Introduction

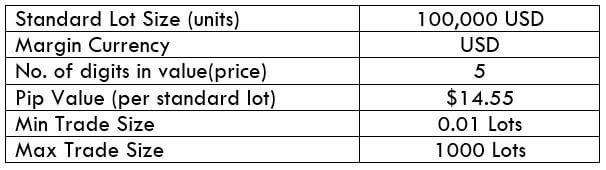

USD/RUB is the tick symbol for the US Dollar against the Russian Ruble. This emerging currency pair has high volatility and usually low volume. Here, the US Dollar is the base currency, and the RUB is the quote currency.

Understanding USD/RUB

The price of this pair determines the value of RUB that’s equivalent to one US Dollar. It is quoted as 1 USD per X RUB. For example, if the market price of this pair was 68.69, then these many Rubles are required to purchase one US Dollar.

Spread

It is the difference between the bid price and ask price in the exchange market. This value is set by the brokers and varies from each other. Also, it varies on the type of execution model.

ECN: 21 pips | STP: 23 pips

Fees

This fee is levied by stockbrokers as well. The fee on ECN and STP account is given below.

ECN: 3-10 pips | STP: 0 pips

Slippage

The difference between the investor’s intended price and the real price executed by the broker is called slippage. Slippage happens solely due to the changes in the market’s volatility and speed with which the broker executes a trade.

Trading Range in USD/RUB

The trading range is a tabular illustration of the minimum, average, and maximum volatility in a currency pair for a given timeframe. Using these values, traders can quickly assess their risk on the trade for any of the given timeframes.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a substantial period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

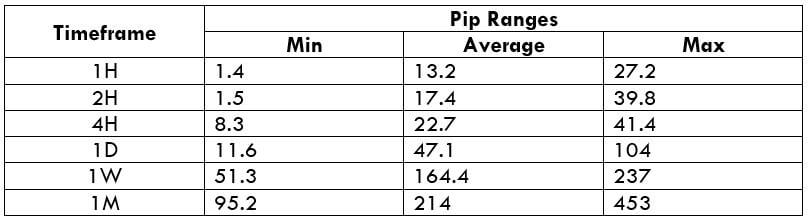

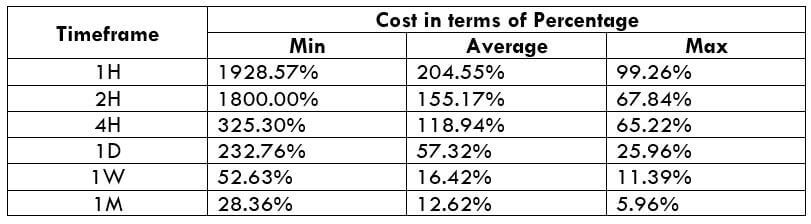

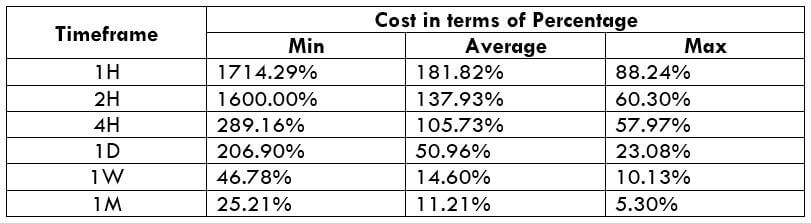

USD/RUB Cost as a Percent of the Trading Range

Total cost is the sum of the slippage, spread, and the trading fee. This varies based on the volatility of the market. And below is a table that represents the cost variation for different volatilities.

ECN Model Account

Spread = 21 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 21 + 3 = 27

STP Model Account

Spread = 23 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 23 + 0 = 26

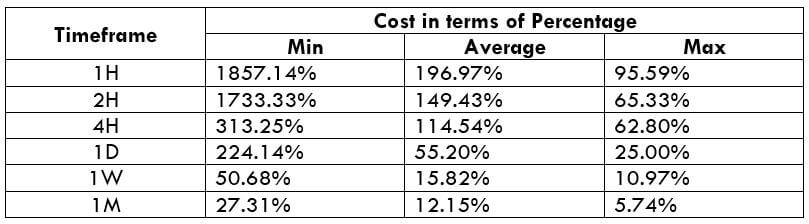

The Ideal way to trade the USD/RUB

Note that, the larger the value of the percentages, the higher is the cost on the trade and vice versa. The table clearly says the costs are high for low volatilities as the magnitudes of costs are high in the min column. But, it is not really ideal to trade in these extreme regions. To ensure decent volatility with comparatively low costs, it is ideal to trade this pair when the Volatility is around the average value in the trading range table.

We can see that slippage is a pretty heavy variable in the total costs. However, it can be nullified simply by placing orders using limit/stop orders rather than market orders. The drop in the total costs on the trade is represented in the below table as follows.

We can see, also that there are substantial costs when trading the USDRUB pair, even ion a daily timframe. That means that you will need to be right on direction and extension of the movement to be profitable, because, on an average trading range it would require about 12 hours of positive price movement to cover the trading costs. Therefore it is recommended to trade this exotic pair on swings of more than a week, to reduce the percent of the movement that is absorbed by the trade cost.