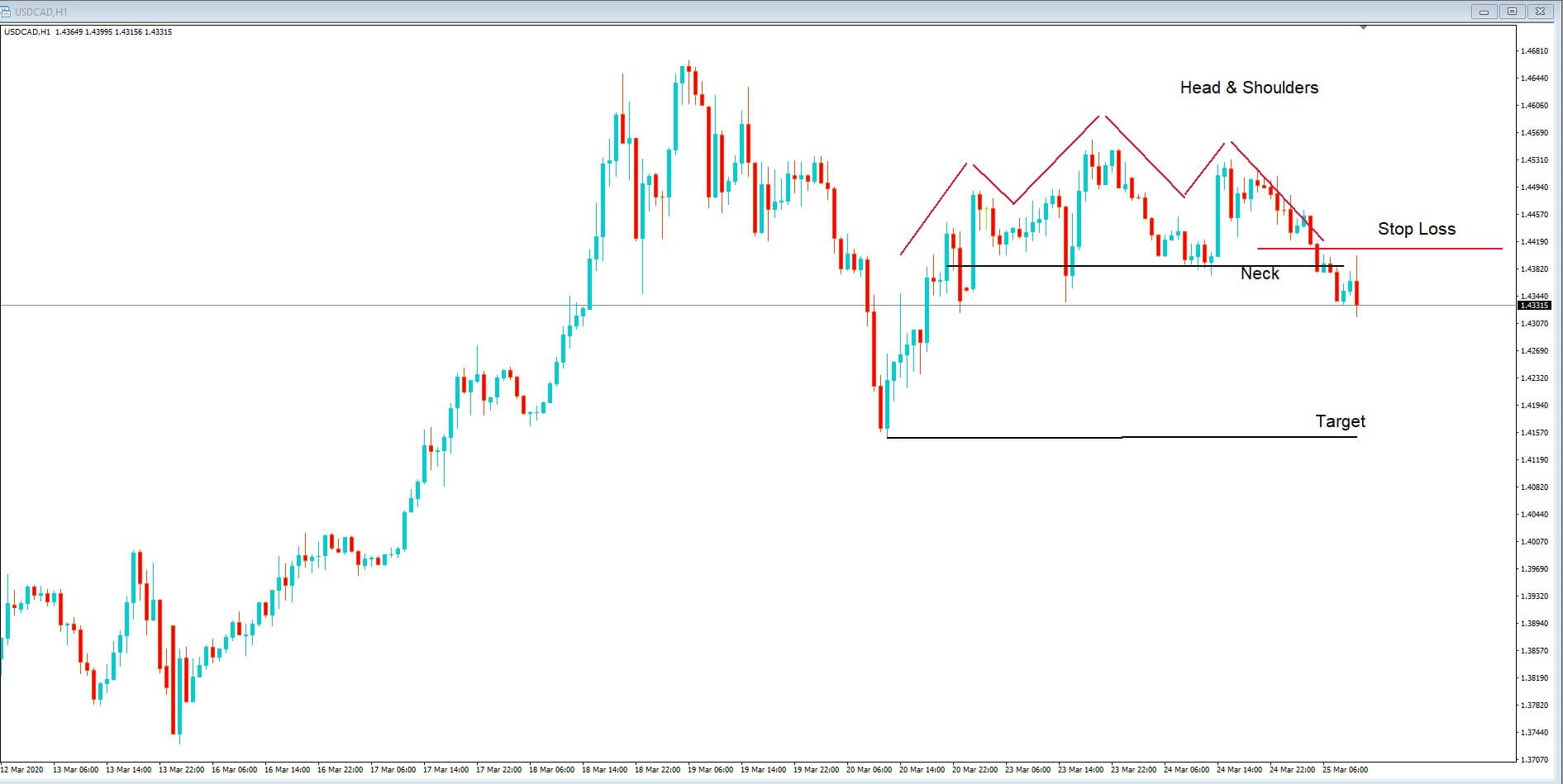

This is a classic head and shoulders pattern where the neckline has been breached, and we expect the price to fall to our target line, which is a previous line of support.

Risk:

Standard Lot = £800

Mini Lot: $80

Micro Lot: $8

1 Hour Chart is used In This Trade.

The head and shoulders formation is a classic technical analysis pattern that professional Traders use in order to determine future price action.

In our setup, we have multi-year highs for this pair, followed by a decline in price action to an area of support around the 1.4150 the key level, which will become our profit target.

Since pulled back from the original multi-year high around the one 1.4700 level, the price has consolidated into our head and shoulders formation, which consists of a left-hand peak and a pullback followed by a higher peak and a pullback and the third peak which again is lower than the second and similar to the first, where price action on each occasion pulls back to an area of support which is called a neckline.

When the neckline is breached, it confirms the setup, and that is where we have gone short. This offers a strong signal to traders that price action will continue down, at least to the previous area of support. And this is the hypothesis for our trade setup, where we have set in place a tight stop loss, just above the neckline, and where we have a generous win to lose ratio.