The foreign exchange market, or Forex, is the largest financial market in the world, with an average daily trading volume of over $5 trillion. The Forex market is a decentralized market, meaning that it has no central exchange or physical location. Instead, it operates through a global network of banks, financial institutions, and individual traders. One of the key factors that make Forex trading so popular is its high liquidity, which is measured by the trading volume.

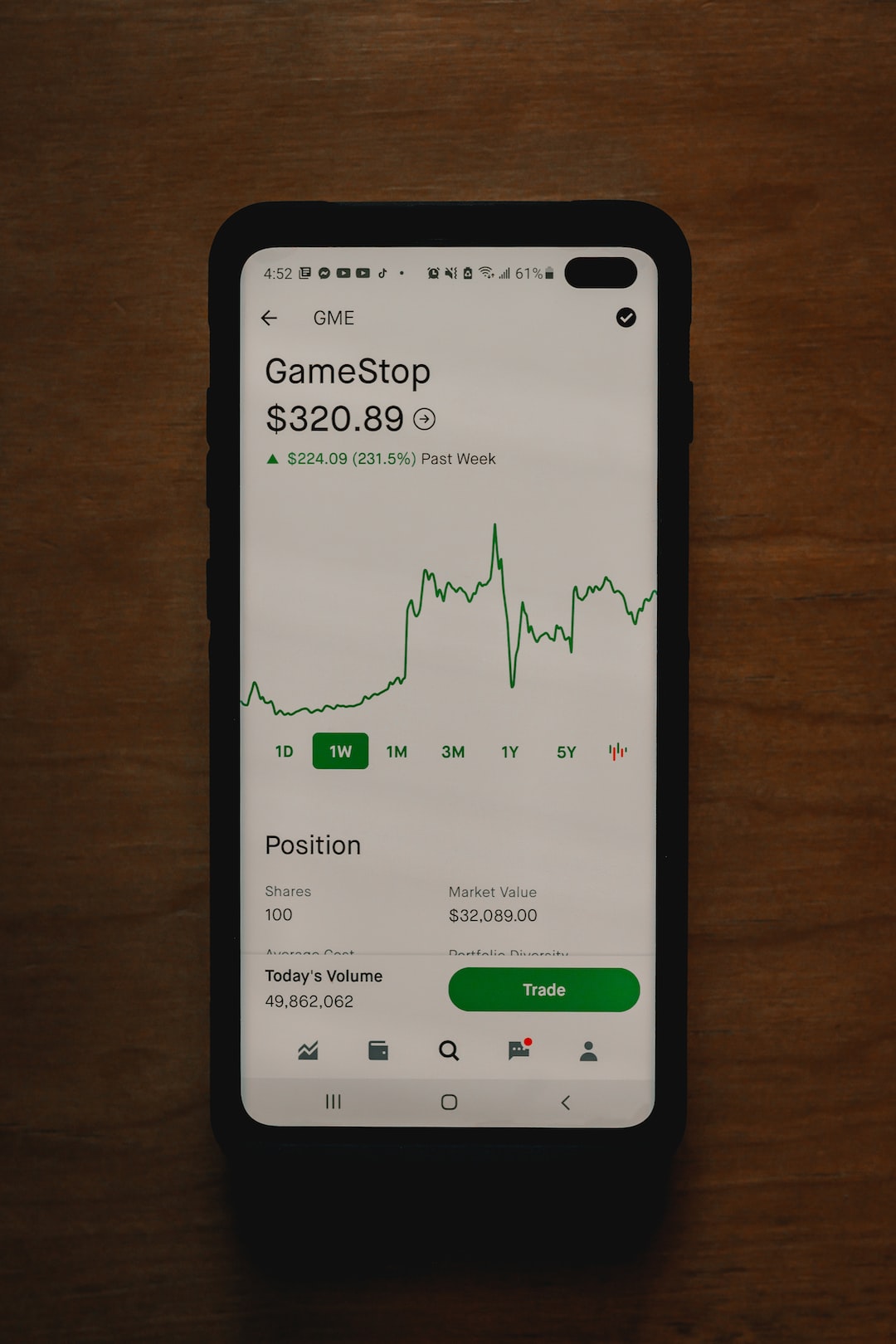

In Forex trading, volume refers to the number of units of a currency pair that are traded during a particular time period. It is an important indicator of market activity and can provide valuable insights into market trends and potential price movements. Volume can also be used to confirm price movements, as a high volume during an uptrend or downtrend can indicate a strong market trend.

There are two types of volume in Forex trading: tick volume and real volume. Tick volume is the number of price changes that occur during a particular time period, while real volume is the actual number of currency units that are traded during that time period. Real volume is generally considered to be a more accurate indicator of market activity, as it takes into account the actual amount of currency being traded.

Volume can also be used in conjunction with other technical indicators, such as moving averages and trend lines, to identify potential market reversals or breakouts. For example, if the volume is increasing along with a price increase, it may indicate a strong uptrend. However, if the volume is decreasing along with a price increase, it may indicate a weaker uptrend that could soon reverse.

Traders can also use volume analysis to identify potential trading opportunities. For example, if a currency pair is experiencing high volume but little price movement, it may indicate that traders are indecisive about the direction of the market. This could present an opportunity for a trader to take a position and profit from a potential breakout.

Another important aspect of volume in Forex trading is the concept of market depth. Market depth refers to the number of open buy and sell orders at various price levels. A deep market with a large number of orders at various price levels can provide greater liquidity and reduce the risk of slippage during trades. This is particularly important for traders who use high-frequency trading strategies, where even small delays or slippage can have a significant impact on profits.

In conclusion, volume is a crucial aspect of Forex trading that can provide valuable insights into market trends and potential price movements. While tick volume can provide some indication of market activity, real volume is generally considered to be a more accurate indicator of trading activity. Traders can use volume analysis to identify potential trading opportunities, confirm price movements, and assess market depth. By incorporating volume analysis into their trading strategies, Forex traders can improve their chances of success in the dynamic and ever-evolving Forex market.