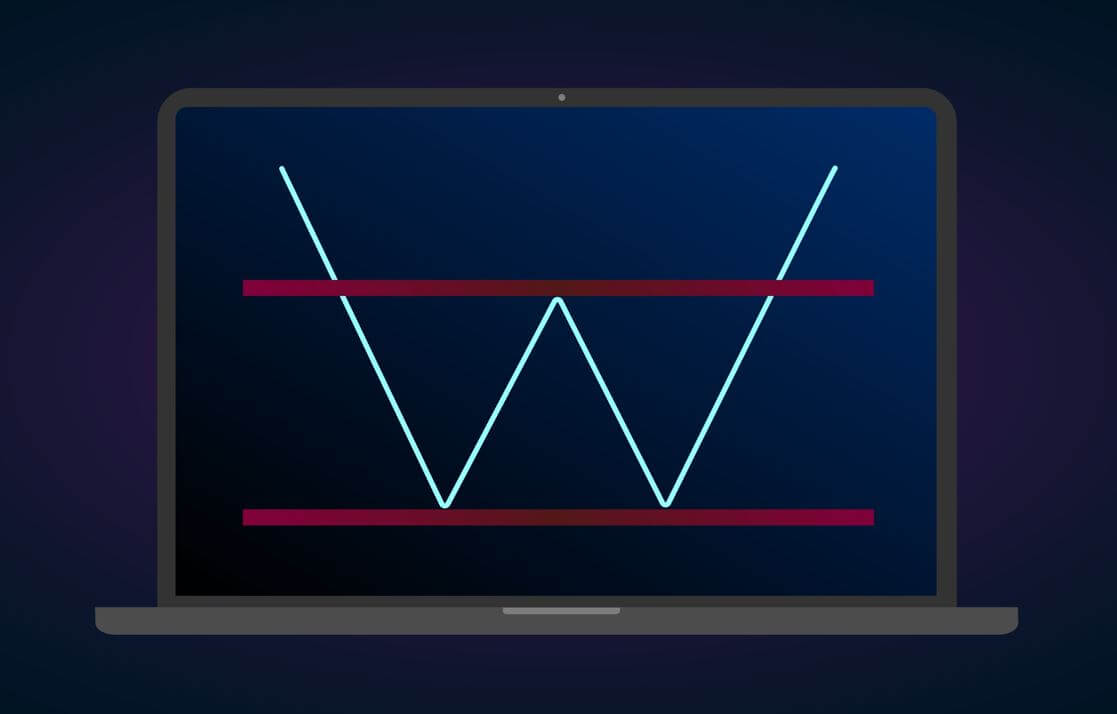

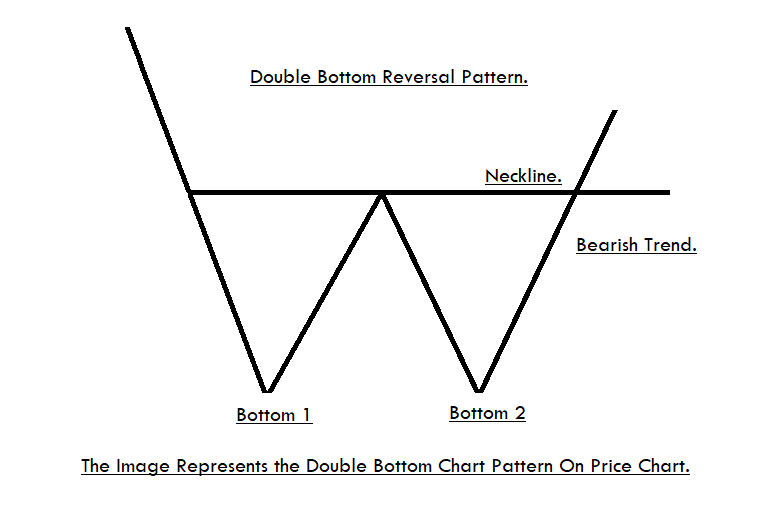

The double Bottom is a technical chart pattern, which helps to identify the change in the direction of the selling trend. The pattern looks like W in shape and it is quite a popular pattern among technical traders. In other words, double Bottom is a bullish reversal pattern. Most of the time double bottom reversals usually mark the long-term trend change in an instrument. In an ongoing downtrend, the price action drops to a floor, a significant support level before beginning the new uptrend. The pattern forms by two consecutive rounding bottoms with approx. Same heights. Most of the time, the momentum of the second Bottom is quite weak, which indicates that the weak selling momentum. Both of the round bottoms retrace until it finds the major resistance area that we call the Neckline. Overall, the pattern indicates that the professional traders, market movers booking the profits, and now the market are ready to print brand new higher high.

The image above represents the Double Bottom Chart Pattern on Price Chart.

Psychology Behind This Pattern

As by now you know that the double Bottom pattern occurs at the major support area, the pattern suggests that when the price action reaches the major support area, it means that the sellers are now afraid of the major support zone so they are booking their profits and as a result, the momentum of the market keeps dying. When price action prints the first Bottom, it indicates that some buyers try to buy; as a result, price action approaches the Neckline, and now at the Neckline, some sellers again try to hit the sell in order to print a brand new lower low. When price action reaches the major support area again, they failed to print a new lower low, and as a result, they booked the profit. Now the markets are entirely under the control of the buyers, and they are ready to print the brand new higher high.

Trading Strategies Using Double Bottom Pattern

Double Bottom Pattern + Bullish Candlestick Patterns

There are several bullish candlestick patterns that are widely used by technical traders in the market. You can use any bullish candlestick pattern to trade the market, some of the popular bullish candlestick patterns are Bullish Engulfing, Morning star, Gravestone Doji, Dragonfly Doji, Three white soldiers. These are widely used, and the most common candlestick patterns exist in the market.

The idea is to find out any bullish candlestick pattern at the second Bottom, when you find out any bullish pattern at the bottom area go long, put the stop loss below the support line, and the first take profit must be at the Neckline, second one should be double than the size of the pattern.

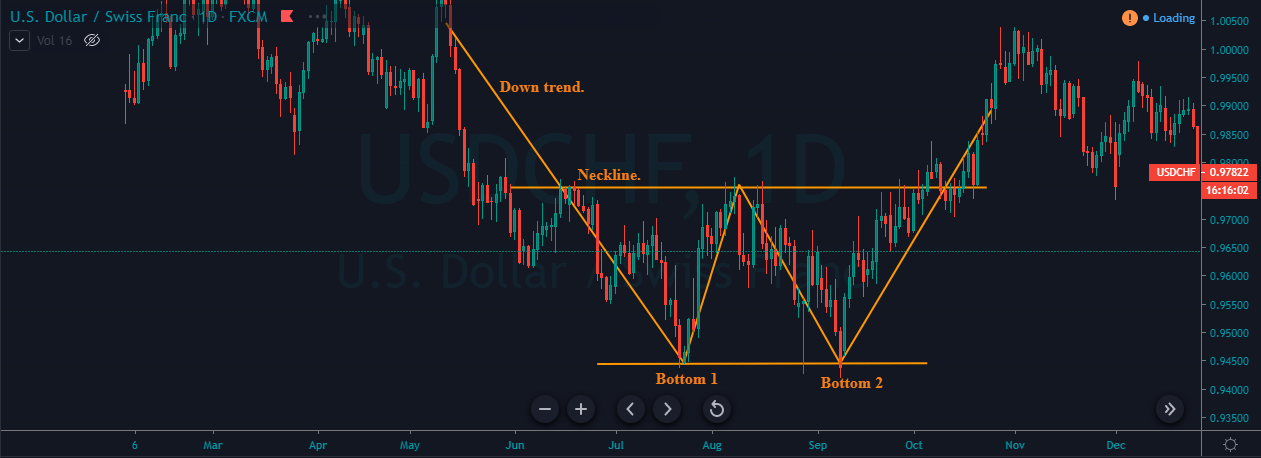

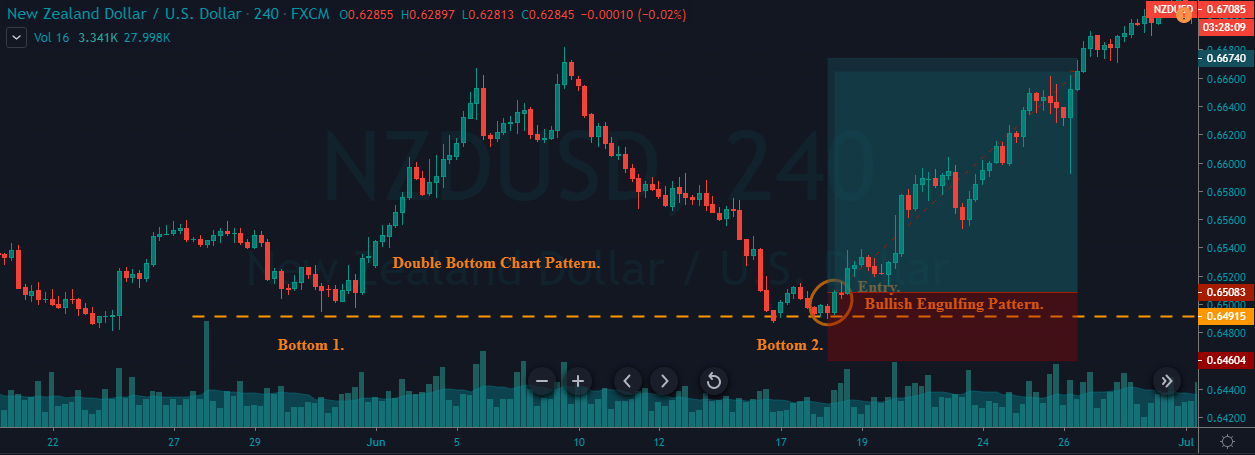

The below Image represents the double bottom pattern on the NZDUSD Forex pair.

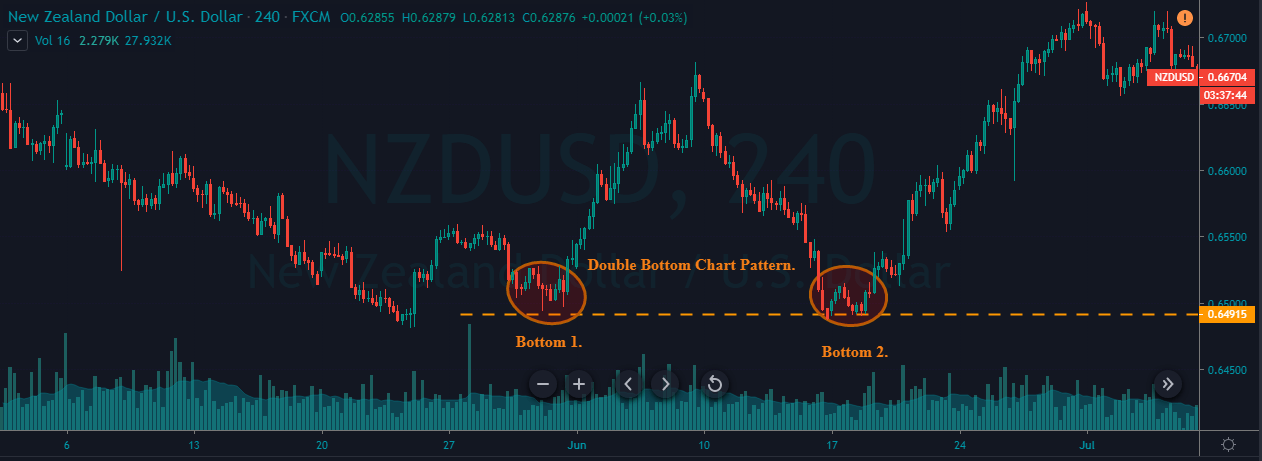

As you can see in the below Image, the market prints the Double Bottom chart pattern, which indicates that the buying trade in this pair. Initially, when the price action approached the support area, at that time, the momentum of the downtrend was really weak, but after the first retracement to the Neckline, the sellers try hard to print brand new lower, but they failed to do it. When price action hits the Bottom second time, the market prints the bullish engulfing pattern, which indicates the buying trade in this pair.

The below Image represents our entry and exits in this forex pair. We took long when the market prints the bullish engulfing pattern, and the take profit was below the second Bottom, the major support line below acts as dynamic support to the price action. You can even go with a smaller stop loss because the line below is so strong that it stops the strong selling trend and even reverse it completely. So you can imagine how strong this line is. The take profit was at the Neckline, you can close your position at the Neckline, or you can hold it for the further target. It is advisable to book half of the profit at the Neckline.

Double Bottom Chart Pattern + Stochastic Indicator

In this strategy, we paired the Double Bottom pattern with the stochastic indicator to identify the trading signals. Stochastic is a quite popular oscillator that is developed by George C. Lane in the 1950s. Most of the traders think that just like other indicators, stochastic also follow the price and volume, but it is not true. In fact, stochastic follows the momentum and speed of price action. The stochastic indicator is used to identify the oversold and overbought buying conditions, and traders use overbought/oversold conditions to trade the market. The indicator also identifies the divergence, which helps the traders to identify the major market reversals.

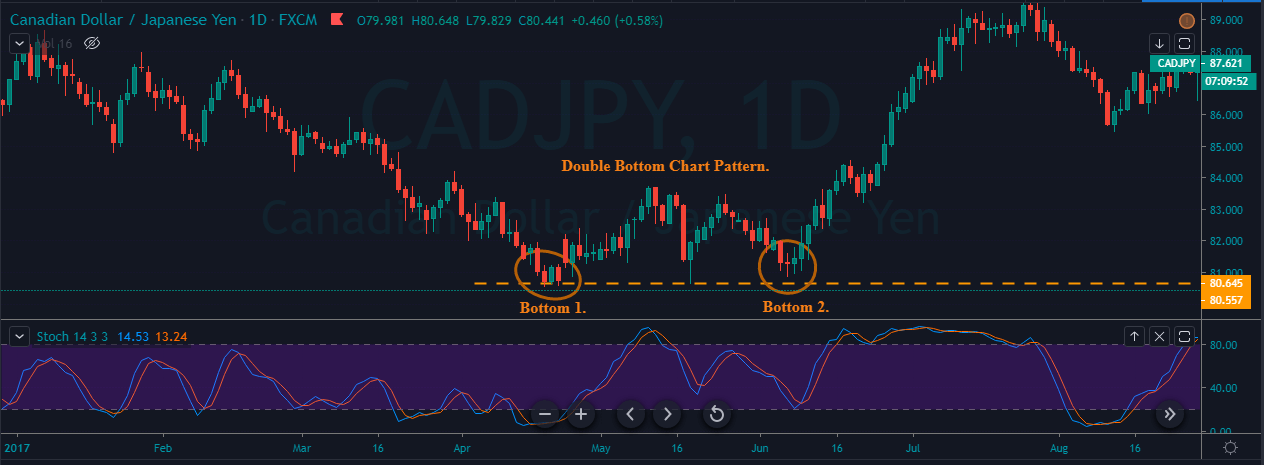

The below Image represents the Double Bottom chart pattern on the Daily chart of the CADJPY forex pair.

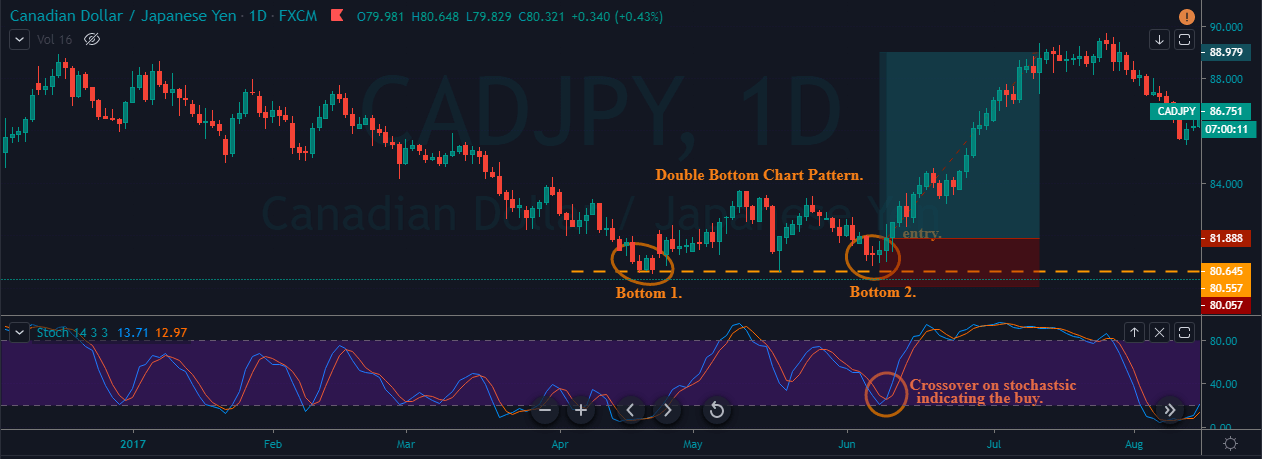

The below Image represents our entry in this pair by using the stochastic indicator and double Bottom chart pattern. As you can see that we took a long position when prices failed to go below the major support line. Most of the traders what they do is activate the buy trades when the price action hits the support line the second time. This is the wrong approach. Instead, let the price action holds and then activate your trade. As you can see, when prices hit the second Bottom at that time, crossover happened on the stochastic indicator, which indicates that the market is oversold and it is time to go long.

The below Image represents our entry and exits in this pair. We took long when the price action hits the second Bottom, also when the crossover happened on the stochastic indicator. Stop below the recent low, and the take profit was at the higher timeframe major resistance area.

Conclusion

The double Bottom is an extremely powerful chart pattern when it is interpreted correctly. If you interpret it incorrectly then it can damage your trading account. You can activate your trades when price action hits the second Bottom, or you can activate trades when price action crosses the Neckline and retests as support. It doesn’t matter where you activate your trade; both of the locations provide a good risk to reward ratio.