Blockchain was conceptualized the first time in 2008 with the launch of Bitcoin. However, it took almost a decade to be fully appreciated as an invaluable public ledger with the potential to disrupt virtually every modern industry. That was the year when the price of Bitcoin got close to $19,900 from a low of $978 at the start of the year, and Ethereum went above $850 from just over $8. At its peak value, Bitcoin’s market cap stood at $320 billion – higher than the total value of all M3 UK currency in circulation. This was before the infamous 2018 cryptocurrency crash of January 2018.

Predictably, the massive cryptocurrency explosion was followed by a big crash, from which many cryptocurrencies that had successfully launched ICOs (Initial Coin Offerings) never recovered. During the preceding explosion, blockchain technology was hyped as the most revolutionary since the internet, and many industries started figuring how it could work for them. From transportation and health industries to banking and voting, the promises and claims that the new technology brought may have set people’s expectations a bit too high too fast.

While famous investors, economists, and even finance professionals warned that the rapid rise of the cryptocurrency prices was a bubble that would ultimately burst, a world driven by vague expectations and hunger for profit failed to listen. Most people read the most subtle signs they wanted to see – such as the listing of bitcoin futures by the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) in December 2017 as a stamp of approval that Bitcoin and cryptos, in general, were ripe for investment.

Weaknesses of blockchain come to light

The rise in the popularity of blockchain and the rapid adoption of Bitcoin, Ethereum, and other cryptocurrencies brought blockchain’s most significant problem to light: it is expensive and can barely work on a large scale. When Bitcoin’s price soared to almost $20,000, its network quickly became overloaded, transactions took as long as a day to confirm, and transaction fees shot up to as much as $60 per transaction.

The world may not have been wrong to believe that blockchains presented a massive opportunity for the human race, but it was at this point that many started having doubts about whether Bitcoin was the currency of the future.

The blockchain technology was introduced to the world just at the right time when we were dealing with the aftermath of the 2008 financial crisis. However, in its current state, it cannot deliver on these promises on a global scale because it has one glaring weakness: it just cannot scale.

To see why this is such a concern, it is necessary to understand how blockchain works.

Blockchain is basically a list of ‘blocks’ of ordered data, in the case of cryptocurrency transactions, ‘chained’ together as a linked list. The blocks, once added to the chain, cannot be modified, which means that the list is add-only. There are specific rules that are followed before a block of data is added to the chain known as ‘consensus algorithm.’ In the case of Bitcoin, it is Proof-of-Work (PoW), while Ethereum is presently switching to Proof-of-Stake (PoS).

Due to this nature, blockchain has no single point of failure or control, its data cannot be altered, and the trail of changes made on the platform can be easily audited and verified. However, these benefits do come at a cost because blockchain is slow, and its immutable database has a very high redundancy rate. This is what makes it very expensive to use and virtually impossible to scale to a global scale.

Blockchain’s need to scale

The evolution of the entire blockchain ecosystem has been rapid over the past couple of years. The widespread implementation of blockchain systems for public use has been a significant vote of approval that the world is ready for it. However, the increasing adoption of these systems has brought to light the need for better design or alternatives.

The consequences of the increase in the number of daily transactions on a blockchain network have shown that block difficulty increases, thus increasing the average computational power required to mine a block of transactions. This translates to increased electricity consumption.

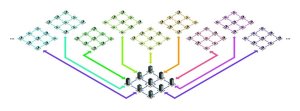

Another problem that prevents blockchain from scaling is that an increase in the number of transactions increases the size of the blockchain, making it harder to set up new nodes on the network to help in maintaining the complete blockchain network and to process and verify transactions. Therefore, the systems get not only slower and more expensive, but also unsustainable for such use cases as making regular small payments.

Potential solutions for blockchain scaling

There are numerous real-world uses of blockchain that have shown just how necessary the technology is for the future of humanity. Aside from payment processing and money transfer, it can also be used in monitoring supply chains, digital identification, digital voting, data sharing, tax regulation, and compliance, weapons tracking, and equity trading, among others.

One area that shows great promise and has accelerated the need for blockchain to scale is dApp or distributed apps that run on the blockchain network.

Over the past year, many developments have been proposed to resolve the platform’s scalability problems – even implemented in some industries. So far, it shows great promise.

Here are some of the most sustainable ideas that blockchain platforms can implement to scale

☑️ Increasing the number of transactions in a block

A blockchain network would scale better when the number of transactions in a block is increased. This can be achieved by either increasing the block size or compressing individual transactions.

Bitcoin’s block size is limited to 1 megabyte. There was a lot of controversy in 2010 through 2015 on whether this size should be altered to accommodate more transactions to help the network scale.

Blockchains can also implement more efficient hashing algorithms that better compress the data to be added to the block. Algorithms that generate shorter signatures would go a long way to reduce the size of the block, and using better data structures to organize transactions may not only reduce the size of the block but also improve the privacy of its content.

☑️ Increasing the frequency in which blocks are added to the chain

The Bitcoin network adds a block of transactions every 10 minutes, while Ethereum does so in about 7 seconds. This duration is a function of the block difficulty level in a Proof-of-Work consensus. Since the frequency in which a new block is added to the chain significantly affects its transaction rate (TPS), reducing this time would significantly increase the network speed and reduce delays.

However, this rate of adding block cannot be arbitrary. Increasing the frequency would mean an increase in the block orphan rate (the rate at which mined blocks are not added to the blockchain due to competition) and an increase in the network bandwidth.

A change of such magnitude would require a hard fork of an existing blockchain platform. Since this is not backward compatible, it would not work for Bitcoin, Ethererum, or other established blockchain systems.

☑️ Implementing alternative communication layers between nodes

There is constant communication between nodes on a blockchain platform depending on the protocol it implements. For instance, in the Bitcoin network, transaction information is sent twice: the first time is in the broadcasting phase of the transaction, and then after the block is mined.

The Lightning Network is an excellent example of a second layer payment protocol that runs on top of the Bitcoin blockchain. It enables faster transaction speeds between nodes by opening a payment channel that commits funding transactions to the underlying layer without broadcasting to it until the final version of the transaction is executed. This is presently touted as the best solution to Bitcoin’s scalability problem.

☑️ Adopting better consensus and verification methods

At the time of writing this post, Ethereum is in the process of switching its consensus mechanism from Proof-of-Work (PoW) to Proof-of-Stake (PoS) to mitigate its scaling problem. Bitcoin uses the oldest yet most difficult to scale PoW. PoS is not only sustainable in power consumption but also results in higher block addition frequency to the blockchain and, ultimately, better scaling platforms.

Other than the blockchain consensus, a blockchain platform can scale better when better storage architecture that saves space is implemented. Blockchain takes up a lot of storage space because each node is required to have the whole blockchain state in order to verify new blocks. Since the size of the block increases with time, the platform would scale better if nodes could only store parts of the chain required to verify current blocks.

Bottom line

Different blockchain platforms have implemented various strategies in an effort to make their platforms scale better. The bottom line, however, remains that blockchain’s scalability problem persists as no solution has proven to be effective without compromising any of the top features that make blockchain a transparent, secure, and truly decentralized ledger system. However, considering how far the world has come in developing this new technology, we remain optimistic that there will come a solution that will finally make a global-wide blockchain system practical and seamless.