Most traders nowadays trade pairs involving currencies such as EUR and USD because they have found such currencies to provide them with the best results. However, once paired, some of the other major currencies we trade in the forex market are said to be extremely profitable trades due to their unique traits. The AUD/NZD currency pair, for example, has been praised by a portion of professional traders who have recognized its great potential. According to these supporters, the nature of this currency pair, or what it is and what it is not in other words, is what makes it so different from all other combinations, making it to some traders’ list of favorites.

If you are a technical trader who keeps looking for ways to evade news and hectic market activity knocking traders’ stop losses, you may find this currency pair particularly interesting despite what you may have heard about it before. Especially during the times of some important events (such as Brexit) or the involvement of some important individuals and organizations (e.g. the European Union), you will find how some of the more popular currency pairs, such as EUR/GBP and GPP/CHF, are heavily encumbered by the surrounding hype and needless news popping up every minute or so. In this case, traders are faced with a few options: give in to the upcoming news events, avoid trading news, and/or avoid trading the affected currencies. What is more, with trading other currency pairs comes the danger of encounter some really choppy periods we can see for ourselves if we take a look at the daily chart. Solidation, on the other hand, is a process traders mostly accept as part of the currency market, but some other downsides of trading popular currency pairs may not always be shared transparently and objectively through all available sources of educational material.

There are quite a few reasons why traders may eventually learn to enjoy trading the AUD/NZD currency pair. Firstly, the pair in question does not involve USD, the currency that is heavily monitored by the big banks whose impact on the market is profound. Secondly, both AUD and NZD are risk-on currencies, which makes trading much easier. Some other currency pairs such as AUD/JPY or EUR/USD entail the risk-on/risk-off challenge, which ties the forex traders close to the activity in the stock market. While trading risk-on/risk-off pairs the market moves exceptionally violently and this may overthrow almost any technical expertise and, thus, affect traders. By entering such trades, you are in fact taking on the risk of not having much control because of dealing with external factors. However, when you are trading two currencies which are both risk-on, you are to an extent trading a pair with no conflicting agendas.

With AUD and NZD being both risk-on currencies, you can feel at ease knowing that you are in fact trading currencies that are both heading in the same direction, further eliminating your list of external factors you ought to be concerned about. Therefore, as you are trading AUD against NZD, you are trading a pair without needing to worry about any derailment on the path to securing your pips. What is more, despite these currencies’ similarities, they still do not exhibit much correlation in the sense that traders sometimes feel annoyed when both currencies go up and down at the same time. In such cases, the correlating movement directly impedes trading as traders cannot trade until this unnerving parallel movement comes to an end. Luckily, while the AUD/NZD pair can at times display similar behavior, it hardly occurs as often as it does with some other currency pairs.

With regard to news, the forex traders who are trading this pair feel relieved because most news comes early in the trading day. Experienced traders using the daily chart who are fond of the AUD/NZD pair claim to trade approximately 20 minutes before the daily candle closes. Such an approach typically leaves them with several hours before any relevant news comes out. In case they find the news to be going against them, they can then still have the remaining 20 hours for the price to take a different turn. According to those who are used to trading the AUD/NZD, many times the price overacts to the news but eventually corrects itself. Should the news, therefore, appear to be negative in any way, traders need not worry since the price often either returns to its initial position or takes the direction the trader favors as the close of the candle approaches.

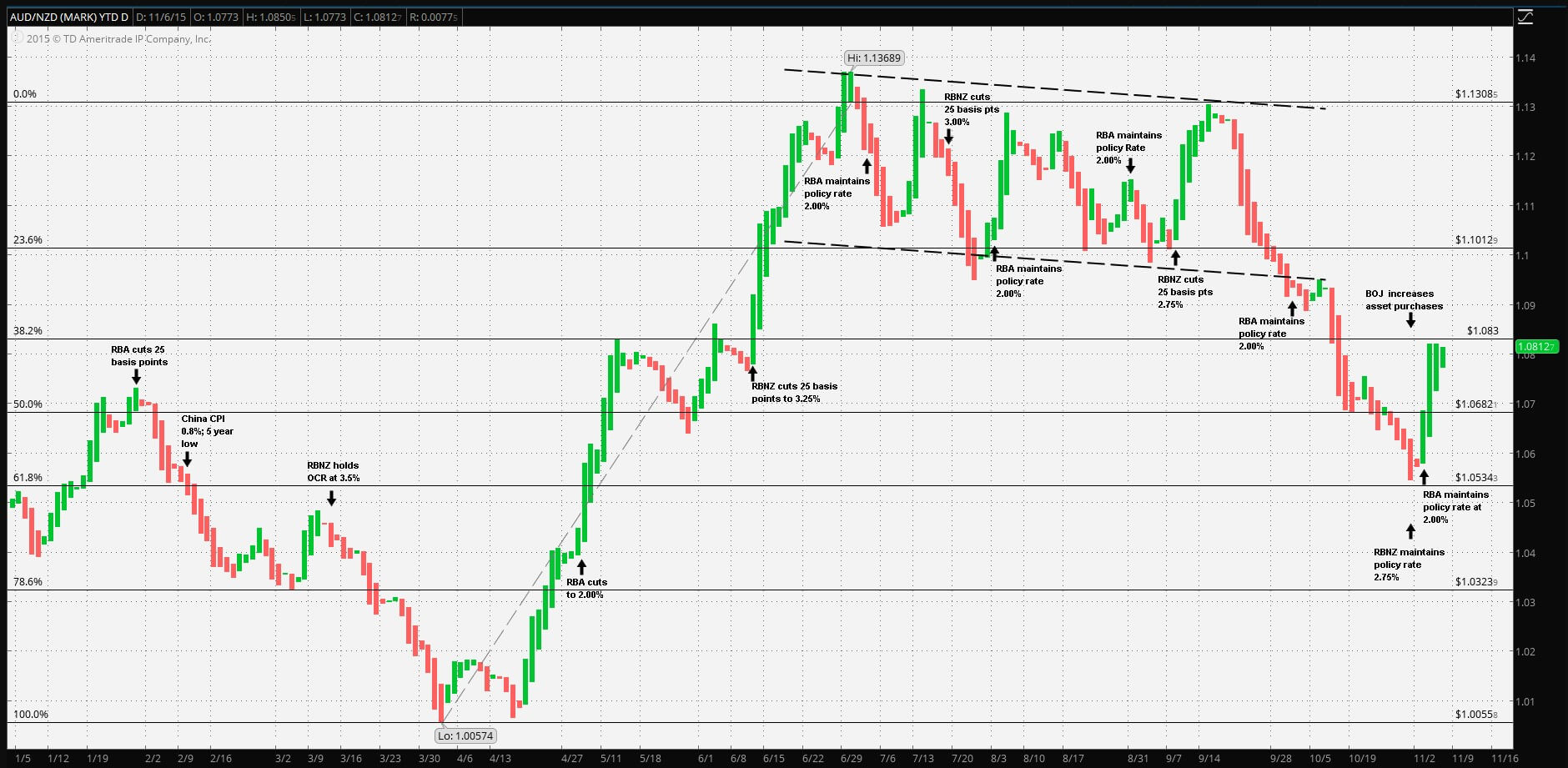

If we compare this pair with the ones involving USD, we should take into consideration the factor of time, which is in that case reduced to only a few hours. USD-based trades entail a considerably limited amount of time for the price to change and end up going the way traders may need them to. AUD/NZD, however, does not pose a challenge in this regard due to the fact that price generally either trends or consolidates. Even if consolidation worries you, professional traders say how a good choice of a volume indicator can help traders evade most consolidation patterns even though this pair is more likely to trend than cause problems. The chart below reflects how this currency pair is not prone to creating any choppy trends we may witness in some other pairs’ charts. Nevertheless, even if you find yourself trapped in one of such unfavorable trend, experts affirm that the result would not be more than one or two losses. They also add that traders should not fear these areas in the chart because if you keep trading, such losses would eventually be eliminated, unlike with some other currency pairs.

The EUR/USD chart reflecting the same period leaves an entirely different impression. Not only is the price moving too rapidly, but traders can hardly make a profit equal to that of AUD/NZD. By relying on a useful trend indicator, you will be able to know exactly when you should start trading, thus avoiding periods of price consolidation. When a chart is too choppy and the price is moving in a hectic manner, even the best indicators may not be able to detect the activity on the chart. You can, therefore, receive false signals and take unnecessary losses just by trading a currency pair that is prone to these erratic movements. Luckily this is more common for pairs such as EUR/USD than it is for the AUD/NZD currency pair. If your system can handle trading other currency pairs, rest assured that it will take you through AUD/NZD trades with ease. Nonetheless, this does not imply that you should not have a set plan for this currency pair regardless of the benefits that naturally come along.

Traders should primarily be prepared to take each trade for which they get a signal even though they may at times get several signals at the same time. Should you need to decide whether to trade AUD/NZD long and AUD/JPY long with a 2% risk, professional traders would advise you to enter the AUD/NZD trade without splitting the risk because of the increased chance of winning. Even though you are taking on the entire risk on one currency pair, understand that the likelihood of winning is much greater. What is more, even when you are testing your system, you can skip this currency pair because it commonly provides favorable trading conditions. Therefore, if you would like how your system operates on some more difficult currencies, you can test USD pairs, but testing AUD/NZD is assumed to be needless because of everything we have discussed earlier. You can also test AUD/NZD first to assess your algorithm because, if it does not work properly with this currency pair, it is much more likely to cause a disaster with some other currency pairs.

It seems that AUD/NZD is not talked about at great lengths in forex traders’ favored media, but the sources that do go into details appear to be extremely satisfied with the results they get from trading this currency pair. Some professional traders even say how the only reason this pair makes the second (and not the first) place is that they cannot enjoy any giant moves with AUD/NZD. Traders’ experiences and trading methods may differ, but this article still reflects an innovative approach to trading and making use of the two currencies. If you have yet to test this currency pair, you will hopefully discover the same benefits professional traders claim to exist, finding reasons to keep trading AUD/NZD. Last but not least, whether you learn to love AUD/NZD for the ability to test your algorithm or the opportunity to avoid choppy trends, trading this currency pair will surely be an interesting experience, especially for those of you who favor calm waters over some news-heavier or more unpredictable currency pairs.