— IMPORTANT NOTICE —

We’ve just received word that Cardiff will now be operating under the brand name Trade360 Australia. Existing clients are being asked to transfer their accounts over to the new brand. Prospective clients are being asked to not register with Cardiff at this time, but instead, register directly with Trade360. We advise contacting the new brand with any questions related to accounts, the trading platform, and conditions.

This ECN broker from Australia is ASIC regulated, well structured, situated in the center of Sydney besides KPMG, PwC, and other financial greats, but not popular. Cardiff’s beginning dates to 2013 since the first ASIC license application. This broker is related to the forexcfds.com that, at first glance does not look like a great brand under Cardiff. Still, from the official Cardiff Global Markets site, traders could see some great trading conditions and we are unsure as to what exactly this broker is missing, except probably better marketing.

The website uses a lot of flashy, redundant wording that in the expanding world of brokerages makes readers unimpressed by the repetition. Real investors like to see figures, comparisons, features details, unique useful tools, and services. Cardiff has none of that which blends them into the averages. Going through their services we will evaluate what benefits you can expect.

Account Types

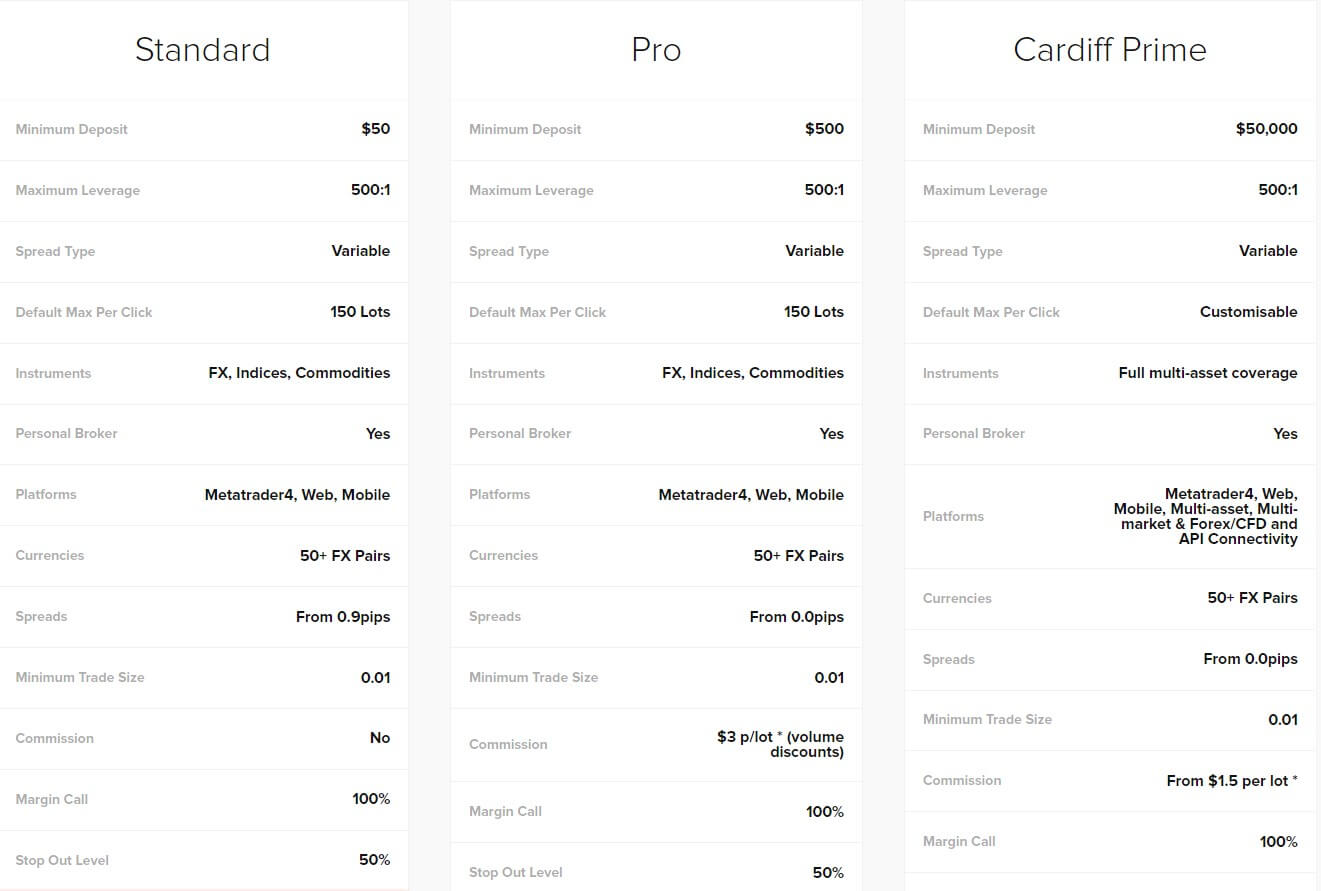

We went into the documents about the product disclosure statements we have encountered two account types. From the Cardiff web site, a total of 3 are offered so we assume that its very new. The information table reveals enough information for each and it is easy to compare the difference. The most affordable type is the Standard, starting from a $50 minimum deposit. The first apparent limit is the trading assets scope. With Standard, you can trade Forex, indices, and commodities only. The platform used for trading is Metatrader 4 in all versions.

Spreads will start from 0.9 pip with this account and at first glance in comparison to the other two account types, this is a major drawback. On the other side, Standard is the only account that does not involve commission at all, making it attractive for traders that stay with the most liquid assets. The margin call is at a 100% level and Stop Out at 50% for all account types.

The next tier is the Pro Account, with the same limiting assets scope. The main difference from the Standard type is lower spreads that start from 0.0 pips. This is usually just a marketing figure, in practice, it is at least 0.1 pip. To offset the spreads, commissions are charged $3 per lot with some discounts possible depending on volume.

The final account type is the Cardiff Prime available from a $50.000 deposit. As this broker expects to deal with high ticket clients, the maximum trading size is customizable and could be larger than 150 lots. An additional advantage, or better to say access, is a better range of assets to trade. As to what exactly is available here is not disclosed. More for this account type is the API connectivity feature and the commission reduction to $1.5 per lot traded. The same 0.0 pip spread is advertised for this account type too. Additional information we found about the execution method related to the account types states that the Standard and the Pro have the STP, No Dealing Desk method and Cardiff Prime is pure ECN.

A warning note to traders, the trading conditions from the web site, client portal and in the legal documents are not the same. More information about this issue in the platforms section.

Platforms

Cardiff Global Markets offer only one platform and that is the Metatrader 4. It is available for Android, iOS, Windows, and Mac. Unfortunately, for those that want a quick glance what Cardiff has to offer, the web MT4 is not available from the web site itself, only through the client portal. A client portal is well designed, with a clear information arrangement and categories. From the dashboard, you will have a wallet where all the transactions come from.

As you will be able to open multiple accounts, funds can be transferred between them. Also, there is a market news feed that works well with the latest information from the DailyFX. Trading Accounts overview gives good management feed over all the accounts a trader has. Here transaction history can be shown based on the account, time frame and open/close time. If traders want to change the leverage or password for the MT4 platform, it can be done from here. The support ticket is opened from Cardiff’s client portal as well as some additional tools that will be reviewed in the education and tools section.

The MT4 platform is at its default settings, version 4 build 1220 (latest at the time of review). Ping to the server is average at 121 ms. Execution times were great and always below 200ms mark, on average 180ms, testifying a real ECN environment. By default after installation, one-click trading is disabled, unlike some other brokers. The trading asset specification widow will show all the usual information a trader may need. The leverage is set during the account creation.

The account opening process through the client portal presented us with completely different trading conditions we have encountered on the Cardiff web site. Account comparison table showed different spreads, maximum leverage levels, commission, minimum trading sizes, minimum deposits, and even different margin call/stop out levels. As we want to be sure what is true, we will use the MT4 platform feedback for each in the following sections of this review. For serious investors, this issue is very aversive.

Leverage

Cardiff has a questionnaire for clients in order to accept them. This will also affect the leverage you are granted. Moreover, the leverage will also depend on the country of origin and the equity in the client account. The default leverage set is 1:20. After all set, the maximum leverage for the Standard Account is up to 1:200 as well as for Pro Account. The Cardiff Prime Account has a maximum leverage of up to 1:50. The leverage levels are customizable with Cardiff and easily requested from their client portal.

Trade Sizes

Another issue about uncorrelated information is the minimum trade sizes associated with the three account types that Cardiff offers. From the platform, we can confirm that for the Standard Account the minimum trade size is 0.01 lots, as well as increment steps. The maximum per trade is 200 lots. For the Pro Account, the comparison table from the client portal shows a minimum trade size of 0.1 lots. Our MT4 platform did not confirm this, the minimum trade was like with the Standard Account, 0.01 lots. The top tier account, Cardiff Prime, has a 0.5 minimal trading size and step.

Trading Costs

Cardiff Global Market presents different figures even for costs. If we take the downloadable Product Disclosure Statement, there are no exact figures but we have noticed the conversion fee that will be charged if your account currency is not the same as the position closed. An additional spread will be applied that the MT4 will not reflect.

The commission rates are shown in the demo account. This is another issue for serious investors because transparency seems is not a priority for Cardiff. The conflicting info about the costs adds to this.

According to the info panel during the deposit process, the Standard (Classic) Account does not have any commissions. The Pro and Prime Accounts have a $5 commission per lot traded.

More from the legal documents shows interest charges that apply to accounts with insufficient margin requirements level. These rates will be determined at Cardiff’s own discretion. Swaps are under normal levels but the positive swap is rare, only minimal for some exotics like for the TRY.

Assets

Cardiff is not a very generous broker regarding the range of assets offered. Cryptocurrencies, ETFs and other categories are absent from the list. Forex market though has 43 pairs for the Standard Account and 47 for the Pro account. SGD has many crosses with the majors and from the exotics, we found TRY, Scandinavian currencies, MXN and ZAR. Interestingly, the Pro Account does not have the HKD/CNH pair present in the Standard.

We are unsure why these differences are not described to the traders in advance. Commodities range is extremely limited to the spot WTI and Brent oil CFD. Precious metals offer is good enough. Traders can choose between Gold, Silver, Palladium, and Platinum denominated in USD and AUD. Equities are limited to indices only. A total of 12 indices, majors like the AUS200, Germany 30, Spain 35, France 40 (two available), Nikkei Index, etc. Any difference between the accounts types except some Forex pairs is not evident. We see a lot of assets that have more influence in the global east market and this is no wonder as Cardiff Global Market is From Australia.

Spreads

Disregarding the information from the Cardiff web site, we will reflect the MT4 platform spreads. What is certain is that all spreads are a variable type. The Standard Account has the spreads as stated in the client portal from 1.6 pips for the EUR/USD pair. SGD/JPY shows 10 pips spread which is great considering the average ATR of this pair. The highest spreads for Forex pairs get up to 8.1 pips for the ZAR/JPY and for GBP/NZD 18 pips. For the Gold, the spread is relatively attractive at 3.5 pips. For the Pro Account, the spreads are lower, for example, the EUR/USD spread is at 1.6 pips, SGD/JPY has 8.6 pips and ZAR/JPY 7.3 pips. In general, the Pro Account has 20-50% tighter spreads than Standard. Cardiff Prime Account has spread around 50-90% lower.

Minimum Deposit

The minimum amount we have detected when filing for the deposit is $100. From the comparison table, the minimum deposit for the Standard Account is $500, therefore the information conflict makes everything unclear. For the Pro account the minimum is $2000 and for Prime, $25.000. Margin requirements are also different, Standard requires 100% level until call and at least 30% before the stop out. Pro requires 100% and 50% levels respectively and Prime 125% and 75%.

Deposit Methods & Costs

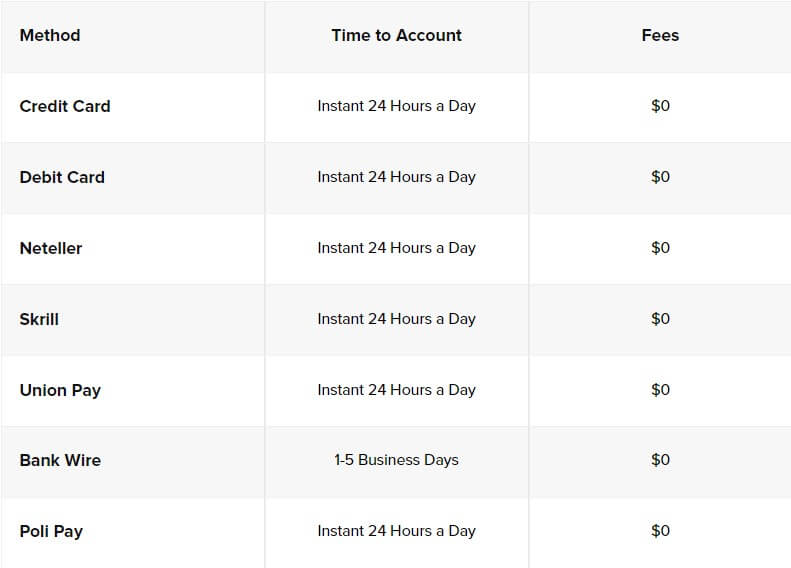

Cardiff legal documents have clearly described the fees associated with the deposit transactions. There are no deposit fees except the client’s bank costs. The deposit methods could change depending on the country you have selected during the registration process. In general, Cardiff accepts Credit Cards, Visa and MasterCard, e-wallets like Skrill, Neteller, B-pay (AUD), Union Pay, Poli Pay, and bank transfers. The deposit maximum is $100.000 or another currency equivalent.

Withdrawal Methods & Costs

The fee for international electronic funds transfer is 20AUD. Depending on the deposit method, the withdrawal will be made using the same channel as the deposit (Skrill, Neteller, Bank Transfer). Any amount that is larger than the original deposit is paid via bank transfer. In the Wallet section of the Cardiff client portal app, traders can add Credit Cards, e-wallets, and bank accounts that can be used for deposits and withdrawals. Here, any withdrawal requests can also be tracked. Additional methods presented at the web site will direct to the client portal wallet.

Withdrawal Processing & Wait Time

All the methods take 24 hours to process by the Cardiff, for the bank wire method additional 1-5 days is required.

Bonuses & Promotions

Cardiff Global Markets does not mention any kind of bonuses. Introducing broker and Money Manager services are available for anyone interested in helping this broker expand their client base.

Educational & Trading Tools

The educational service or material does not exist. What is contributed toward giving some insight into what potential traders are getting into is the Product Disclosure Statement. The document contains Q&A, both related to trading and Cardiff trading environment. The quality of information is good, a lot of facts and definitions about the processes during trading are explained but also what Cardiff is doing. An interesting fact about this broker is the sole discretion to hedge client positions and decide to accept an order. Still. Cardiff claims that no requotes are possible.

The client portal has an interesting news feed tool from the DailyFX that is showing the most recent developments. Clicking the news will open the details and a link to the source. Unfortunately, under the tools section in the client portal there us a market analysis that is no longer operational. This tool used to provide analysis from the Smart Markets. The economic calendar is not available. Taking a look, it seems that Cardiff was once a much better brokerage.

Customer Service

Live Chat that we have used established the connection with the Cardiff support but we have not received a reply to our queries. The contact form is on the site and the ticket service is available through the client portal app. Email and phone are there for visitors that do not want to register.

Demo Account

Cardiff does not hide the demo account like some other brokers that resort to aggressive and manipulative marketing. To open one, traders need to fill in the details and the email where the login credentials will be sent. The phone is required. After this process, you will be able to login to the Cardiff client portal where demo accounts are created. Demos are available like the Standard and Pro Account. For the GBP currency only the Pro. Traders are able to create more than one account so they can easily compare the differences. Note that the demo account does not reflect the commissions charged with real Pro and Prime Accounts.

Countries Accepted

Cardiff does not accept clients from Japan and the United States. Other countries could be on the list if the laws prohibit CFD trading service from this provider.

Conclusion

This broker has evident issues about the information they handle to potential investors. The web site is like any other average broker that does not follow the trends and demands of the market. Beeing regulated with a reputable regulator, a lot of effort is made towards the safety of clients funds, but this may be reserved for Australian clients. The required minimal capital for the Australian Financial Services Licence is 1 million AUD and this is a significant barrier to entry, in return giving some credibility to investors. We are not sure as to why the information about the account type, spreads, commission, and many other key investor figures are not disclosed in a single, accurate and indisputable manner. The Cardiff web site is full of usual sentences that try to assure in the quality of service, safety, etc. It takes more than just saying a broker is great, a leader, innovator, safe, and supportive.

Cardiff Global Market is an ECN broker that is not doing a requote but has a right to hedge and to choose not to accept the order. This is a sign of a market maker but it does not mean that this practice is often. The legal documents provide enough information that could be less obscured and integrated into the web site. Taking all into consideration, the popularity of this broker is low because of the marketing and the inaccurate information that traders will feel at every step, bringing them closer to the decision of no return. Additionally, Cardiff does not offer any popular assets to trade, like the cryptocurrencies, equities, automated trading service, copy trading, and so on. The support is not present in the chat. Traders that are already trading with Cardiff cannot switch to equities or crypto in case of market shifts, will start to seek another broker. Our final opinion is to avoid this broker until a better service is offered.