Cryptocurrencies have all these dazzling features like decentralization, peer-to-peer transactions, and cryptographic security that have made them the darling of investors. The asset class has bucked the trend in these ways, as well as another not so good one, depending on who you’re asking: they’re prone to dramatic price swings. If you’re asking investors, this unpredictability in price is a good thing since it allows them to speculate.

For the rest of the people who wish to utilize the secure and anonymous currency for everyday activities, the usual cryptocurrencies are not an option. Stablecoins, cryptocurrencies that are backed by an external asset, is an innovation to solve this problem.

What is Gemini Dollar?

Gemini dollar is “purpose-built” stablecoin “to bring the value of the U.S. dollar into the modern digital era,” according to its website.

What this means is it’s a cryptocurrency that borrows the stability and credibility of the U.S. dollar and combines it with the fastness, security, and allure of digital money. New Gemini tokens are printed in a highly controlled environment that ensures the amount of Gemini dollars issued and in supply do not exceed the underlying U.S. dollar reserve.

What are Stablecoins?

Stablecoins are cryptocurrencies that are pegged to a “real-world” asset. The real-world asset could be anything from Fiat currency to a commodity such as gold and so on. Still, some stablecoins are pegged against another cryptocurrency whose supply is controlled by an external market mechanism.

The idea behind stablecoins is to provide some stability and predictability to a cryptocurrency. Cryptocurrencies are known for their wild and unpredictable price swings, which renders them unsuitable for regular and everyday use. With stablecoins, users get the privacy and security of cryptocurrencies together with the stability and reliability of crypto.

Stablecoins usually have the same value as their underlying asset. For instance, if a coin is pegged at the ratio of 1:1 to the U.S. dollar, its value will revolve around the value of the dollar. Stablecoins can usually be redeemed for their underlying assets.

Who is Behind Gemini Dollar?

Gemini Dollar is a project of Cameron and Tyler Winklevoss, who are venture capitalists, Bitcoin investors, and owners of the Gemini Dollar exchange. The Gemini Dollar website states that the currency was created by “top technologists and security engineers.”

Gemini is regulated by the New York State Department of Financial Services. The currency takes a departure from a stablecoin norm but is backed by only one bank – State Street. The company is periodically regulated by accounting firm BPM so as to stay in compliance with auditing laws.

How Gemini Dollar Works

Gemini Dollar runs on the Ethereum blockchain. The coins are generated when you deposit Fiat money into Gemini’s custodian account. The Ethereum blockchain confirms the supply of coins, while the auditing firm sees to it that the supply is equivalent to the amount of USD holdings. Each Gemini dollar is equivalent to one U.S. dollar held in the backup reserves.

The Gemini dollar ecosystem comprises three critical layers:

i) The Proxy Layer: this is the governance layer which identifies and allows eligible on-chain processes, and can stop any process if need be. It also creates and transfers GUSD coins.

ii) The Impl Layer. This layer is where data and logic for the execution of smart contracts reside. Here, creation, transfer, and token ‘burning’ are carried out. This layer also ensures that a GUSD is printed for every USD held in reserve.

iii) The Store Layer. This ledger oversees transactions and makes them public so the public can view Gemini dollar transactions. It also serves as the “external and eternal Gemini dollar ledger.”

Security Features of Gemini Dollar

The Gemini Dollar system utilizes the following security features to ensure the safety of funds and client privacy.

- Offline Keys. These are keys that approve high-risk actions and are stored in Gemini’s cold storage system.

- Key Generation. This is the process by which Gemini generates, stores and manages keys by use of hardware security modules (HSMs)

- Multi-signature. Multi-signature keys are used to approve risky transactions. This process involves two or more people signing off a transaction.

- Time lock. This mechanism stops transactions deemed as risky or suspicious for a certain period before execution. During the time lock, the system can detect and respond appropriately to any security or privacy breach.

- Revocation. This mechanism revokes any malicious or erroneous transactions before execution.

How Does Gemini Dollar Differ From Other Stablecoins?

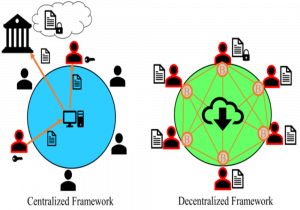

Gemini Dollar belongs to a class of stablecoins that rely on a centralized entity to issue coins and manage a real-world asset reserve. Some of the stablecoins in this category include USD coin (USDC), TrueUSD (TUSD), Paxos Standard Token (PAX), and Tether (USDT).

These coins differ from each other in their function only slightly but otherwise operate on the same centralized model of issuing coins, freezing suspicious transactions, and so on. The key takeaway is that they are not censorship-resistant like, say, Bitcoin or Ethereum.

Gemini Dollar: Tokenomics

Unlike other stablecoins such as Tether and USDC, the Gemini dollar is not enjoying much dominance in the crypto market. As of April 7, 2020, the stablecoin is ranking at #405 amongst all cryptocurrencies. It has a market cap of $5,637,192 and a 24-hour trading volume of $26, 693, 402. It’s a circulating supply of 5,592,534, and its total supply is of the same value.

Where to Buy and Store GUSD

You can purchase Gemini Dollar at any of these exchanges: BitFinex, CoinMex, BitMart, OKEx, YoBit, Bitrue, and so on. In some of the exchanges, you can buy the currency with U.S. dollars, while in others, you need to purchase a cryptocurrency such as BTC, ETH, XRP, USDT, and so on.

Being an ERC token, the Gemini dollar can be stored in any Ethereum wallet. Some popular options include MyEtherWallet and MetaMask. Alternatively, you could store them in safer hardware wallets such as Trezor and Ledger Nano.

Final Thoughts

Gemini dollar’s proposition doesn’t differ much from that of other stablecoins, but it’s mysteriously not performing as well as them. Whether it’s because of branding or market factors beyond its control, it’s hard to figure why. Interested investors can only wait and see if there’s an upturn for the stablecoin in the near future.