Introduction

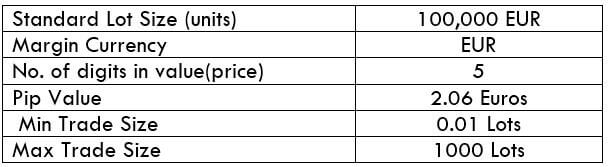

The abbreviation of the Euro Area’s euro against the Romanian Leu is written as EUR/RON. This pair is classified as an exotic currency pair. The volume traded in this pair is pretty low. Here, the EUR is the base currency, and the EGP is the quote currency.

Understanding EUR/RON

The value of the EUR/RON determines the value of RON equivalent to one EUR. It is quoted as 1 EUR per X RON. For example, if the value of EUR/RON is 4.8512, then exactly 4.8512 RON is required to buy one Euro.

Spread

The difference between the bid and the ask price for that currency pair is referred to as the spread. The spread is different on ECN and STP accounts.

ECN: 75 pips | STP: 80 pips

Fees

The fee is simply the commission on the trade. One has to pay a few pips of fee on the trade for entering as well as exiting the trade. However, this is only on ECN accounts. On STP accounts, there is no fee.

Slippage

The slippage is the difference between the trader’s required price for execution and the price the broker actually gave the trader. There is this difference due to the volatility of the market and the broker’s execution speed.

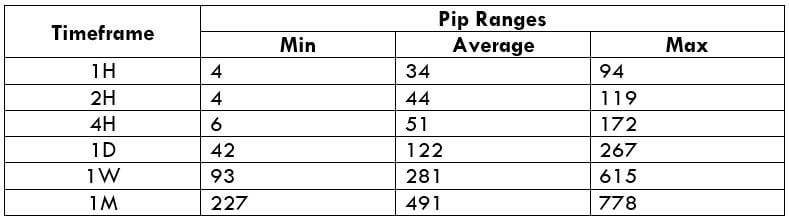

Trading Range in EUR/RON

A Trading range is the illustration of the pip movement of a currency pair in different timeframes. The values are obtained from the average true indicator. The volatility values help us in determining the number of pips our trade can move in a given time frame.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

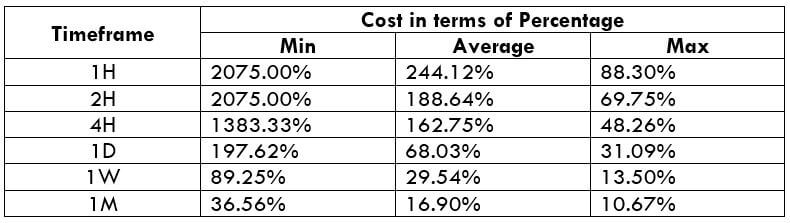

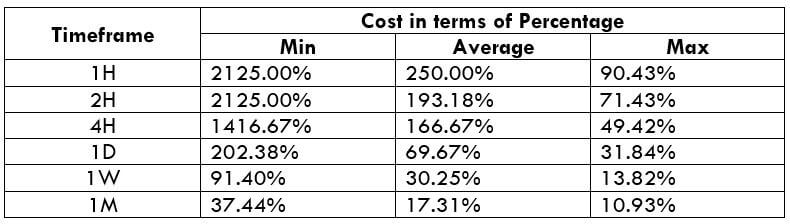

EUR/RON Cost as a Percent of the Trading Range

With the volatilities values obtained above, we can even determine the variation in the cost of the trade. Below are the cost variation tables for ECN and STP accounts.

ECN Model Account

Spread = 75 | Slippage = 5 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 5 + 75 + 3 = 83

STP Model Account

Spread = 80 | Slippage = 5 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 5 + 80 + 0 = 85

Trading the EUR/RON

Which timeframe to trade?

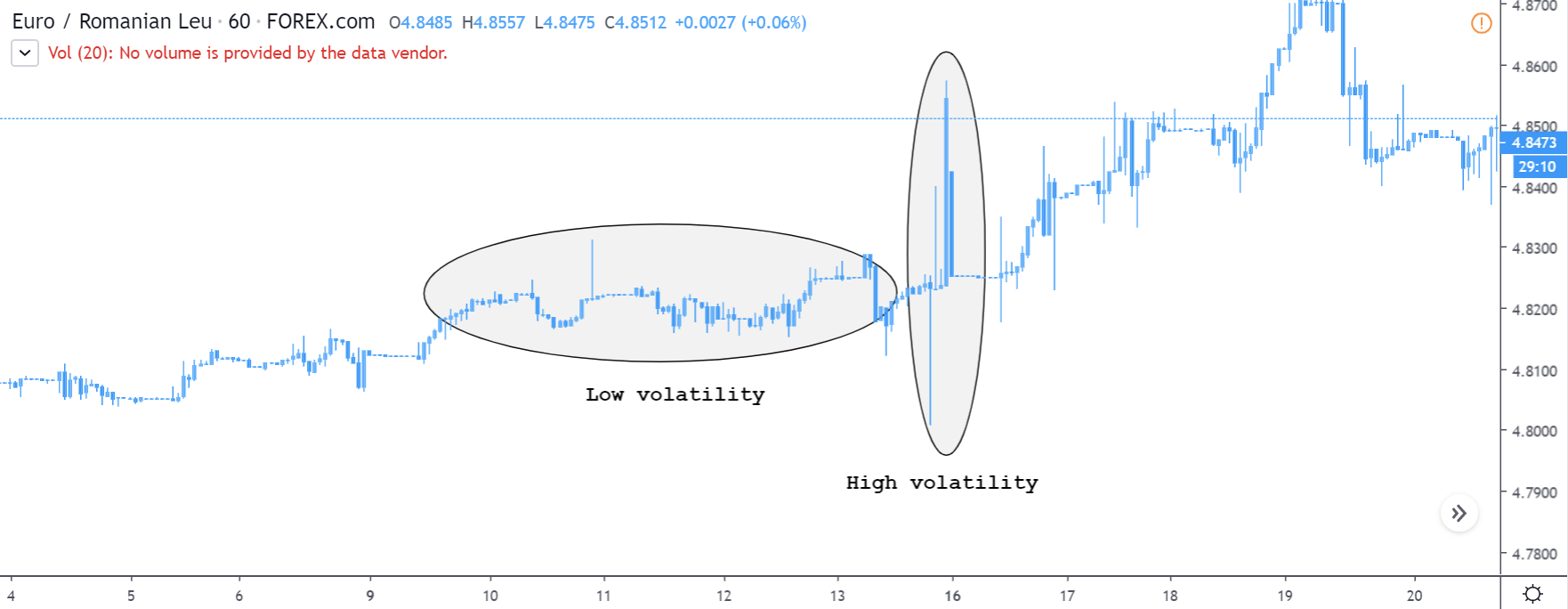

Consider the below chart on the 1H timeframe. We can clearly see that the volatility in this pair is very high. There is hardly any movement for a few hours, but a big spike up/down suddenly. And this type of movement is very risky for business. Hence, it is recommended to avoid trading smaller timeframes of this pair.

Nonetheless, considering the 1D chart of EUR/RON, we can see that the volatility is decent enough. Hence, this becomes a tradable timeframe for us. In fact, any timeframe above the daily can be traded efficiently.

How to manage costs?

In the trading cost table, we can see that the percentage values are large in the min column and small in the max column. This means that the costs are high for low volatilities and small for high volatilities. So, to have a balance between the volatility and costs, one may trade when the volatility is around average values.

Furthermore, trading through limit orders is another way to reduce costs. In doing so, the slippage on the trade will not be applied to the total costs.