Introduction

CAD/PHP is an exotic Forex currency pair where CAD is the Canadian Dollar while PHP is the Philippine Peso, the Philippines’ official currency. This article will cover fundamental aspects that you should know about CAD/PHP before you start trading the pair.

Understanding CAD/PHP

In this currency pair, the CAD is the base currency, and the PHP is the quote currency. The CAD/PHP pair price represents the quantity of the PHP that can be bought by 1 CAD. If the CAD/PHP price is 36.181, it means that for every 1 CAD you have, you can buy 36.181 PHP.

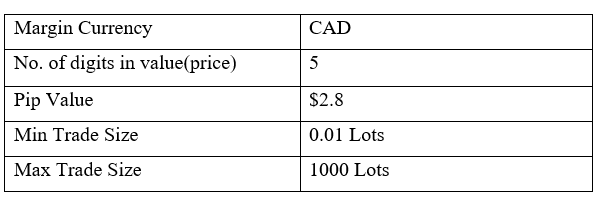

CAD/PHP Specification

Spread

In forex trading, the spread is the difference in the value at which a trader can buy a currency pair and the price at which they can sell it.

ECN: 10 pips | STP: 15 pips

Fees

There are no trading fees associated with STP accounts. However, for the ECN accounts, the trading fees that you will incur per transaction are determined by your forex broker.

Slippage

When trading forex, slippage occurs when there is a difference between the price at which you place your trade and the price at which your broker executes it. Slippage in forex frequently happens at times of higher volatility or when significantly larger orders are made.

Trading Range in the CAD/PHP Pair

Forex traders should know how a given currency pair changes within different timeframes. This change in terms of pips is referred to as the trading range. It is used to analyze the historical volatility of a given pair across different timeframes. Therefore, the trading range can be used to determine the amount of profit that a trader should expect to earn.

The Procedure to assess Pip Ranges

- Add the ATR indicator to your chart.

- Set the period to 1

- Add a 200-period SMA to this indicator.

- Shrink the chart so you can determine a larger period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

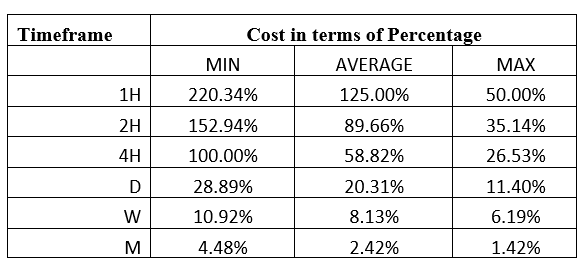

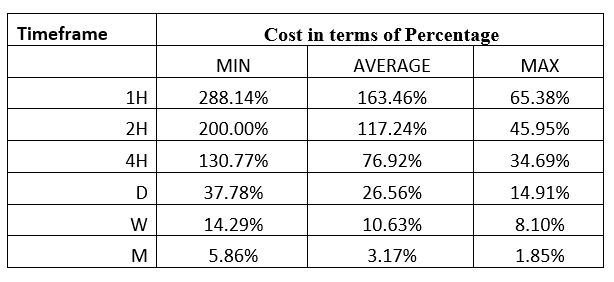

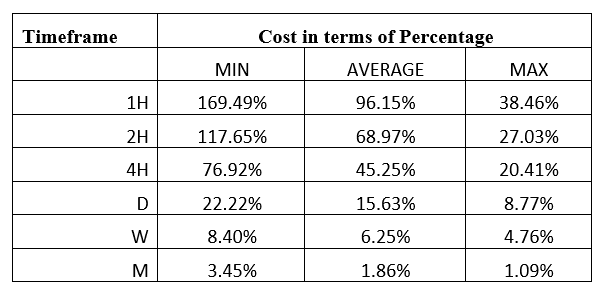

CAD/PHP Cost as a Percentage of the Trading Range

Slippage, spread, and brokers’ fees amount to trading costs to a forex trader.

Total cost = Slippage + Spread + Trading Fee

Therefore, forex traders should be aware of how these costs vary during different timeframes depending on the pip change of the currency they trade.

The tables below are of the percentage costs that can be expected when trading the CAD/PHP pair under the ECN and STP account types. The costs are expressed as pips.

ECN Model Account

Spread = 10 | Slippage = 2 | Trading fee = 1

Total cost = 13

STP Model Account

Spread = 15 | Slippage = 2 | Trading fee = 0

Total cost = 17

The Ideal Timeframe to Trade CAD/PHP

From the above trading range cost analysis, the most cost is incurred at the 1H timeframe at 220.34% for the ECN account and 288.14% for the STP account. These costs imply that it is not ideal to trade during times of low volatility of about 2.3 pips. However, the trading costs associated with the 1H, 2H, 4H, and the 1D timeframes are lower when the market volatility is above average. Intraday traders can time their entry when the volatility of the CAD/PHP is above average.

The longer timeframes for both types of accounts have lower trading costs associated with them. Thus, longer-term traders can get to enjoy lower costs.

Forex traders can also significantly reduce their trading costs by employing limit order types to ensure they do not experience slippage costs. Let’s look at the total costs when slippage is zero with the ECN account.

Total cost = Slippage + Spread + Trading fee

= 0 + 10 + 1 =11

With the ECN account, the highest trading cost reduces from 220.334% to 169.49%, showing that using the limit order types significantly reduces the trading costs.