Introduction

The Euro Area’s euro against the Danish Krone, in short, is written as EURDKK. This is an exotic pair in the forex market. Typically, this pair is traded with low volumes. Here, EUR is the base currency, and DKK is the quote currency.

Understanding EUR/DKK

The current market price in the exchange of this pair depicts the value of Danish Krone equivalent to one euro. It is simply quoted as 1 EUR per X DKK. For example, if the current value of EURDKK is 7.4702, then about 7.5 DKK are required to buy one euro.

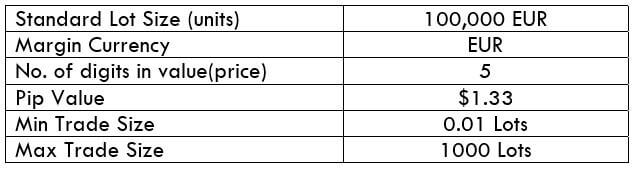

EUR/DKK Specification

Spread

In the foreign exchange market, spreads are the primary source through which brokers make money. They set a different price for buying and a different price for selling the same currency pair. This difference is referred to as the spread. This spread varies from broker to broker and also from the type of execution model used.

Spread on ECN: 40 pips | Spread on STP: 42 pips

Fee

This fee is the same fee is paid to the stockbrokers. In other terms, this is the commission that is paid to the broker. The fee on ECN accounts is between 5-10 pips, while it is nil on STP accounts.

Slippage

The difference between the price at which the trader executed the trade and actual executed price is called the slippage on the trade. This happens only on market orders, due to two reasons – Market volatility & Broker’s execution speed

Trading Range in EUR/DKK

As the name partially suggests, the trading range is a range of pip movements in a currency pair in different timeframes. Pip movement is also referred to as the volatility values. These values are extremely helpful in figuring the gain/loss that can be made on a trade.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

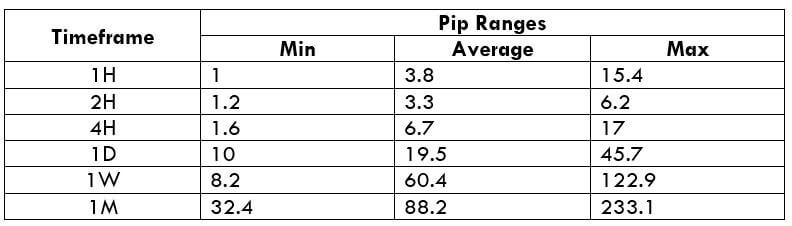

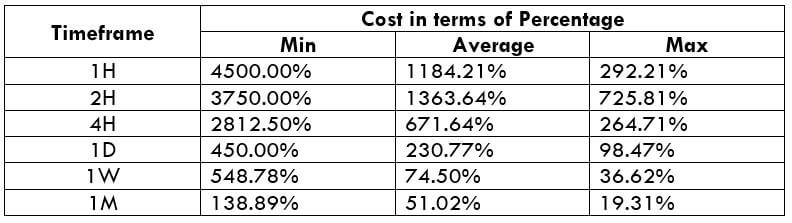

EUR/DKK Cost as a Percent of the Trading Range

The total cost of the trade is determined by summing up the slippage, spread, and the trading fee. And this cost is not fixed. It varies based on the volatility of the market. Below is the tabular representation of the cost variation, which is signified in percentages.

ECN Model Account

Spread = 40 | Slippage = 3 | Trading fee = 3

Total cost = Spread + Slippage + Trading Fee = 40 + 3 + 3 = 46

STP Model Account

Spread = 42 | Slippage = 3 | Trading fee = 0

Total cost = Spread + Slippage + Trading Fee = 42 + 3 + 0 = 45

Note: The costs may seem significantly high because of the Spreads. As we know, these Spreads keep changing from time to time. At times we have seen the spreads for this pair being as low as 12. But we have considered maximum spread to give you the maximum cost percentages.

The Ideal way to trade the EUR/DKK

Trading the EURDKK is different from trading the major/minor currency pairs. And this can be easily figured out from the percentage values.

From the table, we can infer that the percentage values are extremely high on the 1H, 2H, and 4H timeframes. This means that the costs in these timeframes are super-high. Hence, trading this pair on these lower timeframes is a bad decision.

However, if we look at the next three rows (1D, 1W, and 1M), we can see that the percentage values are significantly lower than the above values. Hence, this makes this pair tradable on the daily, weekly, and monthly timeframes.

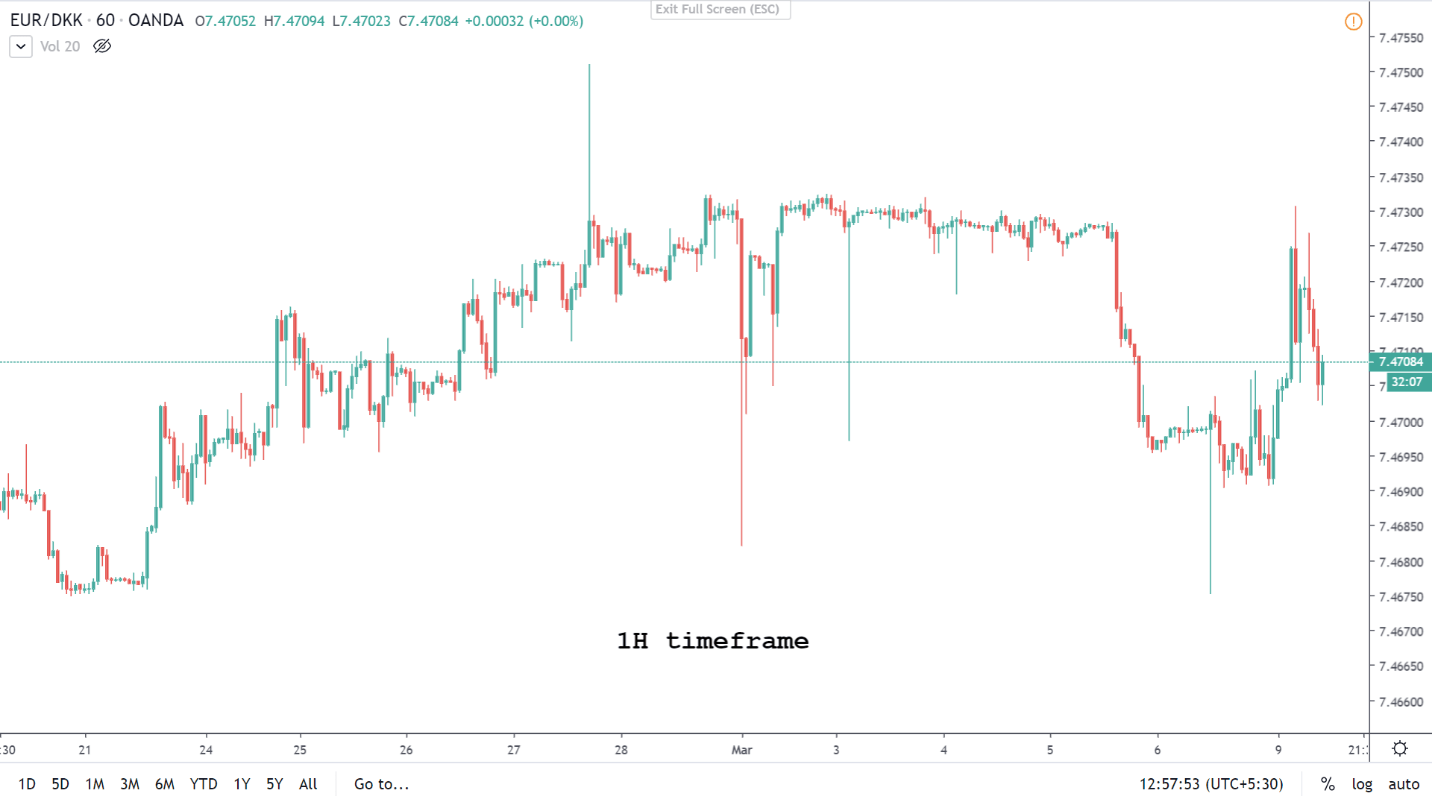

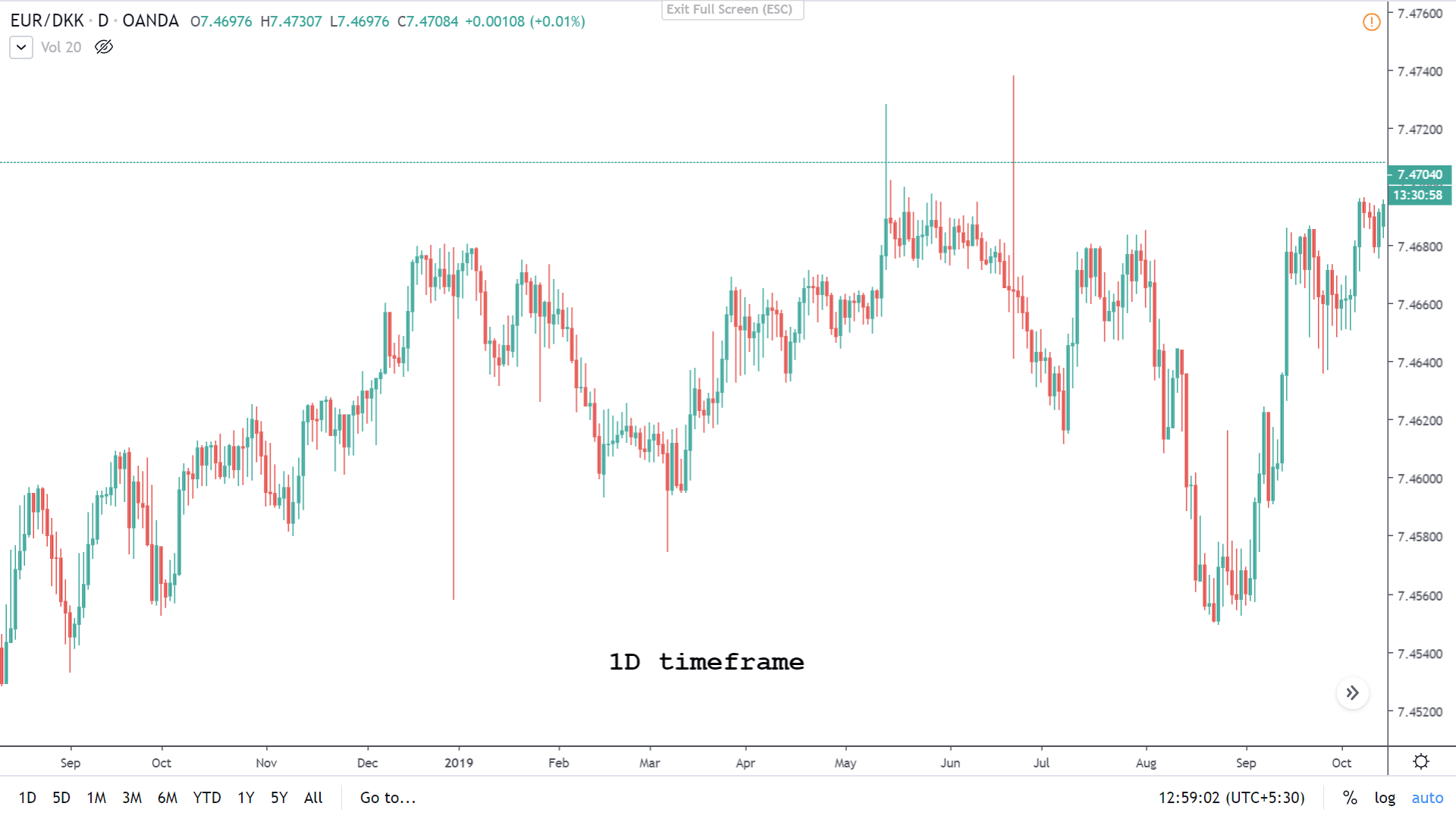

Consider the charts of EURDKK on the 1H and the 1D timeframe. On the 1H timeframe chart, we can see that there is barely any movement in the price. Also, volatility is high here.

On the other hand, on the 1D timeframe, there is enough movement in the prices, and the volatility is not very high as well. Hence, making it the ideal timeframe to trade.

Moreover, a simple and effective way to reduce costs is by trading using limit and stop orders instead of market orders. In doing so, the slippage will be completely nullified. Hence, the total cost will significantly reduce.