Assessing Market Conditions

No matter which markets you trade, but in particular the Forex market, trading conditions change constantly depending on a number of factors, including the time of day the time, the time of the month, and even on an hour by hour basis. This is dependant on both fundamental, technical, and conditions based on sentiment.

Example: on an hour by hour basis because the Forex market has peak trading ours during the European, London and US session – where most volume is going through the market – daily; due to fundamental news release and a change in market sentiment, monthly, because hedge funds typically like to rebalance their portfolios at this time and also on a quarterly basis.

When these factors are taken into consideration, they transfer onto a trading chart as range-bound, which are also known as consolidating markets; breakouts, where markets begin trading outside of a consolidation zone, and we’re these breakouts typically turn into trends. All of these conditions present trading opportunities.

Example ‘A’ is a diagram of a range-bound market, with support and resistance (highs and lows). These areas are also sometimes called; floors and ceilings and where price action will typically move up and down within these ranges. Sometimes traders refer to this as sideways trading.

Example ‘B’ shows a breakout of a previously ranging market, and where a floor or ceiling has been breached and where price action advances outside of the range. We have added a trend line A, B, C. D, where price action to the upside has begun to fade, and wher moves have been limited to this new are of resistance. Incidentally, the line continues to be a support move for the breakout at area D, which again proves to be a barrier for the bulls!

Example ‘C’ shows a trending market. In this type of market, traders look for repeated signs, such as in a bull market (ascending) market and where each high is higher than the previous high, and where each low point (pullback/retracement) is higher than the previous low. The correct terminology is: higher highs and higher lows.

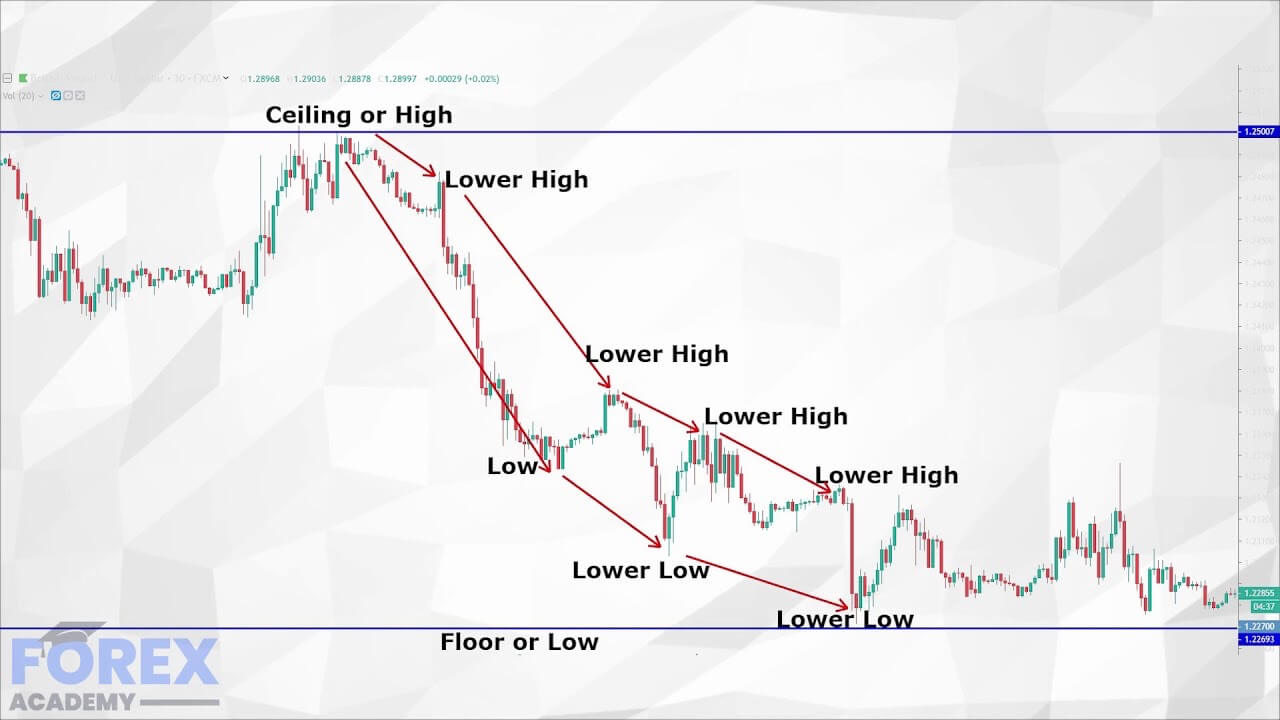

Example ‘D’ in a bear trend (descending) market, the reverse applies, and now traders look for lower highs and lower lows.

So, we know what we are looking for: range-bound, breakouts, and trends, in which case, when is the best time to be looking to trade them?

Let’s consider that you live in the United Kingdom and you want to trade the pound against the US dollar, AKA Cable, trading this pair at 11 PM (Sun-Fri) would not be a particularly good idea, because the European, London, and US markets will be closed at this hour, and the Asian region traders will be coming to market. This could mean that Asian traders have a different view than the other regions, regarding the value of the pound against the US dollar, or and which could be the start of a trend reversal. This could go against technical analysis as inherited

from the aforementioned markets.

Another reason could be that typically Asian markets at this time might be more focused on their own domestic currencies, such as the Yen, Australian and New Zealand dollar, for example. This would, therefore, have the effect of potentially leaving cable with little volume and, therefore, flat. Therefore, for the best time to trade the Cable would be during the European session, including London.

Another thing to be mindful of is the immediate, or near-term financial, economic calendar, especially when it comes to interest rate decisions, gross domestic product GDP releases, and on a more topical note event surrounding Brexit.

However, because currencies are traded in pairs, it is also highly advisable to observe the financial calendar releases for the counter currency, in this case, the US dollar.

We would also recommend caution when trading any of the major currency pairs when an unrelated pair is about to have an economic-related news release as this could impact the counter currency, and which may have a knock-on effect and impact on your trade.

Her is an example: let’s say that you are buying Cable, and the European Union announces an unexpected ten basis point interest rate reduction. This could cause the value of the Euro to fall and cause the US dollar to rise sharply. Thus potentially resulting in a knock-on, or adverse effect on your trade, where you need a weaker dollar and stronger pound.

Please also note that range-bound markets, breakouts, and trends will have a completely different complexion depending on the time frame that a trader chooses to trade with. For example, a 1-minute time frame, which is typically used by scalpers, or intraday traders, tends to be more frantic than a 1-hour time frame, and will also typically offer less movement in terms of pips. Hedge funds, institutions, and governments tend to hold longer views and therefore use longer time frames such as daily, weekly, and monthly set-ups.