Introduction

Fear is the greatest driving force in humans. We tend to react drastically in times of fear or when they are presented with sudden moves from the market. Fear is an emotion that drives traders around the world to watch out for every news announcement, for fear of missing out on important information. Fear results in fast decisions by traders, which are most of the time taken without thinking.

In the previous article, we mentioned that trading the news is one of the best ways to make a profit in a short period of time. We also mentioned focusing on news events with the highest impact (red flags) on the currency. In today’s strategy, we will be trading the Forex market by looking at news events that have the least impact on the currency and do not have a long-lasting effect on the pair.

Timeframe

Balk the talk strategy works well with the 15-minutes timeframe only. Since we are dealing with small price movements, we will capture those little gains by analyzing the 5 minutes time frame chart.

Indicators

In this strategy, we will not be using any technical indicators.

Currency Pairs

The strategy is suitable for trading in all major currency pairs listed on the broker’s platform. Make sure not to use the strategy on Minor and Exotic currency pairs. Currency pairs such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD, AUD/USD, GBP/JPY, and NZD/USD are highly preferred.

Strategy Concept

Although we are trading based on the news data, this strategy’s concept is very different from the previous strategy. Here we will be taking advantage of the sudden surge in volatility due to the news announcement. The volatility leads to price movement, which is not reliable and mostly false. Hence, we will analyze the charts from a technical point of view and position in the currency pair based on the indications provided by technical analysis.

News events that have orange and yellow flags associated with them are the ones that are not of great importance to traders. Even then, during the news announcement, the volatility gives rise to price movement, mostly not dependable. This means any move in the market created by such news releases does not last for long, and the market continues to move in regular from a few minutes after the news release. We will take advantage of this false movement by combining the market’s current price with that of the key technical levels.

Trade Setup

In order to illustrate the strategy, we will be taking the example of the Final Services PMI news announcement, which was released recently. We will analyze the impact of data PMI on the currency and see how we can take a suitable position in the currency based on the volatility induced in the pair due to the announcement.

Step 1

The first step of the strategy is to look for news events that have an orange or yellow flag linked to them. Note down the date and time of the announcement and open the respective chart. We recommend looking for news announcements of major economies only and trade in currency pairs involving the U.S. dollar.

In our example, we will be considering the impact of Services PMI on the EUR/USD currency pair.

Step 2

In this step, we will mark out the key technical levels on the chart. They could be support, resistance, demand, supply, and some indicator signals. Based on the sign of each technical level, we will take the position accordingly.

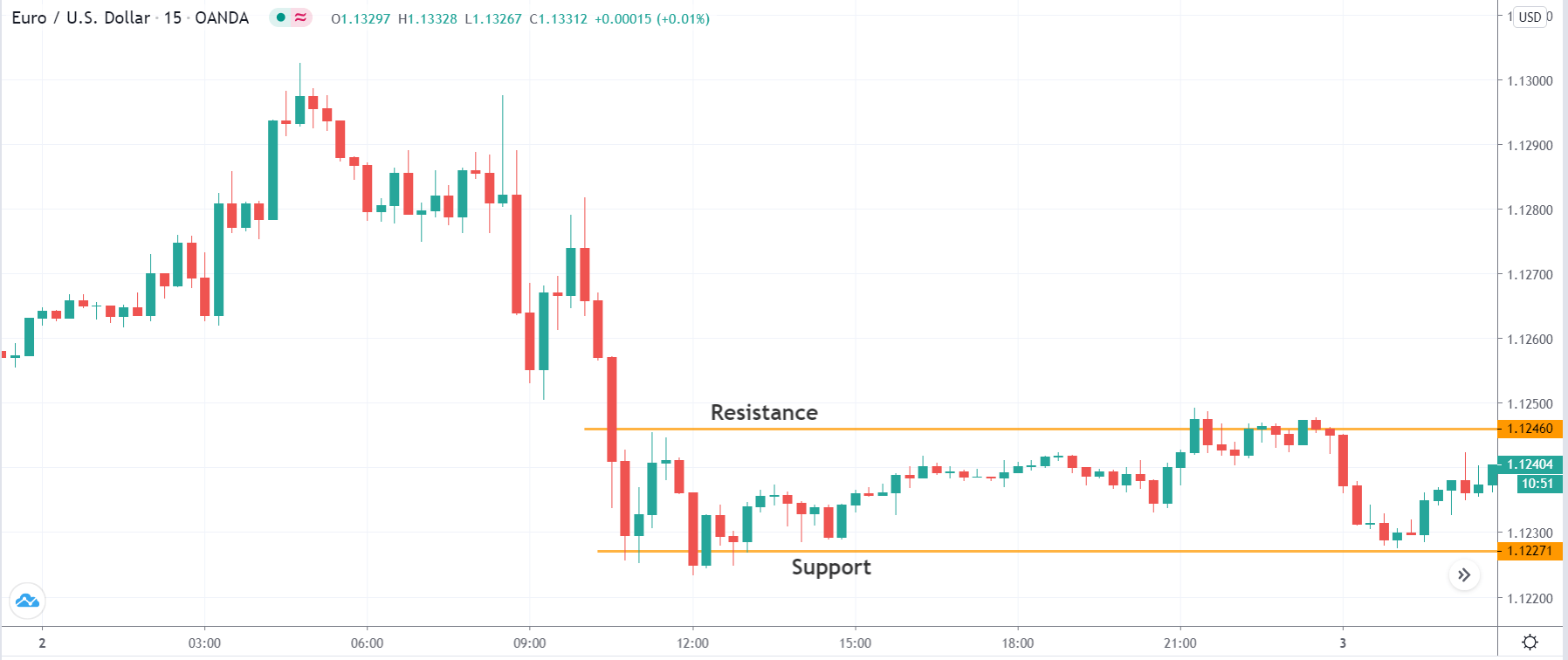

We can see in the image below that we have identified two important levels of support and resistance and marked them on the chart.

Step 3

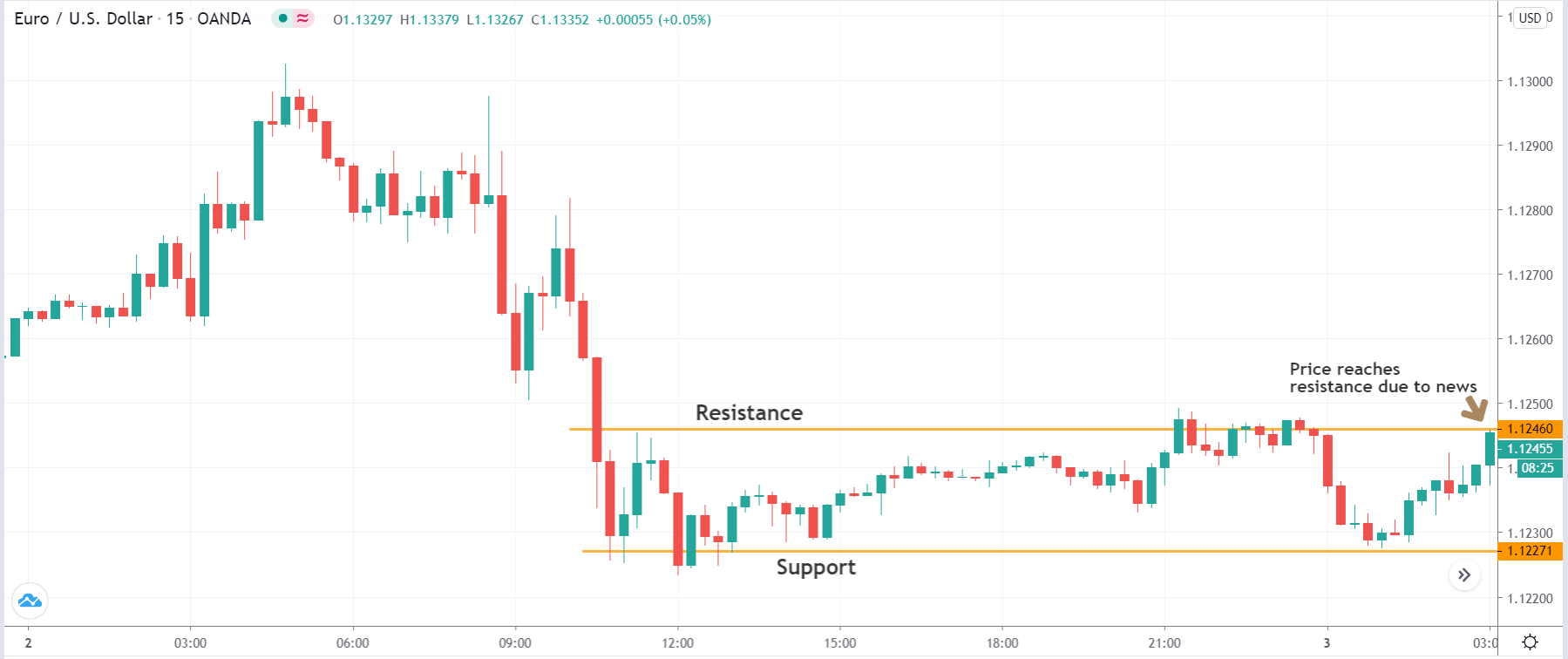

The crux of the strategy is that we wait for the price to reach our key technical levels as a result of the volatility due to the news announcement. Once the price reaches those levels, we will place trades based on our technical analysis and understanding of market psychology. For example, in the below image, we see that due to the Services PMI news release price reaches exactly to our resistance, which we had marked in the previous step. Since the PMI data was slightly better than expectations, it led to bullishness in the currency, thereby taking the price marginally higher.

Since the Services PMI is a low impact event, we cannot afford the market to continuously move higher. This means it will respect key technical levels and follow the major trend of the market. In this case, the trend is down. Therefore, we trigger a ‘short’ trade precisely at the resistance, taking a bearable risk.

Step 4

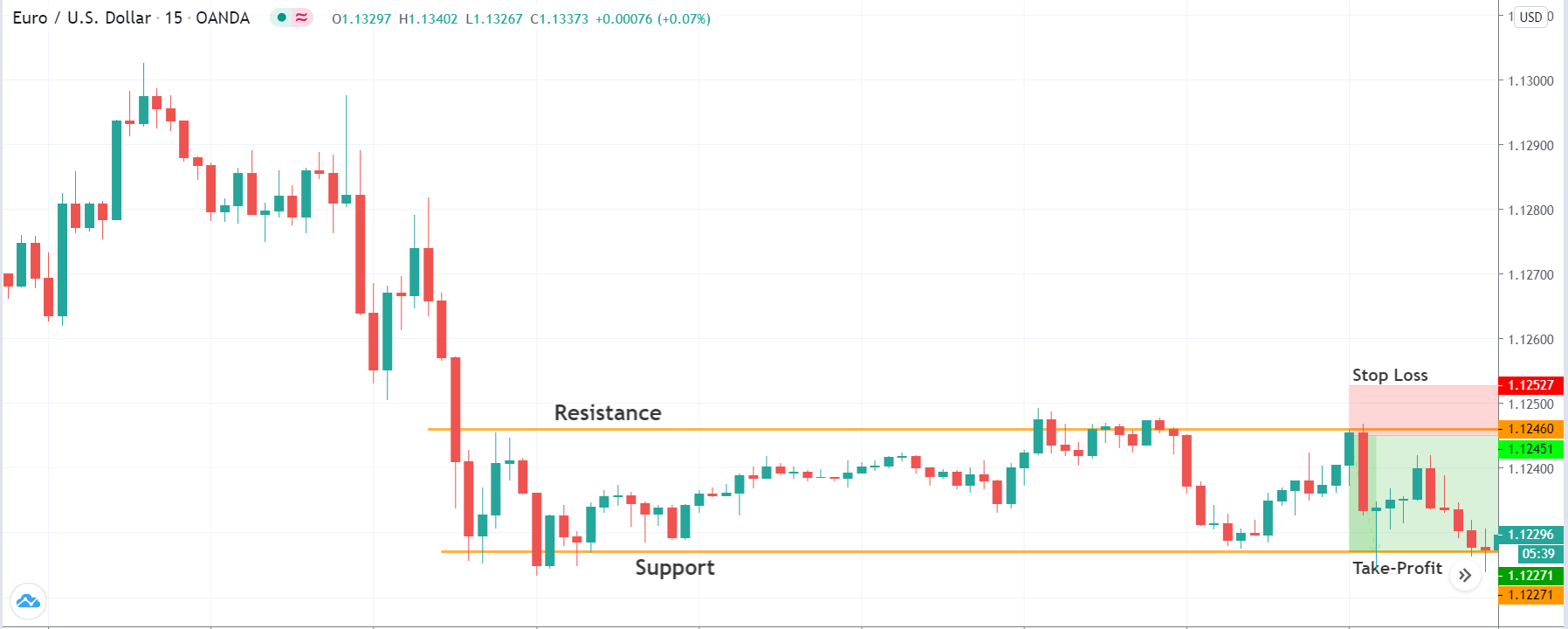

The next step is to determine stop-loss and take-profit levels for the strategy. Since we are taking an aggressive entry, the stop loss for the trade will be small, resulting in a high risk to reward ratio. The take-profit is pretty much straightforward, where it will be set at the latest obstacle.

In this case, the take-profit is placed at the support of the range, which is ideal for booking profits.

Strategy Roundup

The strategy takes advantage of the market reaction when the actual figures of some news events are not of great importance to traders. Such news announcements only create panic in the market with no confidence. Keep in mind that this requires many things to be assessed before being able to successfully use this strategy over and over again. This means a lot of practice is required to apply in the strategy effectively. Pay attention to news releases which do not hold much ground. All the best!