This broker is available across the globe and has offices that cater to local traders in different locations. FIBO Group’s different account types all require minimal deposits, which means that traders can easily choose the one that best fits their strategy and needs. In this article, we will highlight important aspects of this broker, including the available assets, transfer costs, platform features, and other information that you should know before you open an account with them.

Account Types

FIBO Group offers five different types of accounts. Traders also have the option of opening an Islamic account.

MT4 Cent:

MT4 Cent:

Minimum Deposit: $0

Spreads: From 0.6 pips

Commission: $0

MT4 Fixed:

Minimum Deposit: $50

Spreads: From 2 pips

Commission: $0

MT4 NDD:

Minimum Deposit: $50

Spreads: From 0 pips

Commission: 0.003% of the transaction amount

MT4 NDD (No Commission):

Minimum Deposit: $50

Spreads: From 0.8 pips

Commission: $0

cTrader NDD:

Minimum Deposit: $50

Spreads: From 0 pips

Commission: 0.003% of the transaction amount

MT5 NDD:

Minimum Deposit: $1,000

Spreads: From 0 pips

Commission: 0.005% of the transaction amount

What makes this broker unique is that each account type is related to the trading platform used. More specifically, you can choose between MetaTrader 4 (MT4), cTrader, and MetaTrader 5 (MT5). The main difference between the 2 MT4 DD accounts is that one offers no commissions, but has a spread that starts at 0.8 pips. The other one has a commission of 0.003% the transaction amount, but no spread. In addition, each of the 6 account types is different in terms of the default currency options, available assets, and trades sizes. All of which will be outlined in more detail in this article. The Islamic Account has the exact same features as the others. However, it doesn’t have the rollover bonuses while swap fees for overnight positions are only charged on Wednesdays and Thursdays.

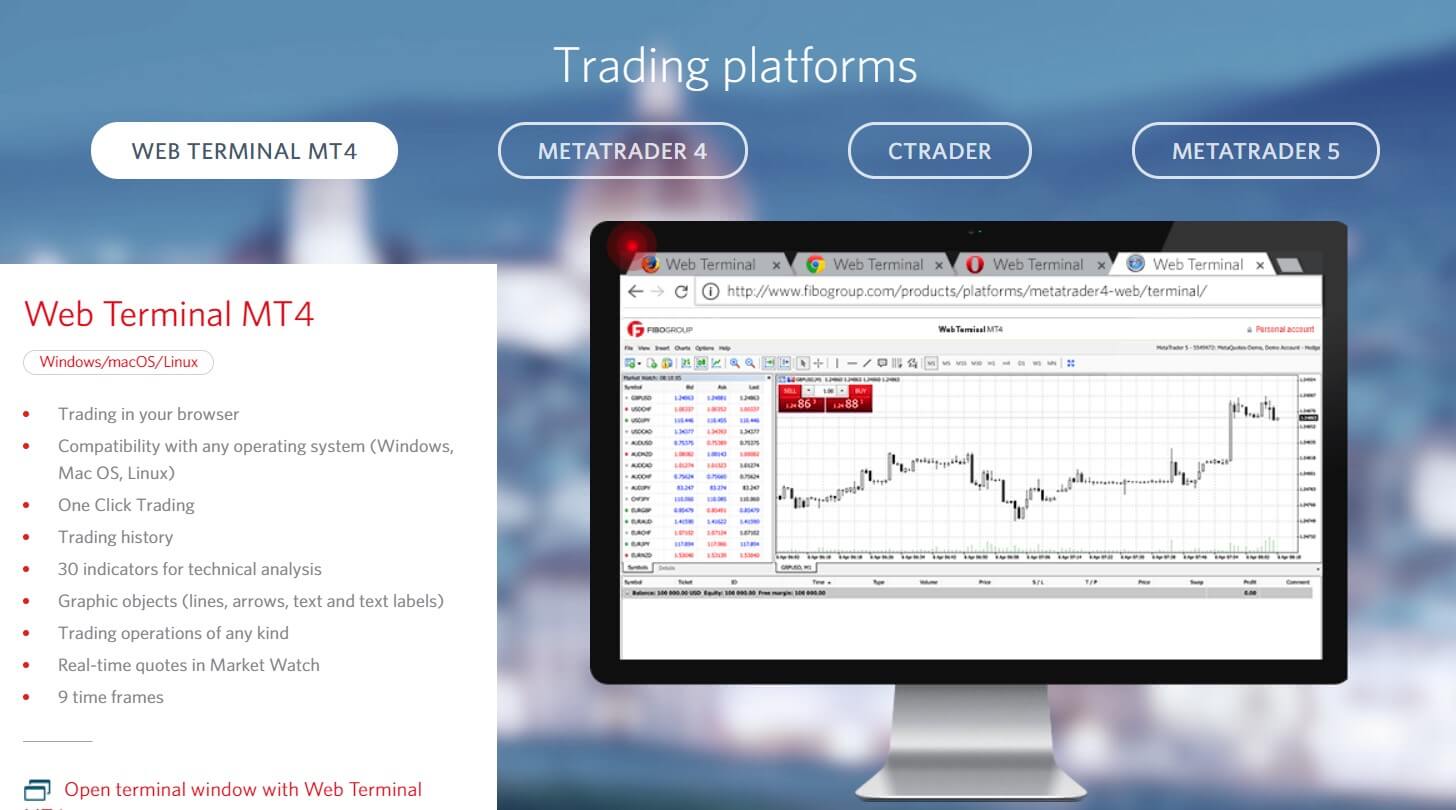

Platforms

You can trade through the MetaTrader 4 (MT4), the modified MetaTrader 5 (MT5) platform, and cTrader. Each of these platforms has its own distinct features and you should pick the one that is most in line with your trading strategy. MT4 gives you access to over 50 different technical indicators and allows you to code your own trading signal.

MT5 is more advanced than MT4 because it gives you access to more order types and lets you manage several account features from one screen. Both platforms can be installed on Macs, Windows, iOS, and Android devices. You can download them directly from FIBO’s website. Keep in mind, though, that if you want to download MT4 on your Mac, you might have to do so directly from the platform’s website because it requires specific software. Only the windows version of MT5 can be downloaded through the broker’s website.

In addition to those 2 platforms, FIBO Group gives you access to cTrader. Just as with MT4 and MT5, you are able to use a wide variety of technical indicators, code your own trade signals, and execute orders at a very high speed through cTrader. The platform is also available in 14 languages.

Leverage

FIBO Group offers incredibly high leverage that is amongst the best in the market. MT4 Cent account holders have up to 1:1000 in leverage, which is almost unheard of in the industry. MT4 Fixed Accounts only have 1:200, but the other 4 give you up to 1:400 in leverage, which is still higher than what other brokers have to offer.

Trade Sizes

Lot and trade sizes are dependent on the type of account you choose. The minimum lot size is the same across the board at 0.01. Only MT4 Cent has a maximum volume requirement; traders can’t have more than 50 open positions at the same time and each trade has to be 100 lots or less. All accounts, however, have restrictions on volume per trade, which varies from one currency pair to another.

Stop-Out: 20% (MT4 Cent, MT4 Fixed, and cTrader NDD) and 50% (Both MT4 NDD accounts and MT5 NDD).

When the stop-out level is reached, FIBO Group will give you 30 minutes before the markets close to exit some/all of your positions or deposit additional funds. Otherwise, the broker will close all or some of your positions to bring it to that level. It is important to note that, during weekends, FIBO Group might increase the margin call and stop-out as well as minimize the maximum leverage. The changes will depend on the market’s volatility and how risky your trades are.

Trading Costs

FIBO Group will charge you either a commission or the spread fee. MT4 Cent, MT4 Fixed, and MT4 NDD have a spread of 0.6 pips, 2 pips, and 0.8 pips, respectively. Meanwhile, the other 3 account types (MT4 NDD, cTrader NDD, and MT5 NDD) have 0 spreads. The commissions are charged based on the trade or transaction size. For example, buying 1 standard lot of the USD.CAD (which equals $100,000) will come with a 0.003%/$3 USD commission (MT4 NDD and cTrader NDD) or a 0.005%/$5 commission (MT5 NDD). Overnight positions also mean that you have to pay the swap fees, which depend on interest and market developments that pertain to the currency pair that you are trading. Islamic Accounts, for religious reasons, do not incur spread fees. The only exceptions are positions that are open overnight on Wednesdays and Thursdays.

Assets

Assets

You can trade over 60 ForEx pairs through FIBO Group, alongside various CFDs, spot metals, and cryptocurrencies. However, access to these assets depends on the account type you choose. Only MT4 Fixed allows you to buy or sell 60 currency pairs. MT4 Cent and MT4 NDD (with commission) provide you with 38 and 32 currencies, respectively. MT4 NDD (no commission), cTrader NDD, and MT5 NDD give you access to 45, 41, and 42 currency pairs, respectively. Just as importantly, only MT4 Fixed and MT4 NDD (with commission) let you trade CFDs. The available default currency options also vary.

- MT4 Cent: USD cent and GLD (SPDR Gold ETF) cent

- MT4 Fixed: USD, GBP, EUR, CHF, and RUR (Old Russian ruble)

- MT4 NDD: USD, EUR, and GLD

- MT4 NDD (No Commission): USD, EUR, GLD, BTC (Bitcoin), and ETH (Etherium)

- cTrader NDD: USD and EUR

- MT5 NDD: USD only

Spreads

Accounts that don’t pay commissions will have to incur spread fees. While FIBO Group’s spreads are relatively low, they can vary from one currency pair to another. In addition, two different account types may have a different spread on the same currency pairs. Generally speaking, MT4 Cent has the lowest minimum spreads at 0.6 pips. MT4 Fixed has the highest, ranging from 2 pips upwards, which is way above what other brokers offer.

Minimum Deposit

FIBO Group’s deposit structure is very flexible, especially because all accounts can be easily accessed. The largest minimum deposit is $1,000 (MT5 NDD), which is much lower than what other brokers require, especially those that have different account types. Most of the time, the industry requires 10s, if not 100s, of thousands to open an account with desirable or competitive features, All accounts on FIBO Group have a minimum deposit of $50 or the equivalent in the base currency you choose. Opening an MT4 Cent account, however, doesn’t have a minimum and you can start trading with a deposit that is just enough to buy the smallest available lot size (0.01).

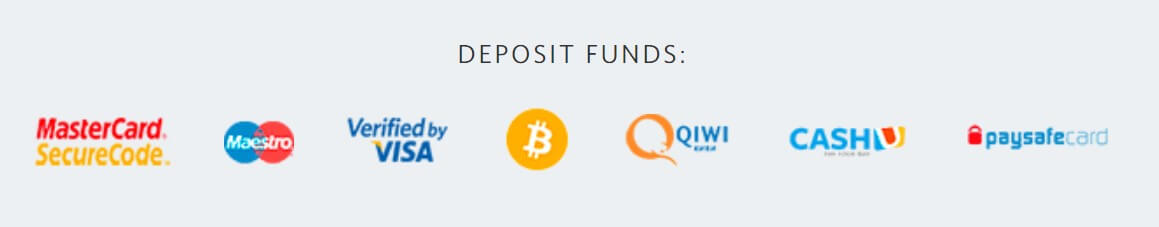

Deposit Methods & Costs

GIBO Group doesn’t charge fees for deposits via bank transfers and debit/credit cards, but they do so when it comes to certain methods.

- Bank Wire Transfers: 2 to 5 days; Only bank fees apply ($35 to $50); USD & EUR deposits

- Credit/Debit Card and Connectum: Instant processing; No fees; Maximum 3,000 EUR per transaction or 10,000 EUR within 24 hours; USD & EUR deposits

- RegularPay: Instantly processed during business hours; No fees; Not available in several countries (including the US and Canada); USD & EUR deposits

- Paysafe Card: Instant processing; No fees; Only available in Saudi Arabia, Kuwait, and the UAE; Only USD deposits

- Bitpay: Instant processing; No fees; No minimums or country limitations; Only Bitcoin and Bitcoin Cash deposits

- Blockchain: Processed during business hours after confirmation by Bitcoin chain; Blockchain main charge fees; Only Bitcoin deposits

- Neteller: Instant if the Neteller account has the same email as the FIBO Group one (if not, it is only processed during business hours); No fees; Minimum deposit of $1.29 only; USD and EUR deposits

- WebMoney: Instantly processed; No fees; Maximum deposit of $100,000 per transaction; USD and EUR deposits

- Skrill: Instant if the Skrill account has the same email as the FIBO Group one (if not, it is only processed during business hours); 3.9% fee; Minimum deposit of $1.00 plus the transfer fees; Only USD deposits

- CashU: Instant processing; 7% fee; Only USD deposits

- Fasapay: Instant during business hours or, otherwise, processed on the next day; 0.5% fees ($0.01 minimum and $5 maximum per transaction); Minimum transfer size of $0.10 and maximum of $1,000,000 per transaction; Only USD and IDR (Indonesian rupiah) deposits

- EcoPayz: Instant processing; No fees; $2,500 deposits per transaction if the account is not verified; Only available in the Gulf Cooperation Council (GCC) countries; Only USD deposits

- Perfect Money: Instant processing; Perfect Money might charge transfer fees; Only available in Afghanistan, India, and Pakistan; Only USD deposits

Withdrawal Methods & Costs

You can withdraw funds by using most of the deposit methods. However, the fees charged by FIBO Group vary.

- Bank Wire Transfers: Bank fees may apply (between $35 and $50); Minimum of $80 per transaction; USD, GBP, EUR, and CHF withdrawals

- Credit/Debit Card and Connectum: Fees of 2.5% the withdrawn amount plus 1.5 Euros per transaction; Maximum of $3,000 during a 24 hour period and $10,000 per month; USD and EUR withdrawals

- RegularPay: $10 fee per transaction; No minimums or maximums; USD and EUR withdrawals

- Neteller: 2% fee per transaction (minimum of $1.29 and maximum of $30); Minimum of $10 withdrawn per transaction (plus fees); USD and EUR withdrawals

- WebMoney: 0.8% fee per transaction (maximum of $50 USD or 50 EUR); Minimum of $5 or 5 EUR withdrawn and maximum of $10,000; USD and EUR withdrawals

- Skrill: 1% fee per transaction; Minimum of $1.00 withdrawn (plus the 1% fee); Only USD withdrawals

QIWI: 1% fee per transaction; Minimum of 5 RUR and maximum of 15,000 RUR or $200; Only USD and RUR withdrawals - Bitcoin: 0.001 BTC fee per transaction (plus Bitcoin fees); Minimum of 0.01 BTC per transaction; Only BTC withdrawals

- Perfect Money: 0.5% fee per transaction; No minimums or maximums; Only USD withdrawals Keep in mind that, for each withdrawal method, the same country-specific and geographical restrictions apply. For example, only traders in Afghanistan, India, and Pakistan can deposit or withdraw funds via Perfect Money.

Withdrawal Processing & Wait Time

- Bank Wire Transfers: Within 3 days

- Credit/Debit Card and Connectum: Instant transfers, but, at times, it can take up to 3 days (especially if the transaction was made after business hours)

- RegularPay: 10 business days

- Neteller: On the same day if the transaction is made during business hours. Otherwise, it will be processed on the next business day.

- WebMoney: 1 day

- Skrill: On the same day if the transaction is made during business hours. Otherwise, it will be processed on the next business day.

- QIWI: Instantly processed

- Bitcoin: Takes several hours to process

- Perfect Money: Takes only a few minutes for funds to transfer

Bonuses & Promotions

FIBO Group doesn’t offer any bonuses or promotions. However, their website has a ‘Promotions’ page with a form that you fill out to signup to their email newsletter. If you are interested in the promotions, you can subscribe and get email updates on when the next bonus or promotional program becomes available.

Educational & Trading Tools

Educational & Trading Tools

There are analytical tools that benefit both short and long-term traders alike. Their analytics articles include content about different currency pairs and events that can impact the market. At the moment, their ‘Long Term Forecasts’ section doesn’t have any posts. However, their ‘Interest Rates’ page is very useful. It has a list of the current rates that the central banks of 15 different countries have set, alongside the date of their last meeting and upcoming policy decisions. You can also access a live economic calendar and customize it based on country, degree of importance, and your desired timeframe.

Customer Service

FIBO Group’s website is available in 14 different languages, including English, Dutch, Italian, Spanish, Arabic, and others. Their global offices cater to traders in local areas across the world, with a unique phone number and email for each. The Austrian phone number and email is the unified contact information for clients in all locations (apart from those where FIBO Group has an office). They can be reached 24 hours a day during weekdays. The other offices are open during the business hours of the location that they serve.

Phone: +43 720 02 23 55

Email: [email protected]

Demo Account

You can open a demo account with MT4 or cTrader, depending on your preference. Each of the 2 platforms allows you to create a demo that enjoys the same features and accessibility to financial instruments that the live ones do.

Countries Accepted

FIBO Group is regulated and licensed in Cyprus and the British Virgin Islands. The broker has offices in Austria, Kazakhstan, Germany, Ukraine, and China. The broker is in compliance with financial market regulations across the world. However, it is not available in the US, UK, Australia, Belgium, Austria (even though they have an office in the capital, Vienna), Iraq, and North Korea.

Conclusion

Unless you live in one of the countries where this broker is unavailable, FIBO Group provides plenty of competitive and resourceful tools. The low deposit requirements and wide range of available platforms give traders a lot of flexibility, while deposit methods make FIBO Group ideal for fiat and crypto enthusiasts alike. In fact, apart from a few restrictions, we find this broker to be one of the best options on the market. As this article has shown, you can enjoy minimal trading costs, access to many resourceful educational materials, and a customer service team that is very easy to reach.