The Danger Of Chart Hopping

One of the biggest areas where new traders fall down is chart hopping.

They flip flop from one chart to another looking for the opportunity which will give them a chance to bag a couple of hundred pips

They flip flop from one chart to another looking for the opportunity which will give them a chance to bag a couple of hundred pips

without fully appreciating all of the dynamics involved in technical analysis.

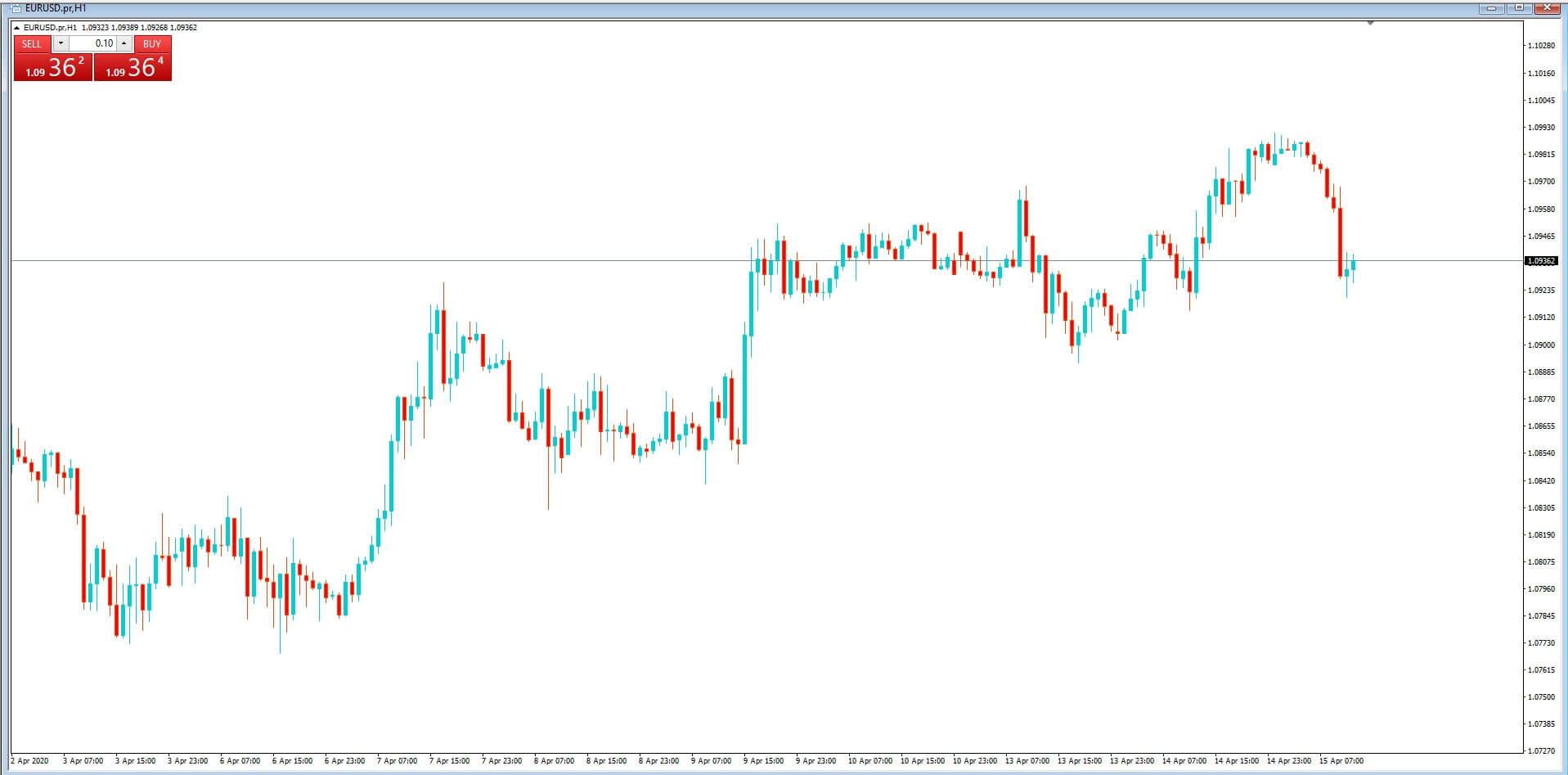

They think they spot a trend and jump right in and execute a trade, thinking only of the money they could make. They often make the mistake of buying at the top of the market or selling at the bottom. Think they may have spotted a trend, and perhaps they have, or it might be that some news has just come out, and they make a split second impulsive decision to buy or sell a currency pair simply based on what they’ve seen or heard.

They think they spot a trend and jump right in and execute a trade, thinking only of the money they could make. They often make the mistake of buying at the top of the market or selling at the bottom. Think they may have spotted a trend, and perhaps they have, or it might be that some news has just come out, and they make a split second impulsive decision to buy or sell a currency pair simply based on what they’ve seen or heard.

And although they may indeed have spotted a nice trend, it could be that that trend is about to stop dead in its tracks and about to turn.

Such traders will not even bother to implement the most basic of technical analysis. It’s trading on a wing and a prayer and is tantamount to gambling.

No matter how much you think or believe that a currency pair may or may be trending, in any given direction, do not execute a trade until you have backed up your theory with tried and tested technical analysis methodology.

So when are trends likely to end? Why do trends finish reverse or go into periods of consolidation? Typically trends will start to fade and finish at the end of trading sessions, such at the end of the Asian, European or US sessions, where those traders had been buying or selling a pair based on their trading needs or beliefs pertaining to market conditions or possibly due to their balance sheet requirements or even because they are influenced due to their own country’s import and export requirements. They may have just seen a good trend and jumped on it, but when their session came to the end, they closed out their interest and took their profits.

So when are trends likely to end? Why do trends finish reverse or go into periods of consolidation? Typically trends will start to fade and finish at the end of trading sessions, such at the end of the Asian, European or US sessions, where those traders had been buying or selling a pair based on their trading needs or beliefs pertaining to market conditions or possibly due to their balance sheet requirements or even because they are influenced due to their own country’s import and export requirements. They may have just seen a good trend and jumped on it, but when their session came to the end, they closed out their interest and took their profits.

Or it might be that they are rebalancing their portfolios by getting in and out of positions to cover market volatility in Risk on and Risk off scenarios. And where the sentiments of one session, which is ending may be completely different to the sentiment of those traders coming into a new session in a new country where they have their own various sets of requirements and beliefs about where currencies should be in relation to one another.

Of course, it could just be that trends fade for no apparent reason. It might come at the end of a 15- minute candlestick or an hourly or daily candle, which is enough to tip the balance and reverse a trend. Or it might be that a currency pair is deemed to be overbought or oversold due to technical analysis. Impending economic data releases is also another time when trains can stop for no apparent reason, or around the times when key policymakers are due to make policy statements or speeches.

One critical mistake is where traders will hop on a trend, which is absolutely great if they have done their homework and all the above mitigating circumstances are taken into consideration, but may not have factored in that perhaps a currency pair has already moved a couple of hundred pips in which case it is

quite dangerous to jump on and expect that trend to continue without some kind of pullback.

So our advice is: do not make impulsive trades based on hopping from one chart to the next. Always do your technical analysis research and make sure your timing is correct and that you have considered all of the above before you execute each trade.