Heikin Ashi Technique – Crypto trading (part 1/2)

There are many effective strategies for trading cryptocurrencies, and each trader needs to find its own comfort zone when it comes to technical analysis and trading. For that reason, it is important to know as many available strategies so you can pick the one that suits you best. Heikin-Ashi technique is used to forecast the price of a cryptocurrency and is considered one of the most effective trading strategies when trading traditional assets.

The Heikin-Ashi strategy revolves around the Heikin-Ashi candles, which are another form of looking at the charts. They can be applied to any time frame without restrictions, so it can suit any trading style. While they were initially designed for trading commodities and stocks, Heikin-Ashi had great success in trading cryptos as well.

The Heikin–Ashi Charts

Heikin–Ashi can be translated from the Japanese language, and means “average bar.” These candlesticks are different than the typical Japanese candlesticks that traders mostly use, even though they look alike. The difference between the two is the formula used. While the regular candlestick uses a form of open-high-low-close (OHLC), Heikin-Ashi uses a modified version of close-open-high-low (COHL).

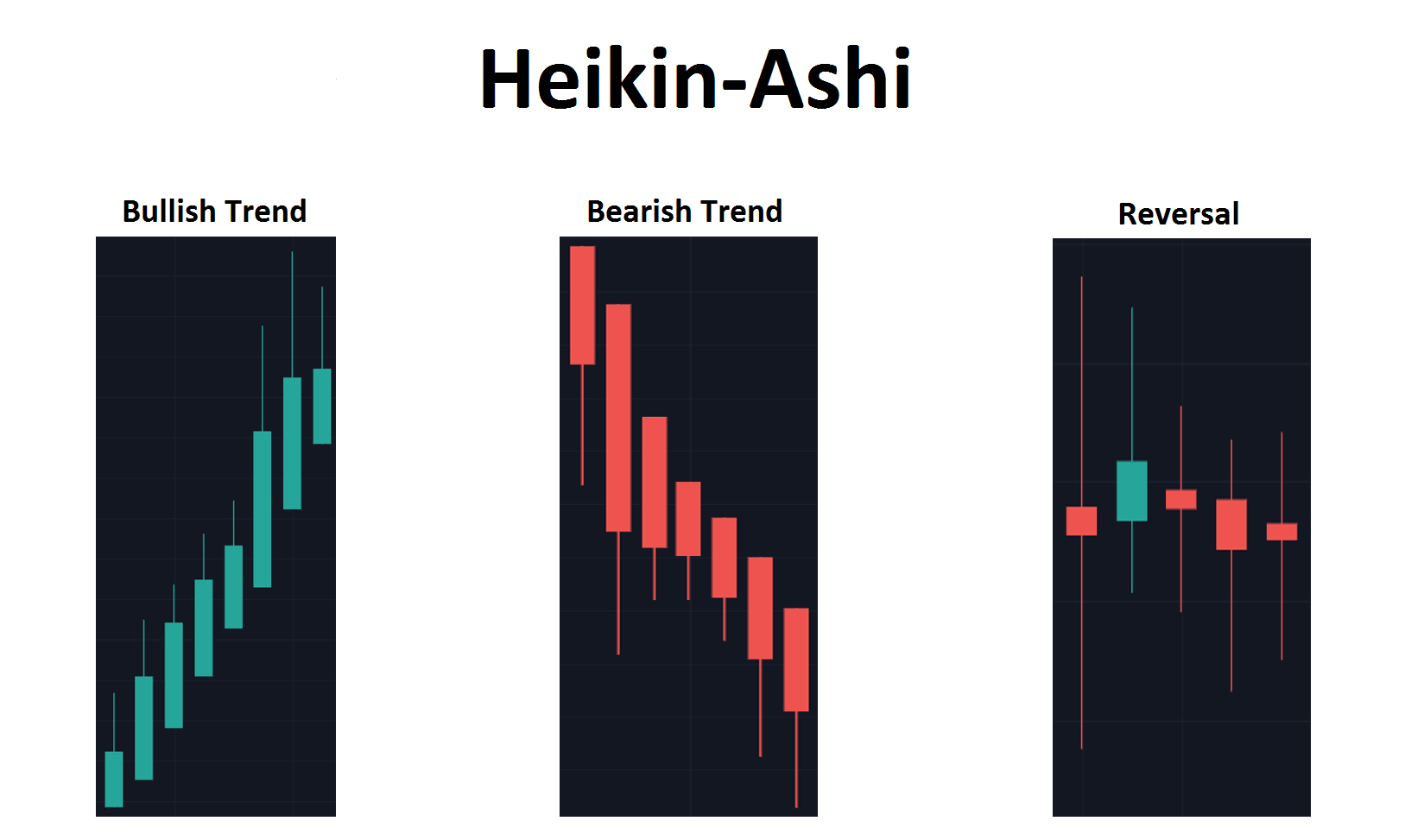

Once we know the way Heikin–Ashi candlesticks work, we can understand how to use this trading strategy. There are two primary signals that traders can identify through the Heikin-Ashi candlestick:

1. Bullish candlesticks that have no or very small wicks indicate a strong move to the upside and good buying opportunities.

2. Small candlesticks that have a small body and big upper and lower wicks show us a potential reversal.

When it comes to bearish signals, the same applies but in reverse:

1. Bearish candlesticks that have no or very small wicks indicate a strong move to the downside and good short-selling opportunities.

2. Small candlesticks that have a small body and big upper and lower wicks show us a potential reversal.

Now that we learned how Heikin-Ashi candlesticks work and how we can read them, we are ready to move on to trading strategies. Check out part 2 of our Heikin Ashi Crypto Trading to learn more about using this strategy for crypto trading.