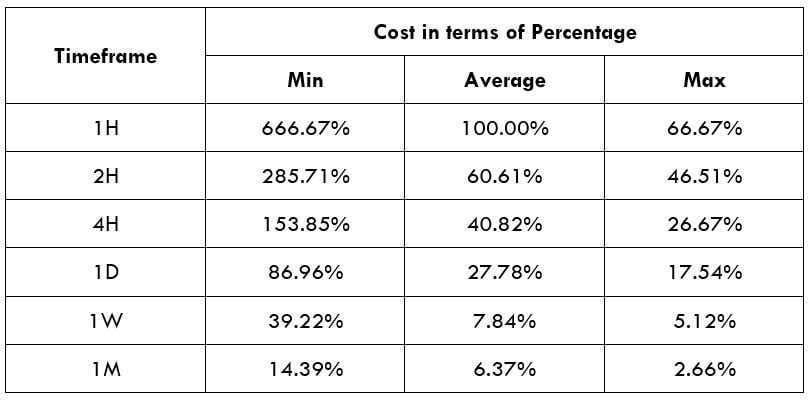

STP Model Account

Spread = 12 | Slippage = 5 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 5 + 12 + 0 = 17

The Ideal way to trade the CHF/BGN

It is not recommended to enter and exit the trade at any time of the day. To manage their trade, a trader must consider various timeframes during the day to reduce both risk and cost of the trade. This is made possible by understanding the above two tables.

In the minimum column, the percentages are generally high. This means the cost is very high when the volatility of the market is low. For example, on the 1H timeframe, when the volatility is three pips, the cost percentage is 666%. This means that one must accept high costs if they enter or exit trades when the volatility is around three pips. Preferably, it is advised to trade when the market’s volatility is above the average.

Additionally, it is considerably better if one trades placing the limit orders instead of market orders, as it invalidates the slippage on the trade. In doing so, the costs of each trade will reduce by approximately 40%.

STP Model Account (Using Limit Orders)

Spread = 12 | Slippage = 0 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 0 + 12 + 0 = 12