Forex price action breakout trading strategies mainly rely on the breakout. Breakout candle’s attributes mean a lot, whether we shall take entry or not. If a breakout takes place with a strong bullish/bearish candle followed by another strong bullish/bearish candle, it is considered a good entry. On the other hand, if a breakout takes place right from the support/resistance level, it is not considered a good entry. In today’s lesson, we are going to demonstrate an example of a breakout from the breakout level. Let us find out what happens in the end.

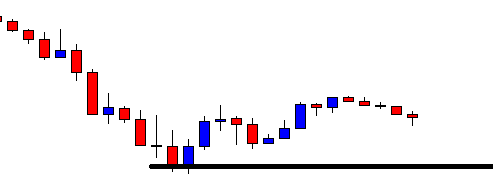

The price after being bearish finds its support. It has been making a bullish correction. The sellers should wait for the price to produce a bearish reversal candle and a breakout with a good-looking bearish candle.

The price heads towards the level of resistance. If the last candle makes a breakout closing well below the level of resistance, it would be a perfect breakout by a good-looking bearish candle. It rather closes adjacent to the level, which may not produce a strong bearish candle to make the breakout.

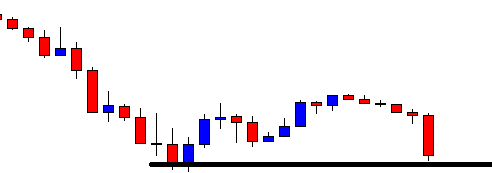

It produces more candles but does not make the breakout. The price is roaming around the breakout level, which is not a good thing for the sellers. Usually, if a candle closes below the breakout level right from the level, it consolidates. Traders are to wait more and get less reward.

The next candle closes below the breakout level. It is a breakout but not the breakout that the breakout traders would love to get. Let us proceed to the next chart to find out what happens next.

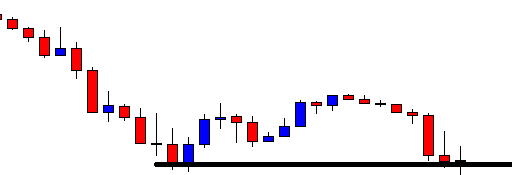

The next candle closes well below the breakout candle. It confirms the breakout. A question may be raised here whether the sellers take the entry or not. Since the breakout is rather a fragile breakout, it is best to skip such entry. The price often comes back to the breakout level and takes time to finds its next direction. Yes, sometimes it continues to go towards the breakout direction too. Let us proceed to the next chart and find out what happens here.

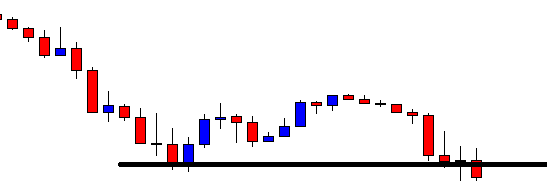

The price here heads towards the South with extreme bearish pressure. The last candle suggests that the trend is strong, and it may continue. According to our today’s lesson, we shall skip taking such entry. It means we have wasted an opportunity. Do you really believe so?

Do not think it is an opportunity missed. A losing trade hurts a lot. We do not only lose money, but we also lose our faith. Forex trading is a psychological game. To be consistent, we must have strong faith in our trading strategy. To have that, we must maintain winning consistency.