Trust Capital is a foreign exchange broker that specializes in online execution on spot forex, spot metals, energy CFDs, commodity CFDs, and other derivatives. They are licensed by the Central Bank of Lebanon (BDL) and regulated by the Capital Markets Authority (CMA) of Lebanon. Trade Capital aims to provide the best service possible for all their clients and so we will be using this review to see exactly what services are on offer from Trade Capital.

Account Types

There are three different accounts available, however, the account comparison only mentioned two of them, we will now briefly look at the two that are mentioned.

Trust Standard account: This account has the use of MetaTrader 4 as a trading platform, it comes with floating spreads and maximum leverage of 1:100. It uses market execution and has access to forex, metals, energies, indices, commodities and has a minimum lot size of 0.1 lots and can have an unlimited amount of trades open at any one time. The account must be in USD and it has access to chart & patterns, research reports, and telephone trading.

Trust Plus Account: This account has the use of MetaTrader 4 as a trading platform, it comes with fixed spreads and maximum leverage of 1:100. It uses instant execution and has access to forex, metals, energies, indices, commodities and has a minimum lot size of 0.1 lots and can have an unlimited amount of trades open at any one time. The account must be in USD and it has access to chart & patterns, research reports, and telephone trading.

Platforms

MetaTrader 4 is the only platform on offer from Trust Capital but it is a good option to have. MT4 is compatible with hundreds and thousands of expert advisors and indicators to help make your trading more straight forward. It also offers high levels of customization and flexibility, impressive analytical tools, and is accessible via a desktop download, mobile application, and web trader. There is a reason why it is one of the most used platforms and trusted by millions of traders all around the world.

Leverage

The maximum leverage on all accounts is 1:100 which is a little low when compared to the 1:500 that a lot of brokers are now aiming for. The leverage can be selected when opening up an account and can be changed by contacting the customer service with the request.

Trade Sizes

Trade sizes start from 0.1 lots, we do not know if they go up in increments of 0.01 lots or 0.1 lots and we do not know what the maximum trade size is. We do know that there is not a limit to the number of open trades you can have at any one time.

Trading Costs

There is no added commission on any of the accounts as they use a spread based system, there are also no swap charges on accounts that trade regularly.

Assets

The assets covered at Trust Capital have been broken down into a number of categories, we will now outline the different instruments within them.

The assets covered at Trust Capital have been broken down into a number of categories, we will now outline the different instruments within them.

Forex: EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NZDUSD, EURAUD, EURCAD, EURNZD, EURCHF, EURGBP, EURJPY, GBPAUD, GBPCAD, GBPNZD, GBPCHF, GBPJPY, AUDJPY, AUDCAD, AUDCHF, AUDNZD, NZDJPY, NZDCAD, NZDCHF, CADCHF, CADJPY, CHFJPY.

Metals: Gold and Silver.

Energies: Light Sweet Crude Oil, Natural Gas, and UK Crude Oil.

Indices: S&P 500, Nasdaq, Dow Jones, DAX 30, and AUS 200.

Commodities: Coffee, Soybean, and Cocoa.

Spreads

The spreads that you get depends on the account you use, the Trust Standard account comes with a floating spread, this means that it moves with the markets. The spreads start from around 1.6 pips but will often be seen a little higher due to the nature of variable spreads.

The Trust Plus account comes with fixed spreads, this means that the do not change no matter what is happening in the markets, the spreads start from 2.8 pips however different instruments can have dramatically higher spreads so which EURUSD is fixed at 2.8 pips, instruments like EURAUD are fixed at 10 pips.

Minimum Deposit

Strangely, this information is not available and so we do not know what the minimum deposit requirement is, we may have missed it, but we could not locate it on the site.

Deposit Methods & Costs

There are a few different methods available to deposit with, these are Credit /. Debit Card, BOB Finance, Cheque Deposit, or Bank Transfers. Trust Capital does not charge or add any fees to incoming transfers but you should check to see if your bank or processor will add any fees of their own.

There are a few different methods available to deposit with, these are Credit /. Debit Card, BOB Finance, Cheque Deposit, or Bank Transfers. Trust Capital does not charge or add any fees to incoming transfers but you should check to see if your bank or processor will add any fees of their own.

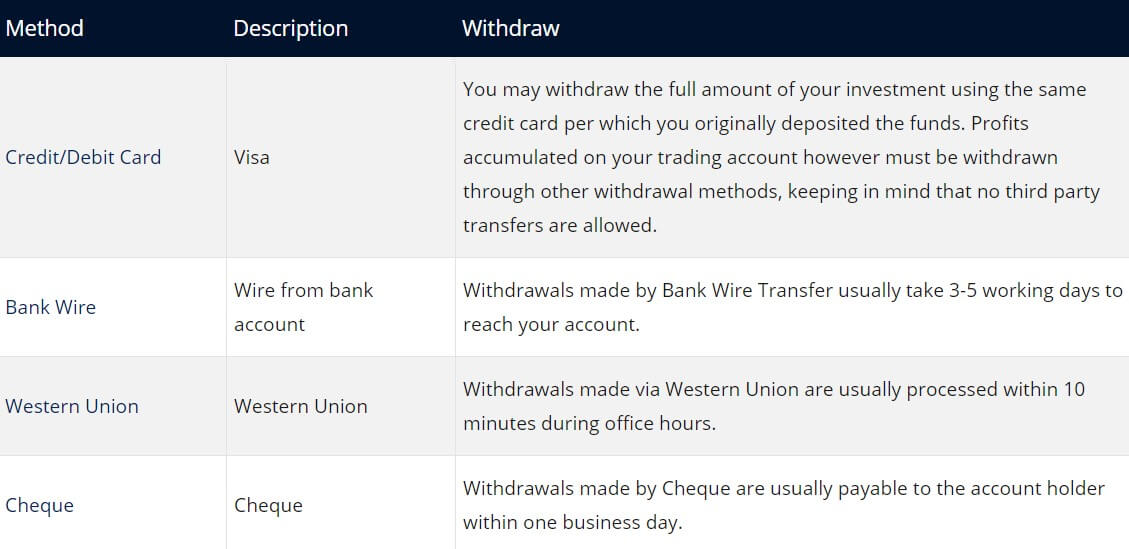

Withdrawal Methods & Costs

You can withdraw using a Credit/Debit card however you can only withdraw the same amount that you deposited with this method, you can also use Bank Wire Transfer, Western Union, or Cheque. Just like with the deposits, there are no added fees from Trust Capital but your own bank or processor may add some processing fees of their own.

Withdrawal Processing & Wait Time

When withdrawing the different methods will have different processing times, we have outlined them for you below.

- Credit/Debit Card – Normally processed within 48 hours.

- Bank Wire Transfer – Processing normally takes between 3 to 5 working days

- Western Union – Usually processed within 10 minutes during office hours

- Cheque – These are normally payable to the account holder within one business day.

Bonuses & Promotions

Looking through the site we did not come across any information relating to any bonuses or promotions so it does not look like there are any currently available, this does not mean that there won’t be though, so if you are interested in them, you could contact the customer service team to see if there are any promotions or bonuses coming up that you could take part in.

Educational & Trading Tools

There are a number of different tools and educational content on the site. The first is a margin calculator, there is also a mobile trading application available. You are able to get the support and guidance from a forex mentor covering various different aspects of trading such as analysis, along with this there are also seminars that you can take part in, but you will need to be there in person and not online. There is an introduction to trading which gives some very basic information on trading. The technical analysis section doesn’t actually give any analysis, instead, it gives you an idea of what is involved during the undertaking of technical analysis. The final section is a little page of basic forex rules such as using stop losses and a glossary of trading-related terms for you to refer to should you come across a word or phrase that you do not fully understand.

Customer Service

The customer service team can be contacted in a number of different ways, you can use the online submission form to fill in your query and then get a reply via email, you can also use the provided postal address, telephone number, or email to choose the method of contact that you prefer.

Address: P.O.BOX 11-3164, Beirut, Lebanon

Email: [email protected]

Phone: +961 1 999 255

Demo Account

Demo accounts allow you to test out the trading conditions and to test new strategies without risking any real capital. Trade Capital offers demo accounts however the conditions used on the demo account are not mentioned and neither are any potential expiration times on the accounts.

Countries Accepted

This information is not available on the site so if you are thinking of signing up with Trust Capital but are not sure of your eligibility, contact the customer service team to find out.

Conclusion

Trust Capital offers two different accounts but the differences between them are very small, just a change of variable and fixed spreads. The leverage is a little low with a ceiling of 1:100 and there isn’t a huge selection of tradable assets available. While the conditions are not the worst, the lack of assets and deposit / withdrawal methods can limit the trading available to clients.