In price action trading, consolidation length is a vital factor. The deeper the consolidation, the further the price goes towards the trend. Sometimes, shallow consolidation takes the price towards the trend direction as well. However, we may skip taking entry when the price makes a shallow consolidation. In today’s lesson, we are going to demonstrate an example of these in the same chart.

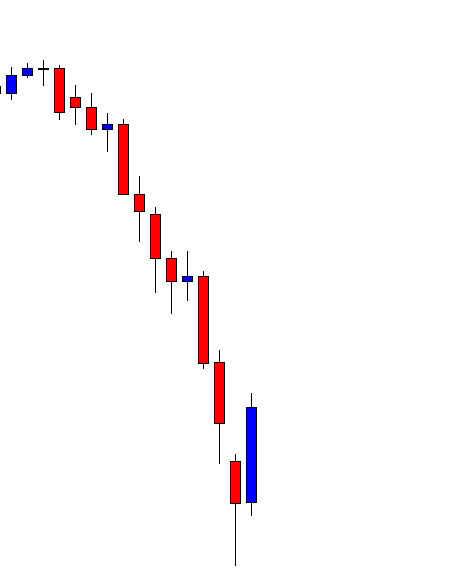

This is a daily chart. The price after being bearish produced a bullish engulfing candle. The breakout trading strategy traders are to wait for the price to consolidate and produce another bullish engulfing candle to offer them entry.

The price consolidates with a doji candle followed by a bullish engulfing candle. It makes a shallow consolidation. Moreover, the bullish engulfing candle has a long upper shadow. The buyers may skip taking the entry. Let us proceed to the next chart.

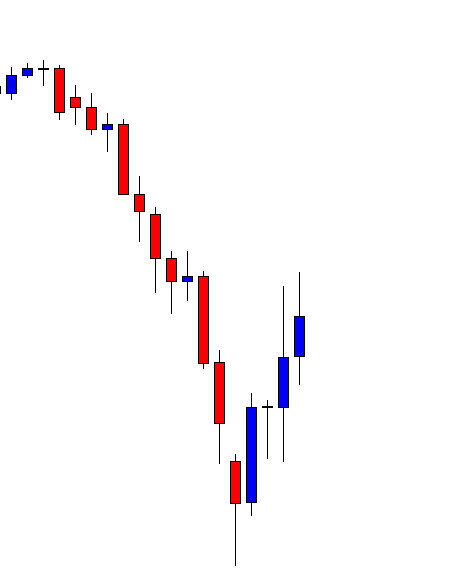

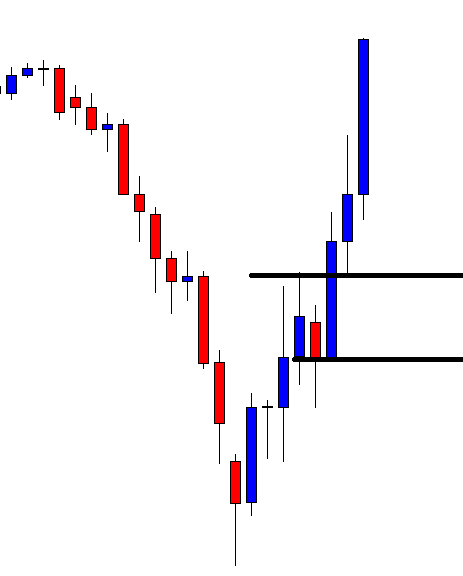

The chart shows that the last candle comes out as a bearish candle. If the price consolidates from here, it is going to be a deep consolidation. Let us wait for a bullish engulfing candle closing well above consolidation resistance to trigger a long entry.

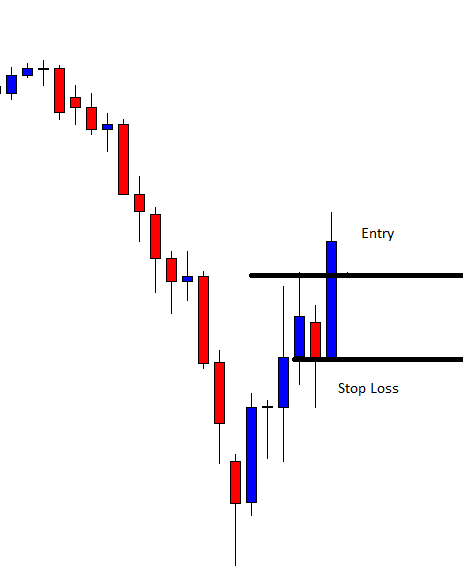

Here it comes. The chart produces a bullish engulfing candle closing well above consolidation resistance. The buyers may trigger a long entry right after the candle closes. The last swing high is quite far, offering more than 1R.

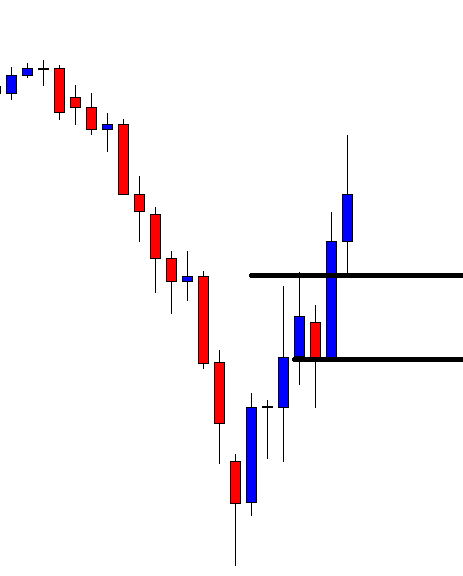

The next candle comes out as a bullish candle as well. The candle has a long upper and a lower shadow. Nevertheless, it is a bullish candle. It looks good for the buyers. The price keeps going towards the North with good momentum. It looks the price hits the last swing high easily.

It does not take more than two candles to hit the last swing high. The last candle suggests that the price may go further up. However, the buyers may consider closing their entry or at least take partial profit. The plan has worked wonderfully well for the buyers.

In this chart, we have seen a shallow and a deep consolidation together. Both have offered entries. However, to be safe, we need to stick with the breakout trading strategy’s rule. We may skip taking entry when the price makes shallow consolidation. In most cases, shallow consolidation brings less liquidity. It means it often goes wrong. On the other hand, if the price makes a deep consolidation followed by an engulfing reversal candle, we may trigger an entry.