“TradeLTD is an industry-leading, regulated trading platform designed to boost your success by giving you access to a wide range of tradable assets. Learn to trade FX, Commodities, Indices, Stocks, and Cryptocurrency online with our user-friendly trading platform that has been expertly designed for any trader. Whether you’re a novice, intermediate, or an experienced trader, their platform has all the features you need to succeed.” that is the opening statement of their website, this review is intended to look into the services being offered bt TradeLTD to see if they live up to their statement.

Account Types

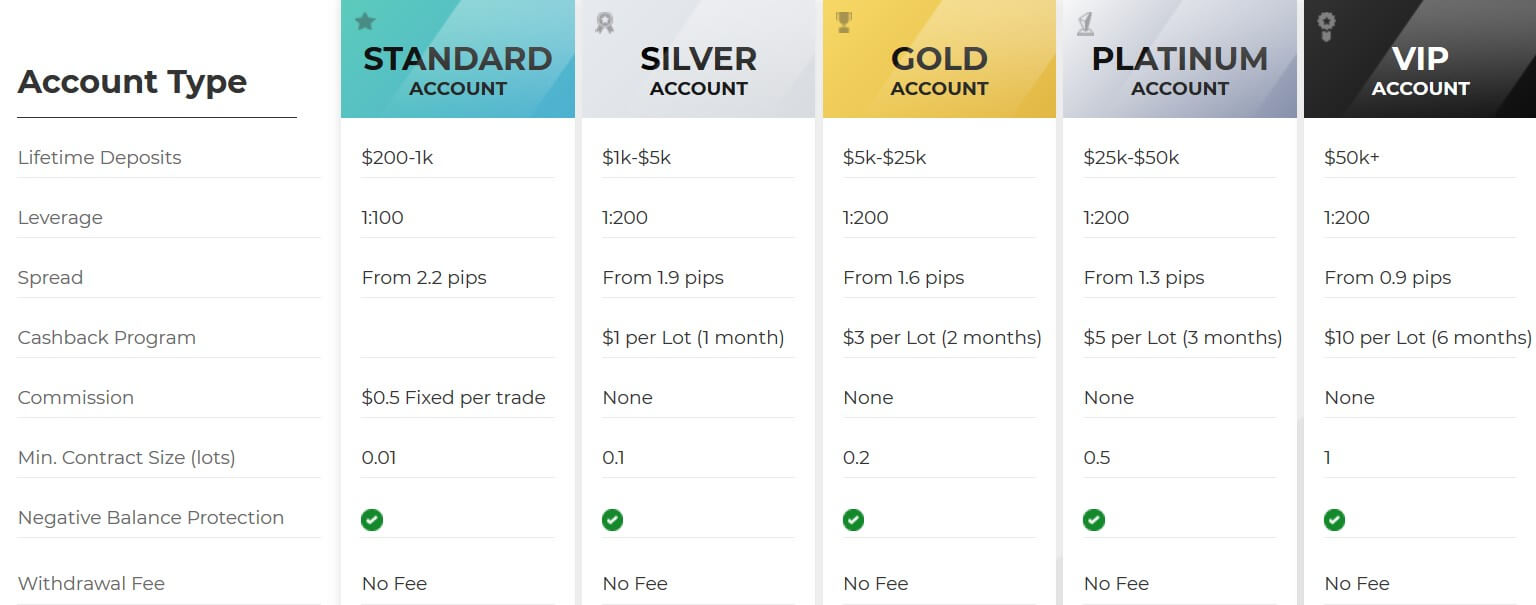

There are 5 different accounts on offer from TradeLTD, each one having a different entry requirement and also different trading conditions, let’s see what they are.

Standard Account: The Standard account requires a lifetime deposit between $200 and $1,000. The account can be leveraged up to 1:100 and has spread starting from 2.2 pips, the account has a commission of $0.5 per trade. The minimum trade size is 0.01 lots and has negative balance protection. The account comes with a personal account manager, educational videos and a live webinar. It also has access to automated trading platforms.

Silver Account: This account requires a lifetime deposit between $1,000 and $5,000. It has leverage up to 1:200, spreads start from 1.9 pips and there is no commission. The account is eligible for a cashback of $1 per lot traded for 1 month. The minimum trade size for this account is 0.1 lots and has negative balance protection. The account also comes with a personal account manager, intro to the markets, access to videos and tutorials, live webinars, access to the mirror trading platforms and a daily market newsletter.

Gold Account: The Gold account requires a lifetime deposit of $5,000 and $25,000. It has leverage up to 1:200 and spread starting from 1.6 pips, it has no commission. It is eligible for cashback fo $3 per lot traded for 2 months, the minimum trade size is 0.2 lots and has negative balance protection. The account also comes with a personal account manager, intro to the markets, access to videos and tutorials, live webinars, access to the mirror trading platforms, a daily market newsletter, personalized analyst expert consultation (monthly) trading signal alerts, free trading notifications, advanced market analysis, and personalized analysis and strategies.

Platinum Account: The Platinum account requires a lifetime deposit between $25,000 and $50,000, it has leverage up to 1:200 and spreads from 1.3 pips, the account is also eligible for a cashback of $5 per lot traded for 3 months. Trade sizes start from 0.5 lots and there is negative balance protection. The account also comes with a personal account manager, intro to the markets, access to videos and tutorials, live webinars, access to the mirror trading platforms, a daily market newsletter, personalized analyst expert consultation (monthly) trading signal alerts, free trading notifications, advanced market analysis, personalized analysis and strategies, and access to live trading rooms and academy.

VIP Account: This is the top-level account and so requires a lifetime deposit of $50,000. Its leverage is 1:200 and it has a starting spread of 0.9 pips and no commissions, it is eligible for a cashback of $10 per lot for 6 months. The account also comes with a personal account manager, intro to the markets, access to videos and tutorials, live webinars, access to the mirror trading platforms, a daily market newsletter, personalized analyst expert consultation (monthly) trading signal alerts, free trading notifications, advanced market analysis, personalized analysis and strategies, access to live trading rooms and academy and something called EFX Plus Bank Forecasts and it states you get 10 lots per month.

Platforms

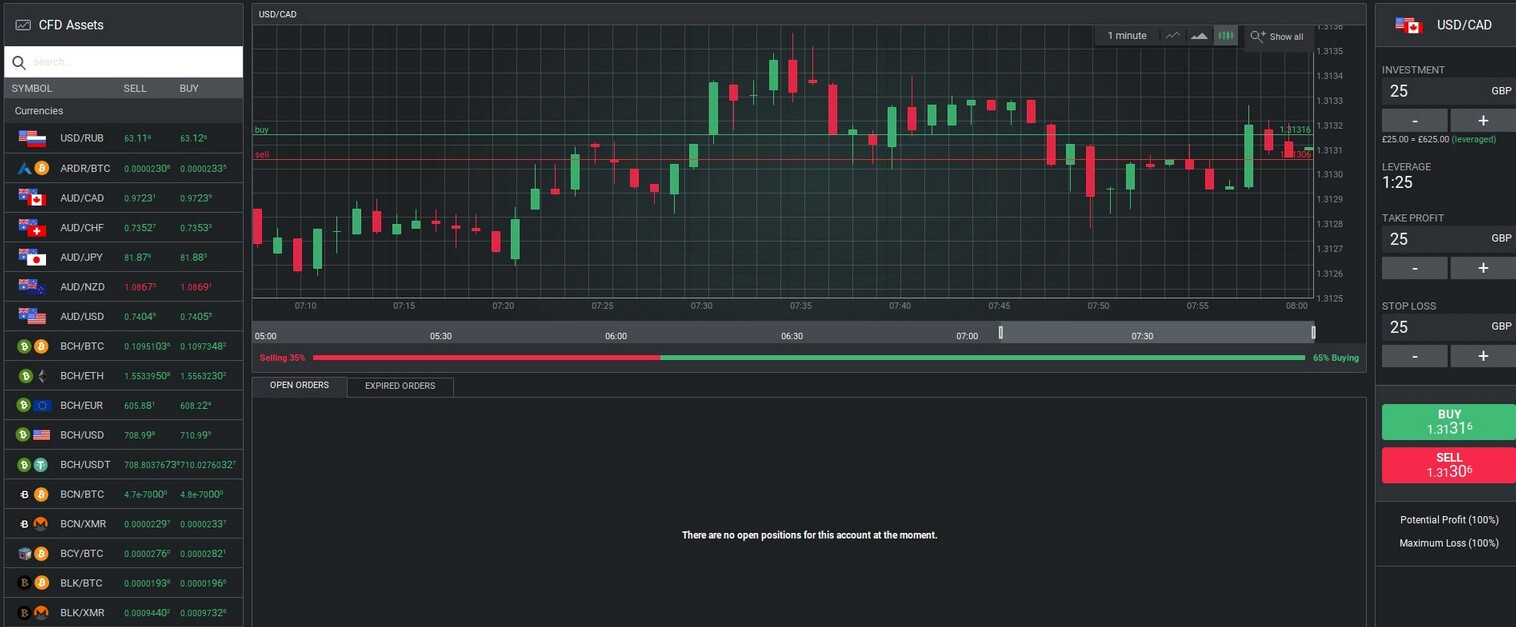

There are a few different options when it comes to trading with TradeTLD, let’s look at what they are.

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. Millions of people use MT4 for its interactive charts, multiple timeframes, one-click trading, trade copying and more. In terms of accessibility, MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Mobile Trade: A mobile app with some features such as trading from anywhere, at any time, rapid trade execution, user-friendly interface, access to all major trading instruments, real-time quotes and, multiple timeframesReal-time interactive charts

Mirro Trader: Follow some of the world’s best trading algorithms. Featuring a real-time interface and innovative tools, it’s quick and easy to filter trade opportunities and subscribe to the strategies that best suit your style. With more than 3,000 verified algorithmic strategies to choose from, Mirror Trader can help you find an edge in the market.

RoboX: Diversify your investment and enjoy the advantages of Forex trading. RoboX uses a unique algorithm that correlates between your personal trading profile and the world’s largest algo’s database to create trading packages that are best suited for you.

Leverage

If you use the Standard account then you will have a maximum leverage of 1:100, all other accounts have a maximum leverage of 1:200, you can select leverage when opening up the account and should you wish to change it once an account is already open you will need to get in contact with the customer service team.

Trade Sizes

Trade sizes depend on the account you are using, we have set out a little list below.

- Standard: 0.01 lots, goes up in increments of 0.01 lots.

- Silver: 0.1 lots, goes up in increments of 0.1 lots

- Gold: 0.2 lots, increment unknown

- Platinum: 0.5 lots, increment unknown

- VIP: 1 lot, increment unknown

In terms of maximum trade size, we could not locate this information, however, we would not recommend trading more than 50 lots as it can become harder for the markets and liquidity providers to execute trades quickly and without commission the bigger they are. There is no limit to the number of trades you can have open at any one time.

Trading Costs

All accounts use a spread based system that we will look at later in this review, the only account with any added commission is the Standard account, it states that the commission is %0.5 per trade, however, we are not sure if this means per lot or every single trade no matter the size.

Swap charges are present which are fees that you wither pay or receive for holding trades overnight, these can often be viewed within the trading platform you are using.

Assets

There doesn’t seem to be a massive selection of tradable assets according to the website, there are forex currency pairs comprising of major pairs, minor pairs, and exotic pairs. Some examples are GBP/USD, EUR/AUD, and USD/HKD. It is confusing as to what other assets are available, there does seem to be some, but we cannot say which ones.

Spreads

Spreads depend on a couple of factors such as the account you are using, the Standard account has spreads starting at around 2.2 pips, the Silver account reduces to a starting level of 1.9 pips, the Gold account drops further to 1.6 pips, the Platinum account has a starting spread of 1.3 pips and finally, the VIP account has a starting spread of 0.9 pips.

The spreads are variable (also known as floating), which means they move with the markets, when the markets are volatile they often widen and can be seen bigger. It should also be noted that the stated number is the starting numbers, they will be seen higher and while EURUSD may have spread starting at 2.2 pips, other pairs such as AUDNZD will have a higher starting spread.

Minimum Deposit

The minimum deposit with TradeTLD is 200 USD, GBP or EUR, it is unknown if this reduces once an account is opened so we will stick with 200 USD, GBP or EUR as a baseline.

Deposit Methods & Costs

Just two methods on offer when depositing with TradeTLD, these are Credit / Debit card (both Visa and MasterCard) and Bank Wire Transfer. There is no mention of any fees so it is unknown if there are any added, either way, be sure to check with your bank to make sure they do not add any fees of their own.

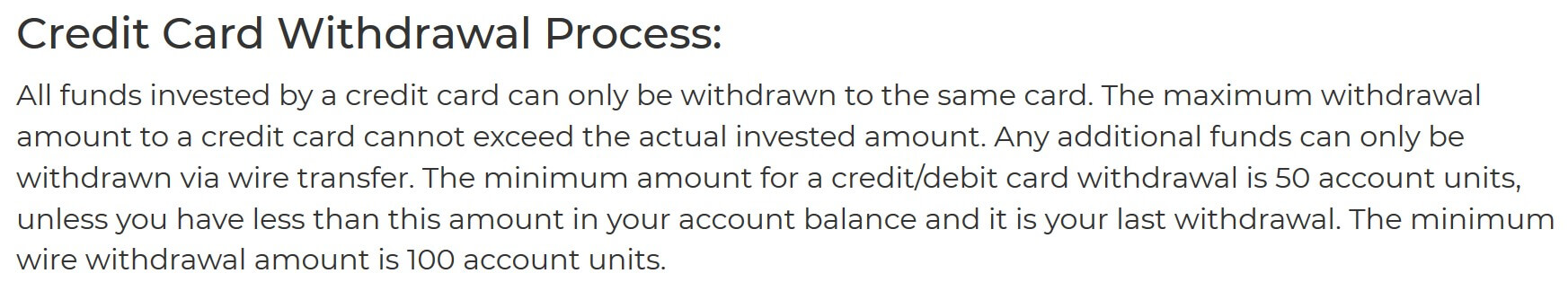

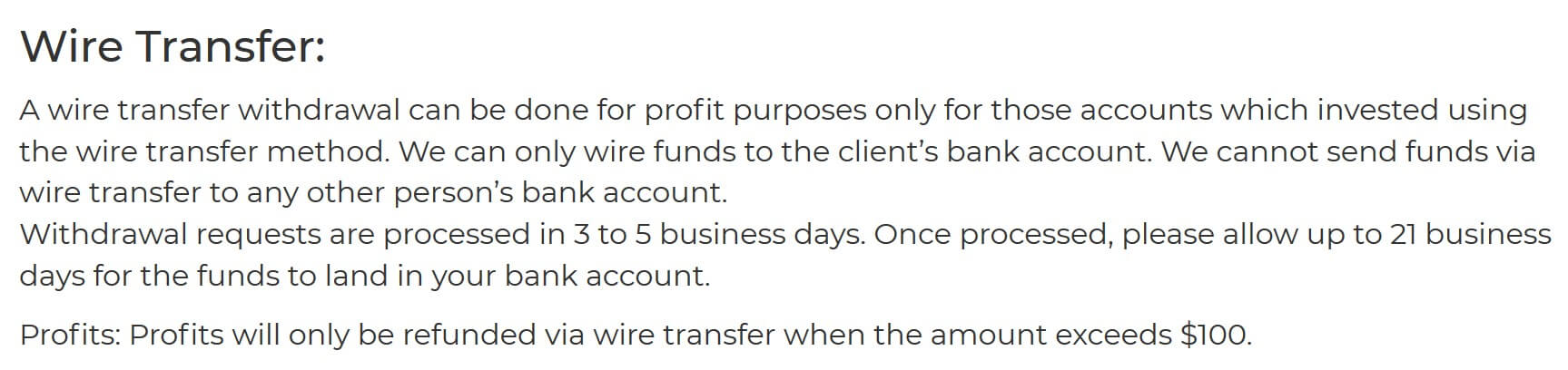

Withdrawal Methods & Costs

The same two methods are available to withdraw, for clarification those are Credit / Debit card (both Visa and MasterCard) and Bank Wire Transfer. There is again no mention of any fees but be sure to check with your bank in case they add any of their own. The minimum withdrawal is 50 unite with a Credit / Debit Card and 100 unite for Bank Wire Transfer.

Withdrawal Processing & Wait Time

TradeTLD will process withdrawal requests within 3 to 5 business days, they suggest waiting up to 21 business days to receive the funds in your bank account which is an incredible amount of time and not one many people would be happy with.

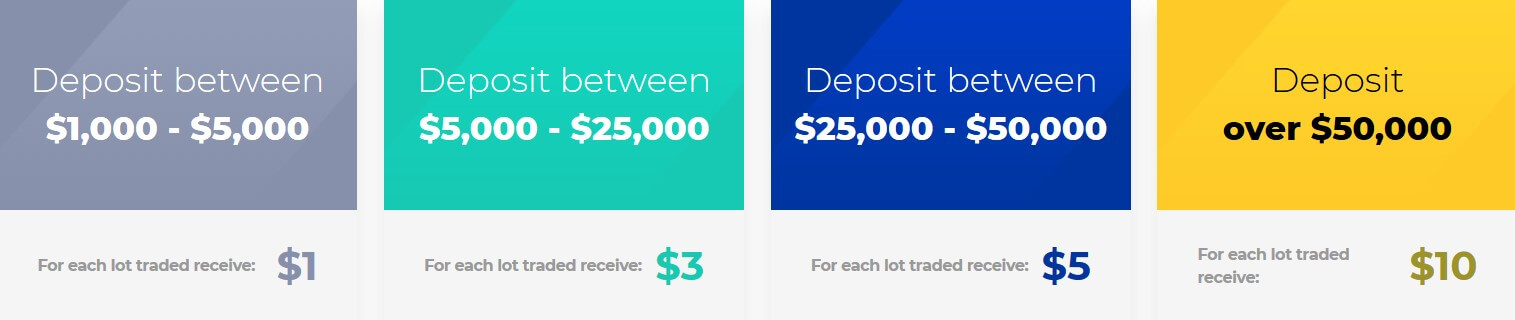

Bonuses & Promotions

It seems that the only bonus currently is the cashback program mentioned in the accounts section. We have set out a little list below of how much cashback you will receive based on your deposit amounts.

- $1,000 – $5,000 = $1 for 1 month

- $5,000 – $25,000 = $3 for 2 months

- $25,000 – $50,000 = $5 for 3 months

- $50,000+ = $10 for 6 months

Educational & Trading Tools

There are a few different educational items available for you to use, there is an E-book looking at things like trading psychology, and different trading techniques. There is a news section, outlining different things that have happened in the news and what affect they had on the markets. There is also an economic calendar detailing upcoming news events and which markets they may affect, along with this tool are two calculators for pivots and Fibonacci. Finally, there is a market analysis that gives you an idea of which way the markets will go on a daily, weekly and monthly basis.

Customer Service

Should you wish to get in contact with TradeLTD between 8:00 (GMT +2) and 22:00 (GMT +2) from Monday to Friday. You can get in contact using the online submission form which you should then get a reply via email. There is also an email address to email directly along with a phone number should you wish to speak to someone over the phone.

Demo Account

There isn’t any mention of demo accounts which is quite strange as TradeTLD seems to have gotten everything else ready. Potential clients often like to use a demo account to test trading conditions and servers while current clients like to use them to test new strategies without risking capital. So it would be good for TradeTLD to ensure that they get demo accounts in the future.

Countries Accepted

There was no information on the site in regards to who can and who cannot open up an account so if you are interested in joining TradeTLD we would recommend getting in contact with the customer service team to see if you are eligible for an account or not.

Conclusion

TradeTLD offers a very slick looking website with plenty of information, their trading conditions seem competitive and welcoming. Plenty to choose from when it comes to trading platforms, it would have been nice for there to be more deposit and withdrawal methods and the potential 21 days to receive your withdrawals is quite shocking. The lack of demo accounts is also a little bit disappointing if you can survive those two downsides, the trading conditions can make TradeTLD an attractive option.