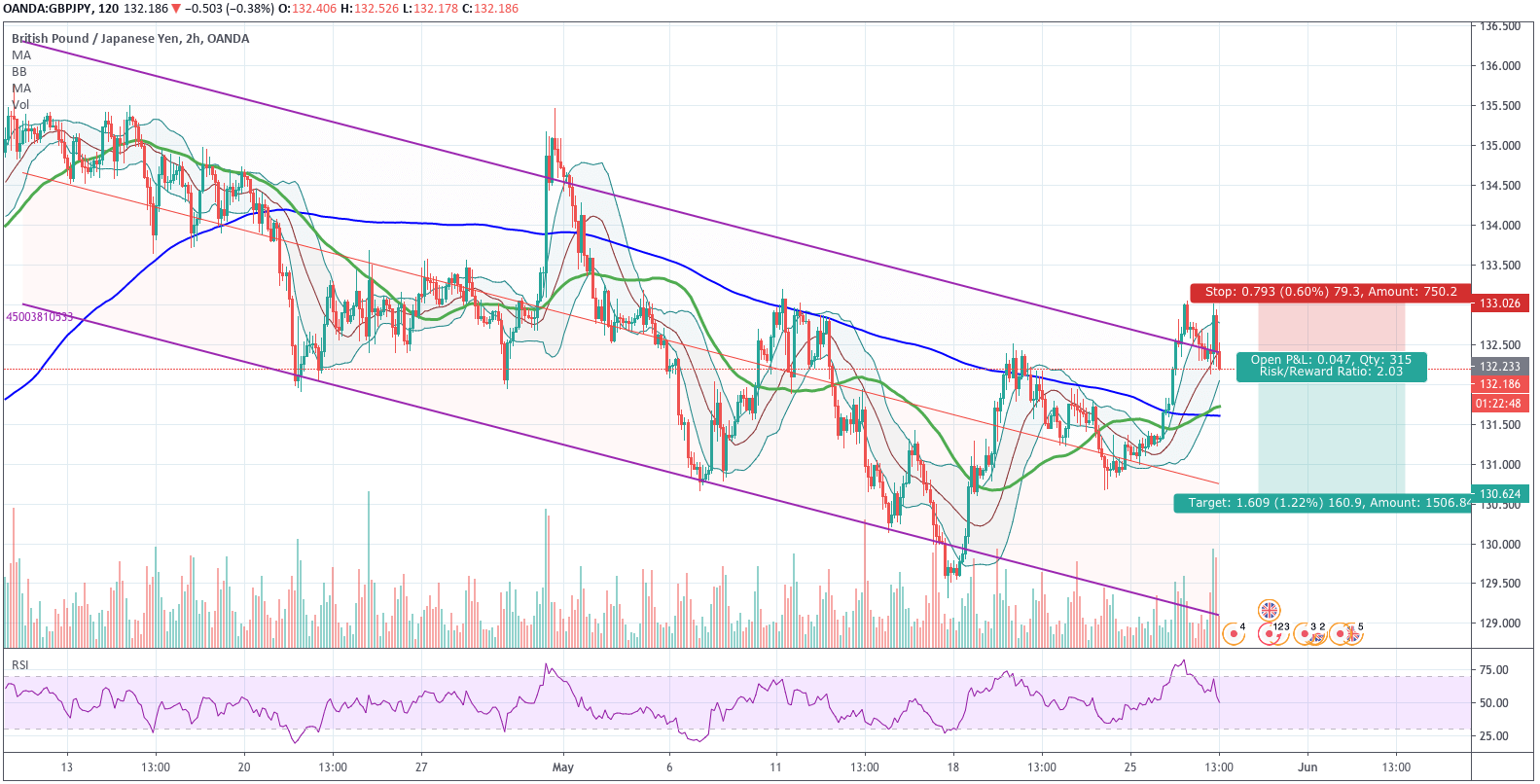

GBPJPY has been moving in a descending channel since April 10. The action created a lot of volatility, driving prices back and forth from top to bottom of the channel. The last iteration drove its price to surpass the upper limit, a +2 sigma event, which means the pair was overpriced if we compare it with what we may call the fair price, which is the linear regression channel, the red mid-line.

After the double top, a large bearish engulfing candle was drawn, confirming the reversal signal; thus, we can set up a short trade with entry at the current level, an invalidation point beyond the last top and a target at the projected linear regression point. The Reward/risk ratio of 2 is a conservative value that will ensure our long-term profitability.

Key levels:

Short-Entry:132.175

Take.profit:130.575

Stop-Loss: 132.965

Reward Ratio: 2.03

Risk:735 USD per lot, 73.5 USD per mini-lot.

Reward: 1,491USD per lot, 149 USD per mini-lot.

Position sizing: 2% Risk equals 3 micro-lots for every $1,000 balance in the trading account.