Trade cryptocurrencies using Fear and Greed Index – part 1/2

It’s a well-known fact that emotions move markets. Greed drives prices up, while fear drives them down. Human psychology always ends up being predictably irrational because a lot of people tend to react very similarly in certain situations.

If people behave almost the same way in certain situations, it is possible to make money trading by just being a contrarian. As an example, Baron Rothschild made his fortune by buying when others panic-sold. His philosophy was relying on “Buying when there’s blood in the streets.”

John Templeton once said to “Invest at the point of maximum pessimism.”

This rings true simply because – the greater the fear — the larger the opportunity for profit.

The Fear and Greed Index

If we conclude that a trader can be profitable by acting contrary to how others are acting, then it is important to pinpoint moments of fear as well as moments of greed.

This strategy is quite simple:

If others are greedy – be fearful.

If others are fearful – be greedy.

One well-known tool that measures cryptocurrency market sentiment is the Fear and Greed Index.

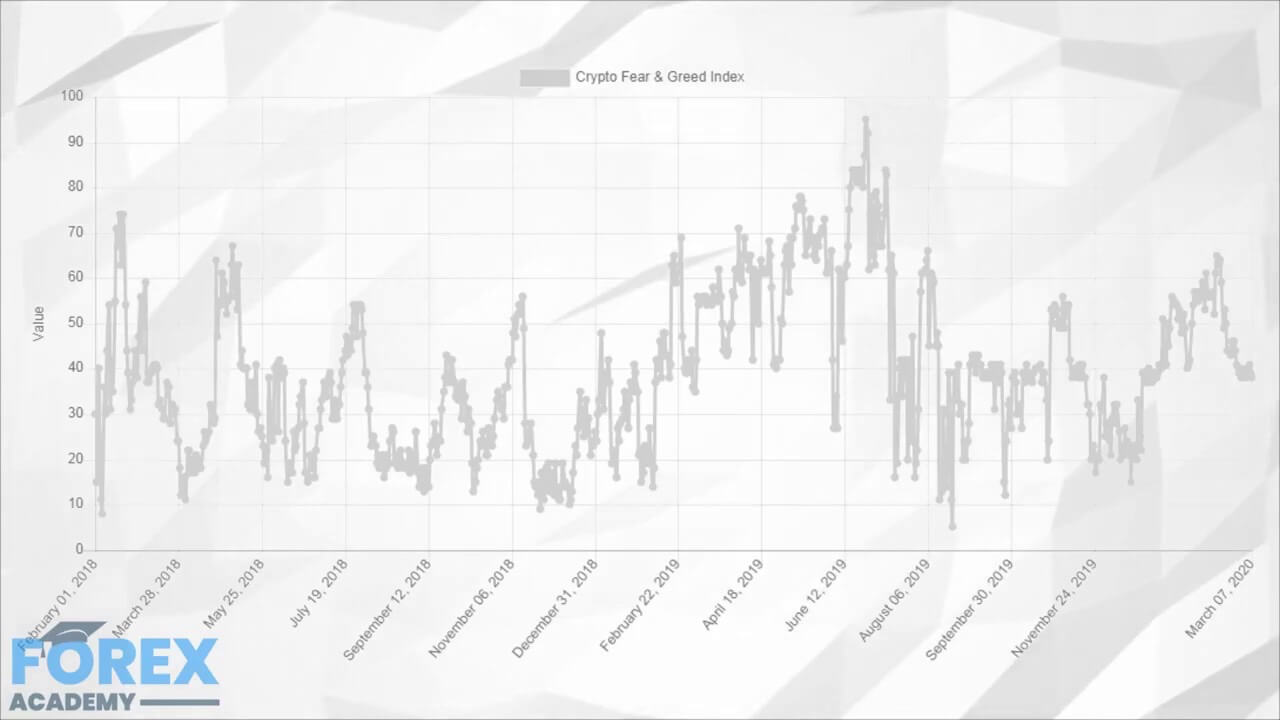

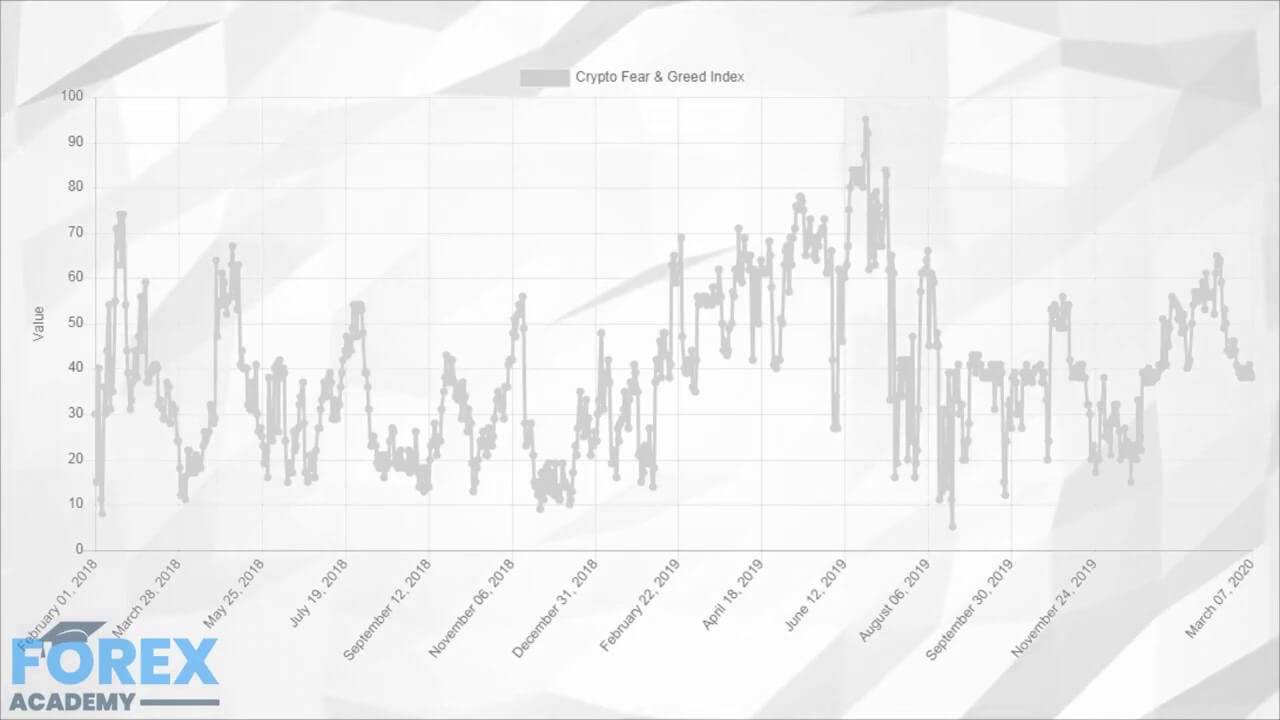

The Fear and Greed Index measures cryptocurrency market sentiment by aggregating data from various sources and generating them into one number, which is on a scale of 0 to 100. A value of 0 is known as “Extreme Fear,” while the opposite (a value of 100) represents “Extreme Greed.”

The data that the index uses is compiled daily. You can also glean the data of the Fear and Greed Index on a daily, weekly, monthly, as well as yearly basis.

Tendencies that show in the Fear & Greed Index

Extreme fear is a place where the first signs of greed are created. As we can see from the graph above, fear can quickly spiral out of control. However, every time the Fear and Greed Index is close to or below the 10 mark, the value of the index quickly reverses to the upside.

This brings us to the conclusion that every time high levels of fear dwells in the minds of traders and investors, opportunists use this market climate to their advantage. Following the ways of savvy investors such as Warren Buffet, Baron Rothschild, or John Templeton, these “bargain hunters” get greedy when others were fearful.

However, just like fear can quickly gain momentum, so can greed. And since emotions move markets, extreme fear drives prices down, while greed drives them up.

Check out part 2 of our Fear and Greed Index guide to learn more about how to use this tool to predict market movement.