At first glance, their low leverage might raise some eyebrows. However, TMS Brokers, established over 14 years ago, enables its account holders to enjoy competitive and market-leading features. In fact, this broker even has its own app, which traders can utilize alongside other popular trading platforms. The firm has over 8,000 certified brokers who work with their customers and offer support, such as one-on-one consultations and in-depth analysis reports. TMS Brokers have account holders from different corners of the world, including major global financial hubs like Beijing, London, Vienna, New Delhi, Ottawa, Tokyo, Mexico City, and others. They are also present in non-financial areas. Washington D.C (United States), Bogota (Columbia), Jakarta (Indonesia), Islamabad (Pakistan), and Oslo (Norway) are a few examples.

Remarkably enough, TMS Brokers heavily prioritizes the role of asset protection and preventing clients’ accounts from turning negative (which mainly happens when traders make risky decisions while using a large amount of leverage/buying power). In fact, these principles guide the firm’s policies when it comes to their margin policies, easily accessible account management software, and, perhaps most noteworthy, the way that they prioritize education. Having said that, there are features that a few types of traders may not find suitable. Many others, meanwhile, will certainly appreciate what TMS Brokers offers. Here is a deeper look into their financial instrument selections, spreads, bonuses, and more.

Account Types

While TMS Connect is the only account type that this broker offers, it is rich with competitive and highly desirable features. For the most part, TMS Brokers charges no commissions, has transparent spreads and gives traders access to plenty to instruments and tools.

Minimum Deposits: None

Spreads: Floating (starting from lower than 1 pip)

Commission: $5 on stocks, $0 on all other instruments

When you open an account, TMS Brokers will ask for certain documents to verify your identity. After submitting them, it usually takes 1 hour or less for the broker to approve them and, from there, you can start trading. However, keep in mind that residents of certain countries (including the US, Canada, and Japan), as well as non-EU citizens, have their own document requirements. To make the account opening process quick and easy, make sure that you provide information that is specific to your residential location or country of citizenship.

Platforms

While TMS Brokers use MetaTrader 5 (MT5), their unique TMS Connect mobile app makes the platform’s features even more user-friendly and accessible. TMS Connect provides you with a live news feed that you can view from your smartphone device and/or directly through your desktop when you log into your MT5 account. Customer service is also available and traders can work with professional analysts that will help them manage their portfolio, understand how each financial instrument works, and choose the right investment approach. Just as importantly, these experts regularly compile reports about important economic developments and news events so that users can get the most up to date information.

Moreover, TMS Connect charges no commissions on currency pairs and other assets, while providing traders with accurate spreads. Position sizes are very flexible, too. MT5 and TMS Connect make it easy to trade crypto CFDs, indices, and commodities. While the MT5 platform is available on all devices, TMS Connect makes managing your account and opening/closing positions from your phone more efficient than if you only did so through MetaTrader’s mobile app. TMS Connect can be downloaded directly from the broker’s website. To install MT5, you have the option of either going through TMS Brokers or downloading it from the platform’s website.

MT5 is very well known for its wide variety of technical indicators and charting tools. TMS Connect enhances these features on smartphones. In fact, they are the only broker in Poland that utilizes MT5. Lastly, through TMS Connect, you can follow other traders and track how they are performing. This adds another layer of in-depth analysis that benefits beginners and professionals alike. Those who are new to the financial markets can learn from profitable traders and emulate successful strategies, while also developing their own approach. Seasoned investors would see how others are doing when trading specific instruments and identify ways to further improve.

Leverage

Forex pairs have a maximum leverage of 30:1, which is considered very low. In most cases, brokers will offer traders between 100:1 and 400:1 in leverage. For that matter, some even provide you with up to 1000:1. When it comes to TMS Brokers, their leverage for indices and commodities is capped at 20:1. The maximum for stocks and cryptos is 5:1 and 2:1, respectively. Across the brokerage industry, digital currencies have low leverage because of their volatility and, therefore, riskiness. However, even TMS Brokers’ 2:1 leverage on cryptos is still low, most other firms have that number at 5:1.

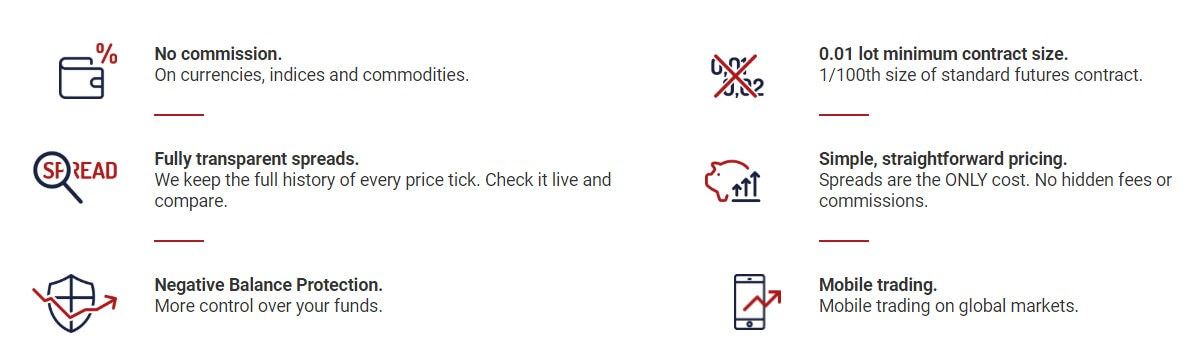

Trade Sizes

The minimum trade size is 0.01 lots, which is a micro lot. TMS Brokers prides itself in offering protection against having a negative balance.

Stop-Out: 50%

In most cases, brokerage firms tend to have separate margin call and stop-out levels. When the margin call is reached, additional deposits are required. Otherwise, you or your broker will have to liquidate some positions and return the account balance to the specified margin requirement.

TMS Brokers, however, doesn’t have a margin call. Instead, once the balance reaches 50% of the margin maintenance, all of your trades will be sold and closed out. Even though there is no margin call that acts as an initial warning, TMS Brokers’s system is set up to prevent you from losing all of your capital and/or having a negative account balance. It might be less convenient, but the main positive aspect of this approach is that your losses and risks will be minimized.

Trading Costs

There are no commissions for trading forex pairs, cryptos, commodities (except for gold and silver), and indices. However, TMS Brokers does charge commissions on stock trades, starting from $5 (or 5 euros). Just as importantly, there are swap fees on positions that are kept open overnight. The charges are based on the interest associated with the currency or instrument that you trade, which can change based on market developments and central banks’ policies. TMS Brokers will also charge you the difference on the spread. Both the swap and spread fees are floating. You can access the most updated figures on this broker’s website.

Assets

There are 42 different currency pairs that TMS Brokers’ account holders can access. Most of them are major, including the USD, EUR, GBP, and AUD. However, you also have the option of trading exotic currencies, such as the Swedish Krone, Norwegian Krone, and Turkish Lira. Traders also access 5 different cryptocurrencies, including Bitcoin.

Amongst the 18 available index CFDs are the Dow Jones Industrial Average, Nasdaq 100, S&P 500, the UK’s FTSE 100, Germany’s DAX 30, and more. There are also 19 different commodities. The list of available stock CFDs includes 47 companies that are traded in the US, as well as 28 from Poland, 19 from Spain, 18 from Germany, and 11 from the UK.

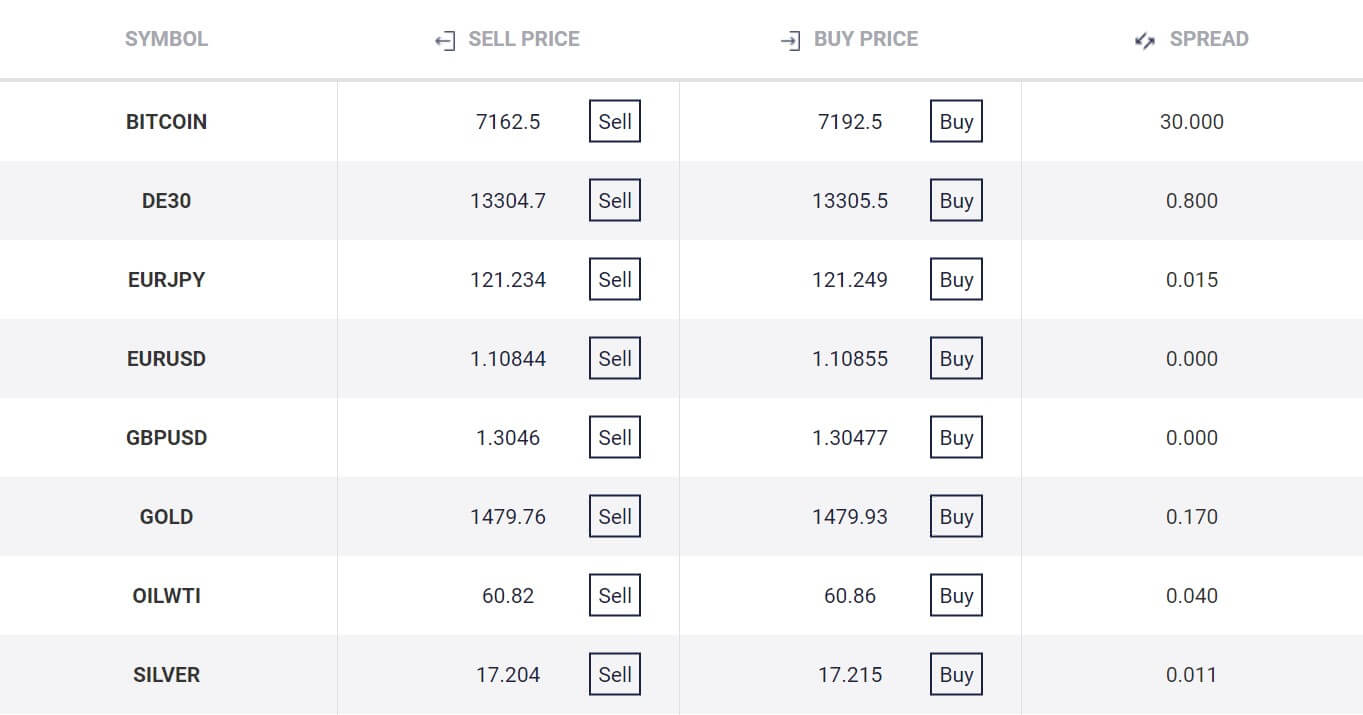

Spreads

TMS Brokers has a floating spread, which varies from one FX pair to another. A list of live spreads can be accessed on the firm’s website and the figures are accurate to the 5th decimal (or a 10th of a pip). Major currencies, like the USD and EUR, have a low spread that tends to be less than 1 pip (during normal market conditions). Similarly, the spread is floating for all other assets that can be traded through TMS Brokers.

Minimum Deposit

You can open an account without depositing any funds. However, TMS Brokers recommends that you initially deposit 100 euros or more, which is the required minimum to avoid transaction costs.

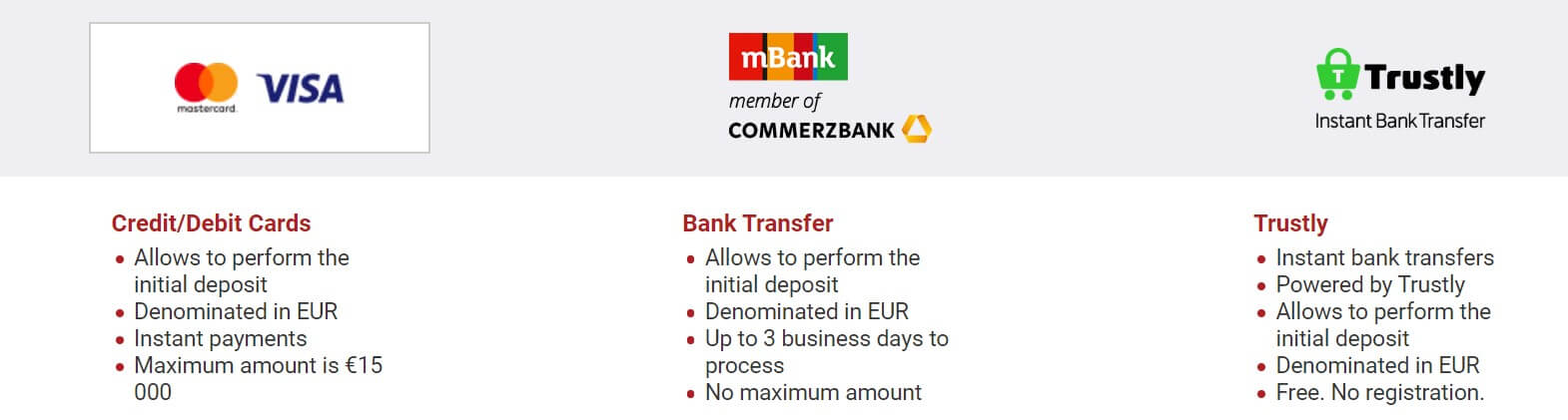

Deposit Methods & Costs

TMS Brokers accepts credit or debit cards, Skrill, and bank wires as deposit methods. All transfers into your account are free (as long as they are 100 euros or more). Deposits via Visa, MasterCard, and Skrill are instantly processed while bank transfers are concluded after 1 business day. Transaction requests are made through your account’s user dashboard.

Withdrawal Methods & Costs

You can only withdraw funds through transferring money to your bank account. Transfers via debit/credit cards and Skrill are not accepted, even if you used these methods to make deposits or initially fund your TMS Brokers account. There are no transfer fees if you withdraw 100 euros or more.

Withdrawal Processing & Wait Time

Withdrawals are processed within 3 business days. When you have withdrawn money for the first time, TMS Brokers will ask you for your bank account number and other information. Afterward, you can automatically use the same bank for future withdrawals, without having to provide the information again.

Bonuses & Promotions

There are four main proportional programs offered by TMS Brokers. The easiest one to get is their 20 euro phone verification bonus. If you use the TMS trader platform, they give you another 20 euros after you execute 10 trades on the demo account. Profitable traders are also awarded by TMS Brokers. First, new account holders have 14 days to make a deposit in order to participate in the promotion. Those who fund their portfolio with at least 250 euros (about $280) receive 100 euros ($110) once they make 100 euros in trading profits.

Moreover, account holders who deposit more than 500 euros get 200 euros if they make that amount in profits. Lastly, if you transfer over 1,000 euros into your account and exceed 300 euros in profits, TMS brokers credit your account with another 300 euros in bonuses. However, the website states that most of their bonuses expired on December 31st, 2017. Because of this, interested traders should ask customer service whether or not these promotions are still active and if they plan on running similar ones in the near future.

TMS Brokers also has a rebate promotion. After clients participate in this program, they earn 10% back when they trade between 50 and 200 lots per month. Meanwhile, 200 to 500 lots gets you 15% and anything above that has a 20% rebate. In many ways, rebates act as a refund on the spread costs, which traders incur because of the difference between the bid and ask prices. Each month’s rebate is added up on the 1st and deposited into account holders’ portfolio on the 10th.

Similarly, TMS Brokers will pay you another 0.5% in interest (relative to your account’s balance) when you trade over 50 lots in a single month. Even if your volume is less than that, TMS Brokers will still reward you with a 0.25% interest payment. For example, a trader that has $10,000 in their TMS Brokers account gets $50 (0.5% their balance) after exchanging 50 lots or more. When they go below it (such as 40 lots in a month), the trader receives $25 (0.25% the balance).

Educational & Trading Tools

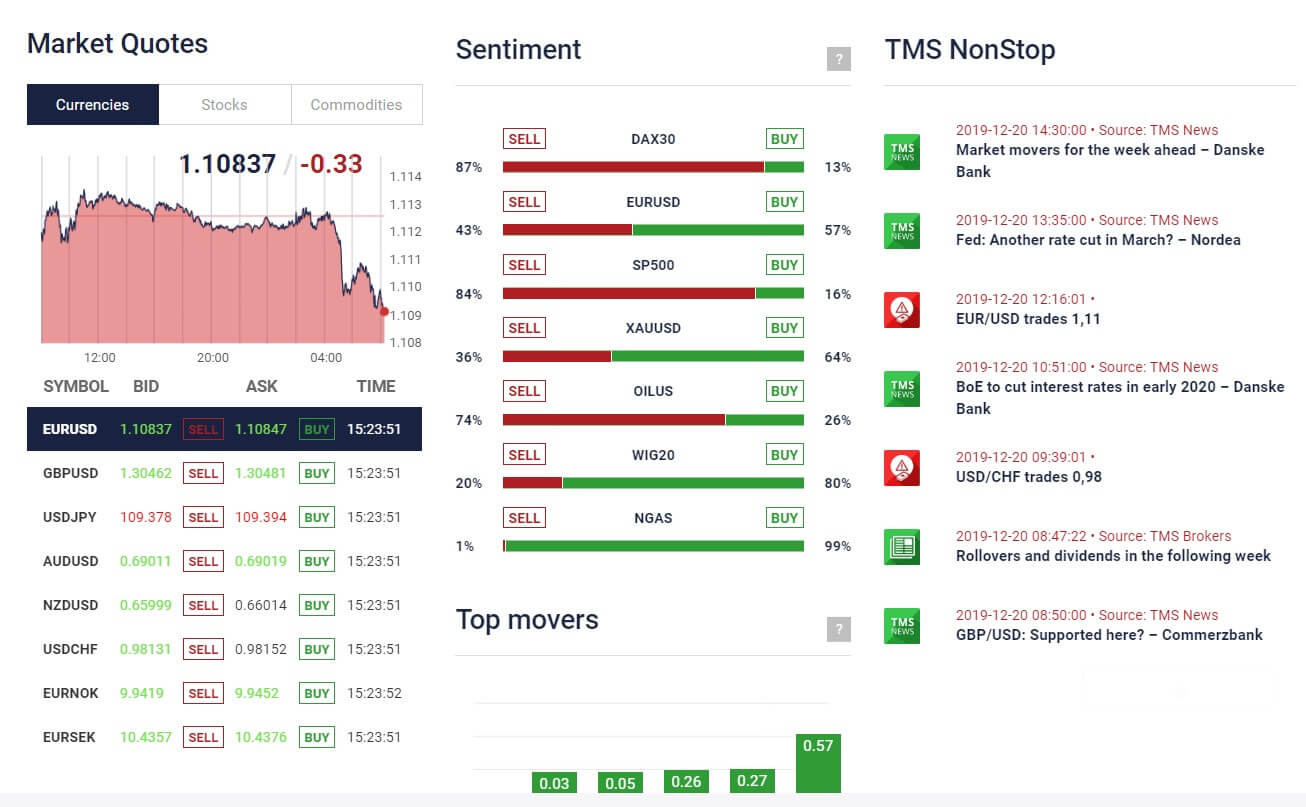

The educational materials include video courses, live webinars, in-person classes, and eBooks. Meanwhile, the trading tools entail economic calendars, a daily schedule of company earnings reports, as well as live prices and charts that are directly accessed from TMS Brokers’s website. Going back to education, the firm has a glossary of major market and trading terms, which are sorted alphabetically. This can especially benefit beginners when they analyze news stories and research reports. Similarly, traders can either watch short tutorial videos or participate in live online classes, which are available in English, Spanish, Russian, Latvian, and Lithuanian.

The 2 eBooks are titled ‘Profitable Investment Strategies’ and ‘Price Action’. The former outlines the win rates and returns that the most successful traders on TMS Brokers have, which may help new market participants measure their performance and find ways to evaluate results. This eBook also discusses the most popular markets and assets amongst the firm’s management team and account holders. Price Action, on the other hand, is about how you can utilize and implement the ‘Pin Bar’ trading strategy. It is written by a group of experienced and professional traders. Lastly, whether you are a new or current account holder, the TMS Nonstop tool is rich with in-depth research reports and analytical content, alongside a live news feed that the broker constantly-updates. In fact, even non-account holders can access this beneficial and useful platform.

Customer Service

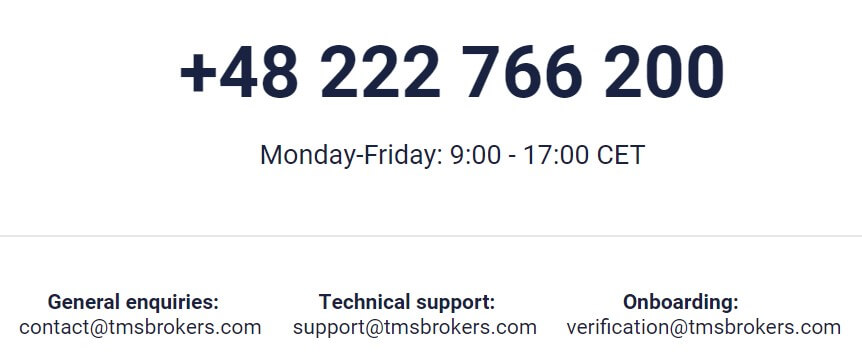

Support is available via phone between 9 am and 5 pm (Central European Time or CST) on weekdays. There are representatives for English, German, Russian, and Spanish-speaking traders, as well as those who prefer other languages. They can also be contacted via email.

Phone: +48 222 766 200 (International), +49 322 11000 7581 (German), +371 66 334 410 (Russian), and +34 911 12 0029 (Spanish).

Email: [email protected], [email protected] (German), [email protected] (Russian), and [email protected] (Spanish).

Demo Account

TMS Brokers will give you 50,000 euros ($55,700) in paper/fake money to practice with when you open a demo account. Just as with a live portfolio, demos can be managed on any device and from anywhere in the world. Moreover, the demo retains the same features that the live account has, including access to the same market prices, trading tools, and platforms. Most people open demo accounts for two main reasons: First, beginners can learn about the market before risking their real money. Second, experienced traders who are unfamiliar with using TMS Brokers’ platforms are allowed time to get comfortable with their different tools and order execution methods.

Countries Accepted

TMS Brokers is headquartered in Poland and its website is available in English, Polish, Russian, Spanish, and other languages, which indicates that they have an international presence. However, traders who are located in Canada, Japan, and the United States may have to abide by certain government restrictions when they open an account with this broker. This is because certain countries tend to regulate CFDs and other financial instruments more strictly because trading them carries more risk than exchanging forex pairs or other safer assets.

Conclusion

To summarize, TMS Brokers has many competitive and market-leading offerings. They include an extensive list of educational content and small spreads. Having said that, the broker does charge somewhat burdensome commissions, the leverage is very small, and their transfer methods are limited. This broker utilizes the MT5 platform, which is more advanced and resourceful than its older version, MetaTrader 4 (MT4), that many brokerage firms still use. Uniquely, they also have their own TMS Connect app.

While this broker only has one account type, they will process applications within only 1 hour. After that, you can immediately start trading. In addition, the customer support team is available in different languages. Their transfers, meanwhile, are a two-sided coin. Deposits, on one hand, can be made via credit/debit cards, wire transfers, and Skrill. They are also free. Withdrawals, on the other end, are only processed as bank wires and transactions take 3 days to complete. Just as with deposits, however, withdrawals are also free.

In comparison to the at large industry, TMS Brokers’ 40+ forex pairs are modest, but not low or limited. Yet, their available commodities and indices are beyond expansive. The same applies to their educational tools, which encompass video courses, eBooks, and more. All of which are available in multiple languages, alongside economic calendars and other useful instruments. They also have various types of bonuses. Lastly, their spreads are relatively contained.

However, TMS Brokers charge an undesirable commission and have a very low maximum leverage of 30:1. Because of this, when you weigh this broker’s pros and cons, always keep your strategy and preferences in mind. High-frequency traders may prefer low commissions, but those who utilize a lot of leverage might not mind these trading fees as long as the spreads are kept at a minimal level.