What is cryptocurrency margin trading?

Margin trading is a way of trading assets where traders use funds provided by a third party. Margin accounts allow traders to trade with much bigger capital, which can, in turn, bring bigger profit. Margin trading allows its users to leverage their positions. Users get to borrow a certain multiple of their original assets, which essentially amplifies their trading results. Amplifying trading results makes margin trading interesting in low-volatility markets such as Forex markets. However, they have their place in cryptocurrency trading as well.

In traditional markets, the additional funds are provided by an investment broker, while cryptocurrency markets work by traders offering the funds. In return for their investment, they earn interest. Some cryptocurrency exchanges also provide margin funds by themselves to their users, but that is far less common.

How does margin trading work?

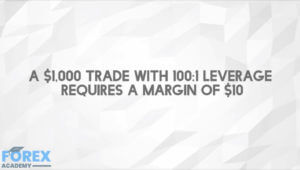

The first thing that has to happen in a margin trade is that the trader commits a percentage of the total order value. These funds are better known as the margin. Margin trading accounts are used to exploit the feature that is leveraged trading. Leverage is the ratio of borrowed funds compared to the margin. As an example, a $1,000 trade with 100:1 leverage requires a margin of $10.

Different trading platforms offer bigger or smaller leverage, based on their capabilities as well as the asset class they are trading. Stock markets usually trade with a 2:1 ratio, while Forex trading can have leveraged trading of up to 200:1. Cryptocurrency trading platforms offer trading of up to 100:1.

Margin trading offers its users the feature to open both long and short positions. A long position is a bet that the asset’s price will go up, while a short position is a bet that the asset’s price will fall. Trader’s assets act as collateral for the borrowed funds for the duration of the position. If the market moves against the position, brokers have the option to liquidate the position. Margin trading is riskier than regular trading due to the leverage it offers. Margin trading cryptocurrencies brings the risk even higher due to their inherent volatility.

Pros and cons of margin trading

If we talk about advantages, the most obvious one is the profit-making potential. Leveraged positions can quickly result in larger profits as a bigger relative value is traded in the position. Margin trading is also useful when diversifying, as traders have the option to open many positions with relatively insignificant capital. The last advantage is simply the ease of use. Margin traders don’t have to shift large amounts of funds to the margin account.

If we talk about the advantages, we have to talk about the disadvantages of margin trading. Leveraged positions can, if not properly managed, bankrupt an account in a matter of seconds. Overleveraged trading that goes against the position will quickly lead to the liquidation of the funds. It’s extremely important to exercise caution while trading with leverage. Any form of stop-loss is also advised.

Margin funding

Trading is a task that requires a lot of research, knowledge, and intuition. Many people do not have the skillset or the risk tolerance to engage in margin trading. However, they still want to make a profit off of the whole margin trading idea. The way for them to profit from leverage trading is margin funding. Some trading platforms and cryptocurrency exchanges offer an option for users to invest their money to fund the margin trades of other users. This process has a set interest rate, which is quite low. However, so is the risk associated with the investment.

Conclusion

Margin trading is a useful tool for risk-averse traders that want to amplify their profit-making potential. If used properly, this method of trading can have an amazing effect on the profit size. On top of that, users interested in diversifying should also look into margin trading.

However, this method of trading amplifies potential losses as well. The risk it inherently brings is not for everyone.