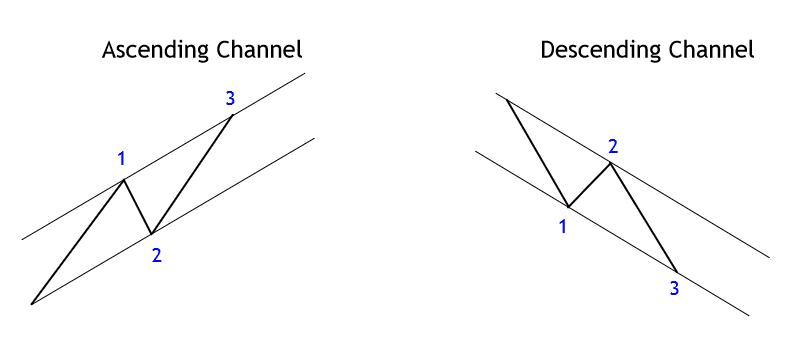

In today’s lesson, we are going to demonstrate an example of the formation of an up-trending equidistant channel. Usually, the price forms an up-trending equidistant channel by having two bounces and one rejection. However, the price sometimes determines the upper band first by having two rejections. In today’s lesson, this is what we are going to demonstrate.

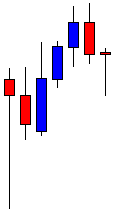

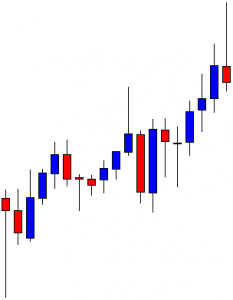

The chart shows that the price makes a bullish move and produces a bearish engulfing candle. The last candle in the chart comes out as a doji candle with a long lower shadow. It suggests that the price finds a strong level of support in the minor charts.

The price heads towards the North and has a strong rejection. The last candle comes out as a bearish engulfing candle again. A candle with a long upper shadow followed by a bearish engulfing candle may drive the price towards the South.

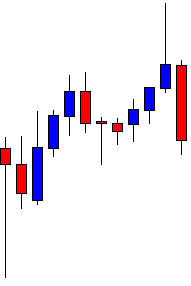

It does not. It produces a bullish engulfing candle and pushes the price towards the North. The chart produces an inverted hammer. The long upper shadow suggests that the price has a rejection from a strong level of support. So far, we have noticed that the price is up-trending by making new higher highs. Do you notice anything else? Let us proceed.

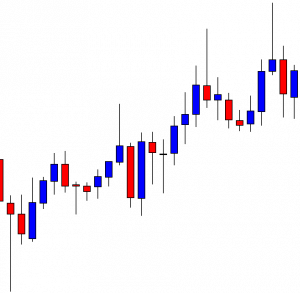

After making a bearish correction, the price finds its support. It produces a bullish engulfing candle and pushes the price towards the North. The last candle comes out as a bullish candle with a long upper shadow though. It is more evident now that the price is up-trending by obeying an equidistant channel.

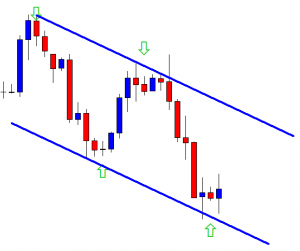

Upon finding its support, it produces a bullish inside bar. It seems that the buyers based on the equidistant channel may go long in the pair. We have not drawn the channel yet. The reason is we have to be able to spot out the channel by looking at the price action. Let us now draw an equidistant channel and see how the price has been obeying it.

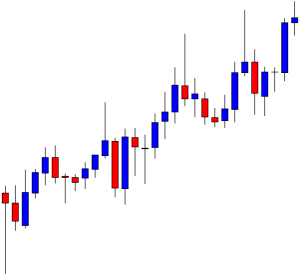

It looks like a copybook equidistant channel. It offers two good long entries. Do you notice one thing here? The price gives a clear sign that it may form an up-trending equidistant channel at the very outset. When it has its second rejection, it does not trend from the lower band. However, it determines its upper band, which helps traders sniff about a potential up trending equidistant channel. This is what happens so often. The price may determine its upper band first not by bouncing off at the lower band or it may determine its lower band by not having rejection from the upper band.