Introduction

Coming from the Latin word that defined the Roman coin denarius. Money is, in general terms, the preferred means for the exchange (charge vs. payment) of goods and services, likewise cancellation and/or acquisition of rights or obligations.

It can be associated with other functionalities or uses:

MONEY AS A MEDIUM OF EXCHANGE.

Money facilitates any exchange of goods and services among economic agents and reduces transaction costs. Any economic system with a high degree of specialization and division of labor uses money as a medium of exchange or payment of goods produced and services provided by different individuals or persons.

An economic system that excludes money as a medium of exchange of these transactions, involves the application of mediation type barter, time banks…

The following properties are required to achieve the present functionality:

- Homogeneity: The units must be identical or close.

- Divisibility in units small enough to be able to exchange any good.

MONEY AS A STORE OF VALUE.

To be able to recognize it as such, money must satisfy the characteristics of durability, allowing people to keep or accumulate wealth through savings.

Money brings the advantage of its liquidity, understanding this in its broadest possible terms, i.e., the temporary capacity that offers any good to be converted to money, without losing its value in commercial terms over time.

Time can affect the value of money in terms of purchasing power and its relation with market prices in its three temporalities: past, present, and future.

MONEY AS A UNIT OF ACCOUNT.

Environment-related to the setting of market prices of goods and services, as well as the control of accounts (accounting).

The monetary unit defines how to measure the expression of the value or market price. Each economic zone shall define its official monetary unit €; $; £…

MONEY CLASSIFICATION:

There are several kinds of money varying in liability and strength. When there was ample availability of metals, metal money came into existence later it was substituted by the paper money. According to the needs and availability of means, the kinds of money has changed.

COMMODITY MONEY

Commodity money is generally accepted as means of payment or exchange and is purchased or sold as an ordinary asset. Gold and silver have been the most common precious metals used as money. The value of this kind of money comes from the value of the resource used. It is only limited by the scarcity of the resource.

Some features: Durability; divisibility; transportable; homogeneity; limited offer…

Ex: gold coins, bread, metal, stones, tea, camels…

FIAT MONEY

A term used to denote a specific form of currency, not bound to any metal supporting it. A significant amount of the paper currency available all over the world is fiat money. Fiat money is backed by national governments as the recognized official medium of payment. Fiat money does not hold any inherent worth of its own, and they do not have the support from any form of reserve, as well. It is operating solely on faith, like the sterling used in Scotland. Nowadays, Fiat money is the basis of all the modern monetary systems. The real value of fiat money is determined by the market forces using demand and supply.

The fiat currency is also sanctioned by the Government for payments of taxes or other legal, financial obligations.

FIDUCIARY MONEY

Is conventionally maintained on a trust. The fiduciary normally retains the assets for a certain beneficiary, who could even be an executor of a will. Payments of fiduciary money could also be made in commodity money like gold or fiat money. Bank Notes and Checking Accounts are examples of the conventional forms of fiduciary money which, in this case, are provided by Banks.

Fiduciary money can be obtained from banks in the form of credible promises. These promises are eligible to be transferred and do perform the functions of conventional money.

The present-day world attaches higher importance to the token money whose variations are fiduciary money and fiat money, which differ significantly from commodity money.

Ex: Bank Notes, checking accounts…

COMMERCIAL BANK MONEY:

It´s possible to describe a commercial bank like an entity that essentially deals with loans and deposits from major business organizations and corporations. Are the most important components of the whole banking system.

The Central Banks and its functions

A Central Bank is a public entity, autonomous and independent of the Government, responsible for the monetary policy of a country.

There´re seven examples of important Central Banks around the world:

Among its functions we can highlight:

Among its functions we can highlight:

- Establishing the purposes and instruments of monetary policy and implementing.

- Setting the official interest rate.

- Centralizing and controlling economic operations abroad, especially making the purchase and sale of foreign currencies that are necessary Managing the country´s Foreign Exchange and gold reserves.

- Supervising the financial system to ensure its proper functioning and that there are no problems that may affect the economy as a whole.

- Authorizing the issuance of bills and coins in exclusivity à Controlling the nation’s entire money supply.

- Acting as a bank of commercial Banks and Government bank.

Since it is responsible for Price stability, Central Banks must regulate the level of inflation controlling the money supply, through the use of monetary policy. A Central Bank performs open market transactions that either inject liquidity into the market or absorb extra funds, directly affecting the level of inflation.

Money Creation

The majority of money in the modern economy is created by commercial banks when making loans.

Money creation in practice differs from some popular misconceptions — banks do not act solely as intermediaries, lending out deposits that savers place with them, and they do not ‘multiply up’ central bank money to create new loans and deposits, either.

The amount of money created in the economy ultimately depends on the monetary policy of the central bank. In normal times, this is carried out by setting interest rates. The central bank can also affect the amount of money directly through purchasing assets or ‘Quantitative Easing.’

Quantitative Easing (QE) is an unconventional form of monetary policy where a Central Bank creates new money electronically to buy financial assets, like government bonds. This process aims to directly increase private sector spending in the economy and return inflation to target.

The aim of quantitative easing is to encourage spending, keeping inflation on track to meet the Government’s inflation target.

QE works, i.e., when we buy gilts, it pushes up their price and so reduces the yield (the return) that investors make when they buy gilts. This encourages investors to buy other assets with higher yields instead, such as corporate bonds and shares. As more of these assets are bought, their prices rise, pushing down borrowing costs for businesses, encouraging them to spend and invest more. We also buy a smaller amount of corporate bonds, which makes it easier for companies to raise money which they can then invest in their business.

Money creation processes by the aggregate banking sector making additional loans

Limits to broad money creation

Limits to broad money creation

- Banks themselves face limits on how much they can lend. 3 Constraints:

- Market forces constrain lending because individual banks have to be able to lend profitably in a competitive market.

- Lending is also constrained because banks have to take steps to mitigate the risks associated with making additional loans.

- Regulatory policy acts as a constraint on banks’ activities to mitigate a build-up of risks that could pose a threat to the stability of the financial system.

- Money creation is also constrained by the behavior of the money holders: households and businesses. Households and companies who receive the newly created money might respond by undertaking transactions that immediately destroy it, for example by repaying outstanding loans.

- The ultimate constraint on money creation is monetary policy. By influencing the level of interest rates in the economy, the monetary policy affects how much households and companies want to borrow.

That occurs both directly, through influencing the loan rates charged by banks, but also indirectly through the overall effect of monetary policy on economic activity in the economy. As a result, the Central Bank is able to ensure that money growth is consistent with its objective of low and stable inflation.

Money Offer

The total amount of existing money, also called money supply, in an economy consists of cash in the hands of the public and the deposits held in the banks.

That amount of money grows or decreases as a result of bank credit and preference for the public’s liquidity, which together determine the value of the monetary multiplier.

The money supply, M, is, therefore, the result of the expansion of the base money, M0, due to the effect of the monetary multiplier m:

In the money multiplier process, the key is in a very important proportion: the ratio between the reserves of the banks (they correspond to their deposits in the central bank) and the deposits of the public in the banks plus other liabilities.

In the money multiplier process, the key is in a very important proportion: the ratio between the reserves of the banks (they correspond to their deposits in the central bank) and the deposits of the public in the banks plus other liabilities.

Banks want to keep that ratio at a certain level, partly to have liquidity with which to deal with withdrawals of funds from their customers and operations with other banks, but, above all, because their central bank, usually, requires them to maintain this relationship above a minimum level.

Depending on the central bank they have different names:

- ECB → Mandatory minimum reserves

- FED → Required or mandatory reserves

Therefore, banks keep a slightly higher proportion than the mandatory minimum, so as not to run the risk of breaking that coefficient. Although, they are not interested in keeping a liquidity level too high because it would mean a loss of return that’s obtainable if they’re able to spend that excess liquidity to buy profitable assets.

Then, when the volume of reserves of banks increases above the mandatory minimum ratio, bank entities may grant credit to the private sector and the public sector. The opposite occurs when their volume of reserves is decreased.

An example to clarify this issue:

Let’s assume that the proportion desired by the Central Bank in a certain country is 2%; that is, for every 100 monetary units in deposits, banks need to hold two 2 units in liquid assets.

Imagine that yesterday all banks fulfilled that proportion, and, today, the volume of liquid assets on a certain bank has increased by 100 monetary units. Now, its coefficient is higher than the 2% desired, therefore, the bank will be interested in placing all or part of that surplus, awarding, for example, a credit to the private sector.

How will the maximum amount be known? If the numerator has increased by 100 monetary units and the quotient has to remain 2%, the denominator is allowed an expansion of up to 5,000 monetary units. The process of creating money and the process of creating credit have been launched, the final result of which is a high multiple of the initial operation.

We should understand that the amount of money in circulation varies at every moment, due to the thousands of simultaneous operations of creation, and destruction. It is interesting to realize that Central Banks control this creation process, and for this purpose, it needs a mechanism to increase or reduce the reserve account of the banks and a mechanism to regulate the creation of credit when the reserves grow, as previously commented. It is here when the so-called Monetary Policy is applied.

Each central bank has its own objectives. As is the case of the ECB, whose sole objective is price stability through a low and steady inflation rate of less than or equal to 2% per annum. On the contrary, the FED pursues two objectives: price stability without a quantified inflation level, and maximizing employment, together with the sustainability of long-term interest rates.

The implementation of the monetary policy requires the use of one or several instruments for the creation and destruction of reserves, thus, establishing the initiation of a process of creation or destruction of credit and money.

Although they manage a wide set of tools, they can be summarized into three:

- A mechanism for withdrawing and conferring credit from and to the banks. This is the case of the periodic liquidity auctions by the European Central Bank.

- Open market operations: buying or selling public debt to banks. When a central bank purchases government bonds from banks, it injects liquidity into the system, and the opposite happens when the central bank sells public doubt to the banks. This is one of the main tools currently used by the FED. Remember the explanation of QE.

- And last but not least is the required minimum reserve ratio, where its decrease releases liquidity in banks and increases the amount of money. The opposite holds when there is an increase in the coefficient. It is important to take into account the limited widespread use of this tool. That’s because it usually causes large distortions on the bank’s liquidity.

Interest rate

Interest rate

The interest rate is a variable that is present in almost all decisions of households, companies, financial entities and Governments. These decisions refer to actions or consequences that take place at different times of time and therefore, the interest rate represents the price of time. We could interpret it as the prize that is demanded to delay the enjoyment of something from today until tomorrow or the premium that you have to pay to advance that enjoyment from tomorrow to today.

Although there are many types of interest, let’s focus on interest rates of assets and liabilities and financial operations; so we would be dealing with the returns obtained when lending or placing wealth in a financial asset or the cost of Debt.

As already mentioned, central banks usually use two instruments to increase or decrease the circulation of liquid assets or reserves held by banks:

- The granting of credit to banks →

- Open market operations →

Central banks usually manage these instruments through a very short-term interest rate. Following the examples of the previous central banks, it is known that the ECB periodically announces an interest rate of the main financing operations that serves as a guide to the banks to the banks for the weekly credit auctions. The extent of that interest rate and its expected future changes will be a useful indicator of the expansive or contractive nature of monetary policy. An increase in that interest rate is indicative of a tightening of monetary policy, that is, a liquidity contraction and a higher cost of central bank credit, as well.

In the FED’s case, this decision sets the federal funds rate, indicating the interest rate at which it is willing to buy public debt to the banks to provide them with liquidity or, to sell it, thus, withdrawing liquidity. Therefore, that rate and its expected or announced changes will also imply changes in the sign of monetary policy.

However, the central bank controls the short-term interest rate, but families, companies, and Governments are mainly affected by the longer-term rates. This means that monetary policy has a limited, but real, effectiveness on financing conditions.

Therefore, a better understanding of the role of monetary policy in setting interest rates establishes:

- In very short terms, interest rates are usually controlled by the rate that the Central Bank uses to implement its monetary policy. If, as an example, we say that the eurozone banks are receiving ECB weekly credits at 2%, a logical assumption will be that the next week’s interest rates will be close to 2%, except if excesses or significant liquidity deficiencies

- manifest the Monetary authorities can also influence the longer-term rates, announcing their purposes about future interest rates. That would be the case, for example, when they announce they will keep their interest rates very low for one year.

- Authorities may also influence long-term nominal rates if they announce a feasible and credible inflation target.

Central Banks, at best, can only control nominal rates, because the expected rate of inflation will depend on the expectations of economic agents.

In a simplified way, the likely evolution of the relationship between short and long-term types in a country is as follows:

If we take as starting base a situation of a balanced performance of the economic activity, with normal market returns and subsequently, the economic activity accelerates, along with inflation expectations, its likely outcome will be a rise of the long-term interest rates.

Under these conditions, it is likely that the central bank decides to practice a restrictive monetary policy, and therefore, a rise in the interest rates in a very short time.

This monetary policy will end up moderating production and prices. As the markets anticipate this result, the long-term rates will fall again and the central bank will be able to reduce the restrictive nature of its monetary policy by returning to equilibrium.

Inflation shows the upward or downward movements of thousands of prices, which implies the difficulty in identifying the continuous and sustained changes in the set.

Inflation shows the upward or downward movements of thousands of prices, which implies the difficulty in identifying the continuous and sustained changes in the set.

However, the accuracy shown is relevant because a price variation may arise from many possible causes. In the same fashion, it happens on the movements and one-time changes in many prices, and, also, on the seasonal changes. But beware: a continued and sustained rise in the overall level of prices will not happen without any visible cause.

Who is worried about inflation?

- Governments

- companies

- workers

- customers

Why?

- A rise in domestic prices not compensated by the depreciation of the currency produces a loss of competitiveness with other nations.

- Price raises may alter the distribution of income and wealth, damaging agents who have not been able to anticipate or protect against that. It is for this reason that countries suffering from high and variable inflation also experience episodes of malaise and social conflicts.

- Inflation can extend over time, generating expectations that often auto-fulfill.

- It is a non-democratic and regressive tax on money.

- If inflation is large and variable, it may generate large inefficiencies.

- Stopping inflation, once installed, is usually difficult and costly.

What is the cause of inflation?

If we take supply and demand as our base assumption, many possible causes can be identified, some on the demand side, such as the increase in consumer income and others on the supply side, such as an increase in the productive factors or the tax levied on the product.

Please note that a significant rise in prices will reduce the purchasing power of money, which leads to a monetary concentration. That will, in turn, raise interest rates and slow down the growth of production and prices. However, this will not happen if the growth of money supply is accelerated, which reduces the real interest rates, and, consequently, founds the increase in aggregate demand (consumption, investment, public expenditure, exports, and imports).

Faced with this reality, the following we may state the following:

- If inflation is not accompanied by growth in money supply, a larger growth on some of the components of aggregate demand or costs (labor, raw materials) will generate a one-time price increase.

- The creation of an adequate money supply is a necessary condition for any sustained growth of the general price level.

In addition, it can also be a sufficient condition for inflation since if economic agents receive more money than they need to finance their transactions, they will spend it, and in that process, they will generate an increase in the demand for goods and services and a rise in prices.

- Not all changes in money supply cause a rise in prices: Companies whose sales grow will need a larger balance of money in their possession, money the company won’t expend so that it won’t produce price increases.

- Therefore, the following approach arises:

Inflation is always a monetary event caused by the excessive growth of the amount of money concerning what is necessary to finance the real growth of the economy. That explains why Central Banks are committed to controlling inflation: because they control the amount of money.

To understand the relationship between Central Banks and inflation, it should be conceded that usually, the monetary authority of a country establishes the objective of its monetary policy in terms of the desired inflation rate (∏*). This rate of inflation that is usually low, stable and positive, will be the one that the monetary authority tries to achieve in a relatively long term and in this way avoid an erratic monetary policy. Sometimes they include a goal regarding the rate of growth of the gross domestic product, trying to match the potential growth rate of the economy (y*), compatible with a complete use of resources, so that below (left) it, costs tend to be reduced by the pressure of unemployment and above (right), costs tend to increase due to over-use of resources. Therefore, observing the following table, it is understood that point A is the one desired by the monetary authority, as previously mentioned.

If the economy is at point E, the Central Bank will practice an expansive monetary policy and keep interest rates low. When approaching B, it will probably raise the interest rate, with the objective of preventing the economy from moving to the right of y* (before arriving at A) given the slowness of the effects of monetary policy.

In C the monetary policy of the Central Bank will be clearly restrictive, in an attempt to return to A.

In D, the Central Bank will be faced with several alternatives: If it pursues the objective of inflation the action will raise interest rates with the consequent accentuation of the recession. Establishing here an observation beacon for monitoring the reaction of economic agents. I.e. The fear that trade unions might push for higher wages increases the likelihood of an interest rate increase. This explains the reason for the reaction of the Central Banks to the rise in costs such as oil or ad valorem taxes even if they produce one-time price increases → The fear that that may turn into wage increases, even more so if they use automatic indexing on wages.

An inflation like C is attacked by the use of a restrictive monetary policy, and a reduction of the rate of growth in production is the first parameter to be affected, which will shift to F, and solely after a while, it will end up achieving the objective: A.

Inflation is maintained around the desired level ∏* through an expansive monetary policy but at a very moderate level, and it must be accompanied by other measures such as:

- The prohibition for the central bank to finance the public deficit, thus avoiding the excessive growth of the amount of money.

- A monetary exchange rate policy compatible with the monetary restriction

- Salary moderation as a countermeasure, to avoid more rigorous monetary restrictions and its negative effects such as unemployment and recession before inflation can be reduced.

- Credibility and perseverance in government policy, because if Government’s announcements lack these attributes in the eyes of the economic agents, the moderation of inflation will be a lot more difficult.

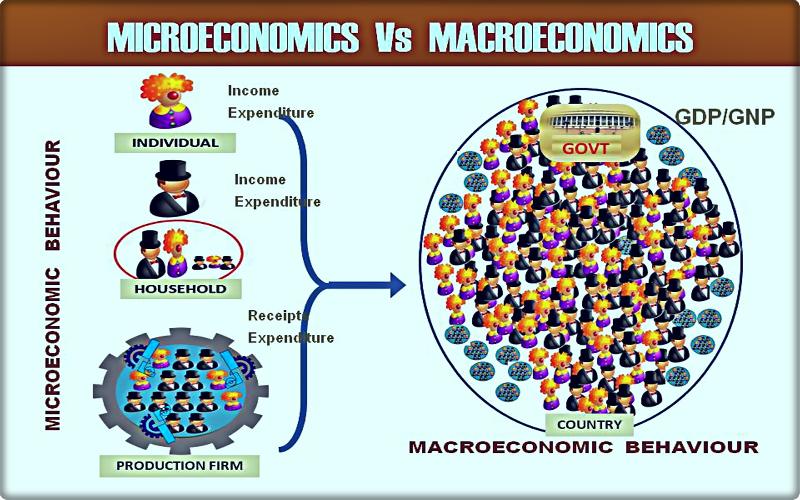

Value: To be able to add the production of heterogeneous goods and services and express them in a common monetary unit: Pound Sterling, Dollar, Euro.

Final: To avoid the problem of the double accounting of goods that become part of the production of other goods and services, such as raw materials and intermediate products. GDP equals added value.

Of Production: Not of sales.

Of goods and services: But only the remunerated ones, so leisure, study, bricolage… and the legal ones are excluded. Underground economy and the illegal activities are not included: drug trafficking …

In a country: Region or city. It will depend on what you want to cover.

During a given period: (one quarter, one year …). Transactions carried out with goods produced in the past are not included.

At market prices: (sale to the public) including net indirect taxes (VAT).

To understand GDP, it is necessary to know other concepts related to:

There are three procedures to calculate the GDP of a country:

Kind regards

©Forex.Academy

Among its functions we can highlight:

Among its functions we can highlight:

In the money multiplier process, the key is in a very important proportion: the ratio between the reserves of the banks (they correspond to their deposits in the central bank) and the deposits of the public in the banks plus other liabilities.

In the money multiplier process, the key is in a very important proportion: the ratio between the reserves of the banks (they correspond to their deposits in the central bank) and the deposits of the public in the banks plus other liabilities.

Interest rate

Interest rate

Inflation shows the upward or downward movements of thousands of prices, which implies the difficulty in identifying the continuous and sustained changes in the set.

Inflation shows the upward or downward movements of thousands of prices, which implies the difficulty in identifying the continuous and sustained changes in the set.