If we want to take our Forex trading to a higher level, it is necessary to have some knowledge of microeconomics and macroeconomics. Perhaps the macroeconomic aspects are more relevant for the trader, but here we will show you everything you at least need to know about both disciplines.

Many people who approach the world of Forex or the financial markets in general wonder if they have the right preparation to carry out such activity and some wonder if it is necessary to have a university degree or studies in economics to be able to trade in a market like Forex.

In reality, online broker platforms open the doors to everyone, but having the possibility to invest a certain capital in a particular market is simply an opportunity: does not in any way mean that more specialised knowledge or information can be dispensed with.

On the other hand, a short-term operation like most that takes place in the various currency markets tends to be influenced to a large extent by what happens in the world.

For example, news about a country’s politics makes its currency more or less stable.

But what is Microeconomics?

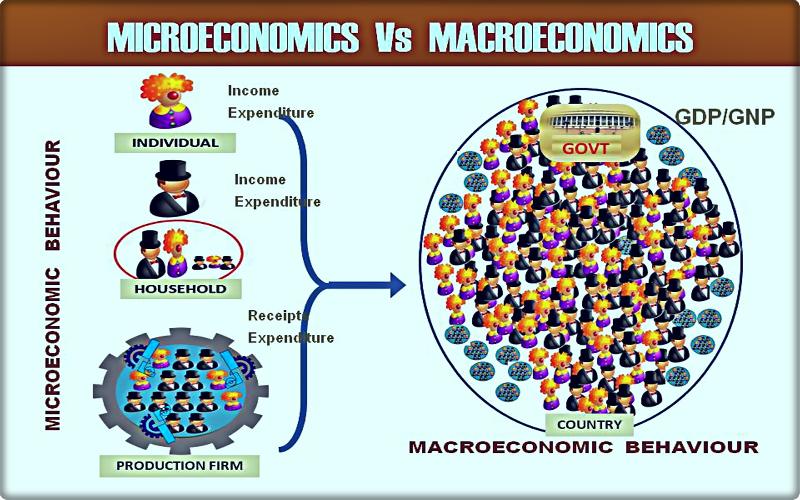

Microeconomics analyses the decisions of individuals and different economic agents in a theoretical way. This discipline proposes simplified models of reality in order to understand the implications of personal decisions and how to decide.

Is Microeconomics the Economy of the Small?

Not exactly, Microeconomics studies the decisions of the different economic agents from the individual point of view. For example, Microeconomics analyses the decisions of companies, large or small.

How does Microeconomics analyze decisions?

Microeconomics connects the objectives of economic agents with their possibilities. These economic actors will try to achieve their objectives to the maximum extent possible, but bearing in mind that other economic actors will also try to do the same.

What kind of economic agents study microeconomics?

Microeconomics studies the decisions of both individuals and groups as a family, a company, an association… Thus, for example, it stops at the decisions of the State, but also at those of individuals who make decisions within the State.

What forms of expression does Microeconomics use?

It uses three forms of expression: the intuitive way of expressing itself through spoken or written words, the graphical form, and the use of mathematics.

Intuitive: Analyzes decisions through discourse, offering greater proximity to unfamiliar audiences. It has a didactic interest since what is understood either graphically or mathematically must be explained.

Graphs: Very useful when making comparisons and understanding the effects of a certain type of situation on the decisions of individuals.

Mathematics: They are a tool for calculating, but above all for thinking. They provide rigor and conciseness, favoring the analysis of how many factors influence decisions. Many discourses can be replaced with an equation.

Does Microeconomics Help to Understand the Financial World?

Much, more every day. Finance involves many decisions such as how much to save and how much to consume, what to invest in, or how to cover that risk. It also provides tools to understand the strategies that occur in the interrelationship of the actors involved in the financial system.

What about the company world?

One of the growing interests of Microeconomics is to understand the decisions of all kinds that take place in the company. Aspects such as commercial, financial, human resources decisions, etc.

What is the macroeconomy?

Macroeconomics analyses and studies the overall functioning of the economy, in order to explain the evolution of economic aggregates.

What is macroeconomics good for?

Macroeconomics is useful because it allows us to analyse how best to achieve a country’s economic objectives. Economic policy is the tool that governments have to achieve these goals. Objectives such as achieving price stability, achieving economic growth, promoting employment, and maintaining a sustainable and balanced balance of payments.

Some questions we can ask ourselves…

– What are the data that usually have the greatest impact on financial markets?

-Could an increase in consumer prices affect currencies and other instruments?

-Why is economic growth important to investors around the world?

An important part of the fundamental analysis is related to the publication of macroeconomic data. While some indicators have a greater impact than others, the publication of data that takes the market by surprise – either by being published in advance or by exceeding expectations – can cause considerable market volatility.

Employment, the pulse of an economy

Probably the most relevant indicator of an economy’s health is the employment figure. This is because employment directly influences all aspects of economic activity, from supply to demand.

Unemployment rates inform us of the percentage of the total workforce that is unemployed but active in employment and willing to work. A steady rise in unemployment levels is a manifestation of the country’s deteriorating economic situation, negatively perceived by financial markets as a signal to withdraw from the currency. Normally, the market concludes that the higher the level of unemployment, the weaker the currency.

Non-Farm Payroll (NFP)

One of the most important data with the greatest impact on markets is the non-agricultural payroll of the United States. Non-agricultural payrolls are released every first Friday of the month and inform us of new jobs in all sectors except agriculture, as well as the unemployment rate of the previous month.

Given that consumers account for approximately 70 percent of a country’s economic activity, the state of the labour market is of vital importance for the generation of the overall well-being of countries. An improvement in the NFP data indicates that the US labor market is strengthening, improving the outlook for the US economy, and therefore a positive effect on the US dollar.

Inflation, the key to central bank decisions

The main objective of central banks is to promote price stability in the economy. Price stability is measured as inflation changes, so investors monitor inflation reports to determine the future course of central bank policies.

CPI is probably the most important indicator of inflation

Here we are talking about a statistical estimate calculated on the basis of the use of prices of a significant sample of representative products whose prices are collected on a regular basis. The CPI simply measures the rise in the prices of goods and services and is calculated for different categories and subcategories.

If the publication of the CPI is above expectations, this means that inflation pressure is high and the central bank could raise interest rates, which could lead to an increase in the value of the currency.

In general, central banks try to counteract an increase in inflation with higher interest rates, which can lead to a strengthening of currencies. A low inflation rate on the other hand is offset by lower interest rates, which can lead to a weakening of the currency.

GDP – the true color of an economy

It is the largest indicator of a country’s economy and shows the total market value of all services and goods produced in a given year. Impacts of GDP on personal finance, investment, and employment growth. Investors look at the growth rate of a country or economy to decide whether to adjust their asset allocation. They also compare countries’ growth rates with each other to decide where the best opportunities might be. This strategy includes the purchase of shares of companies in fast-growing countries.

When you start in the world of negotiation and trade, it is very convenient to focus on the indicators we have mentioned before, before you want to move forward and delve into other data such as consumer confidence, business surveys, or even retail sales.