Introduction

Forex scalping is the riskiest trading strategy trader use. It is a strategy where traders are looking to make short term profits throughout the trading session. Most of the day traders and the long term traders always avoid the scalping because they believe that the fast-paced nature of it can quickly become gambling. It doesn’t mean that scalping is not possible; some so many successful scalpers made millions of dollars from the market. In short, scalpers took numerous small trades throughout the day to make small profits usually 10 or 20 pips from one single trade. For successfully scalping the market you need the below necessities:

- THE RIGHT MINDSET.

- A SUPER FAST BROKER.

- A SUPER FAST PLATFORM.

- MARKET VOLATILITY.

- The Right Mindset – As a scalper, your goal is to take a lot of trades every single day, and most of the time scalpers deal with the stressful environment, and they have to be much disciplined. If you are not able to cope with the stress, then you should shift your focus from scalping to day or swing trading. Scalpers make quick decisions of entry and exit, and if you caught into the emotions or you misinterpreted the direction, then you can quickly lose money. So the first thing is the right mindset which must be free from the emotions, doubt and negativity.

- A SUPER FAST BROKER – In scalping every little pip count, so you must choose the excellent broker who can execute your trades as fast as they can. Always look for STP, ECN and DMA type of brokers who gave them greater access to the market because big brokers most of the time provide the as close to the actual forex prices. Before opening an account with any broker always choose to check the reviews of the broker and find out the broker allow the scalping or not.

- A SUPER FAST PLATFORM – Your trading platform should be able to place the order as the exact price you choose or at least get as close as possible to them.

- MARKET VOLATILITY – Scalpers thrive on the market volatility and if any of the currency isn’t volatile enough then it is not possible to scalp it, so always choose the pair which is volatile enough and place a couple of trades throughout the day. If the market is not volatile, then you can skip the scalping, or you may try a different trading approach. When specific markets overlap, that’s the excellent time to find volatility such as a London opening or US opening. Some traders scalp the market before the significant news events and other scalp it directly during the news.

SCALPING STRATEGIES.

Some scalpers use the price action for scalping the market, and some use the indicators. Ideally, whatever the strategy you use, you must always look for confluence. Confluence is when the two things line up in one direction and giving the buy or sell opportunity. By using the two signals, you can very likely to get the results in your favour and in this way you can filter out the low probability trades.

- USING THE DOUBLE MOVING AVERAGE TO TRADE THE MARKET.

The very first strategy is to pair the two moving averages to trade the crossovers. If the crossover happened below the price, it means merely buy, and when the crossover occurred above the price action, it indicates the selling.

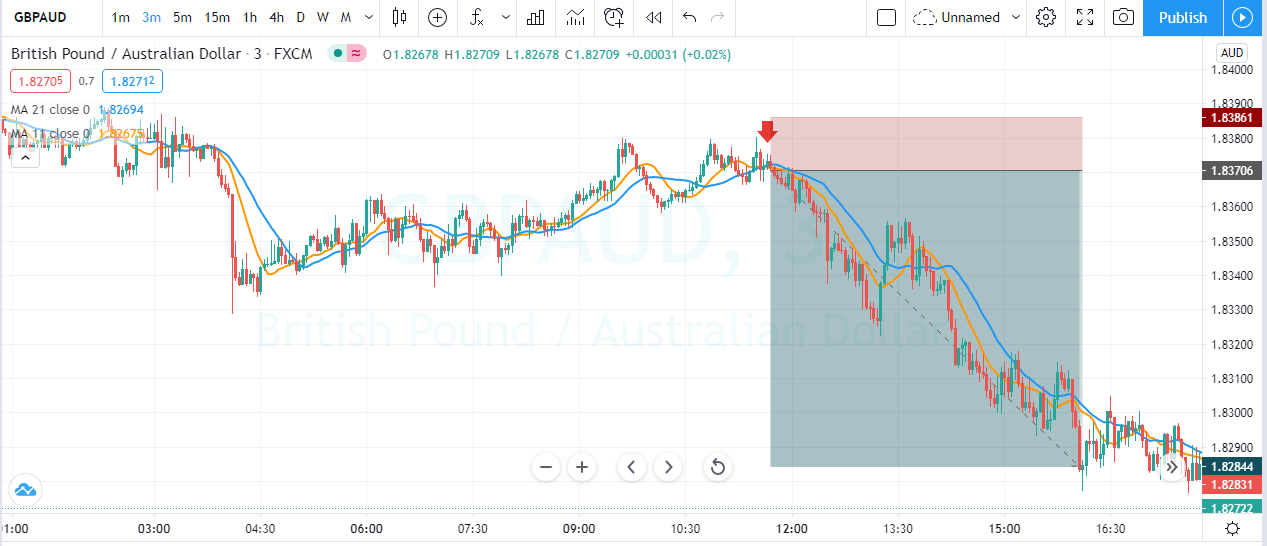

The image below is the representation of the selling trade in the GBPAUD forex pair. As you can see, when the price action pulled back enough, we witnessed the moving average crossover, which was a sign to go short. The activation of the trade was with the smaller stop loss, and the aim was to let the prices shows us brand new lower low.

- USING VOLUME AND TREND LINE TO TRADE THE BREAKOUT.

Volume is a wonderful tool to find out the story behind the price action. Rising volume is an indication of rising momentum, so when the price action breaks the major zone with rising volume, it is an indication to take a trade. Conversely for the sell-side when volume rises and price breakdown it means to get ready to go for short selling.

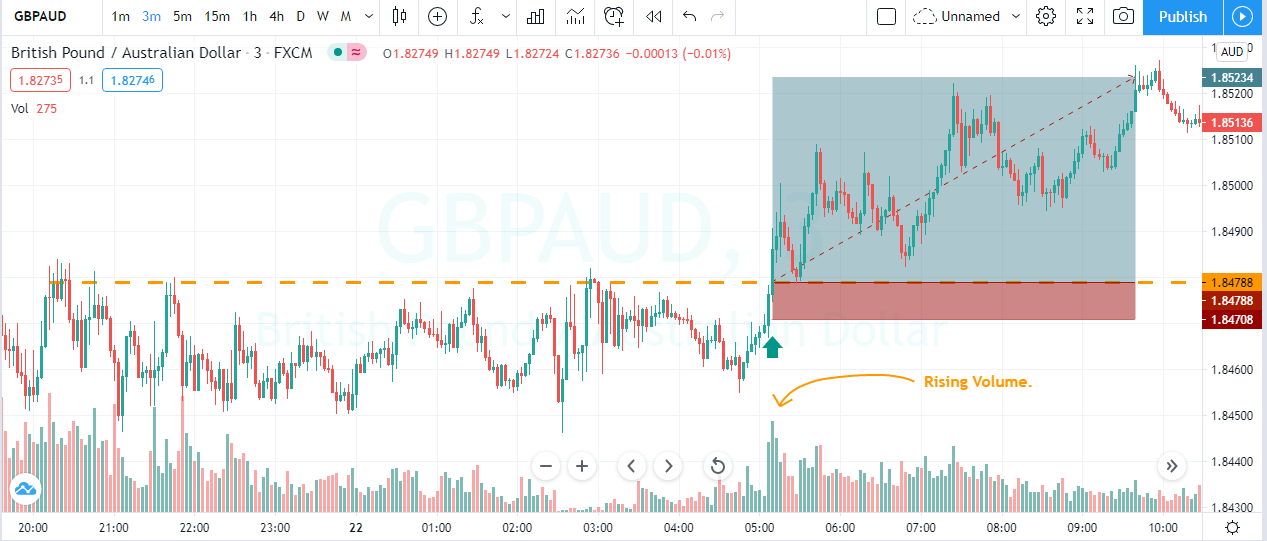

The image below is the indication of the buying entry in the GBPAUD forex pair. Price action was holding below the significant level; this is because buyers were not strong enough to challenge the resistance level. The breakout with the rising volume was a sign of buyers got enough power to go for brand new higher high. At the breakout of the major level, we choose to go long with the stops just below the entry.

- PAIRING THE TREND LINE WITH THE STOCHASTIC OSCIALLTOR.

Stochastic is a wonderful tool to trade the overbought and oversold market conditions. In an uptrend place the trend line below the price action and let the prices break the trend line to the downside and look for a stochastic reversal at the oversold area to go short. For sell-side place, the trend line above the price action and wait for the prices to break above the trend line and reversal on the stochastic at the overbought area is an indication to go long.

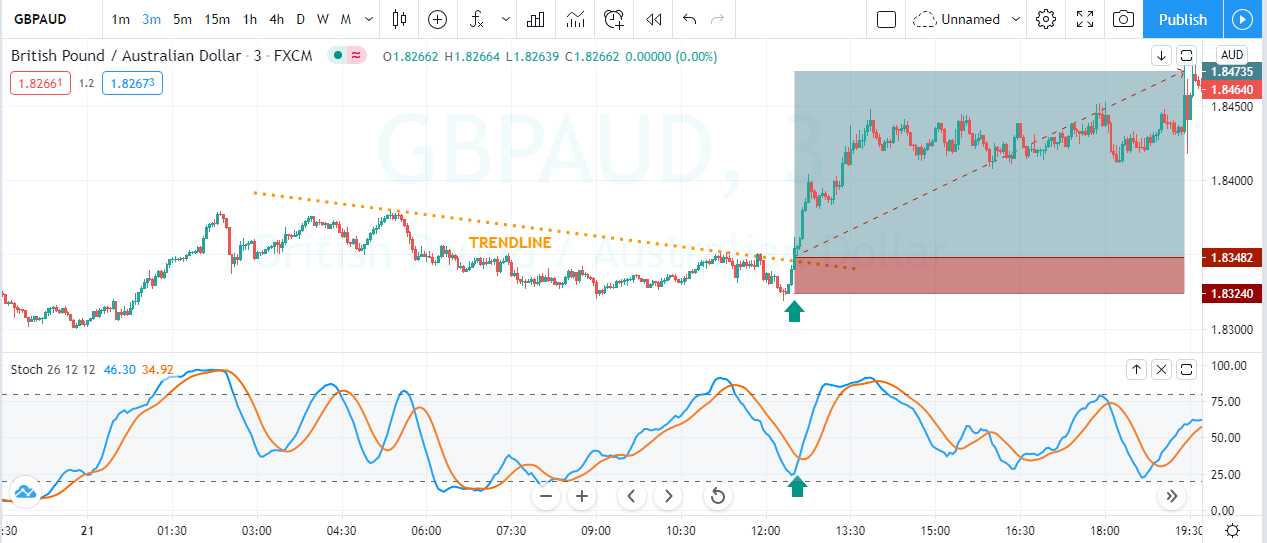

The image below is the indication of the buying trade in the GBPAUD forex pair. The pair was overall in an uptrend during the pullback phase price action was continuously respecting the trend line. At the breakout of the trend line, the stochastic oscillator gave crossover at the oversold area, which was a clear indication of buyers gaining the strength. The entry was at the breakout of the significant level with the stops just below the trade.

- USING THE BOLLINGER BAND TO SCALP THE MARKET.

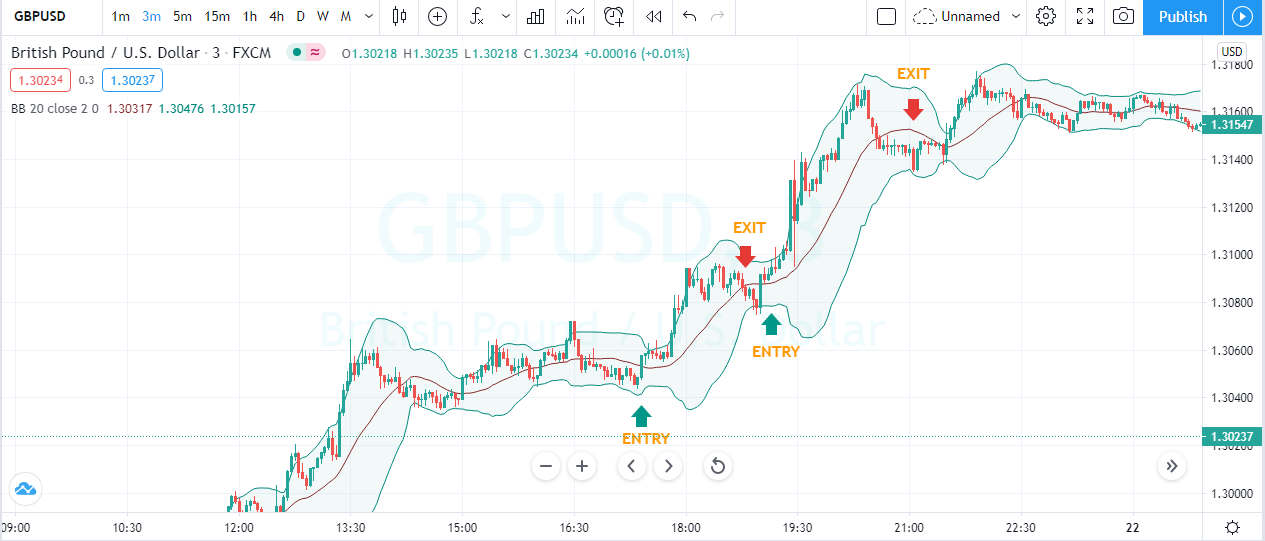

Bollinger Bands is a wonderful tool to scalp the market successfully. You can use the Bollinger bands in so many different ways, you can take buy and sell trades when the price action hit the lower and upper band, or you can use it to take the buy trade in the uptrend and sell trade in a downtrend. Another way traders use this indicator is they look for the breakout above the centerline to ride the trend. For scalping don’t use the complicated techniques, we are in the game for small moves only. So for buy when price action hit the lower band and go for sell when price action hit the upper band and if the trend is healthy, then try only to take the trade with the trend.

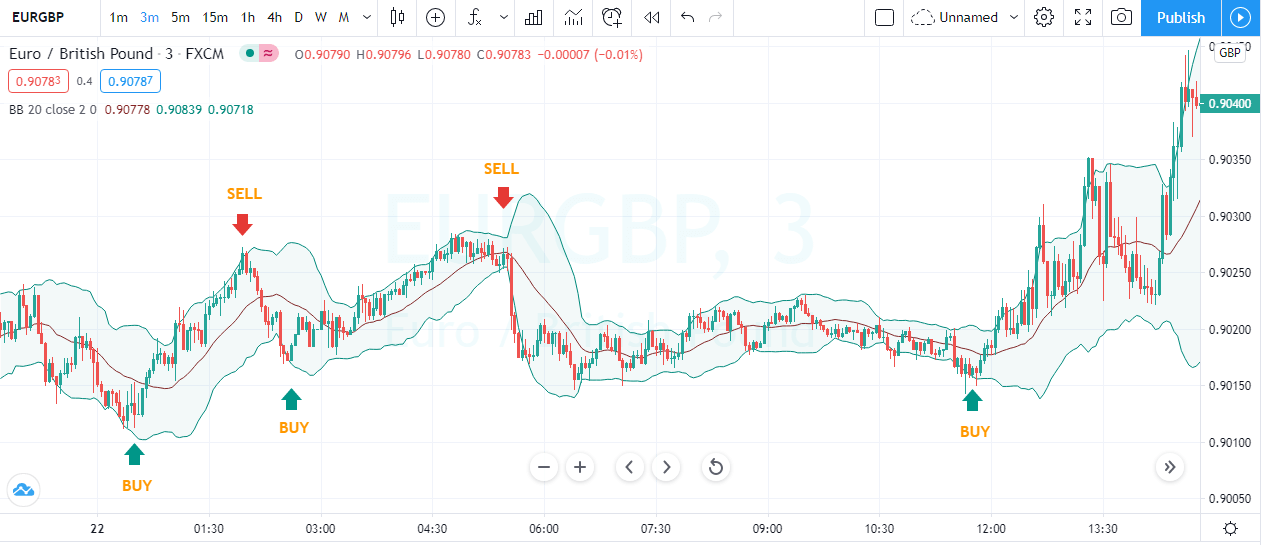

The image below represents a couple of buying and selling trades on EURGBP forex pair. In this one, we purely trade the buy and sell opportunities based on the bands of the indicators. This method of trading is beneficial in scalping, but your mindset and emotions must be entirely in control to trade this method and don’t force the market to give you trade and don’t make rational decisions.

CENTERLINE BREAKOUT.

We are using the centerline breakout method to trade the market. This method purely works in strong trending conditions only. On this three minute chart, when the prices go above the main level we choose to go long, and when the prices go below the centre line, it was an exit for us. In this way, we took two trades, and both of them end up in good profit.

CONCLUSION.

Scalping is a game of the brave-hearted alphas that have fucking full control on themselves. By placing a couple of trades in a day and over time, these small gains generate large profits. Make sure you are fully ready to scalp the show. Your mindset must be ready, don’t fall into the trap of emotions, go hard and must have a fast broker and lightning-fast platform. Don’t use the new strategy every day to scalp the market; in this way, you are not going to make any serious money. The successful trader always repeats the same kind of setups every day to make the big kill at the end of the year.