To draw Support/Resistance, price action traders are to be sensible. They often need to be adjusted. In today’s lesson, we are going to demonstrate an example of this. To spot out support/resistance, traders are to aim the zones. Then, in the end, they are to draw levels to have the confirmation of a breakout. Let us learn more about this from the examples below.

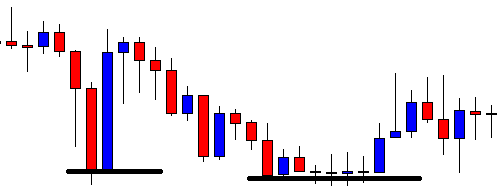

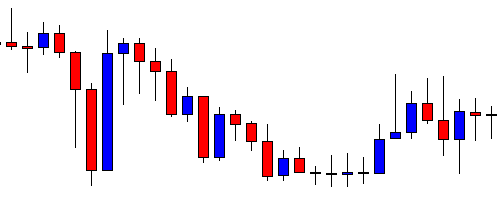

This is an H1 chart. The chart shows that the price has been choppy for quite a while. It has been roaming within a descending triangle. The price may make a breakout to either side. Let us work with horizontal support and spot out point/points where the price bounces twice.

We may spot out two points here. These two levels are nearby to each other. Without any doubt, this is a strong support zone. If we consider levels, we may get confused since we get two levels. In such a situation, we may closely observe what the price does around the last swing low. Let us proceed to the next chart.

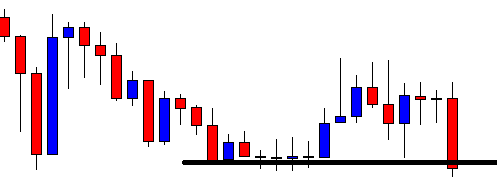

The chart shows that the last candle breaches the level of support (the last swing low). This is not an explicit breakout. We must wait for the next candle to have the breakout confirmation.

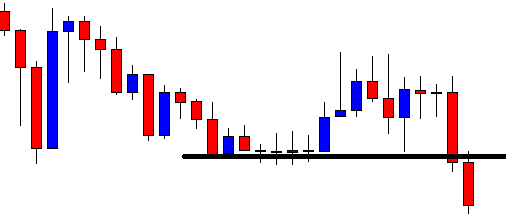

The next candle comes out as a bearish candle as well as closing well below the breakout candle. If we consider the price action for the last two candles, it is clear that the sellers have taken the control. The level of support at the last swing low holds the key as far as the last two candles’ price action is concerned. The H1 breakout strategy sellers may trigger a short entry right after the candle closes. Let us proceed to the next chart what the price does after triggering the entry.

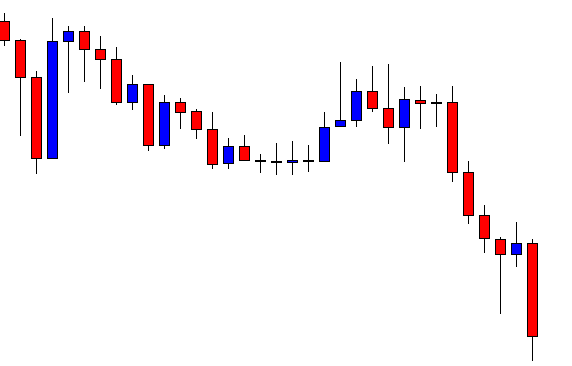

The price heads towards the South with good bearish momentum. The sellers achieve their 1R with ease. The last candle’s attributes suggest that the price may go towards the South further. In a word, this has been a prolific trade setup for the sellers.

If we consider the first swing low on this chart, we may get confused about the breakout. Considering the price action and the last swing low, it is a basic thing to understand that the price makes a breakout at the last swing low. The last swing low matters most as far as the breakout strategy is concerned. If the price consolidates after a breakout, then other levels (previous levels of support/resistance) may work as flipped support or resistance. This is one important thing to be remembered by the price action traders.