When Will BTC Hit $20,000? Analyst Opens Up

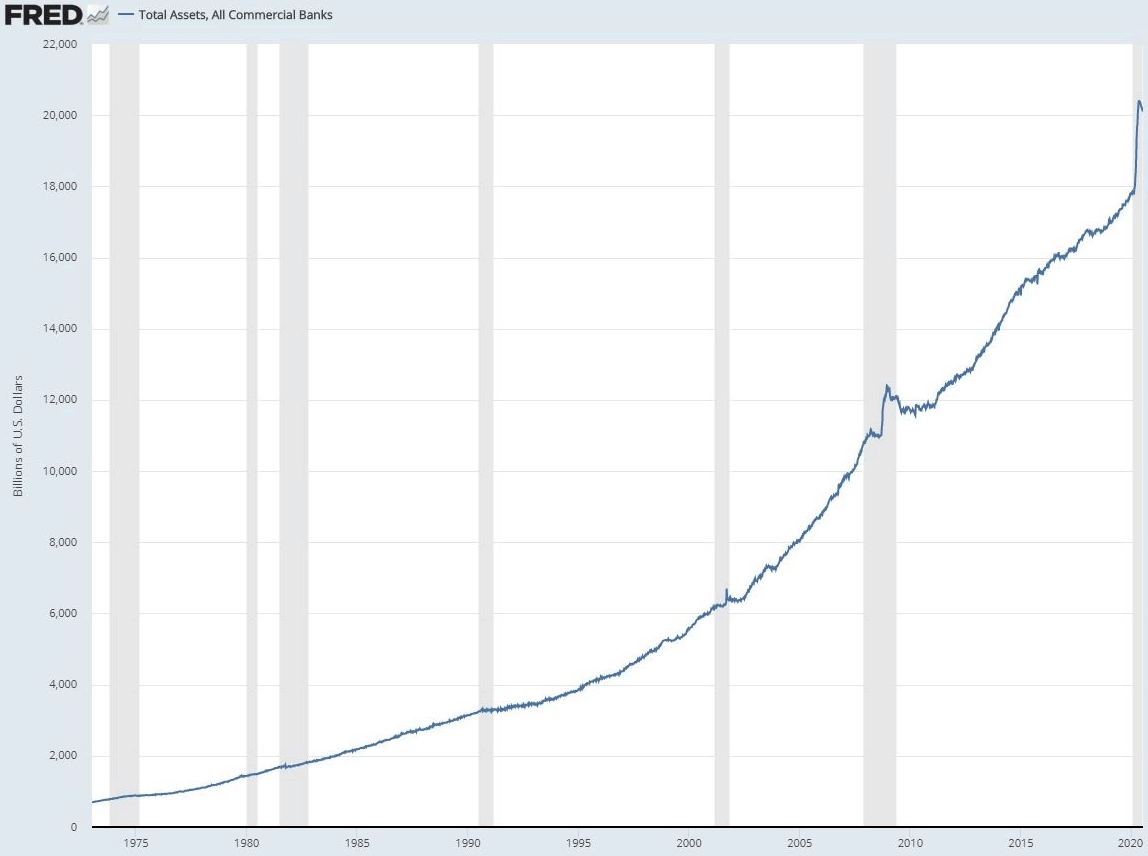

Capriole digital asset manager Charles Edwards made a statement that, in his opinion, Bitcoin will pass $20,000 if US banks invest even 1% of their assets in crypto. On top of that, he added that this was not impossible as the unfolding trend is “not hard to see.”

“If US banks put even just 1% of their assets into Bitcoin as an investment, insurance or hedge… the Bitcoin price will more than double” he wrote on Twitter, further adding:

“Just Grayscale already owns 2% of circulating Bitcoin supply today. It is not hard to see which direction this is going in.”

Edwards uploaded a chart of US banks’ asset balances as further proof of the potential impact they could have if they leaned even slightly towards BTC.

Institutions quietly buying BTC

While this is the opinion of only one analyst, the current market development is showing that this is not just an opinion. US lenders received a green light from regulators to engage in cryptocurrency custody activities last week, which opened up a lot of possibilities.

Whether an influx of buyers from the banking sector would ultimately benefit Bitcoin remains a contentious topic, but the overall opinion of the community leans towards this being beneficial, if not mandatory, for Bitcoin’s price development.

As time passes, we will see more and more institutions reaching towards crypto, therefore increasing the demand. “It’s not a matter of it being good or bad,” Edward said.